1. Boost Hiring to Meet Demand

The growth of any business often hinges on having the right team in place. Small business loans provide the capital to recruit skilled employees, which can be critical in sectors like healthcare, technology, or retail where demand often fluctuates. With the additional funds, businesses can invest in hiring practices, including posting job listings, running training programs, and offering competitive salaries to attract top talent.

Building a strong team isn’t only about filling positions—it’s about ensuring that as demand increases, your business can keep up. For example, a healthcare provider might need more nursing staff to handle an influx of patients, while a tech company might need more developers to accelerate product launches. Small business loans help bridge this gap, giving owners the financial cushion to expand their team as needed.

2. Enable Expansion into New Markets

Accessing new markets can be a highly effective way to increase revenue, but it often requires a significant upfront investment. Small business loans give owners the flexibility to explore new markets, from purchasing inventory and equipment to advertising and marketing efforts.

For retail and e-commerce businesses, market expansion may include opening new physical locations or establishing an online presence in a different region. Small business loans offer the financial foundation to make these moves. With the funds, you can conduct market research, purchase any necessary equipment or inventory, and fund promotional campaigns that introduce your business to new customers.

3. Launch New Product Lines

Diversifying your offerings by launching new products or services can open doors for growth. But creating and promoting a new product line requires substantial upfront investment. Small business loans provide the capital needed to cover costs like product research and development, marketing campaigns, and initial inventory.

For instance, a manufacturer might want to add a new line to appeal to a different demographic or seasonal demand. With the support of a small business loan, these businesses can fund the production, hire skilled workers, or invest in machinery upgrades required for product diversification. This expansion allows businesses to appeal to a broader customer base, increasing overall revenue potential.

4. Improve Cash Flow for Stability

Healthy cash flow is crucial for any business. Seasonal demand, unexpected expenses, or large inventory purchases can put pressure on your cash reserves. A small business loan provides the flexibility to manage cash flow effectively, ensuring you can meet operational expenses even during slower months.

With steady cash flow, business owners can maintain essential operations, keep up with payroll, and manage suppliers without risking their credit or reputation. For example, an e-commerce retailer facing high holiday sales needs to stock up on products months in advance, which can strain cash flow. A small business loan ensures they have the necessary inventory to meet holiday demand without interrupting day-to-day operations.

5. Enhance Equipment and Technology

Upgrading equipment and technology can play a crucial role in staying competitive. This is especially important in industries like healthcare, logistics, and manufacturing, where outdated tools can hold back productivity. Small business loans can help fund the purchase of new equipment or the upgrade of existing systems.

For a logistics company, this might mean investing in warehouse management systems, automated picking and packing machines, or GPS tracking for delivery trucks. In healthcare, it could involve purchasing advanced medical equipment to improve patient outcomes. With small business loan funding, businesses can take advantage of the latest tools to streamline operations, enhance quality, and ultimately better serve customers.

6. Bolster Marketing Efforts to Reach More Customers

Marketing is a powerful tool for growth, but effective marketing campaigns require time and resources. Small business loans can help business owners invest in both digital and traditional advertising, build brand awareness, and attract new customers.

A business in the technology industry, for instance, might want to increase its presence through online ads, email marketing, and social media campaigns. Loans give these companies the budget to target specific audiences, conduct split testing, and optimize their strategies. This targeted approach, made possible by sufficient marketing funds, can help businesses reach and convert potential clients effectively.

7. Upgrade Physical Space for Better Customer Experience

The quality of a business’s physical location can have a direct impact on its success. From renovating a storefront to expanding an office, small business loans provide the capital to make improvements to a physical location that may otherwise be out of budget.

For example, a retail store could use loan funds to revamp its layout, creating a more inviting shopping environment that enhances the customer experience. In the healthcare sector, clinics can use funds to renovate waiting areas or invest in equipment that makes procedures more efficient. This attention to detail can improve client satisfaction, leading to repeat business and referrals.

8. Streamline Inventory and Supply Chain Management

Inventory management is essential for retail, manufacturing, and other product-driven industries. Managing inventory efficiently can be a challenge, especially when your business is growing. Small business loans provide the funds needed to purchase inventory in bulk, take advantage of supplier discounts, or invest in storage and logistics.

With access to funding, companies can afford to keep a wider selection of products on hand, ensuring they’re ready to meet customer demand without delay. For instance, a retailer can use a loan to stock up on popular items ahead of peak shopping seasons, while a manufacturer may need to purchase raw materials in bulk to reduce production costs. These funding options help you stay competitive, reduce the risk of stockouts, and create a smoother operational flow.

9. Weather Economic Downturns and Unexpected Expenses

Business can be unpredictable, with economic shifts and unexpected costs arising when you least expect it. A small business loan acts as a financial buffer, allowing you to navigate challenging times without draining reserves. This can be essential for businesses in fluctuating markets like retail and healthcare, where unexpected costs—such as equipment repairs, emergency inventory purchases, or facility upgrades—can put a strain on cash flow.

For example, during economic downturns, businesses might experience a decline in customer spending. Having extra funds from a loan can keep operations running, allowing businesses to adjust their strategies, retain employees, and maintain stability until conditions improve. This ability to cover unplanned expenses or weather financial disruptions can be a lifeline for sustaining growth in a volatile economy.

