In the bustling world of retail, staying ahead of the curve isn’t just about having the latest products or the trendiest storefront. It’s about having the financial muscle to expand, manage inventory, and keep cash flowing smoothly. That’s where retail business loans come into play. Let’s dive into how these financial tools can help store owners thrive in a dynamic industry.

The Retail Landscape: A Snapshot

Retail is a fast-paced, ever-evolving sector. Consumer preferences shift like the wind, seasonal trends can make or break sales, and the rise of e-commerce has added a new layer of competition. To navigate this landscape successfully, retailers need agility, foresight, and, importantly, access to capital.

Why Retailers Need Business Loans

Running a retail business isn’t a walk in the park. From stocking shelves to marketing campaigns, the expenses pile up. Here are some key reasons why retailers might seek out business loans:

- Expansion and Renovation: Opening a new location or sprucing up an existing one requires significant investment. A well-designed store can enhance customer experience and boost sales.

- Inventory Management: Keeping up with demand, especially during peak seasons, means having ample stock on hand. Purchasing inventory in bulk often requires upfront capital.

- Cash Flow Stability: Retailers face fluctuating sales cycles. Loans can provide a cushion during slow periods, ensuring that operations run smoothly.

- Technology and Equipment Upgrades: Modern point-of-sale systems, security equipment, or other technology enhancements can streamline operations and improve customer service.

