In the dynamic world of business, acquiring the right equipment is essential for maintaining competitiveness and operational efficiency. Whether you’re launching a startup or expanding an existing enterprise, securing the right equipment financing can significantly impact your success.

This guide will walk you through understanding your equipment needs, assessing requirements, exploring leasing versus purchasing, and leveraging business equipment financing options. Let’s dive into how you can effectively use small business equipment financing to enhance your business.

Understanding Your Equipment Needs

Before seeking small business loans, it’s crucial to have a clear understanding of what business equipment financing you need and how it will benefit your business.

Key Considerations:

Business Type and Size: Different types of businesses have unique business equipment financing needs. For instance, a restaurant requires kitchen appliances, while a manufacturing company might need industrial machinery. Identifying your business type and scale will help determine the exact equipment needed.

Operational Requirements: Determine how the equipment will fit into your operations. Will it boost productivity, improve quality, or expand your capabilities? Understanding these aspects will guide you in choosing the most suitable equipment.

Future Growth: Consider how the equipment will support your business’s growth. Investing in equipment that can scale with your business or handle increased capacity will provide long-term benefits.

Assessing Equipment Financing Requirements

With a clear picture of your needs, the next step is to assess the specific requirements for the equipment.

Steps to Assess Equipment Requirements:

Technical Specifications: Identify the key features and performance criteria that are important for your business.

Budget Constraints: Determine how much you can afford to spend on equipment, including not just the purchase price but also maintenance and operational costs.

Vendor Research: Compare equipment options from various vendors. Look into product reviews, warranties, and support services to ensure you select a reliable supplier.

Exploring Equipment Leasing vs. Purchasing

Choosing between leasing and purchasing equipment is a significant decision that can impact your business’s financial health and operational flexibility.

Leasing:

Advantages:

Lower Initial Costs: Leasing typically requires a smaller upfront payment, making it more accessible for businesses.

Flexibility: Leasing allows you to upgrade equipment more frequently, which helps keep your business up-to-date with the latest technology.

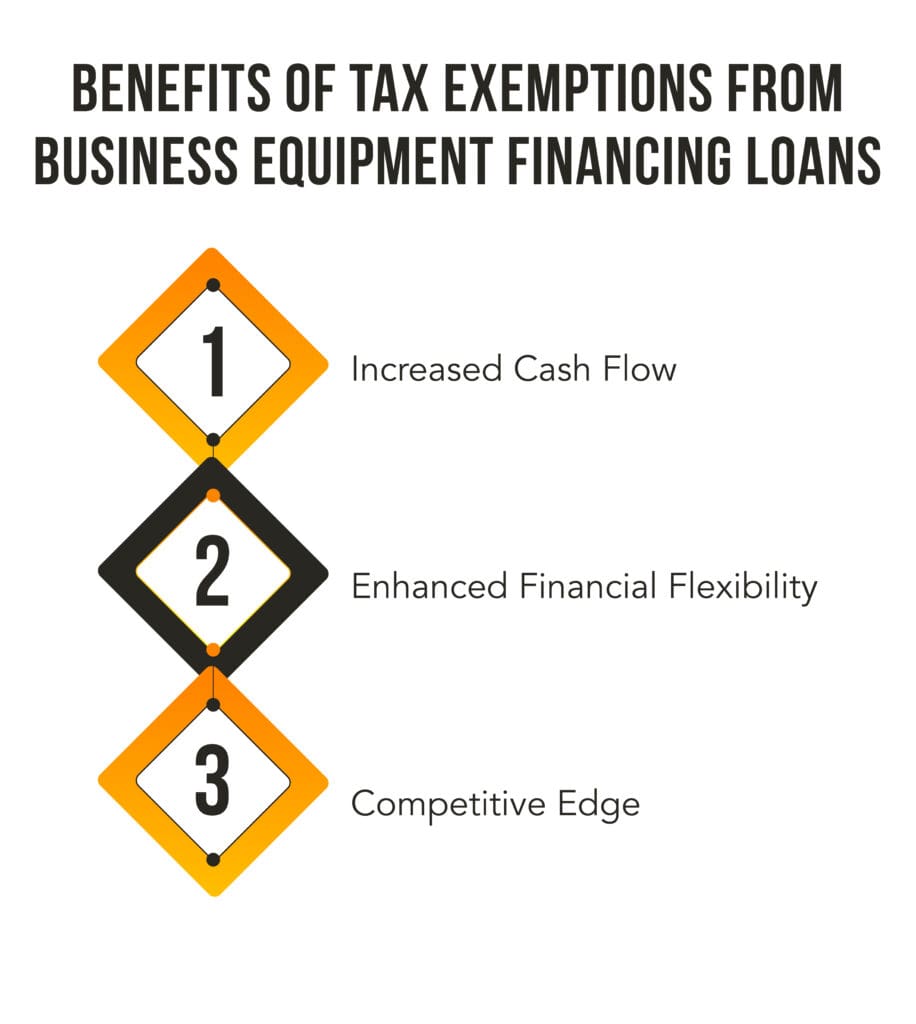

Tax Benefits: Lease payments may be deductible as a business expense, offering potential tax advantages.

