However, the process of obtaining a loan is fraught with potential pitfalls that can negatively impact your business. Entrepreneurs frequently make mistakes that not only jeopardize their chances of getting approved but also affect the long-term health of their business.

Understanding and avoiding these common small business loan mistakes can make the difference between a business that’s thriving and one that’s struggling. In this blog post, we’ll delve into the most frequent errors small business owners make when seeking loans and provide actionable tips on how to avoid them. By being informed and prepared, you can enhance your chances of securing favorable financing terms on your working capital loans and set your business up for lasting success.

Mistake 1: Lack of Preparation

Securing a small business loan requires careful preparation. This foundational step can make the difference between securing favorable financing and facing rejection or unfavorable terms. Thorough preparation not only demonstrates to lenders that you are a credible and reliable borrower but also ensures that you fully understand your business needs and capabilities. Here’s why preparation is crucial and why common small business loan mistakes should be avoided.

Importance of Preparation Before Applying for a Loan

Preparation involves understanding your business inside out and presenting it in the best possible light to potential lenders. It encompasses having a solid business plan, maintaining comprehensive financial records, and clearly defining the purpose of the loan. Proper preparation allows you to anticipate questions lenders might ask and to provide clear, confident answers. It also helps you understand your financial position and how the loan will fit into your overall business strategy.

Common Mistakes

Not Having a Solid Business Plan

A business plan is a roadmap that outlines your business goals, strategies, and how you plan to achieve them. It is essential for convincing lenders of the viability of your business. Many small business owners make the mistake of either not having a business plan or having an incomplete one. A vague or poorly constructed business plan can signal to lenders that you haven’t thoroughly thought through your business strategy or that you’re not serious about your venture.

Inadequate Financial Records

Lenders need to see that your business is financially sound and capable of repaying the loan. This requires up-to-date and accurate financial records, including balance sheets, income statements, and cash flow statements. Inadequate or disorganized financial records can create doubt about your business’s financial health and your ability to manage finances, making lenders hesitant to approve your loan application.

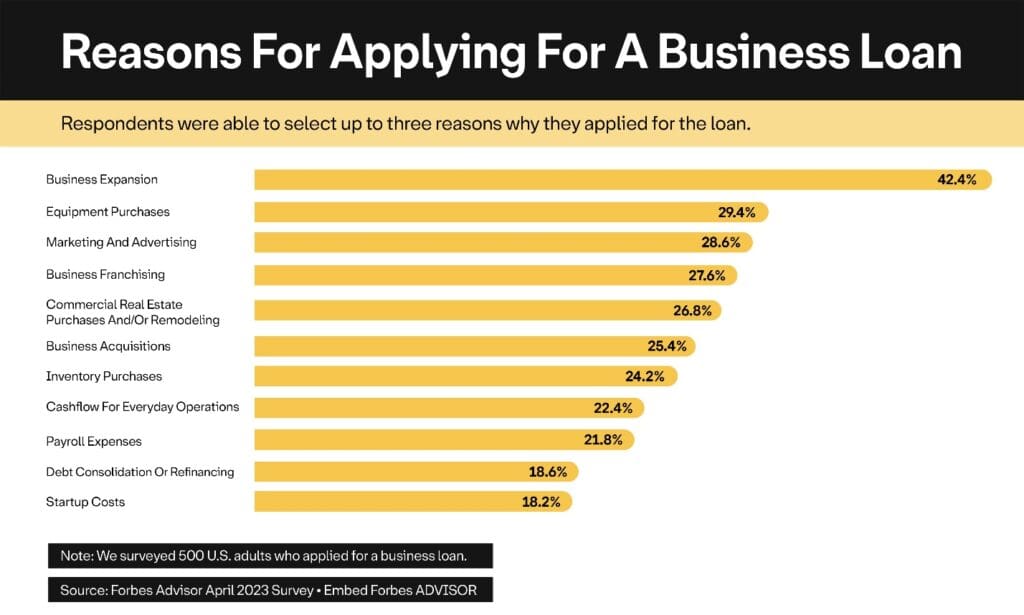

Lack of Clear Purpose for the Loan

Knowing exactly why you need the loan and how you plan to use the funds is crucial. Vague or unclear loan purposes can make lenders question your planning and decision-making skills. You need to demonstrate that you have an apparent, specific reason for borrowing and that the loan will be used in a way that benefits your business and enhances its ability to repay the debt.

