Starting a new business is an exciting endeavor that requires careful planning, strategic decision-making, and, crucially, the right equipment. The importance of equipment in a business cannot be overstated; it is the backbone that supports operations, enhances productivity, and drives growth.

For new businesses, acquiring this essential equipment can be daunting, primarily due to the high costs involved. This is where equipment financing comes into play, providing a viable solution to ease the financial burden and set the stage for success.

The Essential Role of Equipment in Business Success

Identifying Your Equipment Needs

The first step in leveraging equipment for business success is identifying what you need. The type of equipment required varies significantly based on the nature of your business and your growth plans. Here’s how to categorize essential equipment:

- Office Equipment: Desktops, laptops, printers, scanners, and office furniture are critical for any business that requires administrative work.

- Industry-Specific Equipment: This includes machinery for manufacturing, medical equipment for healthcare providers, kitchen appliances for restaurants, and tools for construction businesses.

- Technology and Software: Cutting-edge software,servers, and network infrastructure are vital for businesses in the tech industry or those heavily reliant on digital operations.

- Vehicles: Delivery trucks, company cars, or specialized vehicles necessary for businesses like logistics and transportation.

Identifying your equipment needs involves assessing your current operational requirements and future growth projections. A well-thought-out plan ensures you invest in equipment that aligns with your long-term business goals.

The Impact of Up-to-Date Equipment

Modern equipment offers several advantages that can significantly impact your business’s efficiency, productivity, and safety.

- Efficiency: Newer equipment is often designed to perform tasks faster and more accurately. This efficiency can lead to shorter production times, quicker turnaround for services, and overall improved operational workflows.

- Productivity: Advanced equipment can handle more tasks or more complex processes, allowing your team to focus on other critical areas. For example, automated machinery in manufacturing can increase output without proportionally increasing labor costs.

- Safety: Up-to-date equipment typically adheres to the latest safety standards, reducing the risk of workplace accidents and ensuring a safer working environment. This is particularly crucial in industries like construction and manufacturing.

Investing in modern equipment not only optimizes your current operations but also prepares your business to meet future demands more effectively.

