In the dynamic world of business finance, short-term loans for businesses play a crucial role, providing rapid access to capital for various immediate needs. These loans offer businesses the flexibility to address financial gaps and seize opportunities without the lengthy approval processes associated with traditional financing.

This comprehensive guide will explore what short-term business loans are, why businesses are increasingly turning to private lenders, and how to determine if they are the right fit for your financial needs.

Why Are Businesses Preferring Private Short-Term Loans Over Traditional Financing?

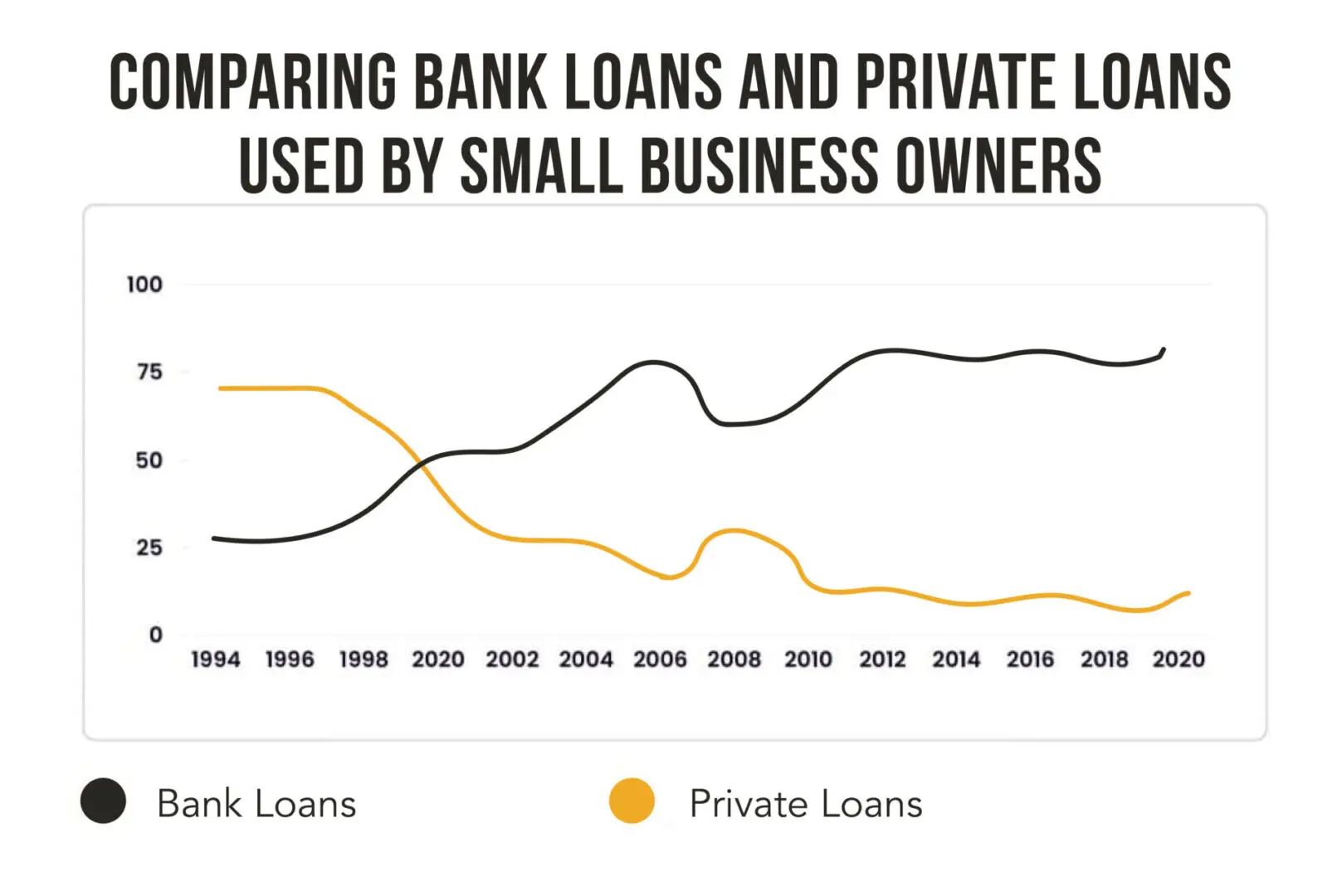

The shift towards private short-term loan providers over traditional financing options is driven by several key factors:

Speed of Approval: Traditional bank loans often involve a lengthy approval process, requiring extensive documentation and multiple rounds of verification. In contrast, private lenders offer a streamlined application process that allows businesses to receive funds much faster. This speed is particularly advantageous for businesses that need immediate capital to address urgent needs or capitalize on time-sensitive opportunities.