Purchasing:

Purchasing:

Advantages:

Ownership: Purchasing equipment means you own it outright, which can be beneficial for long-term use.

Depreciation Benefits: You can claim depreciation on purchased equipment, which may offer additional tax benefits.

No Ongoing Payments: Once the equipment is purchased, there are no further payments, simplifying financial management.

Exploring Business Financing Options

Business financing provides flexible and tailored solutions for acquiring equipment. It includes various options that can be customized to fit your business’s needs.

Types of Private Financing:

Short-Term Loans for Small Businesses: These loans offer quick access to funds and are ideal for addressing immediate equipment needs. They are designed to provide fast solutions without long-term financial commitments.

Equipment Loans: Specifically intended for purchasing equipment, these small business loans use the equipment as collateral, which can streamline the approval process and offer structured repayment plans.

Leasing Companies: Private leasing companies offer equipment leases with flexible terms that can be adjusted to your business’s needs, allowing for manageable payments and the opportunity to upgrade equipment as needed.

Filename: Business-equipment-financing-document-on-the-table

Alt Text:Document outlining terms for business equipment financing

Image Caption: A detailed document outlining the terms and conditions for business equipment financing

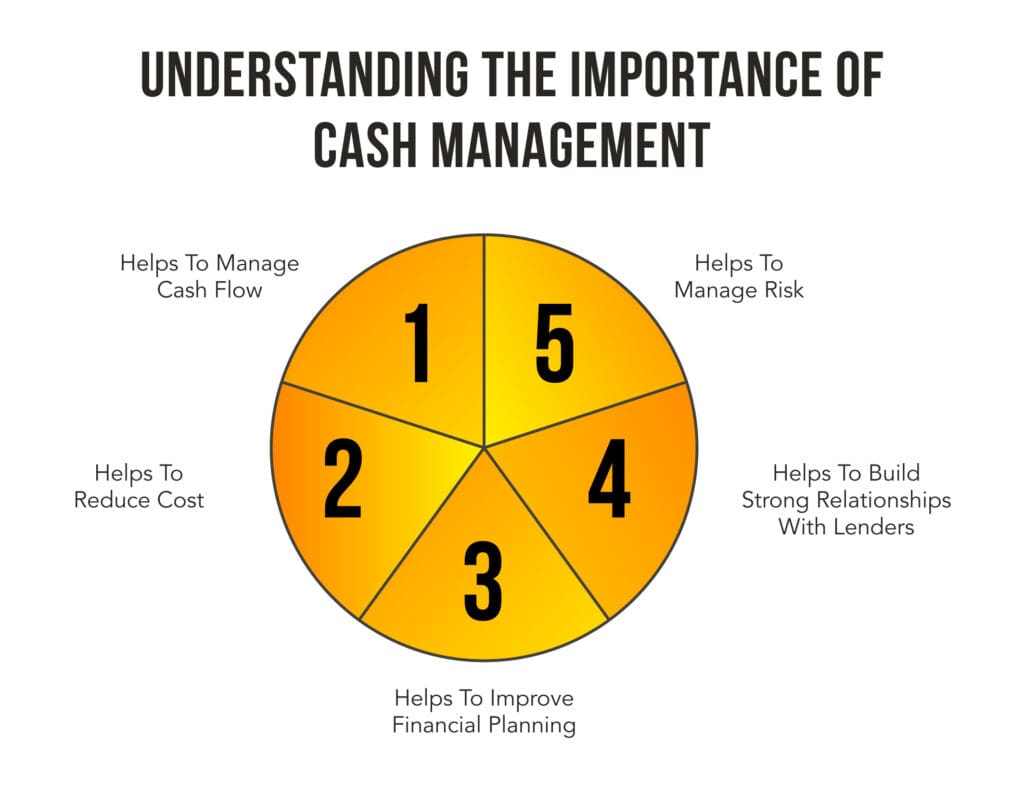

Understanding Business Equipment Financing

Business equipment financing involves obtaining funds from non-bank sources to purchase or lease equipment. This type of financing offers several advantages:

Key Features:

Flexibility: Private lenders provide customizable terms, allowing you to tailor the financing to your specific business needs and cash flow requirements.