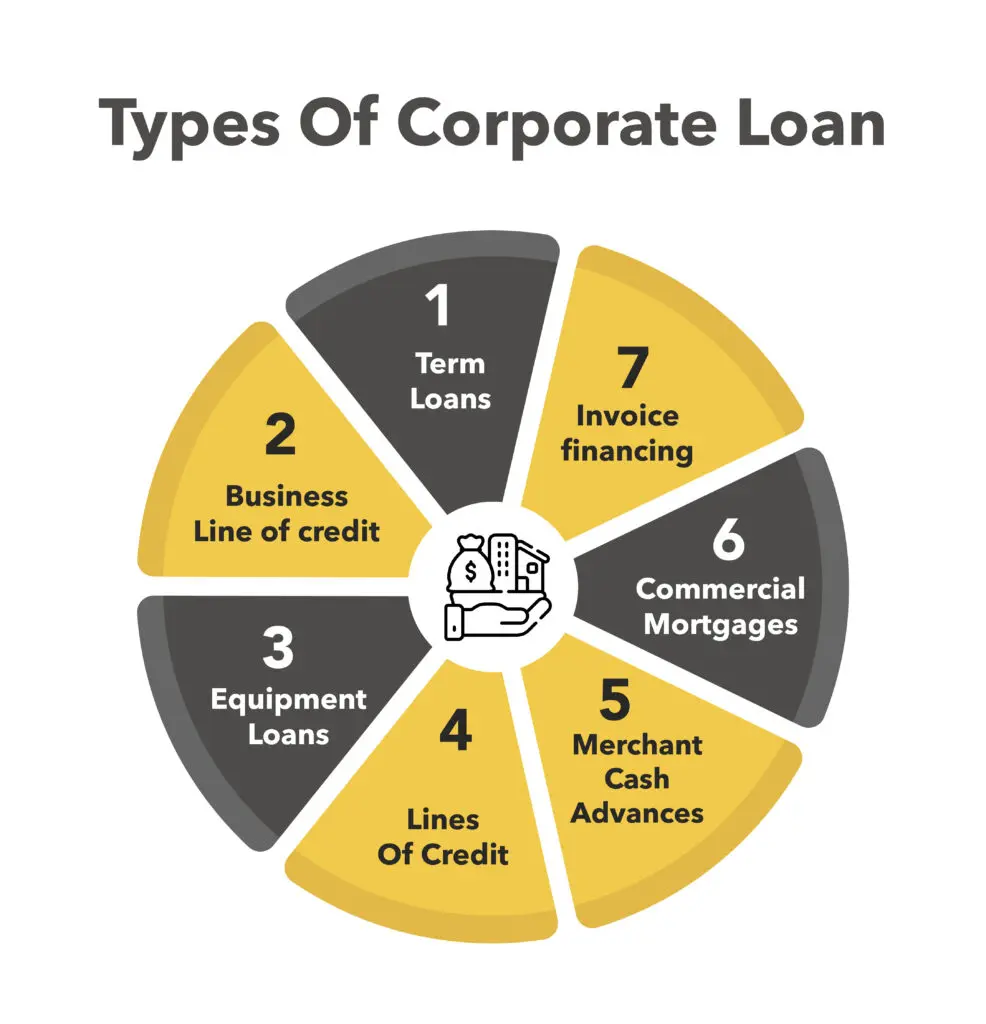

Types of Retail Business Loans

Not all loans are created equal. Depending on specific needs, retailers can explore various financing options:

1. Term Loans

A lump sum provided upfront, which is repaid over a fixed period with interest. Ideal for significant investments like opening a new store or major renovations.

2. Business Lines of Credit

Think of it as a credit card for your business. Access funds up to a certain limit and pay interest only on the amount used. Perfect for managing cash flow and unexpected expenses.

3. Inventory Financing

Loans specifically designed to purchase inventory. The inventory itself often serves as collateral. This ensures that retailers can meet customer demand without straining their finances.

4. Equipment Financing

Funds allocated for purchasing equipment, where the equipment serves as collateral. Useful for upgrading point-of-sale systems or other essential machinery.

5. Merchant Cash Advances (MCAs)

A lump sum provided in exchange for a percentage of future credit card sales. While offering quick access to funds, MCAs can be expensive and impact cash flow due to daily repayments.

How Loans Propel Retail Growth

Access to capital can be a game-changer for retailers. Here’s how:

Expansion and Renovation

A fresh, inviting store layout can attract more customers. However, remodeling or expanding requires funds. Business loans provide the necessary capital to undertake such projects without depleting operational cash reserves.

Inventory Management

Stocking up for the holiday rush or introducing a new product line means investing in inventory. Inventory loans offer quick access to capital, allowing retailers to act swiftly on purchasing opportunities and meet customer demand.

Cash Flow Stability

Seasonal fluctuations can lead to cash flow gaps. Short-term loans or lines of credit can bridge these gaps, ensuring that retailers have the funds to cover expenses during slower periods.

Technology and Equipment Upgrades

Investing in modern technology can streamline operations and enhance customer experience. Equipment financing allows retailers to upgrade without the burden of upfront costs.

Choosing the Right Loan

Selecting the appropriate financing option depends on several factors:

- Purpose: Clearly define what the funds will be used for. Expansion projects might warrant a term loan, while managing seasonal inventory could be better suited for a line of credit.

- Repayment Terms: Understand the loan’s repayment schedule and ensure it aligns with your business’s cash flow.

- Interest Rates and Fees: Compare different lenders to find competitive rates and be aware of any additional fees.

- Collateral Requirements: Some loans require collateral, such as property or inventory. Assess the risks involved.

How Retail Business Loans Help in Digital Transformation

In today’s tech-driven world, digital presence is no longer optional for retailers—it’s essential. But setting up and optimizing an e-commerce platform, mobile app, or digital marketing campaign requires funds. Business loans enable retailers to:

- Develop an E-Commerce Platform– Setting up an online store, integrating secure payment gateways, and managing logistics can be costly. A loan can provide the financial backing to build a seamless digital shopping experience.

- Invest in Digital Marketing– SEO, social media ads, and influencer partnerships can drive traffic to both online and physical stores, but they require upfront investment.

- Implement Omnichannel Strategies– Syncing online and in-store experiences through tech solutions like AI-powered chatbots, digital kiosks, and loyalty apps can enhance customer engagement.