How to Avoid These Small Business Loan Mistakes

Develop a Comprehensive Business Plan

Invest time in creating a detailed business plan. It should include an executive summary, company description, market analysis, organizational structure, product line or services, marketing and sales strategies, funding request, financial projections, and an appendix. This document should clearly articulate your business goals and the strategy you will use to achieve them. It should also provide a realistic assessment of your market and competitive landscape.

Maintain Organized and Up-to-Date Financial Records

Ensure your financial records are meticulously maintained and regularly updated. Use accounting software to keep track of all transactions and generate accurate financial statements. Regularly review your financial statements to understand your business’s financial health and make necessary adjustments. Being able to present detailed and accurate financial records will instill confidence in lenders about your financial management capabilities.

Clearly Define the Purpose and Amount Needed for the Loan

Before applying for a loan, clearly define why you need it and how you will use it. Break down the amount you need and allocate it to specific expenses such as equipment purchases, inventory, marketing, or working capital. This clarity will show lenders that you have a well-thought-out plan for the loan funds and that you’re borrowing responsibly. Additionally, it helps in creating a repayment plan that aligns with the cash flow generated from these investments.

In summary, preparation is key to successfully securing a small business loan. By developing a comprehensive business plan, maintaining organized financial records, and clearly defining your loan’s purpose, you can present a strong case to lenders and increase your chances of getting approved on favorable terms. Taking these steps shows lenders that you are a responsible and strategic business owner, ready to use the loan effectively to grow your business.

Mistake 2: Ignoring Credit Score

Your credit score plays a pivotal role in the small business loan approval process. It is a key factor that lenders use to evaluate your creditworthiness and determine the terms of your loan. Ignoring your credit score can lead to loan rejections or less favorable loan terms, such as higher interest rates and fees. Understanding the importance of your credit score and taking steps to maintain or improve it can significantly enhance your chances of securing a small business loan.

The Role of Credit Scores in Loan Approval and Terms

Credit scores provide a numerical representation of your credit history and financial behavior. They are derived from various factors, including payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries. For small business loans, both your personal and business credit scores may be considered, especially if your business is relatively new or small.

Lenders use credit scores to assess the risk of lending to you. A higher credit score indicates a lower risk, suggesting that you are more likely to repay the loan on time. Consequently, applicants with higher credit scores are more likely to be approved for loans and receive more favorable terms, such as lower interest rates and longer repayment periods. Conversely, a low credit score can result in loan rejection or approval with high interest rates and stringent terms, reflecting the higher risk perceived by the lender.

Common Mistakes

Not Knowing Your Credit Score

One of the most fundamental small business loan mistakes entrepreneurs make is not knowing their credit scores. Without this knowledge, you cannot gauge your likelihood of loan approval or anticipate the terms you might be offered. Many entrepreneurs are unaware of their credit score or assume it is sufficient without verifying it. This oversight can lead to unpleasant surprises during the loan application process.

Applying with a Poor Credit Score

Applying for a loan without considering your credit score is another critical mistake. If your credit score is low, you are less likely to be approved, or you may receive unfavorable terms that could strain your business finances. Some entrepreneurs apply for loans without first addressing issues on their credit report, hoping for the best. This approach often results in rejections or suboptimal loan conditions, further complicating your financial situation.

How to Avoid These Mistakes

Regularly Check Your Credit Score

Regularly monitoring your credit score is crucial. Obtain your credit reports from major credit bureaus and review them for accuracy. Errors or outdated information on your credit report can negatively impact your score. By checking your credit score periodically, you can catch and correct mistakes, stay informed about your credit status, and make necessary adjustments to improve your score.