Challenges of Upfront Equipment Purchases

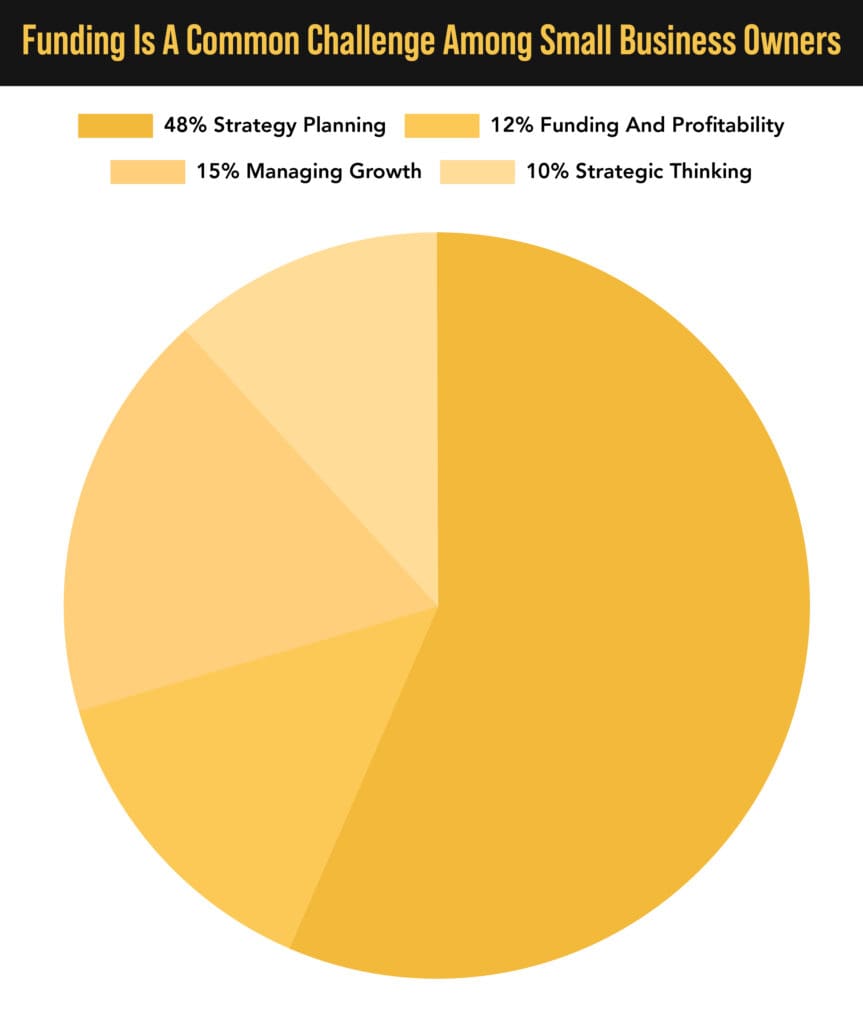

Despite the clear benefits, acquiring new equipment presents significant challenges, especially for new businesses. The most prominent challenge is the financial burden.

- High Initial Costs: The cost of purchasing new equipment can be prohibitively high. For a startup, allocating a large portion of the initial capital to equipment can strain other essential areas like marketing, staffing, and inventory.

- Cash Flow Management: Maintaining a healthy cash flow is crucial for any business, particularly in its early stages. Large upfront purchases can deplete cash reserves, making it difficult to manage day-to-day expenses and unexpected costs.

- Depreciation: Equipment loses value over time, and the return on investment might not be immediate. The depreciation factor can impact financial planning and profitability.

Given these challenges, many new businesses turn to equipment financing as a strategic solution.

