Business Loans

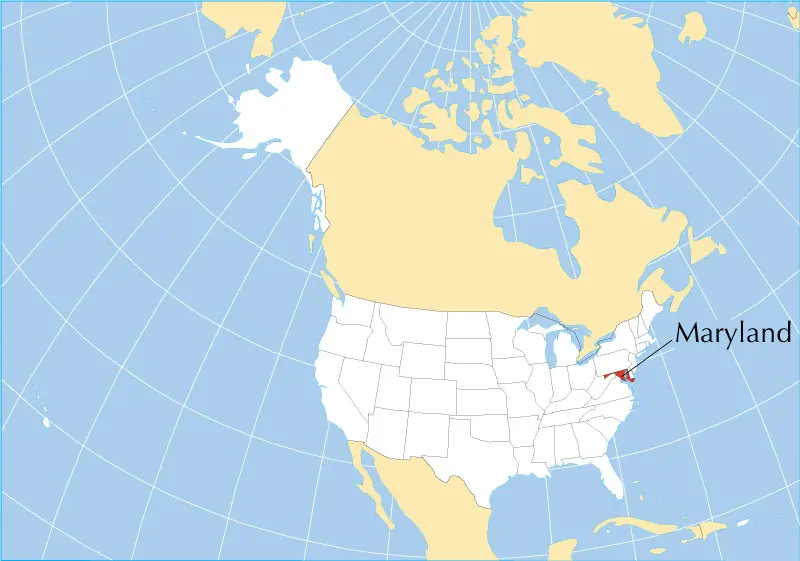

Seamless Small Business Funding in Maryland

Did you know that according to the U.S. Small Business Administration (SBA), over 99.7% of Maryland businesses are classified as small businesses? That’s a huge number! These businesses are the backbone of the state’s economy, creating jobs and bringing life to local communities. But even the best companies can face cash flow gaps. Maybe you need to restock inventory before a big sale, cover payroll expenses, or pay for unexpected bills. Small business loans help bridge these gaps, ensuring you have the money you need to keep your business operating smoothly.

Imagine this: you’re running a thriving bakery in Maryland. Customers love your fresh bread and delicious pastries. But then, disaster strikes-your oven breaks down right before the busy holiday season! The repair costs are high, and you can’t afford to lose business during this crucial time. This is where small business loans come in, providing the financial support you need to fix the oven and keep your business running smoothly.

Small businesses in Maryland face significant challenges when it comes to securing funding, particularly for day-to-day operations. These challenges stem from several factors, including the need for seamless working capital and the lack of reliable lenders in the state.

One of the biggest hurdles for small businesses in Maryland is the need for seamless working capital funding. Working capital is essential for covering day-to-day operational expenses such as payroll, inventory, rent, and utilities. Without adequate working capital, businesses may struggle to maintain their operations, leading to cash flow problems and potential closures.

Many small businesses in Maryland require consistent and reliable access to working capital to keep their operations running smoothly. However, securing this funding can be a challenge due to the strict requirements of traditional lenders such as banks. Banks often require businesses to have a strong credit history, significant collateral, and a lengthy track record of profitability, which can be difficult for small businesses, especially startups, to meet.

Additionally, small businesses in Maryland may face challenges in finding reliable lenders who are willing to provide them with the funding they need. While there are many lenders in the state, not all of them may offer the right type of funding or have the flexibility to meet the unique needs of small businesses. This can result in small businesses having to settle for less-than-ideal funding options or being unable to secure funding at all.

Another challenge for small businesses in Maryland is the lack of awareness about alternative funding options. Many small business owners may not be aware of the various funding options available to them, such as alternative lenders, crowdfunding, or government grants. This lack of awareness can limit small businesses’ ability to explore all their funding options and find the best solution for their needs.

To address these challenges, small businesses in Maryland need to be proactive in seeking out funding options and building relationships with reliable lenders. Small business owners should take the time to research and understand the different funding options available to them and be prepared to present a strong business case when seeking funding. Additionally, small businesses should consider working with financial advisors or consultants who can help them navigate the funding landscape and find the right funding solution for their needs.

But where do you find such lenders? Well, you’ve come to the right place!

Seamless Small Business Funding in Maryland

Running a business in Maryland is exciting! You’re your own boss, building something special. But sometimes, even the most amazing ideas need a little cash boost to get off the ground, or maybe your business is growing like crazy, and you need a helping hand to keep up. That’s where VIP Capital Funding comes in! We specialize in making small business loans in Maryland seamless, quick, and efficient. But what sets us apart? Our loans are tailored to your business’s unique needs, with flexible repayment options and competitive interest rates. Here’s why VIP Capital Funding is different and can be a great fit for your Maryland business:

Fast Funding, Fewer Headaches

Imagine this: you have a fantastic opportunity, a new marketing campaign that could bring in a ton of customers, but you need some cash upfront. Traditional banks can take weeks, even months, to approve a loan. With VIP Capital Funding, you can get pre-approved in just 24 hours and have the funds you need in your account in as little as 1-3 business days. That means you can seize opportunities quickly and not miss out on your chance to grow!

