Niche small businesses are the backbone of local economies across the United States, from the bustling clinics of California to specialty stores in Florida, auto repair shops in Texas, and growing e-commerce brands in New Jersey. These businesses serve specialized customer needs and face unique financial challenges that demand flexible funding solutions.

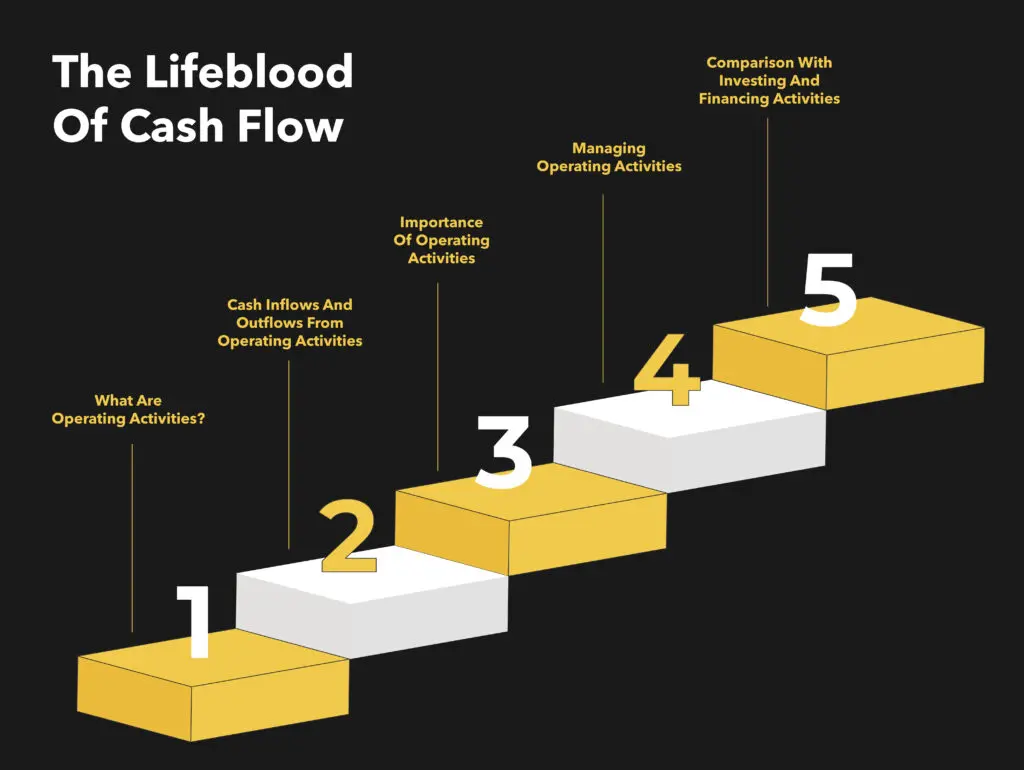

Maintaining a steady cash flow is often the biggest hurdle. Expenses pile up before revenue catches up, seasonal demands fluctuate wildly, and unexpected costs can strain operations. This is where working capital loans become vital.

Unlike traditional term loans, which focus on long-term assets or projects, working capital loans provide short-term, flexible funding to cover everyday expenses, seize timely growth opportunities, and stabilize your business through volatile periods.

At VIP Capital Funding, we understand the intricacies of various niche industries and tailor working capital loans to meet these distinct needs. Whether you’re a medical clinic in California or an e-commerce startup in Texas, our fast, transparent funding solutions empower you to keep growing without financial interruptions.

This comprehensive guide dives into how working capital loans transform niche businesses sector by sector, offering practical examples, timing strategies, and insights on structuring your financing for success.

What Are Working Capital Loans and Why They Matter

Before diving into how different niche businesses use working capital loans, it’s essential to understand what these loans are and why they play such a critical role in sustaining small businesses.