Less Stringent Requirements: Traditional lenders typically have stringent eligibility criteria, including high credit score requirements and substantial collateral. Private short-term loan providers often have more flexible criteria, making it easier for businesses with less-than-perfect credit to qualify. This accessibility is crucial for startups and small businesses that may not yet have an established credit history.

Less Stringent Requirements: Traditional lenders typically have stringent eligibility criteria, including high credit score requirements and substantial collateral. Private short-term loan providers often have more flexible criteria, making it easier for businesses with less-than-perfect credit to qualify. This accessibility is crucial for startups and small businesses that may not yet have an established credit history.

Flexibility: Private lenders offer a wide range of short-term small business loans tailored to various needs. Whether a business requires working capital, inventory financing, or equipment purchases, private lenders can provide customized solutions. This flexibility allows businesses to choose a loan that aligns with their specific requirements and financial situation.

Accessibility: Short-term loans are often more accessible to businesses that might struggle to secure traditional financing. For instance, seasonal businesses or startups may not meet the rigorous criteria of traditional banks but can still obtain short-term financing through private lenders. This increased accessibility helps businesses manage cash flow and navigate financial challenges more effectively.

Common Misconceptions About Short-Term Loans

Despite their advantages, short-term loans for businesses are often surrounded by misconceptions. Addressing these myths can help businesses make more informed decisions about using short-term financing:

High Costs: A common misconception is that short-term loans are excessively expensive. While they may come with higher interest rates compared to long-term loans, the overall cost should be evaluated in the context of the benefits they provide. The speed and flexibility of short-term loans can justify the costs, especially if they help businesses avoid more expensive alternatives or capitalize on valuable opportunities.

Only for Financial Emergencies: Short-term loans are frequently associated with emergencies, but they can also be used strategically for planned financial needs. For example, businesses might use short-term loans to finance a new marketing campaign, invest in technology upgrades, or expand their product line. Using short-term loans proactively can support growth and operational improvements.

Poor Creditworthiness: Some businesses believe that short-term loans are only available to those with excellent credit. In reality, many private lenders consider factors beyond credit scores, such as current cash flow and business performance. This broader evaluation can make short-term loans accessible to businesses with varied credit profiles.

Short-Term Loans Affect Long-Term Financing: There is a concern that taking out a short-term loan might negatively impact a business’s ability to secure long-term financing. However, responsible use of short-term loans can demonstrate a business’s financial stability and management skills. This positive track record can enhance a business’s credibility with potential long-term lenders.

When to Consider a Short-Term Loan: Signs Your Business Needs a Cash Injection

Determining when to seek a short-term loan requires a keen understanding of your business’s financial needs and goals. Here are some signs that a short-term loan might be appropriate:

Seasonal Fluctuations: Many businesses experience variations in revenue due to seasonality. For instance, retail stores may see increased sales during the holiday season but face cash flow challenges in the off-season. A short-term loan can help bridge the gap, ensuring that the business has sufficient funds to manage expenses and prepare for peak seasons.

Inventory Needs: Businesses that rely on inventory may face challenges when demand spikes or when they need to replenish stock. Short-term small business loans can provide the capital necessary to purchase inventory or manage supply chain disruptions. This ensures that the business can meet customer demand without compromising financial stability.

Unexpected Expenses: Unforeseen expenses, such as emergency repairs, urgent operational costs, or sudden opportunities, can strain a business’s cash flow. Short-term loans offer a quick solution to address these expenses, allowing the business to continue operations smoothly without significant financial strain.

Opportunities for Growth: Businesses often encounter growth opportunities that require immediate funding. Whether it’s expanding into new markets, launching a new product line, or investing in new technology, short-term loans can provide the necessary capital to capitalize on these opportunities and drive business growth.

Short-Term Loans for Seasonal Businesses

For seasonal businesses, managing cash flow can be particularly challenging. Short-term loans are an effective tool for addressing these cyclical needs. By securing financing ahead of peak seasons, businesses can prepare for increased demand, invest in inventory, and cover operational expenses during slower periods.