No More Paper Chase

Remember those mountains of paperwork traditional banks make you fill out? Yeah, we don’t do that. Our easy online application can be completed in just a few minutes. There’s no need to print anything out. Answer some basic questions about your business, and you’re on your way.

Financing Solutions for Every Business

Every business is unique, and your financial needs are too. That’s why we offer a variety of flexible loan options to fit your specific situation. Here are a few examples:

- Need to stock up on inventory for the holiday rush?Our inventory financing solutions can help!

- Got a great idea for a new product or service but need the cash to make it happen?Our working capital loans can bridge the gap.

- Is your business growing so fast that you need some extra breathing room?Our small business loans can provide the resources you need to keep up with the momentum.

We understand that financial jargon can be confusing. At VIP Capital Funding, we explain things clearly and straightforwardly. No fancy terms, just honest explanations of our loan options, fees, and repayment structures. You’ll know exactly what you’re getting into before you commit.

We believe in Maryland’s small businesses, and we want to see you succeed! Our dedicated loan specialists are more than just lenders; they’re experienced professionals who can answer your questions, guide you through the financing process, and even offer helpful tips based on their experience.

Getting a loan shouldn’t be a stressful experience. With VIP Capital Funding’s streamlined process and fast funding, you can focus on what truly matters: running your amazing Maryland business! Whether you’re a seasoned entrepreneur or just starting, we’re here to help you take your business to the next level.

So, if you’re a Maryland business owner looking for fast, easy, and hassle-free funding, contact VIP Capital Funding today! Let’s chat about your goals and see how we can help you turn your vision into reality. Remember, a little financial boost can go a long way, and VIP Capital Funding is here to be your partner in success!

Our Small Business Loan Program in Maryland

At VIP Capital Funding, we believe in providing flexible short-term financing solutions that fit your Maryland business, no matter where you are in your journey. Whether you’re a seasoned entrepreneur or just starting, we have the program to empower you:

- Inventory Loans: Manage seasonal spikes or unexpected customer demand with our inventory financing solutions. These loans provide the upfront capital you need to stock up on inventory, ensuring you have what your customers need and avoid lost sales.

- Working Capital Loans: Bridge temporary cash flow gaps and keep your business running smoothly with our working capital loans. These loans offer the flexibility to cover payroll, invest in marketing campaigns, or handle unexpected costs so you can keep your business operating seamlessly.

- Small Business Loans: Our versatile small business loans can be used for various purposes. Need to upgrade equipment, invest in renovations, or expand your marketing reach? These loans provide the resources to take your Maryland business to the next level.

- Online Business Loans: In today’s digital age, online businesses are a driving force. Our online business loans cater specifically to the needs of e-commerce ventures, providing the capital you need to manage inventory, invest in marketing automation tools, or enhance your online presence.

- First-Time Business Loans: Launching your first venture can be exciting but also daunting. VIP Capital Funding understands the challenges faced by first-time entrepreneurs. Our first-time business loans can help bridge the funding gap, providing the resources you need to turn your dream into a reality.Get in touch with our small business funding specialists today to discover limitless possibilities.

- Bridge Loans:Unexpected expenses or temporary setbacks can disrupt your cash flow. Our bridge loans offer a quick and flexible solution, providing the capital you need to navigate these temporary hurdles and maintain momentum in your business.

- Business Term Loans:Invest in long-term growth strategies with our business term loans. These loans provide a fixed interest rate and a defined repayment schedule, allowing you to plan for the future and make strategic investments with confidence.

Get in touch with our small business funding specialists today to discover limitless possibilities.

Streamlined Process, Fast Funding, Real Results

Small business loans are like lifesavers for Maryland’s amazing small businesses, providing the financial boost they need to keep things running smoothly or take things to the next level. At VIP Capital Funding, we understand the unique challenges and needs of small businesses, and we’re here to support you.

Small business loans are a powerful tool for Maryland’s entrepreneurs. They help keep businesses running smoothly, fuel growth, and turn dreams into reality. With quick and seamless funding options available, there’s no reason to wait. In the fast-paced world of business, delays can be costly. Explore your financing options, find the right loan for your business, and watch your business grow to new heights.

Get in touch with VIP Capital Funding today and apply for small business short-term loans to take your business to new heights.