Speed: Approval and funding processes are typically faster compared to traditional methods, enabling you to acquire equipment quickly and maintain operational efficiency.

Tailored Solutions: Private lenders can offer financing solutions that align with your unique equipment needs, ensuring a personalized approach to meet your business’s goals.

Types of Equipment Financing Available

There are several types of equipment financing options available, each suited to different business needs and financial situations.

1. Term Loans

A fixed amount borrowed with a set repayment schedule over a specific period. Term loans are ideal for businesses that want clear terms and predictable payments.

2. Equipment Leasing

Renting equipment for a specified term with the option to purchase at the end of the lease. Leasing is suitable for businesses seeking flexibility and regular upgrades.

3. Equipment Loans

Loans specifically for purchasing equipment, with the equipment serving as collateral. This option is great for businesses looking to own equipment while spreading the cost over time.

4. Sale and Leaseback

Selling existing equipment to a lender and leasing it back. This option is useful for businesses needing immediate cash flow while continuing to use their equipment.

5. Operating Leases

Short-term leases with lower payments and the option to return the equipment at the end of the term. Operating leases are ideal for businesses that need equipment for a short duration or expect frequent upgrades.

Building a Strong Financing Application

A well-prepared financing application is crucial for securing favorable terms and approval. Here are some steps to strengthen your application:

1. Create a Detailed Equipment Proposal

Provide a thorough proposal outlining the equipment you plan to acquire, including its specifications, costs, and benefits for your business. This helps lenders understand your needs and the positive impact on your operations.

2. Prepare Financial Projections

Offer clear financial projections, showing how the new equipment will enhance revenue and save costs. This demonstrates the financial benefits and your ability to manage the financing.

3. Gather Essential Documentation

Include necessary documentation such as business financial statements, tax returns, and details about existing equipment. This provides lenders with a comprehensive view of your business’s financial health and equipment needs.

4. Highlight Business Viability

Emphasize your business’s growth potential, market position, and operational efficiency. This shows lenders that your business is a solid investment and that you can effectively handle the financing.

The Application and Approval Process

Securing equipment financing involves several steps, from initial application to final approval. Understanding this process is crucial for efficiently obtaining the funds you need.

1. Initial Research and Preparation

Understand Your Needs: Identify the equipment you need and its costs. Determine how it will benefit your business in terms of productivity and growth.

Explore Financing Options: Research various business financing options available for equipment. This includes short-term loans for small businesses, equipment loans, and leasing arrangements.

2. Submitting Your Application

Choose a Lender: Select a private lender or financing company that offers the terms and conditions suitable for your business needs.

Fill Out the Application: Provide detailed information about your business, the equipment you intend to purchase or lease, and your financial status.

3. Review and Approval

Lender Evaluation: The lender will review your application, including your business’s financial health and the equipment details.

Approval Decision: Once reviewed, the lender will decide whether to approve the financing and under what terms.

Essential Documents for Equipment Financing

Having the right documents ready can streamline the application process and increase your chances of approval. Here’s a checklist of essential documents you’ll need:

Business Plan: A detailed plan outlining your business objectives, operational strategies, and how the equipment will contribute to your goals.

Financial Statements: Recent financial statements, including balance sheets and income statements, to provide an overview of your business’s financial health.

Tax Returns: Recent tax returns to verify income and financial stability.

Equipment Details: Specifications, cost, and vendor information for the equipment you intend to finance.

Lease or Purchase Agreement: If applicable, include any agreements related to the equipment lease or purchase.

Proof of Business Ownership: Documentation proving ownership of the business, such as incorporation documents or partnership agreements.

Bank Statements: Recent bank statements to demonstrate cash flow and liquidity.

Tips for a Strong Financing Application

A strong application can significantly impact your chances of securing equipment financing. Here are some best practices to follow:

Be Thorough andAccurate: Ensure all information provided is accurate and complete. Any discrepancies or missing details can delay the process or lead to rejection.

Highlight Business Potential: Emphasize how the new equipment will positively impact your business, such as increasing productivity or expanding capabilities.

Prepare a Clear Proposal: Outline your equipment needs, costs, and benefits in a clear and organized proposal. This helps lenders quickly understand your requirements and the value of the equipment.

Maintain Strong Financials: Keep your financial statements up-to-date and ensure they reflect a healthy business. Strong financials are crucial for convincing lenders of your ability to repay the loan.

Choose the Right Lender: Research lenders to find one that offers favorable terms and understands your industry. Tailoring your application to the lender’s preferences can improve your chances of approval.