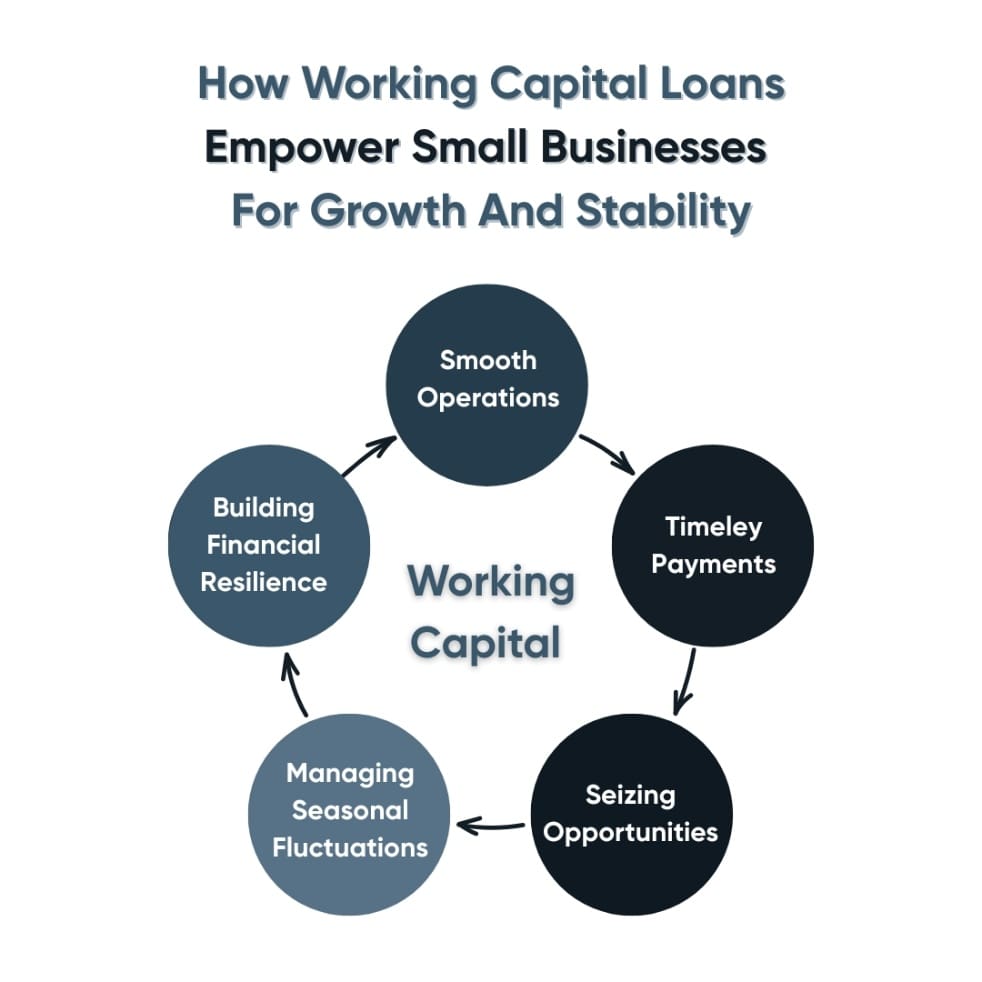

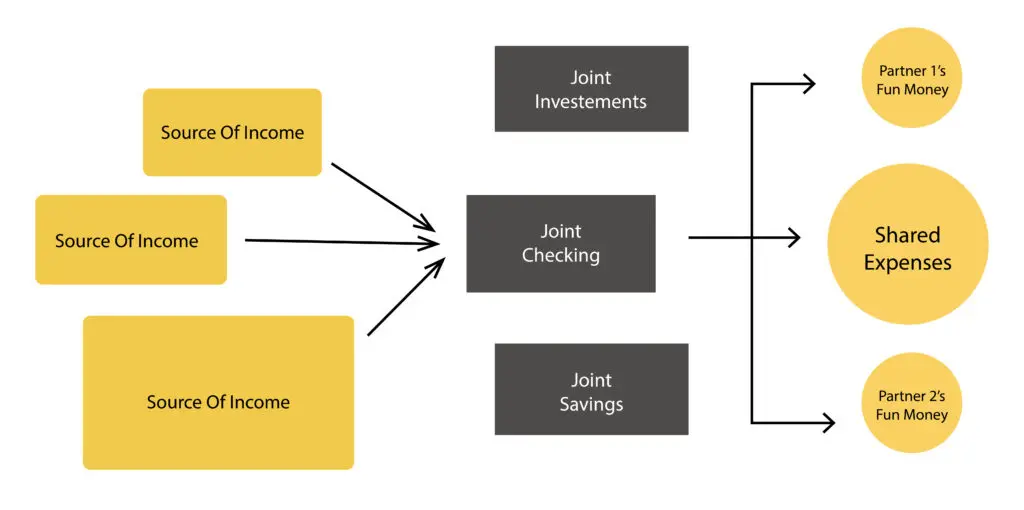

Working capital represents the liquid funds a business has on hand to cover its day-to-day operational expenses. These include essentials such as rent, payroll, utilities, purchasing inventory, and paying vendors. While revenue is the lifeblood of any business, many small businesses face a common challenge: their cash inflows and outflows often don’t align perfectly. Expenses arise immediately, but payments from customers or clients can be delayed due to billing cycles, seasonality, or credit terms.

This timing gap creates cash flow shortages that can slow down growth, negatively affect service quality, or even threaten the business’s survival if not managed effectively. Without sufficient working capital, businesses may struggle to meet payroll, replenish stock, or keep up with other fixed and variable costs.