Seasonal businesses, such as those in retail or agriculture, often experience fluctuations in revenue that can impact their ability to maintain steady operations. Short-term loans help these businesses navigate the ups and downs of their seasonal cycles, ensuring they have the necessary resources to manage both peak and off-peak periods effectively.

Bridging the Gap: Using Short-Term Loans for Growth Opportunities

Short-term loans are not only useful for immediate financial needs but also for strategic growth initiatives. When businesses encounter opportunities for expansion, such as entering new markets, acquiring new technology, or launching innovative products, short-term financing can provide the necessary capital to seize these opportunities.

Using short-term loans to bridge the gap between funding needs and long-term financial stability allows businesses to stay agile and competitive. By leveraging short-term financing for growth, businesses can enhance their capabilities, improve their market position, and achieve their strategic objectives.

How Short-Term Loans Work

Here’s an in-depth look at how these loans work:

The Short-Term Loan Application Process

Applying for a short-term loan is generally more straightforward compared to traditional loans. The application process typically involves providing basic information about the business, including its financial status, operations, and loan purpose. Lenders may request recent financial statements, bank statements, and tax returns to assess the business’s creditworthiness and ability to repay the loan.

The streamlined application process allows businesses to receive funds quickly, often within a few days. This rapid turnaround is beneficial for addressing urgent financial needs or capitalizing on time-sensitive opportunities.

Repayment Terms and Structures

Short-term loans are characterized by their brief repayment periods, which generally range from a few months to a year. Repayment terms can vary depending on the lender and the specific loan product. Common repayment structures include daily, weekly, or monthly payments, and the terms are outlined in the loan agreement.

Businesses should carefully review the repayment terms to ensure they can meet the schedule without straining their financial resources. Understanding the repayment structure helps businesses manage their cash flow effectively and avoid potential repayment issues.