Take Steps to Improve Your Credit Score Before Applying

If your credit score is not where it needs to be, take proactive steps to improve it before applying for a loan. Here are some strategies to consider:

- Pay Your Bills on Time:Timely payments are one of the most significant factors affecting your credit score. Set up reminders or automatic payments to ensure you never miss a due date.

- Reduce Debt:High credit card balances and debt can lower your credit score. Aim to reduce your debt-to-credit ratio by paying down balances and avoiding new debt.

- Limit Credit Inquiries:Each time you apply for credit, a hard inquiry is made on your credit report, which can slightly lower your score. Minimize the number of credit applications to maintain a higher score.

- Maintain Old Accounts:The length of your credit history positively impacts your score. Keep older accounts open, even if you don’t use them frequently, to benefit from a longer credit history.

- Diversify Credit Types:Having a mix of credit accounts, such as credit cards, installment loans, and retail accounts, can boost your score. Ensure you manage all types responsibly.

By understanding and managing your credit score, you can significantly improve your chances of securing a small business loan with favorable terms. Regular monitoring and proactive steps to enhance your credit score demonstrate to lenders that you are a responsible borrower, reducing the perceived risk and increasing your loan approval likelihood.

Mistake 3: Overlooking The Terms and Conditions

Understanding the terms and conditions of a loan agreement is crucial to making informed borrowing decisions. The fine print often contains critical information that can significantly impact your business’s financial health. Overlooking these details can lead to unexpected costs and financial strain. By comprehensively reviewing and understanding the terms and conditions, you can avoid costly small business loan mistakes and ensure that the loan supports your business objectives.

Understanding the Fine Print of Loan Agreements

Loan agreements are legally binding contracts that outline the terms under which the lender will provide funds and the borrower’s obligations. These documents include details such as interest rates, repayment schedules, fees, penalties, and other conditions. The fine print in these agreements can contain clauses that might seem insignificant but can have substantial financial implications. Therefore, understanding every aspect of the agreement is essential to avoid any surprises that could negatively affect your business.

Common Mistakes

Not Reading the Loan Agreement Thoroughly

One of the most common small business loan mistakes is not reading the loan agreement thoroughly. Many borrowers glance over the document, focusing only on the loan amount and interest rate, and fail to catch critical details hidden in the fine print. This oversight can lead to misunderstandings about repayment terms, interest calculations, and other crucial aspects of the loan. Failing to read the agreement thoroughly can result in unexpected financial obligations and potential legal issues.

Overlooking Hidden Fees and Penalties

Hidden fees and penalties are often buried within the fine print of loan agreements. These can include origination fees, prepayment penalties, late payment fees, and other charges that can significantly increase the cost of the loan. Many borrowers overlook these fees, leading to higher-than-expected costs and financial strain. Understanding these charges upfront is essential to accurately assess the total cost of the loan and ensure it is manageable for your business.

How to Avoid These Mistakes

Read All Terms and Conditions Carefully

The first step in avoiding these small business loan mistakes is to read the entire loan agreement carefully. Take the time to go through each section of the document, paying close attention to the terms and conditions. Look for any clauses that outline fees, penalties, interest rate changes, and repayment schedules. Understanding these details will give you a clear picture of your obligations and help you make informed decisions.

- Interest Rates:Ensure you understand how the interest rate is calculated and whether it is fixed or variable. Variable rates can change over time, potentially increasing your repayment amounts.

- Repayment Schedule:Review the repayment schedule to understand the frequency and amount of payments. Ensure the schedule aligns with your business’s cash flow.

- Fees and Penalties:Identify any fees associated with the loan, such as origination fees, application fees, and penalties for early repayment or late payments. Calculate these costs to understand the total cost of the loan.

Ask Questions and Seek Clarification from the Lender

If any part of the loan agreement is unclear, do not hesitate to ask questions and seek clarification from the lender. Lenders should be willing to explain any terms or conditions that you do not understand. Some specific areas to seek clarification on include:

- Prepayment Penalties:Understand the terms around early repayment and any associated penalties. Some loans impose penalties if you pay off the loan ahead of schedule.

- Collateral Requirements:If the loan is secured, ensure you understand what assets are being used as collateral and the implications if you default on the loan.