Loans for Sustainable and Eco-Friendly Retail Practices

Sustainability is a growing trend in retail, with consumers increasingly favoring brands that prioritize eco-conscious initiatives. Retailers can use loans to:

- Source Sustainable Materials– Stocking eco-friendly products, packaging, and store fixtures can be more expensive but appeal to a growing segment of conscious shoppers.

- Upgrade to Energy-Efficient Equipment– Installing LED lighting, solar panels, or energy-efficient refrigeration units can reduce long-term costs.

- Implement Recycling and Waste Reduction Programs– Offering take-back programs or switching to biodegradable materials requires capital investment but boosts brand reputation.

Franchise Expansion Loans: A Retailer’s Shortcut to Growth

For those looking to expand their retail brand through franchising, loans can:

- Fund Franchise Fees– Buying into a well-known brand requires upfront franchise fees that can be covered through business loans.

- Secure Prime Locations– Leasing or purchasing a storefront in a high-traffic area demands significant capital.

- Maintain Brand Standards– Franchise agreements often come with requirements for store design, inventory, and marketing, all of which require funding.

Using Retail Loans to Improve Employee Productivity and Customer Service

Employees are the backbone of any retail business, and investing in their skills and well-being can drive success. Loans can help retailers:

- Offer Competitive Salaries– Attracting and retaining skilled staff in a competitive job market often requires financial flexibility.

- Provide Training and Development– Upskilling employees in customer service, sales techniques, or inventory management can improve store efficiency.

- Enhance Workplace Culture– Offering incentives, better breakrooms, or employee wellness programs can boost morale and productivity.

The Competitive Edge

In today’s retail environment, standing still isn’t an option. Business loans empower retailers to:

- Stay Ahead of Trends: With access to capital, retailers can quickly adapt to market trends, stock the latest products, and meet evolving customer preferences.

- Enhance Customer Experience: Investing in store ambiance, staff training, and technology can set a retailer apart from competitors.

- Expand Market Reach: Opening new locations or enhancing online presence can tap into new customer bases.

Real-World Success Stories

Consider the case of a boutique owner in Georgia who noticed a surge in demand for eco-friendly products. Lacking the funds to expand her inventory, she secured a small business loan, allowing her to stock a wider range of sustainable goods. This move not only increased her sales but also attracted a loyal customer base passionate about environmental responsibility.

In another instance, a family-owned bookstore in Ohio faced stiff competition from online retailers. To enhance the in-store experience, they obtained an equipment financing loan to set up a cozy café within the bookstore. This addition created a community hub, boosting foot traffic and sales.

Navigating the Loan Application Process

Applying for a business loan can seem daunting, but with the right preparation, it becomes manageable:

- Assess Your Financial Health: Ensure your financial statements are up-to-date and accurately reflect your business’s performance.

- Define Your Needs: Clearly articulate why you need the loan and how it will benefit your business.

- Research Lenders: Explore various lenders, including banks, credit unions, and online platforms, to find the best fit.

- Prepare Documentation: Gather necessary documents such as tax returns, financial statements, business licenses, and a solid business plan.

- Understand the Terms: Before signing, ensure you comprehend the loan terms, interest rates, repayment schedule, and any associated fees.

Conclusion: Powering Retail Success with Smart Financing

In the high-stakes world of retail, access to capital is often the key differentiator between thriving and just surviving. Whether you’re looking to expand, restock inventory, manage cash flow, or upgrade technology, the right retail business loan can provide the financial boost needed to stay competitive.

By understanding your financing options and choosing the best loan type for your business needs, you can confidently scale operations, enhance customer experiences, and adapt to market changes with ease. As the retail industry continues to evolve, securing the right funding can position your business for long-term success.

Get the Right Financing for Your Retail Business

At VIP Capital Funding, we provide working capital business loans, short-term loans for small business, and business equipment financing to help your retail store grow. Whether you need easy small business loans or fast small business loans, we’ve got you covered. Let’s fuel your success today—apply for small business loan now!