Understanding Equipment Financing Options

Beyond Traditional Financing

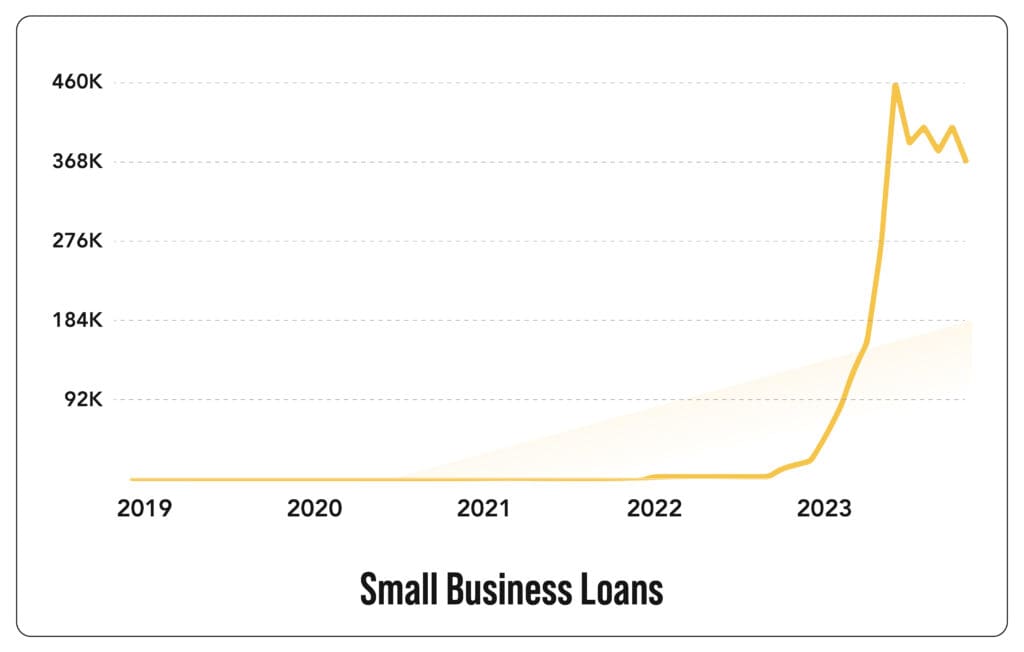

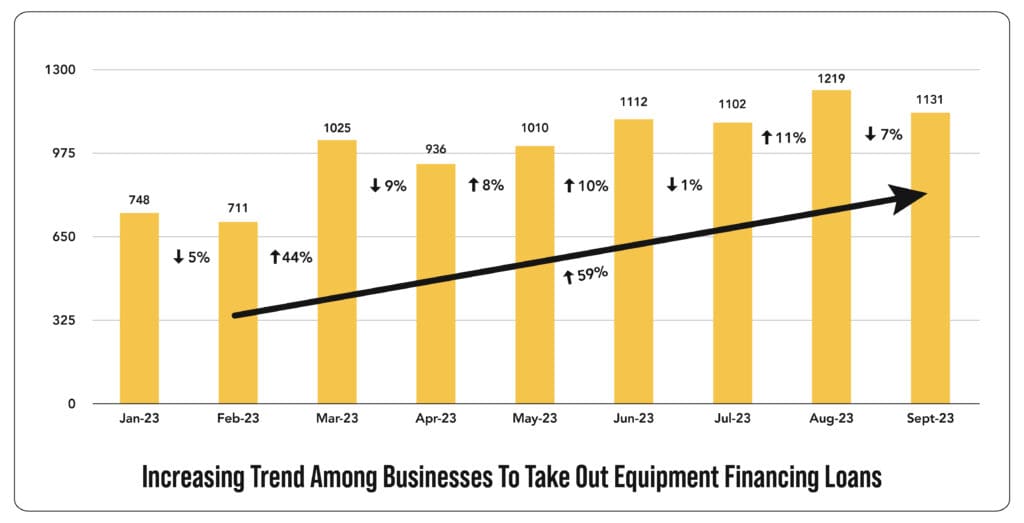

When it comes to financing equipment, traditional bank loans are often the first option that comes to mind. However, banks can be hesitant to lend to new businesses due to perceived risks. Additionally, bank loans typically involve lengthy approval processes and stringent qualification criteria. This is where alternative financing solutions, such as equipment financing loans from revenue-based private money lenders, become invaluable.

Equipment Financing Loans from Private Money Lenders

Private money lenders offer a more flexible and accessible financing option compared to traditional banks. These lenders focus on the revenue potential of your business rather than solely relying on credit scores and financial history. Here’s how equipment financing through private money lenders works:

- Revenue-Based Lending: Instead of a fixed repayment schedule, revenue-based lenders adjust repayments based on your business’s income. This means payments are lower during slow periods and higher when business is booming, easing the financial strain.

- Quicker Approval Process: Private money lenders typically have a faster approval process, allowing you to secure funds quickly and get your business up and running without significant delays.

- Flexible Terms: These lenders offer more flexible terms and conditions tailored to your business needs, making it easier to negotiate favorable terms that align with your financial situation.

By opting for equipment financing loans from private money lenders, new businesses can access the equipment they need without the hurdles and delays associated with traditional bank loans.

Bank Loans vs Private Money Lenders

While bank loans have their place, they might not be the best fit for new businesses looking to finance equipment. Here’s why private money lenders are a preferable choice:

- Lower Barriers to Entry: Banks often require extensive financial documentation and a proven track record, which new businesses may lack. Private lenders are more interested in your business potential.

- Speed and Efficiency: The quicker approval process of private money lenders ensures that you can acquire the necessary equipment without long waiting periods, which is critical for maintaining business momentum.

- Customized Solutions: Private lenders offer more personalized financing solutions that can be tailored to the specific needs and cash flow of your business, unlike the rigid structures of traditional bank loans.

By leveraging the flexibility and accessibility of private money lenders, new businesses can overcome the financial barriers of equipment acquisition and set a strong foundation for growth.

Benefits of Equipment Financing for New Businesses

Conserve Working Capital

One of the most significant advantages of equipment financing is the ability to conserve working capital. This means your cash flow remains available for other crucial business expenses such as marketing, hiring staff, and purchasing inventory. Here’s how it helps:

- Maintain Liquidity: Keeping your cash reserves intact ensures that your business can operate smoothly and handle unexpected expenses or opportunities.