- Default Terms:Know the lender’s policies if you miss a payment or default on the loan. This includes understanding the grace period and any potential legal actions.

Seeking professional advice from a financial advisor or attorney can also be beneficial. They can review the loan agreement with you, explain complex legal terms, and help identify any potential issues.

Mistake 4: Borrowing More Than You Need

While securing a loan can provide the necessary capital to grow your business, borrowing more than you need can pose significant risks. Excessive borrowing can lead to financial strain, mismanagement of funds, and an inability to repay the loan, ultimately jeopardizing your business’s stability. Understanding the potential pitfalls of borrowing too much and taking steps to avoid these small business loan mistakes can help ensure that your loan supports your business objectives without creating additional financial burdens.

The Risks Associated with Borrowing Excessive Funds

Borrowing more than you need might seem like a good idea at first, providing a financial cushion for unexpected expenses. However, excessive borrowing can lead to several negative consequences. Firstly, higher loan amounts come with increased interest payments, raising the overall cost of the loan. Secondly, having extra funds can tempt business owners to spend on non-essential items or investments that do not yield a significant return. Lastly, the increased debt burden can strain your cash flow, making it challenging to meet repayment obligations and potentially leading to default.

Common Mistakes

Overestimating Financial Needs

One of the primary small business loan mistakesowners make is overestimating their financial needs. This often occurs due to a lack of thorough financial planning and analysis. Without a clear understanding of how much money is actually required to achieve specific business goals, entrepreneurs may request larger loans than necessary. This can result in higher debt levels and increased interest costs, which can be burdensome over time.

Mismanagement of Loan Funds

Even if the loan amount is justified, mismanagement of funds can still occur. Some business owners fail to allocate the borrowed funds effectively, spending money on non-essential or low-priority expenses. This can quickly deplete the loan funds without achieving the intended business objectives. Mismanagement of loan funds can lead to cash flow problems, making it challenging to meet repayment schedules and potentially harming the business’s financial health.

How to Avoid These Mistakes

Conduct a Thorough Assessment of Your Financial Requirements

To avoid borrowing more than you need, start with a comprehensive assessment of your financial requirements. Determine the specific purpose of the loan and calculate the exact amount required to achieve your goals. This might include funding for equipment purchases, inventory, marketing campaigns, or working capital. Take into account any potential fluctuations in revenue or expenses to ensure you have a realistic estimate.

- Analyze Business Goals:Clearly define what you aim to achieve with the loan and identify the necessary resources.

- Evaluate Costs:Break down the costs associated with each goal, ensuring that you include both direct and indirect expenses.

- Consider Cash Flow:Assess your business’s cash flow to determine how much you can afford to borrow and repay without causing financial strain.

Create a Detailed Budget for the Loan Funds

Once you have determined the amount you need, create a detailed budget for the loan funds. A well-structured budget will help you allocate the funds effectively and avoid unnecessary spending. Outline how each portion of the loan will be used and prioritize expenses that directly contribute to your business’s growth and profitability.

- Prioritize Spending:Allocate funds to high-priority items that will provide the greatest return on investment.

- Monitor Expenditures:Keep track of how the loan funds are being spent to ensure adherence to the budget. Use accounting software or financial tools to maintain accurate records.

- Adjust as Needed:Be prepared to adjust your budget if circumstances change. Review your financial situation regularly and make necessary adjustments to stay on track.

By conducting a thorough assessment of your financial needs and creating a detailed budget, you can avoid the pitfalls of borrowing more than you need. These steps will help ensure that the loan funds are used effectively to achieve your business objectives without creating unnecessary debt burdens. Responsible borrowing and careful management of loan funds will position your business for long-term success and financial stability.

Short Term Business Funding with VIP Capital Funding

Applying for a small business loan can feel overwhelming. Common mistakes like inadequate planning or unclear financial statements can slow down the process or, worse, lead to rejection.

VIP Capital Funding is here to help! Whether you’re applying for a small business loan or looking for working capital funding, our experts are here to help you throughout the process.

Get in touch today!