Working capital loans are specifically designed to address this challenge by providing short-term cash injections tailored to operational needs. These loans give businesses the liquidity they need to keep functioning smoothly, even during tight cash flow periods.

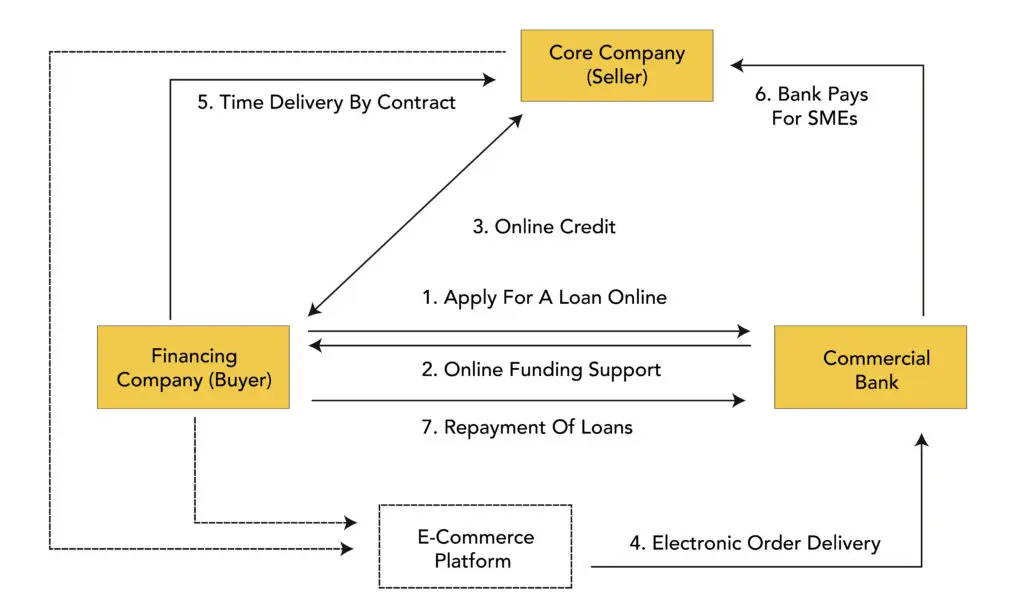

Unlike traditional long-term loans meant for asset purchases or expansion, working capital loans are more flexible. They are often structured as revolving lines of credit, allowing businesses to borrow, repay, and borrow again as needed. Other forms include short-term lump-sum loans or merchant cash advances, each offering unique benefits depending on the business cycle.