10. Fund Digital Transformation for Competitive Edge

Digital transformation is more crucial than ever, with businesses of all types adapting to new technology to enhance efficiency and customer experience. Small business loans can cover the cost of implementing digital tools, from upgrading e-commerce platforms to using CRM systems for better customer relationships.

For small and mid-sized businesses in industries like healthcare and e-commerce, investing in technology could mean using data analytics to understand customer behaviors, automating customer service functions, or building a more user-friendly online shopping experience. This investment in technology allows businesses to streamline their processes, improve communication, and ultimately better serve their customers, which can lead to long-term growth and a strong competitive advantage.

11. Invest in Training and Development for Your Team

Investing in your team’s skills and knowledge is critical for growth, especially in specialized industries like technology, software development, and healthcare. Small business loans can help fund training programs, professional development courses, and certifications for employees, equipping them with the skills needed to deliver top-quality service.

For instance, a medical services provider might use loan funds to train staff on new healthcare protocols, while a tech company may offer courses on the latest programming languages. Not only does training improve employee satisfaction and retention, but it also enhances your team’s productivity and ability to deliver value to clients. This long-term investment in your workforce often translates into higher customer satisfaction, setting your business apart from competitors.

12. Simplify Debt Management and Consolidation

For businesses managing multiple debt obligations, consolidating them into a single loan with a lower interest rate can simplify finances and improve cash flow. Small business loans can be used to pay off existing high-interest debts, leaving the business with one manageable monthly payment. This can free up funds to reinvest in growth initiatives rather than being tied up in debt servicing.

Debt consolidation helps reduce the stress of managing various payment schedules and interest rates, allowing owners to focus on core business operations. By freeing up cash flow, a single, more affordable loan can give businesses more flexibility to pursue growth strategies without the constant burden of juggling multiple debts.

Take Control of Your Business Growth Today

Small business loans are a valuable asset, providing the financial support needed to expand your business, increase customer satisfaction, and adapt to new opportunities. With flexible financing options, businesses like yours can make smart, growth-oriented decisions that foster success for years to come.

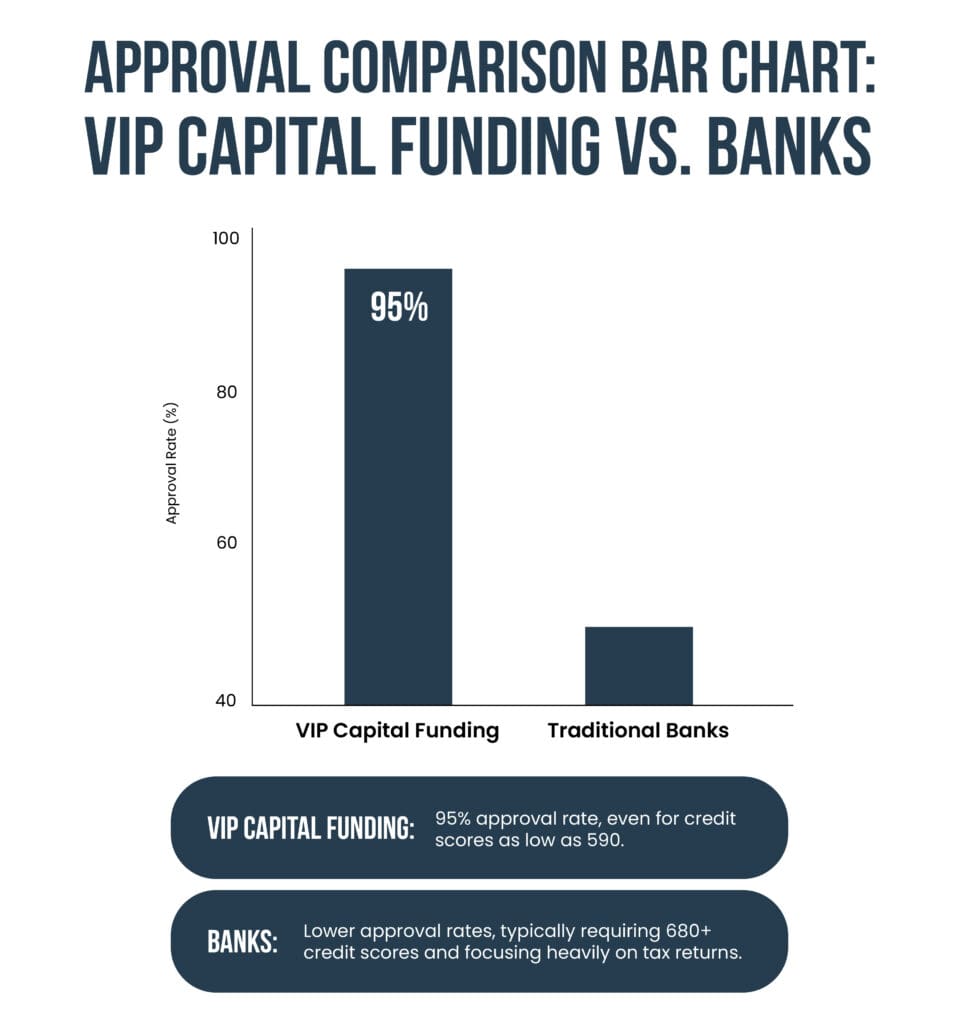

Ready to take the next step? Connect with VIP Capital Funding today for fast, reliable business funding that puts you in control of your company’s future. With competitive approval rates, no prepayment penalties, and tailored funding options, we’re here to help your business thrive.

Contact us today.