Costs Associated with Short-Term Loans

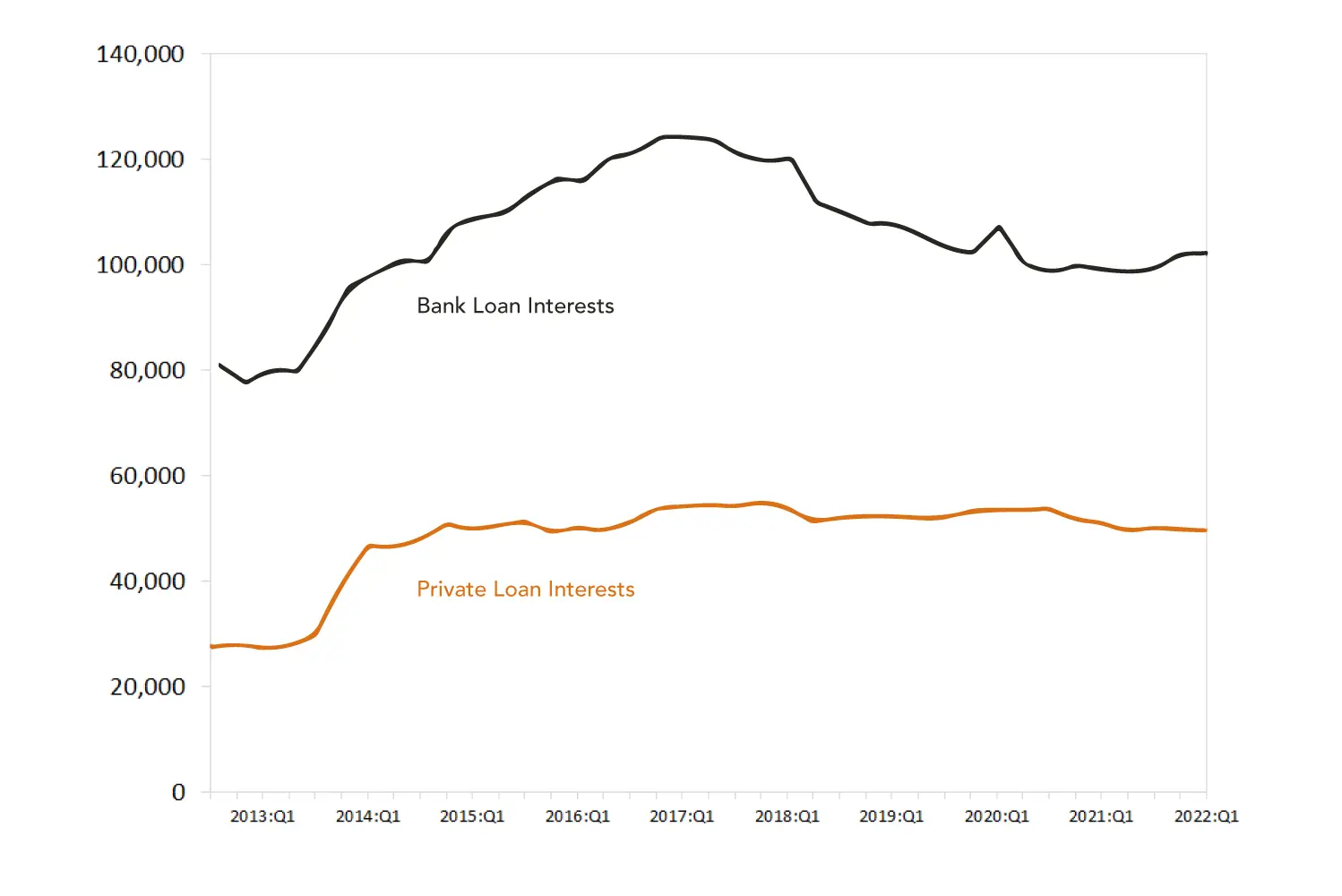

While short-term loans offer quick access to capital, they may come with associated costs. These costs can include interest rates, origination fees, and other charges. The overall expense of the loan will depend on factors such as the loan amount, repayment term, and the lender’s fee structure.

It is crucial for businesses to evaluate the costs associated with short-term loans and compare them with the benefits they provide. By considering both the costs and advantages, businesses can make informed decisions about whether short-term financing is the right solution for their needs.

5 Common Mistakes Small Business Owners Make When Taking a Loan

Understanding and avoiding common mistakes can significantly impact the effectiveness of short-term loans for businesses. Here are five prevalent errors that small business owners often make:

Choosing Loans with High Interest Rates

One of the most common mistakes is selecting a loan with a high      interest rate. Small business owners sometimes prioritize speed over cost, leading them to choose lenders that offer rapid approval but charge exorbitant interest rates. While these loans might solve immediate cash flow problems, the long-term costs can be substantial. High-interest loans can strain a business’s finances and potentially offset the benefits of obtaining quick capital. It’s essential to compare interest rates and understand the total cost of borrowing before committing to a loan.

Neglecting to Review the Loan Terms Carefully

Another common mistake is not thoroughly reviewing the loan terms. Small business loans can come with various fees, repayment schedules, and conditions that can affect the overall cost and manageability of the loan. Failure to understand these terms can lead to unexpected financial burdens and difficulties in meeting repayment obligations. Business owners should carefully review all loan agreements and seek clarification on any terms or conditions that are unclear.

Overestimating Repayment Capacity

Small business owners sometimes overestimate their ability to repay a loan, leading to cash flow problems and financial strain. It’s crucial to assess your business’s financial health realistically and ensure that you can comfortably meet the loan repayments without jeopardizing other operational needs. Underestimating the impact of loan repayments on your cash flow can lead to missed payments and potential damage to your credit profile.

Using the Loan for Non-Essential Expenses

Using a short-term loan for non-essential or discretionary expenses is a common error. Short-term loans should be used for critical needs that directly impact your business’s operations, such as inventory purchases, equipment upgrades, or managing cash flow during seasonal fluctuations. Utilizing the loan for non-essential expenses can lead to unnecessary debt and diminish the benefits of the loan. It’s essential to have a clear plan for how the loan funds will be used to ensure they contribute to the growth and stability of your business.

Key Factors to Consider When Choosing a Lender

Selecting the right lender is crucial for maximizing the benefits of short-term loans for business. Here are key factors to consider when choosing a lender:

Interest Rates and Fees

Interest rates and fees significantly impact the overall cost of a loan. Different lenders offer varying rates, and understanding the total cost of borrowing is essential for making an informed decision. Look for lenders who offer competitive rates and transparent fee structures. Avoid lenders with hidden fees or excessive charges that can increase the cost of the loan.

Loan Terms and Repayment Flexibility

Loan terms and repayment flexibility are important factors to consider. Short-term loans can come with different repayment schedules, such as daily, weekly, or monthly payments. Ensure that the repayment terms align with your business’s cash flow and financial capabilities. Lenders who offer flexible repayment options can provide more manageable terms and reduce the risk of financial strain.