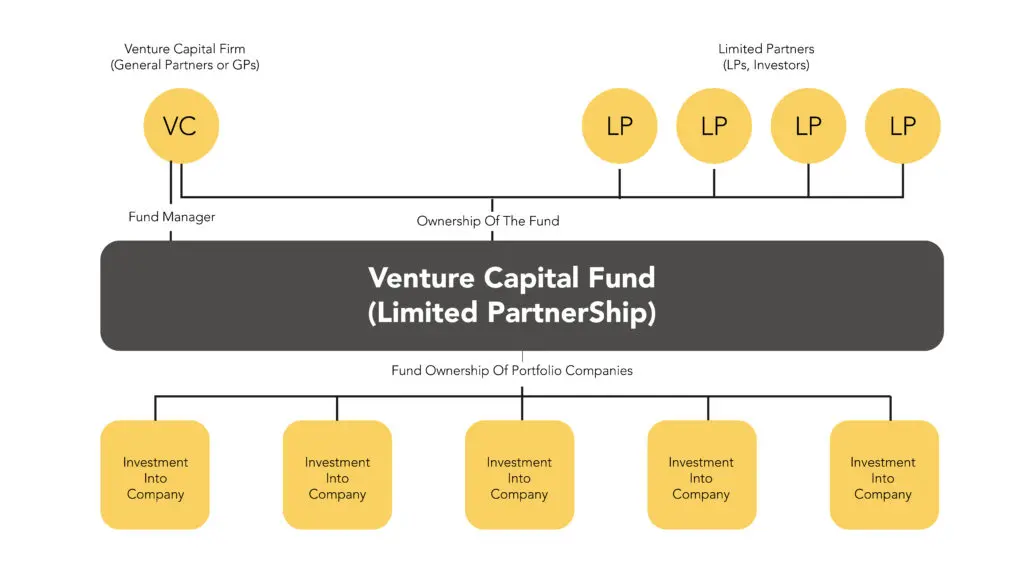

What makes working capital loans particularly valuable is their accessibility. Traditional financing options often require extensive collateral, lengthy approval processes, and rigid repayment terms. In contrast, working capital loans focus on your recent revenue, cash flow health, and overall business performance.

This makes them accessible to a wide range of industries, including niche businesses that might not qualify for conventional bank loans. For small businesses across sectors—from medical clinics to specialty retail and beyond—working capital loans provide a crucial financial safety net and growth accelerator.

Medical Clinics: Stabilizing Care Delivery Amid Reimbursement Cycles

Medical and healthcare businesses operate in one of the most complex financing environments. Insurance reimbursements and patient payments can take weeks or months to materialize, yet operational expenses—staff salaries, rent, medical supplies, equipment maintenance—are immediate and ongoing.

Clinics in states like California, Maryland, and Florida rely heavily on medical practice financing and working capital loans to bridge these reimbursement gaps. For example, a family practice in California might use a working capital loan to cover staff payroll and purchase diagnostic supplies while awaiting insurance claim settlements. Similarly, a dental clinic in Maryland could finance new dental chairs and equipment upgrades without disrupting cash flow.

VIP Capital Funding’s working capital solutions allow medical providers to focus on patient care rather than financial stress. Our tailored loan terms reflect the cyclical nature of healthcare reimbursements and regulatory requirements, helping clinics navigate seasonality and operational spikes confidently.

If you operate a medical business in Texas, Pennsylvania, or Virginia, explore our specialized business loans for healthcare professionals designed to meet your sector’s demands.

Specialty Retail: Managing Inventory and Customer Demand

Specialty retail businesses must balance inventory purchasing, staffing, and marketing—all while navigating seasonal fluctuations and changing consumer trends. For small retailers in New Jersey, Illinois, or Ohio, working capital loans are a vital tool for staying stocked, relevant, and competitive.

Imagine a boutique in New Jersey preparing for the holiday rush. Early access to capital allows them to purchase trending inventory in bulk, negotiate better terms with suppliers, and invest in seasonal marketing campaigns. Without sufficient working capital, these opportunities are lost to competitors.

Retailers also face overhead costs like rent, utilities, and payroll year-round. Slow seasons can stretch resources thin, making it harder to maintain consistent service levels. Access to flexible small business loans in New Jersey or Illinois helps smooth cash flow, ensuring the business remains operational and ready for the next peak.