Understanding the Underwriting Process

The underwriting process is where lenders evaluate your application and decide on the terms of your financing. Here’s how lenders typically assess your application:

Creditworthiness: While credit scores are not mentioned here, lenders assess other aspects of your creditworthiness, such as your business’s financial health and history.

Business Viability: Lenders review your business plan, financial statements, and overall market potential to ensure your business can sustain the equipment financing.

Equipment Value: The lender evaluates the equipment’s value, including its condition, cost, and how it will benefit your business.

Repayment Ability: They assess your business’s ability to make regular payments, considering factors like cash flow and existing financial obligations.

Accelerating the Approval Process

Speeding up the approval process can be crucial, especially if you need equipment urgently. Here are some strategies to help accelerate the process:

Prepare Thorough Documentation: Ensure all required documents are complete and accurate before submitting your application. This reduces back-and-forth with the lender and speeds up approval.

Streamline Communication: Maintain clear and prompt communication with the lender. Respond to requests for additional information quickly to avoid delays.

Work with a Specialized Lender: Choose a lender that specializes in equipment financing. They are more familiar with the process and can often expedite approvals.

Pre-Approve Financing: If possible, get pre-approved for financing. This can streamline the final approval process and provide you with a clearer idea of your financing options.

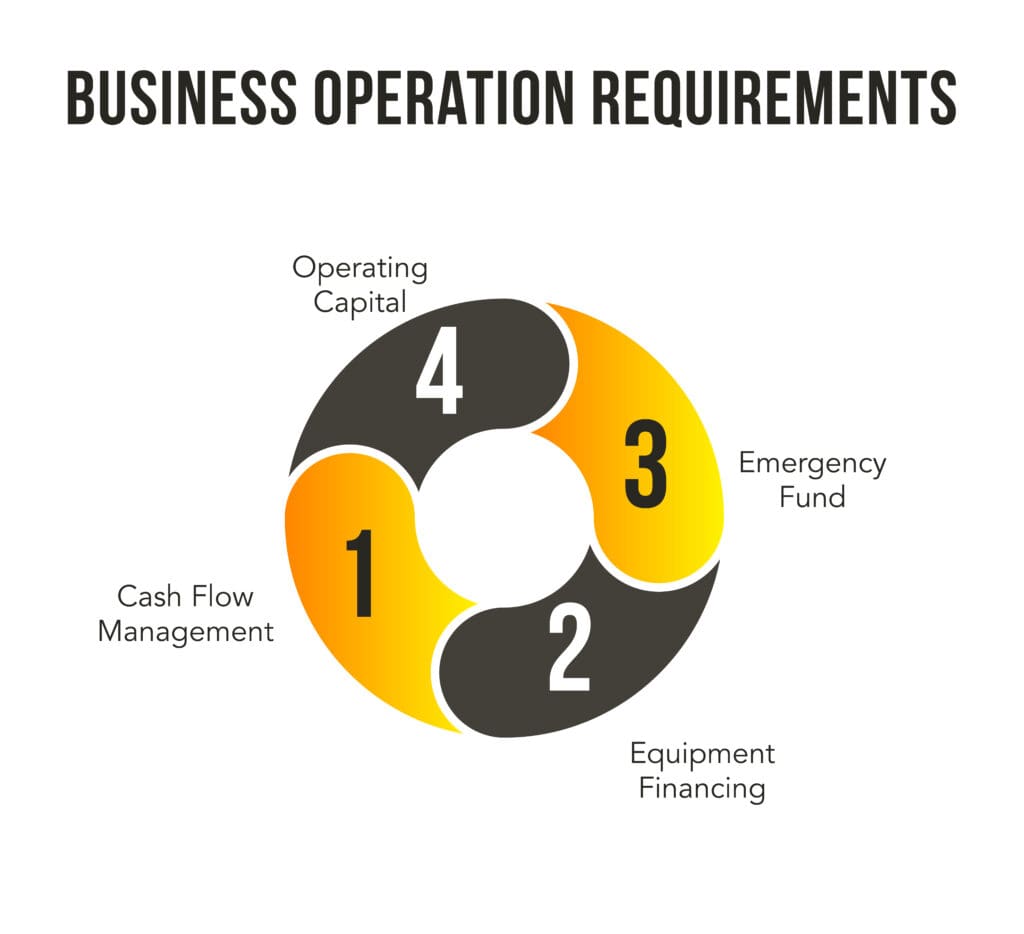

Managing Your Equipment Financing

Once you secure financing, effective management is key to maintaining your financial health and ensuring the equipment benefits your business.

1. Monitor Payments

Keep track of your payment schedule and ensure payments are made on time to avoid penalties and maintain a good relationship with your lender.

