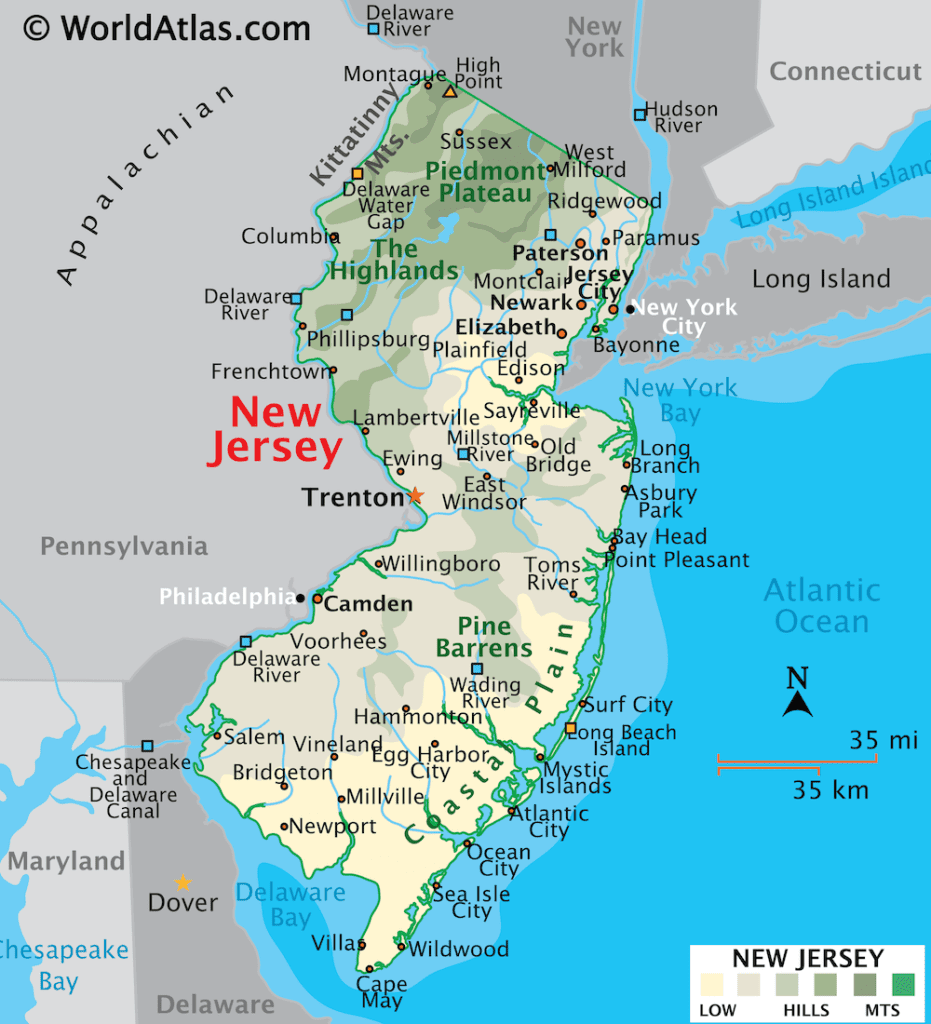

New Jersey, affectionately nicknamed the “Garden State,” isn’t just known for its fertile farmland and stunning coastlines. The true engine driving its economy lies within its vibrant network of small businesses. These businesses, often family-owned and deeply rooted in their communities, play a crucial role in shaping the social and economic fabric of New Jersey.

Here’s why small businesses are essential to the state’s well-being:

Job Creators and Economic Drivers: According to the U.S. Small Business Administration (SBA), a staggering 97% of all businesses in New Jersey are classified as small businesses. This translates to a massive network of over 861,000 enterprises. More importantly, these businesses are responsible for a significant portion of the state’s workforce. The New Jersey Chamber of Commerce reports that small business employers in New Jersey account for a remarkable 87% of all private-sector employers. This means that for every ten jobs created in New Jersey’s private sector, nearly nine come from a small business. As these businesses grow and expand, they create additional job opportunities, contributing to a healthy and diverse job market.

Local Anchors and Community Hubs: Small businesses are often deeply integrated into the social fabric of their communities. They are the local bakery you frequent every Saturday morning, the independent bookstore hosting author readings, or the family-run hardware store where everyone knows your name. These businesses not only provide essential goods and services but also foster a sense of community and belonging. They sponsor local events, support charities, and create gathering places for residents. A study by the National League of Cities found that small businesses are more likely to source goods and services locally, further strengthening the economic fabric of their communities.

Innovation and Entrepreneurship: Small businesses are often at the forefront of innovation. Unburdened by the bureaucracy of larger corporations, they have the agility to adapt to changing consumer preferences and technological advancements. This fosters a culture of entrepreneurship within the state, attracting talented individuals and fostering the development of new ideas and products. This innovative spirit not only benefits the businesses themselves but also contributes to the overall economic growth of New Jersey.

Diversity and Inclusion: Small businesses often offer opportunities for individuals from diverse backgrounds to pursue their entrepreneurial dreams. A report by the Institute for Local Self-Reliance found that minority-owned firms are more likely to be located in low- and moderate-income communities, providing essential services and creating jobs in areas that might otherwise be underserved. This fosters economic inclusion and empowers diverse communities within New Jersey.