Our inventory financing loans complement working capital by funding large purchases that convert into sales, maximizing both availability and profitability.

Auto Repair Shops: Handling Costs and Capturing Growth

Auto repair businesses operate on tight margins with fluctuating parts costs and labor demands. Shops in Texas, Georgia, and Michigan face unpredictable customer flow, costly parts inventory, and occasional equipment upgrades—all of which impact cash flow.

Working capital loans provide the immediate funds necessary to purchase parts in bulk, pay technicians, and cover facility expenses during slow periods or sudden upticks in demand. For instance, a shop in Georgia may use working capital financing to manage payroll while waiting for payments from extended warranties or fleet contracts.

As more vehicles incorporate advanced technology, auto repair businesses must invest in diagnostic equipment and technician training to stay competitive. These investments often require upfront capital that can strain operating budgets. Our equipment financing loans help businesses acquire the tools they need without sacrificing day-to-day liquidity.

Auto repair shops considering expansion, additional service bays, or new locations can also leverage business term loans and commercial business loans tailored to their growth ambitions.

E-Commerce Businesses: Balancing Inventory and Scaling Fast

E-commerce companies experience rapid growth but often struggle with cash flow due to upfront inventory costs, digital marketing expenses, and fulfillment challenges. Working capital loans provide a crucial financial cushion, allowing these businesses to seize growth opportunities without being hampered by liquidity constraints.

Whether you’re an online retailer in California, a startup in Texas, or an established brand in Florida, access to capital means timely inventory purchases, expanded marketing campaigns, and faster shipping operations. Many e-commerce companies use working capital to manage seasonal peaks—such as holiday sales or product launches—without compromising customer experience.

Our flexible online business loan applications streamline access to funding for e-commerce entrepreneurs, making it easier to secure working capital tailored to digital business models.

Moreover, e-commerce businesses benefit from revolving lines of credit, allowing them to borrow, repay, and re-borrow based on fluctuating needs. This flexibility supports cash flow cycles driven by sales volumes, supplier terms, and promotional schedules.

