Corporate Loans

Driving Business Growth

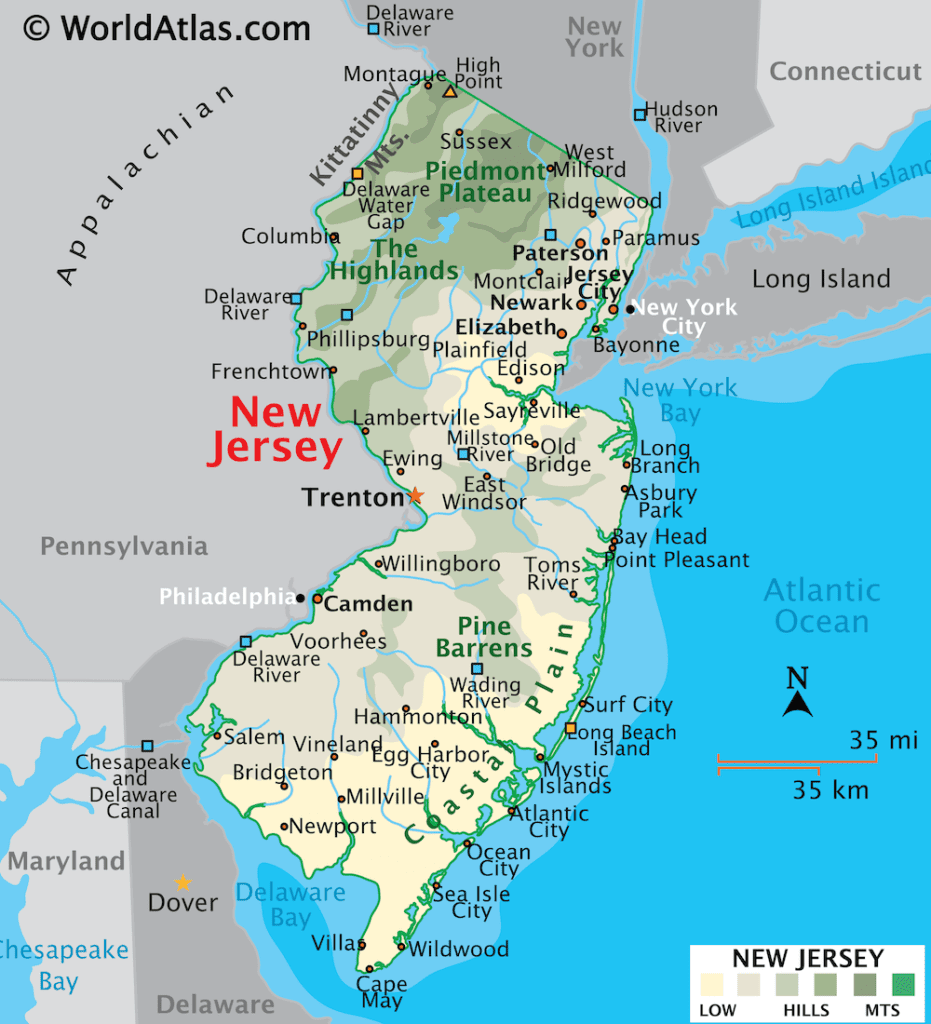

New Jersey boasts one of the largest economies in the United States, fueled by a diverse array of industries such as technology, manufacturing, pharmaceuticals, and finance. Its strategic location near New York City and Philadelphia creates a vibrant business landscape for companies of all sizes. Whether you’re a small manufacturer in Trenton or an innovative startup in Newark, corporate loans can provide the essential capital to help you grow, innovate, and thrive. At VIP Capital Funding, we are dedicated to offering flexible corporate financing solutions tailored specifically for businesses in New Jersey.

Understanding Corporate Loans

Corporate loans represent a crucial source of financing for companies, assisting them in managing cash flow, acquiring assets, or funding growth initiatives. Unlike typical small business loans, these loans cater specifically to businesses and typically allow for much larger sums. Businesses can utilize corporate loans for various purposes, such as capital expenditures, expansion efforts, or addressing cash flow shortfalls.