2. Budget for Maintenance

Factor in maintenance and operational costs for the equipment in your budget to avoid unexpected expenses and ensure smooth operations.

3. Regular Reviews

Periodically review your financing arrangement and equipment performance to ensure they continue to meet your business needs.

Payment Plans and Repayment Options

Flexible payment plans and repayment options can significantly ease the financial burden of equipment financing. Here’s what you should consider:

Customizable Payment Plans: Many private lenders offer customizable payment plans that can be adjusted based on your business’s cash flow. This flexibility can help manage finances more effectively.

Deferred Payments: Some lenders offer deferred payment options, allowing you to start payments after a certain period. This can be useful if you need time to ramp up operations.

Seasonal Payment Plans: For businesses with seasonal cash flow, seasonal payment plans align payments with your revenue cycles, making it easier to manage expenses.

Early Repayment and Refinancing

Early repayment and refinancing can offer benefits such as reduced interest costs or better financing terms. Here’s how to approach these options:

1. Early Repayment

Benefits: Paying off your loan early can reduce the total interest paid and improve your credit profile. Ensure you understand any prepayment penalties before making early repayments.

2. Refinancing

Benefits: Refinancing can provide better terms, lower interest rates, or more favorable payment schedules. Evaluate refinancing options when market conditions or your business’s financial situation changes.

Protecting Your Investment with Equipment Insurance

Insurance is essential for protecting your equipment investment against unforeseen events such as accidents, theft, or damage. Here’s why it’s important:

Coverage for Loss: Equipment insurance ensures that you are covered for the replacement or repair of equipment if it’s damaged or lost.

Financial Protection: Insurance helps safeguard your financial investment, preventing significant financial loss due to equipment-related issues.

Peace of Mind: Knowing your equipment is insured provides peace of mind, allowing you to focus on running your business effectively.

Equipment Maintenance and Upkeep

Proper maintenance and upkeep of equipment are crucial for ensuring its longevity and performance. Here’s how maintenance impacts your financing:

Extended Equipment Life: Regular maintenance helps extend the life of your equipment, ensuring it remains productive and efficient over the long term.

Preserved Value: Well-maintained equipment retains its value, which is important if you plan to sell or upgrade in the future.

Operational Efficiency: Keeping equipment in good condition prevents unexpected breakdowns and operational disruptions, supporting smooth business operations.

Tips for Scaling Your Business with Equipment Financing

Prioritize Flexibility

Opt for financing solutions that offer flexibility, such as adjustable repayment terms or the ability to upgrade equipment. This will help you adapt to changes as you scale your business.

Monitor Performance

Regularly assess the performance of your new equipment and its impact on your business growth. Use this information to make adjustments and ensure you’re meeting your scaling objectives.

Plan for Future Needs

Consider your future equipment needs as you scale. Ensure that your financing plan can accommodate future upgrades or additional equipment requirements.

Implement a Phased Approach

Begin with a phased implementation of new equipment to manage costs and minimize disruptions. Gradually scale up your equipment investment as you assess its impact on your business operations. This approach allows you to adjust your strategy based on real-time results and ensures a smoother transition during periods of rapid growth.

Monitor Cash Flow Regularly

Keep a close eye on your cash flow to ensure that your equipment financing aligns with your financial capabilities. Regularly review your cash flow statements to anticipate any potential challenges and make adjustments as needed. Effective cash flow management helps maintain financial stability and supports continued growth and scaling efforts.

Leverage Data-Driven Decision Making

Leverage Data-Driven Decision Making

Analyze Performance Metrics: Use data analytics to track the performance of your new equipment and its impact on your business. Analyze metrics such as production efficiency, downtime, and return on investment.

Make Informed Adjustments: Utilize the insights gained from data analysis to make informed decisions about further scaling. Adjust your equipment strategy based on real-time performance data to optimize operations and maximize growth.

Invest in Scalable Equipment Solutions

Select Modular Equipment: Choose equipment that offers modular features or scalability options, allowing you to expand or upgrade as needed. Modular equipment can adapt to changing business needs and grow with your operations.

Future-Proof Your Investment: Opt for technology and machinery that can accommodate future advancements. Investing in equipment with upgrade capabilities or compatibility with emerging technologies can help you stay ahead of the competition.

Looking for reliable funding for your business? VIP Capital Funding offers tailored solutions for small business loans, including short-term loans, construction loans, and working capital. Whether you’re in New Jersey, North Carolina, Ohio, or beyond, we have you covered with flexible financing options.

Apply online for fast, easy access to the capital you need to grow and succeed. Contact us today to explore your financing options!