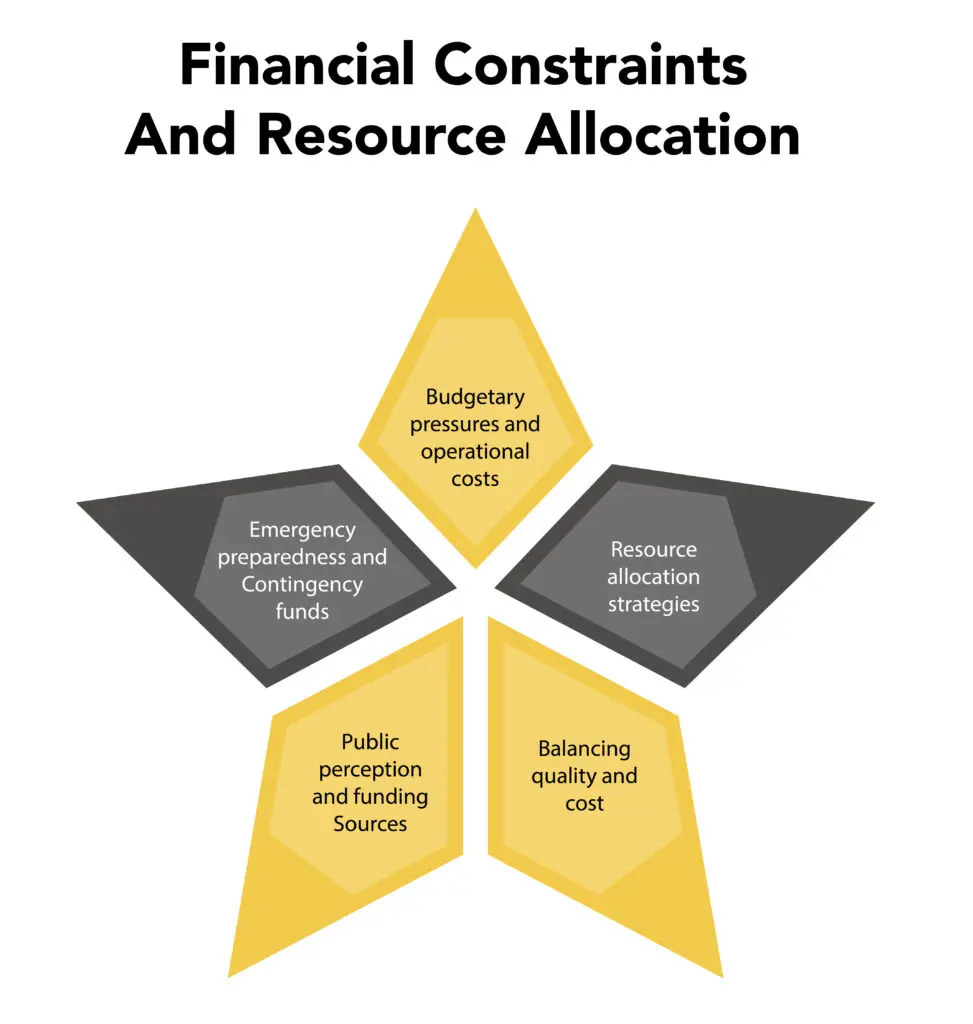

Strategic Timing and Structuring of Working Capital Loans

Achieving success with working capital loans depends heavily on two critical factors: timing and loan structure. Borrowing too early can unnecessarily increase interest costs, while waiting too long can mean missed business opportunities, operational disruptions, or cash flow crises. Striking the right balance is essential to maximize the benefits of working capital financing and sustain growth.

For seasonal businesses such as specialty retail stores and e-commerce companies, planning ahead is crucial. Retailers in New Jersey, for example, should consider securing working capital loans well in advance of peak shopping seasons like Black Friday or the winter holidays. This ensures they have sufficient funds to stock inventory, hire seasonal staff, and invest in marketing campaigns that drive sales.

Similarly, landscapers in North Carolina gearing up for the busy spring and summer months should access capital early to purchase supplies and cover upfront labor costs. When working capital loans are timed strategically, businesses are better positioned to meet demand and capitalize on revenue spikes.

Medical and healthcare providers also benefit from aligning their loans with their unique reimbursement cycles. Clinics in Maryland or Virginia often experience delays in insurance payouts or patient billing collections, creating gaps in cash flow.

By timing working capital loans to coincide with these reimbursement delays, medical businesses can ensure payroll and essential operating expenses are covered without interruption. This precise timing keeps care providers focused on patient outcomes instead of financial stress.

Auto repair shops and service providers in states like Ohio and Georgia frequently encounter unpredictable cash flow swings due to fluctuating parts costs and labor needs. Maintaining access to revolving credit facilities or short-term working capital loans allows these businesses to quickly respond to sudden spikes in expenses or increased service demand. This financial agility ensures repair shops can deliver timely service without waiting for client payments.

Beyond timing, structuring repayment schedules to match revenue inflows is fundamental. VIP Capital Funding works closely with clients to develop customized repayment plans that align with their project milestones, billing cycles, and cash flow realities. Properly structured loans minimize financial strain, prevent costly penalties, and foster healthier borrowing relationships.

In sum, smart timing and thoughtful loan structuring transform working capital loans from mere financial tools into powerful enablers of growth, stability, and competitive advantage across niche industries.