In New Jersey, corporate loans are vital for companies aiming to scale operations, invest in technology, or finance substantial equipment purchases. These loans come with a range of terms, giving businesses the flexibility to select financing that meets their unique needs.

The Importance of Corporate Loans for New Jersey Businesses

Driving Innovation and Growth: New Jersey is home to numerous research and development initiatives, particularly in pharmaceuticals and biotechnology. Corporate loans can support businesses in financing the development of innovative products, technologies, and services.

Managing Cash Flow: Industries such as retail and agriculture often face seasonal fluctuations. Corporate loans can provide a financial cushion to help businesses navigate slower periods, ensuring they can cover operational costs without interruption.

Facilitating Expansion and Acquisition: Companies in New Jersey may seek to enter new markets or acquire other businesses. Corporate loans deliver the necessary funding for these strategic initiatives, enabling growth and enhancing competitiveness.

Corporate Loan Options in New Jersey

Term Loans: Offering a lump sum for a particular project or long-term investment, these loans have a fixed repayment schedule and interest rate, allowing for predictable budgeting.

Lines of Credit: A flexible credit option that allows businesses to withdraw funds as needed, which can be repaid over time—ideal for managing cash flow and unexpected expenses.

Equipment Financing: Tailored for businesses in sectors such as manufacturing and logistics, this type of financing helps acquire machinery and technology, with the equipment itself often serving as collateral for favorable terms.

Invoice Financing: Companies dependent on customer invoices can utilize this option to bridge the gap between issuing invoices and receiving payment—a common solution in industries like construction and wholesale.

Merchant Cash Advances: For businesses with significant credit card transactions, this funding option advances capital based on a percentage of daily credit card sales, beneficial for those in retail or hospitality.

Corporate Loan Options in New Jersey

Term Loans: Offering a lump sum for a particular project or long-term investment, these loans have a fixed repayment schedule and interest rate, allowing for predictable budgeting.

Lines of Credit: A flexible credit option that allows businesses to withdraw funds as needed, which can be repaid over time—ideal for managing cash flow and unexpected expenses.

Equipment Financing: Tailored for businesses in sectors such as manufacturing and logistics, this type of financing helps acquire machinery and technology, with the equipment itself often serving as collateral for favorable terms.

Invoice Financing: Companies dependent on customer invoices can utilize this option to bridge the gap between issuing invoices and receiving payment—a common solution in industries like construction and wholesale.

Merchant Cash Advances: For businesses with significant credit card transactions, this funding option advances capital based on a percentage of daily credit card sales, beneficial for those in retail or hospitality.

Advantages of Corporate Loans for New Jersey Businesses

Higher Loan Amounts: Compared to other business financing options, corporate loans typically offer larger amounts, making them suitable for businesses requiring significant capital for expansion, equipment investments, or substantial projects.

Flexible Terms: Depending on the loan type, businesses can select from various repayment terms and structures that best align with their cash flow cycles and financial needs.

Predictable Payment Schedules: Loans with fixed payment terms allow businesses to budget effectively, providing clarity on when payments are due and the expected amounts.

Enhanced Cash Flow Management: Options like business lines of credit and invoice financing help bridge cash flow gaps, supporting smooth operations even during tough economic conditions.

How VIP Capital Funding Supports New Jersey Businesses

Streamlined Application Process: Our online application is quick and straightforward, allowing businesses to apply in minutes with minimal documentation.

Rapid Approval and Funding: Understanding the urgency involved, our approval process is efficient, with funds potentially available in as little as 1-2 business days.

Customizable Loan Terms: We collaborate with businesses to create financing solutions that fit their needs, providing flexible repayment options and competitive rates.

Dedicated Support: Our team offers personalized guidance throughout the process, ensuring that businesses find the most suitable loan options for their unique financial situations.

Conclusion

Corporate loans are vital resources for New Jersey businesses aiming to expand, invest in new initiatives, or manage cash flow effectively. By offering adaptable terms, competitive rates, and swift approval processes, VIP Capital Funding equips New Jersey businesses with the financial backing necessary for success. Whether you’re a small startup or an established company, corporate loans can propel your business towards achieving its objectives.