Challenges and Looking Ahead: While small businesses are vital to New Jersey’s success, they also face significant challenges. Access to capital, competition from larger corporations, and navigating complex regulations can often hinder their growth.

New Jersey boasts a thriving network of small businesses, forming the backbone of its economy. These businesses create jobs, foster innovation, and contribute significantly to the social fabric of the state. However, despite their vital role, many New Jersey small businesses face a significant hurdle that can cripple their growth – access to reliable funding.

The Funding Gap: Securing capital is a major challenge for New Jersey’s small businesses. Traditional banks often have strict lending criteria, requiring strong credit scores, established business history, and substantial collateral – factors that many startups or young companies lack.

The High-Cost Alternative: While alternative lenders might fill the funding gap, their offerings often come with a hefty price tag. These lenders might offer shorter loan terms and significantly higher interest rates compared to traditional banks. A report found that interest rates for alternative small business loans in the state can range from 9% to 30%, significantly straining a small business’s cash flow and hindering long-term financial stability. This “payday loan” style of financing can trap businesses in a cycle of debt, making it difficult to invest in true growth initiatives.

The Information Maze: Navigating the complex landscape of financing options can be overwhelming for small business owners. Many valuable resources, like government grants, microloan programs, and angel investor networks, might go underutilized due to a lack of awareness or difficulty meeting specific qualifications. The New Jersey Economic Development Authority (NJEDA) offers various funding programs for small businesses, but the application process can be lengthy and complex, deterring some entrepreneurs from even considering this avenue.

The Reliability Dilemma: Finding a reliable lender can be equally challenging. A lack of transparency in loan terms and hidden fees can leave small business owners vulnerable to predatory lending practices. This not only erodes trust but also puts the financial health of the business at risk.

The Collateral Conundrum: Securing loans often requires collateral, which many small businesses, particularly those in service sectors, might not possess. For example, a local bakery might struggle to come up with enough assets to secure a traditional loan, restricting its ability to invest in new ovens or expand its menu offerings. This lack of collateral further limits access to traditional financing, hindering its potential for growth.

At VIP Capital Funding, we recognize the unique funding challenges faced by small business owners in New Jersey. You’re building something remarkable in the Garden State, but financial constraints impact your progress. Here’s how we can help your business survive and thrive.

Helping Businesses Grow: Cash flow gaps shouldn’t stall your momentum. We offer a diverse range of working capital loans, from $50,000 to $15 million, meticulously tailored to your specific needs. Looking to invest in cutting-edge equipment for your Newark manufacturing facility or expand your seasonal inventory for the bustling Jersey Shore tourism season? Our flexible funding solutions have you covered.

Prepayment Discounts: We believe hard work deserves a significant reward. That’s why we offer substantial prepayment discounts of 10% to 35% if you pay off your loan early. Focus on growing your business without the burden of high interest, and keep more of your hard-earned money flowing back into your venture.

Flexible Requirements: Unlike traditional lenders with rigid requirements, we understand that success comes in all shapes and sizes. Our low minimum annual revenue requirement allows us to partner with a wider range of New Jersey businesses, from blossoming startups to established enterprises. We believe in your vision and potential, not just your bottom line.

Financing on Your Terms: Every business has a unique cycle. That’s why we offer flexible repayment plans ranging from 6 to 24 months, ensuring your payments align seamlessly with your cash flow. This financial freedom allows you to focus on growing your business without the stress of rigid repayment schedules.

Credit Score Confidence: Building a strong credit history takes time and dedication. That’s why we utilize a soft credit pull, minimizing any impact on your score. Apply with confidence, knowing your creditworthiness won’t hinder your access to the funding you need to propel your business forward.

Fast Funding, Faster Growth: In the competitive New Jersey market, time is of the essence. That’s why we offer a streamlined application process. Get pre-approved within 24 hours and access funds in just 1-3 business days. Seize opportunities quickly and turn your vision into a thriving reality without delay.

Maximize Your Tax Advantages: Did you know that loan interest payments may be tax-deductible? This can significantly reduce your tax burden and free up valuable resources to reinvest in your business and fuel further growth within the Garden State.

Get in touch with our small business funding specialists today to discover limitless possibilities.

At VIP Capital Funding, we understand the time constraints and complexities faced by New Jersey entrepreneurs. Securing funding shouldn’t be an additional hurdle on your road to success. That’s why we’ve designed a streamlined application process, and a seamless funding experience and offer a diverse range of loan programs to meet your unique business needs.

Our application process is designed to minimize disruption to your busy schedule. We’ve replaced mountains of paperwork with a straightforward online application that can be completed in minutes. Gone are the days of waiting weeks for a decision; at VIP Capital Funding, you can get pre-approved within 24 hours. This allows you to quickly assess your financing options and make informed decisions for your business.

Once you’re pre-approved, the funding process is just as smooth. We understand that access to capital is often time-sensitive. That’s why we’ve streamlined our approval process, allowing you to access funds in as little as 1-3 business days. This eliminates the waiting game and allows you to seize fleeting opportunities or address immediate needs without delay.

We offer a variety of loan programs specifically designed to cater to the diverse needs of New Jersey businesses. Here’s a glimpse into some of our core offerings:

Get in touch with VIP Capital Funding today and apply for small business short-term loans to take your business to new heights.