- Invest in Growth: By financing equipment, you can allocate funds to other areas that drive growth, such as expanding your product line, enhancing your services, or entering new markets.

Access to Newer Technology

Equipment financing allows you to acquire the latest technology without the hefty upfront costs. This has several benefits:

- Stay Competitive: In industries where technology evolves rapidly, having access to the latest equipment can keep you ahead of competitors.

- Improve Efficiency and Quality: Modern equipment often comes with advanced features that improve the quality of your products or services and enhance operational efficiency.

- Scalability: As your business grows, financing allows you to scale up your equipment needs without significant financial strain, ensuring that your operations can expand seamlessly.

Tax Advantages

Equipment financing can also offer potential tax benefits, which can improve your overall financial health. Here’s how:

- Tax Deductions: In many cases, the interest paid on equipment financing loans can be tax-deductible. Additionally, some financed equipment may qualify for depreciation deductions.

- Consultation with Tax Advisors: It’s essential to consult with a tax advisor to understand the specific tax benefits available for your business. They can help you navigate the complexities of tax regulationsand maximize your savings.

These tax advantages make equipment financing an even more attractive option for new businesses looking to optimize their financial strategies.

The Equipment Financing Process: A Step-by-Step Guide

1. Researching and Comparing Lenders

Choosing the right lender is the first and most crucial step in the equipment financing process. Here are the key factors to consider:

Interest Rates: The interest rate determines the cost of borrowing. Compare rates from different lenders to find the most competitive option. Lower interest rates reduce your overall repayment amount and ease the financial burden on your business.

Loan Terms: Loan terms include the repayment period and schedule. Some lenders offer flexible terms that can be tailored to your cash flow needs, while others may have fixed terms. Evaluate what works best for your business model.

Customer Service Reputation: The lender’s reputation for customer service is important. You want a lender who is responsive, helpful, and supportive throughout the financing process. Check online reviews, ask for referrals, and speak to other business owners who have used the lender’s services.

Specialization in New Businesses: Some lenders specialize in providing equipment financing for new businesses. These lenders understand the unique challenges startups face and may offer more favorable terms and conditions to accommodate them.

2. Preparing a Financing Application

A well-prepared financing application increases your chances of approval and can lead to better loan terms. Here’s what you need to do:

Gather Necessary Documents: Collect all the required documents, including business registration papers, personal and business tax returns, bank statements, and proof of business ownership. Some lenders may also require a business plan and financial projections.

Prepare Financial Statements: Financial statements, such as balance sheets, income statements, and cash flow statements, provide lenders with insight into your business’s financial health. Ensure these documents are accurate and up-to-date.

Obtain Equipment Quotes: Get detailed quotes from suppliers for the equipment you intend to purchase. Include specifications, prices, and any warranties or maintenance agreements. Providing this information shows lenders that you have done your homework and are serious about your equipment needs.

Present a Strong Application: Compile all the documents and organize them neatly. Write a cover letter that outlines your business, your equipment needs, and how the financing will help you achieve your goals. Highlight any strong points, such as a solid business plan, experienced management team, or early customer traction.

3. Negotiating Terms and Finalizing the Agreement

Once your application is approved, the next step is to negotiate the loan terms and finalize the agreement:

Understand Loan Contracts: Read the loan contract carefully. Ensure you understand all the terms and conditions, including interest rates, repayment schedule, fees, and penalties for late payments or early repayment. If anything is unclear, ask for clarification.

Negotiate Favorable Terms: Don’t be afraid to negotiate. Discuss the interest rate, repayment period, and any fees with the lender. If you have received better offers from other lenders, use them as leverage. Negotiating can save you money and create a more manageable repayment plan.

Secure Funding for Your Equipment: Once you agree on the terms, sign the contract and secure the funding. The lender will disburse the funds directly to the equipment supplier or to your business account, depending on the agreement.

Tips for Managing Your Equipment

Acquiring equipment is just the beginning. Effective management of your equipment is crucial to maximizing its lifespan and ensuring it contributes to your business’s success.