Avoiding Common Pitfalls with Working Capital Loans

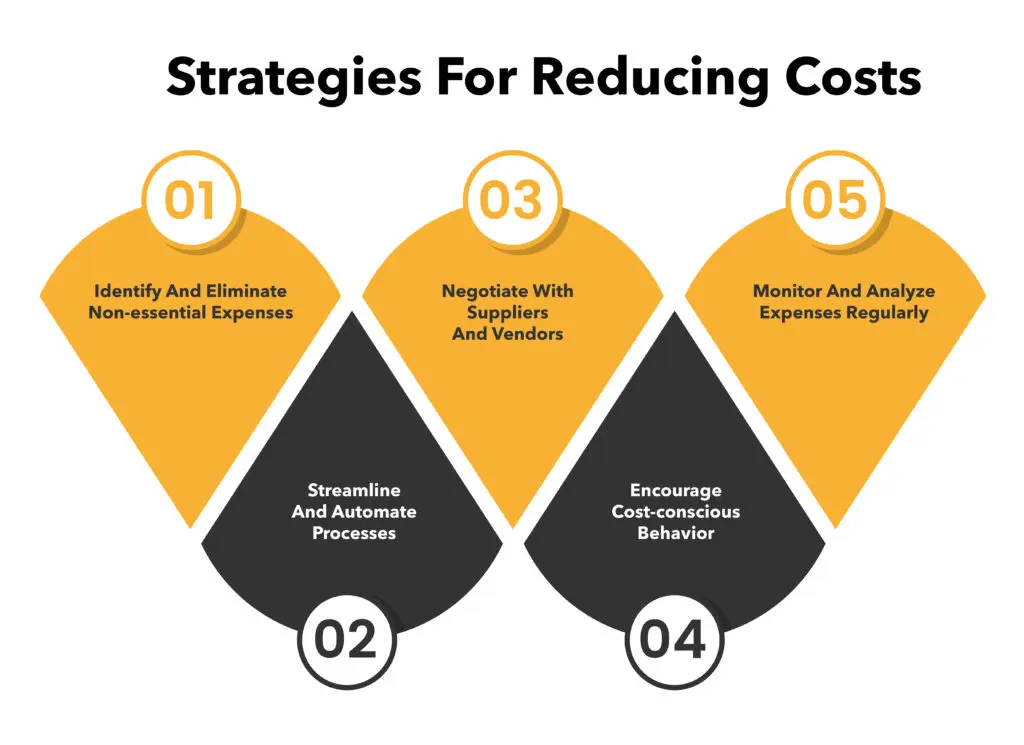

While working capital loans provide essential support to small businesses, responsible borrowing is crucial to ensuring long-term financial health and growth. One of the most common mistakes businesses make is over-borrowing beyond their realistic repayment capacity. Taking on more debt than your cash flow can handle creates a cycle of financial stress, missed payments, and potential damage to your credit profile, making future borrowing even more difficult.

Another critical aspect of successful borrowing is thoroughly reviewing loan terms before committing. Many businesses overlook fine print related to interest rates, hidden fees, and repayment schedules. At VIP Capital Funding, we prioritize transparency by providing clear, straightforward agreements with no surprise costs. Our clients know exactly what they are agreeing to, which builds trust and fosters responsible financial planning.

Strategic use of working capital loans is also vital. These loans should fund specific, impactful needs such as purchasing inventory, covering payroll during slow periods, or financing marketing campaigns that drive growth. They are not a permanent fix for chronic cash flow problems. Misusing working capital loans as a crutch can lead to ongoing financial instability.

Our team guides clients through this process, helping them identify the best loan products for their unique situation, whether that’s a small business loan in California or a short-term business loan in Florida.

Why VIP Capital Funding?

VIP Capital Funding stands out for its personalized approach, speed, and transparency. We understand that niche small businesses across the country—from Texas to Pennsylvania—have diverse funding needs.

Our strong track record, supported by glowing Trustpilot reviews and Better Business Bureau accreditation, reflects our commitment to empowering small businesses with tailored working capital loans and other financial products.

Explore our full suite of options including bridge loans, inventory financing, and unsecured business loans to find the right fit for your business growth.

Working capital is the fuel that keeps niche small businesses thriving through uncertainty and opportunity. Whether you’re managing a medical clinic in Maryland, running a specialty retail shop in Illinois, or growing an e-commerce brand in Nevada, VIP Capital Funding offers the customized funding solutions you need.

Apply for working capital loans today and join the thousands of satisfied business owners nationwide who trust us to keep their operations moving forward.

See why builders, entrepreneurs, and professionals across the U.S. rely on VIP Capital Funding—read our client reviews, check our BBB accreditation, and discover a trusted lending partner committed to your success.