Lender’s Reputation and Customer Service

The reputation and customer service of a lender play a significant role in the borrowing experience. Research the lender’s track record and customer reviews to gauge their reliability and service quality. A lender with a positive reputation and responsive customer service can provide a smoother borrowing experience and support you throughout the loan process.

Approval Speed and Funding Process

The speed of approval and funding process can vary between lenders. For businesses that need quick access to capital, choosing a lender with a fast approval process and efficient funding turnaround is crucial. Ensure that the lender can meet your timeline and provide the funds when you need them.

Eligibility Requirements

Different lenders have different eligibility criteria for short-term small business loans. Some may require specific credit scores, financial statements, or collateral. Assess your business’s eligibility and ensure that you meet the lender’s requirements before applying. Lenders with more flexible eligibility criteria can be beneficial for businesses with varying financial profiles.

How to Use the Short-Term Loan

Once you’ve secured a short-term loan, using the funds effectively is key to achieving your financial goals. Here’s how to make the most of your loan:

Develop a Clear Plan

Before using the loan funds, develop a clear plan for how the money will be used. Identify the specific needs or opportunities that the loan will address, such as purchasing inventory, upgrading equipment, or covering operational expenses. Having a well-defined plan ensures that the loan funds are used strategically and contribute to the growth and stability of your business.

Prioritize Essential Expenses

Allocate the loan funds to essential expenses that directly impact your business’s operations. Prioritizing critical needs ensures that the loan contributes to immediate financial stability and supports long-term growth. Avoid using the funds for non-essential or discretionary expenses that do not align with your business’s strategic objectives.