1. Developing a Preventative Maintenance Schedule

Preventative maintenance is essential to minimize downtime and extend the lifespan of your equipment. Here’s how to develop an effective schedule:

Regular Inspections: Conduct regular inspections to identify any potential issues early. Check for wear and tear, leaks, or any signs of malfunction.

Scheduled Servicing: Follow the manufacturer’s recommendations for servicing your equipment. This may include routine checks, lubrication, part replacements, and software updates.

Record Keeping: Maintain detailed records of all maintenance activities. Include dates, descriptions of the work done, and any parts replaced. This information is valuable for tracking the equipment’s history and planning future maintenance.

2. Tracking Equipment Performance

Monitoring your equipment’s performance helps identify opportunities for optimization and cost savings. Here’s what you need to do:

Utilize Performance Metrics: Track key performance metrics such as uptime, output, energy consumption, and efficiency. Use these metrics to assess how well your equipment is performing and identify any areas for improvement.

Implement Monitoring Systems: Use monitoring systems or software to collect real-time data on equipment performance. These systems can alert you to any anomalies or issues, allowing for quick intervention.

Analyze Data for Insights: Regularly analyze the performance data to gain insights into your equipment’s operation. Look for patterns or trends that indicate potential problems or opportunities for optimization.

3. Planning for Future Equipment Needs

As your business grows, your equipment needs will evolve. Planning for future equipment acquisition is essential for sustained growth. Here’s how to do it:

Project Future Growth Requirements: Assess your business’s growth projections and determine what additional equipment you will need to support that growth. Consider factors such as increased production capacity, new service offerings, or expansion into new markets.

Align Financing Strategy with Growth Plans: Ensure your financing strategy supports your long-term equipment acquisition plans. Consider setting up a revolving credit line or negotiating flexible terms with your lender to accommodate future purchases.

Stay Informed About Industry Trends: Keep up-to-date with industry trends and technological advancements. Staying informed will help you identify new equipment that could improve your operations or give you a competitive edge.

5 Common FAQs About Equipment Financing Loans

1. What is easy equipment financing and how does VIP Capital Funding make it accessible for new businesses?

Easy equipment financing simplifies the process of obtaining funds for essential business equipment. VIP Capital Funding focuses on your revenue rather than credit score, allowing businesses with scores as low as 590 to qualify, provided they meet our revenue criteria of at least $50K monthly or $600K annually.

2. How do equipment financing loans from VIP Capital Funding differ from traditional bank loans?

VIP Capital Funding bases 80% of its decision on your business’s revenue, with only 10% on credit scores and 10% on industry. This approach contrasts with traditional banks, which heavily weigh credit scores and tax returns, enabling quicker approvals and funding for businesses.

3. What are the advantages of choosing business equipment financing through VIP Capital Funding?

Advantages include flexibility in qualification, preservation of working capital, access to modern equipment, and potential tax benefits. Our revenue-based model ensures that even businesses with lower credit scores can secure the necessary funding to grow.

4. What are the basic requirements to apply for a small business loan for equipment financing at VIP Capital Funding?

Requirements include generating at least $50K monthly or $600K annually, basic financial documentation, a minimum credit score of 590, and details about your business industry. These criteria ensure a thorough but flexible assessment process.

5. How can I ensure my application for equipment financing loans is successful with VIP Capital Funding?

Ensure your financial statements are accurate, highlight your revenue, provide detailed equipment quotes, gather all necessary documents, and present a well-organized application. Emphasizing these key aspects will increase your chances of securing financing.

Unlock the potential of your business with VIP Capital Funding! Apply for small business loans tailored to your needs, whether you’re in California, Florida, Texas, or beyond. Our easy equipment financing and working capital loans offer quick access to funds, perfect for manufacturers, medical practices, and construction companies. Enjoy fast small business loans, short-term business funding, and specialized financing options in Georgia, Illinois, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Virginia, and Washington.

Apply for an online small business loan today and propel your business to new heights with our flexible and efficient financing solutions.