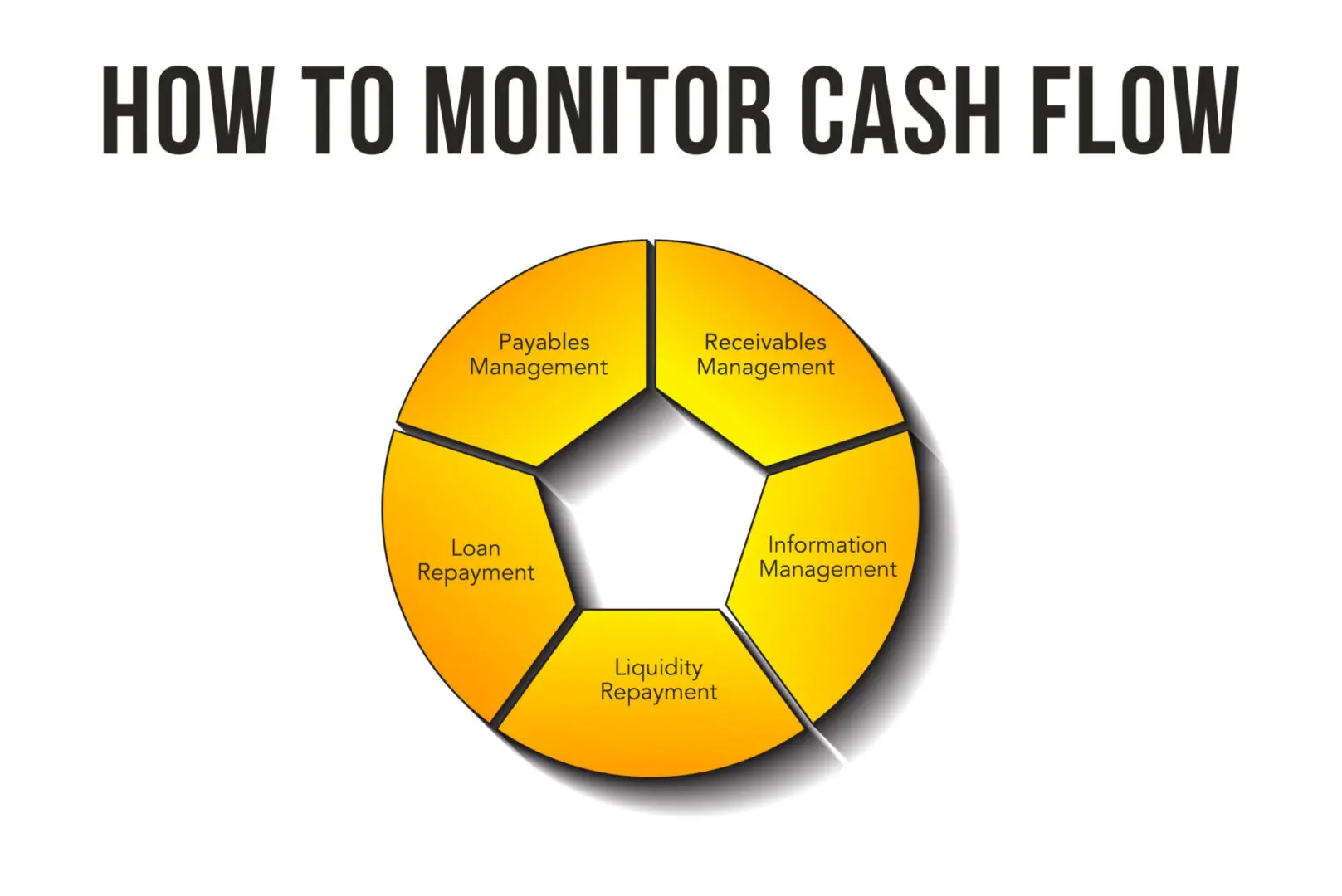

Monitor and Manage Cash Flow

Effective cash flow management is crucial when using a short-term loan. Monitor your business’s cash flow regularly to ensure that the loan funds are being used efficiently and that you can meet repayment obligations. Implement financial management practices, such as budgeting and forecasting, to maintain a healthy cash flow and avoid potential financial challenges.

Communicate with Your Lender

Maintain open communication with your lender throughout the loan term. If you encounter any challenges or anticipate difficulties in meeting repayment obligations, inform your lender promptly. A proactive approach can help you address issues early and explore potential solutions, such as modifying repayment terms or restructuring the loan.

Budgeting for Loan Repayments

Budgeting for loan repayments is essential to ensure that your business can manage its financial obligations without strain. Here’s how to effectively budget for short-term loan repayments:

Calculate Repayment Amounts

Determine the total repayment amounts, including principal and interest, based on the loan terms and repayment schedule. Use this information to calculate the monthly or periodic payments required to fulfill your repayment obligations. Accurate calculations help you plan and allocate funds accordingly.

Integrate Repayments into Your Budget

Incorporate the loan repayments into your business’s overall budget. Allocate a portion of your revenue to cover the loan payments and ensure that other operational expenses are also accounted for. Adjust your budget to accommodate the new financial commitment and maintain a balanced cash flow.

Monitor Cash Flow and Adjust as Needed

Regularly monitor your cash flow to ensure that you can meet your repayment obligations. If your cash flow fluctuates or if you encounter unexpected expenses, adjust your budget to maintain financial stability. Effective cash flow management helps you stay on track with repayments and avoid potential financial issues.

Build a Repayment Reserve

Consider building a repayment reserve or contingency fund to cover loan payments in case of unexpected cash flow challenges. Having a financial cushion can provide added security and reduce the risk of missed payments. This reserve helps you manage repayments more effectively and maintain financial stability.

Review and Update Your Budget Regularly

Regularly review and update your budget to reflect changes in your financial situation or loan terms. Adjust your budget as needed to accommodate any variations in cash flow or repayment requirements. Staying up-to-date with your budget ensures that you can manage loan repayments efficiently and maintain financial control.

Short-Term Loans for Startups: Tips

Startups often face unique challenges when seeking short-term small business loans. Here are some tips to help startups navigate the loan process effectively:

Build a Strong Business Plan

A well-prepared business plan is crucial for securing short-term loans. Lenders want to see a clear and detailed plan that outlines your business model, target market, financial projections, and growth strategies. A strong business plan demonstrates your business’s potential and increases your chances of obtaining financing.

Establish a Solid Credit Profile

Building a solid credit profile is essential for securing short-term loans. Even if your startup is new, focus on establishing a good credit history by managing your personal and business credit responsibly. Pay bills on time, maintain low credit card balances, and avoid taking on excessive debt.

Seek Professional Advice

Consider seeking professional advice from financial advisors or business consultants to guide you through the loan process. Professionals can help you prepare your loan application, evaluate loan options, and ensure that you make informed decisions. Their expertise can be valuable in navigating the complexities of securing short-term loans for businesses.

Unlock the potential of your business with VIP Capital Funding! Whether you need short-term loans, construction financing, or working capital, we offer tailored solutions for your needs.

Apply online now for fast approval and funding in New Jersey, North Carolina, Ohio, and beyond. Start your application today and secure your financial future!