Hey there, savvy entrepreneur! Let’s talk about something that’s as crucial to your business as your morning coffee—equipment financing loans. Whether you’re eyeing that shiny new piece of machinery, the latest tech gadget, or a fleet of vehicles to rev up your operations, equipment financing can be your ticket to success without draining your cash reserves. So, grab a seat, and let’s dive into the world of equipment financing with a laid-back, hip, and trendy vibe.

What Exactly Is Equipment Financing?

Picture this: You need top-notch equipment to keep your business humming, but the price tag makes you break into a sweat. Enter equipment financing—a financial arrangement that lets you acquire the gear you need now and pay for it over time. It’s like having your cake and eating it too!

In simple terms, equipment financing involves getting a loan or lease to purchase or use equipment for your business. The best part? The equipment itself often serves as collateral, which means you don’t have to put up additional assets to secure the loan.

Why Should You Consider Equipment Financing?

Great question! Let’s break down the perks:

1. Preserve Your Cash Flow

Shelling out a lump sum for equipment can put a serious dent in your cash reserves. With equipment financing, you spread the cost over time, keeping your cash flow steady and your stress levels low.

2. Stay Ahead with the Latest Tech

Technology evolves faster than fashion trends. Financing allows you to upgrade to the latest equipment without waiting until you’ve saved enough to buy it outright. Stay ahead of the curve and keep your business competitive.

3. Flexible Payment Options

Equipment financing offers flexible terms and payment structures tailored to your business needs. Whether you prefer monthly payments or seasonal ones that align with your cash flow, there’s likely a plan that fits.

4. Potential Tax Benefits

Depending on your jurisdiction, the interest paid on equipment loans and the depreciation of the equipment might be tax-deductible. Always consult with a tax professional to understand the benefits specific to your situation.

Loan vs. Lease: What’s the Deal?

When it comes to equipment financing, you’ve got two main options: loans and leases. Let’s break it down:

Equipment Loans

- Ownership:You own the equipment once you’ve paid off the loan.

- Down Payment:Typically requires a down payment, often around 20%.

- Depreciation:You can claim depreciation on your taxes.

- Interest Rates:Usually fixed, providing predictable payments.

Equipment Leases

- Ownership:The lender owns the equipment; you pay to use it.

- Down Payment:Often no down payment required.

- Flexibility:Easier to upgrade to newer equipment at the end of the lease term.

- Payments:Generally lower monthly payments compared to loans.

Choosing between a loan and a lease depends on your business goals, cash flow, and the type of equipment you need.

How to Qualify for Equipment Financing

Ready to rock and roll with equipment financing? Here’s what lenders typically look for:

- Credit Score:A solid credit score boosts your chances of approval and better terms.

- Business History:Lenders prefer businesses with a track record, usually at least a year in operation.

- Revenue:Demonstrating consistent revenue shows you can handle the payments.

- Equipment Details:Lenders will assess the equipment’s value, condition, and usefulness to your business.

The Application Process: Smooth and Simple

Applying for equipment financing doesn’t have to be a headache. Follow these steps to keep it chill:

- Identify Your Equipment Needs:Know exactly what you need and why.

- Gather Financial Documents:Have your financial statements, tax returns, and business plan ready.

- Shop Around:Compare offers from different lenders to find the best fit.

- Submit Your Application:Fill out the application accurately and provide all required documentation.

- Review Terms:Carefully review the loan or lease terms before signing on the dotted line.

Remember, it’s all about finding a financing partner that vibes with your business goals.

Types of Equipment That Can Be Financed

Equipment financing isn’t a one-size-fits-all solution—it’s versatile! Here’s a glimpse of the types of equipment businesses can finance:

- Machinery:From industrial equipment to manufacturing machines, businesses can upgrade without waiting to save capital.

- Technology:Computers, software, servers, and other IT infrastructure can be financed to keep businesses technologically competitive.

- Vehicles:Whether it’s a delivery van or an entire fleet, vehicle financing is common for businesses in logistics, transportation, and services.

- Medical Equipment:Clinics and hospitals can finance advanced diagnostic tools, imaging machines, or lab equipment to provide better patient care.

- Construction Equipment:Bulldozers, cranes, and other heavy machinery crucial to construction businesses are easily financed.

- Retail Fixtures:Point-of-sale systems, shelves, and other store equipment can also be acquired through financing.

Certain industries require niche tools, and specialised equipment financing can cover items like agricultural machinery, restaurant kitchen appliances, and even renewable energy systems such as solar panels.

The Hidden Costs of Buying Equipment Outright

While buying equipment outright might seem like a financially savvy decision, it can come with hidden costs:

- Opportunity Cost:Every pound or dollar spent upfront is a pound or dollar not spent on marketing, hiring, or other growth activities.

- Risk of Obsolescence:Equipment, especially technology, loses value quickly as newer models are released.

- Maintenance Costs:Outdated equipment often comes with higher repair and maintenance costs.

- Liquidity Challenges:Large upfront costs can tie up your working capital, leaving you less flexible to respond to unexpected expenses.

Equipment financing mitigates these risks by spreading costs over time and allowing businesses to reserve cash for other priorities.

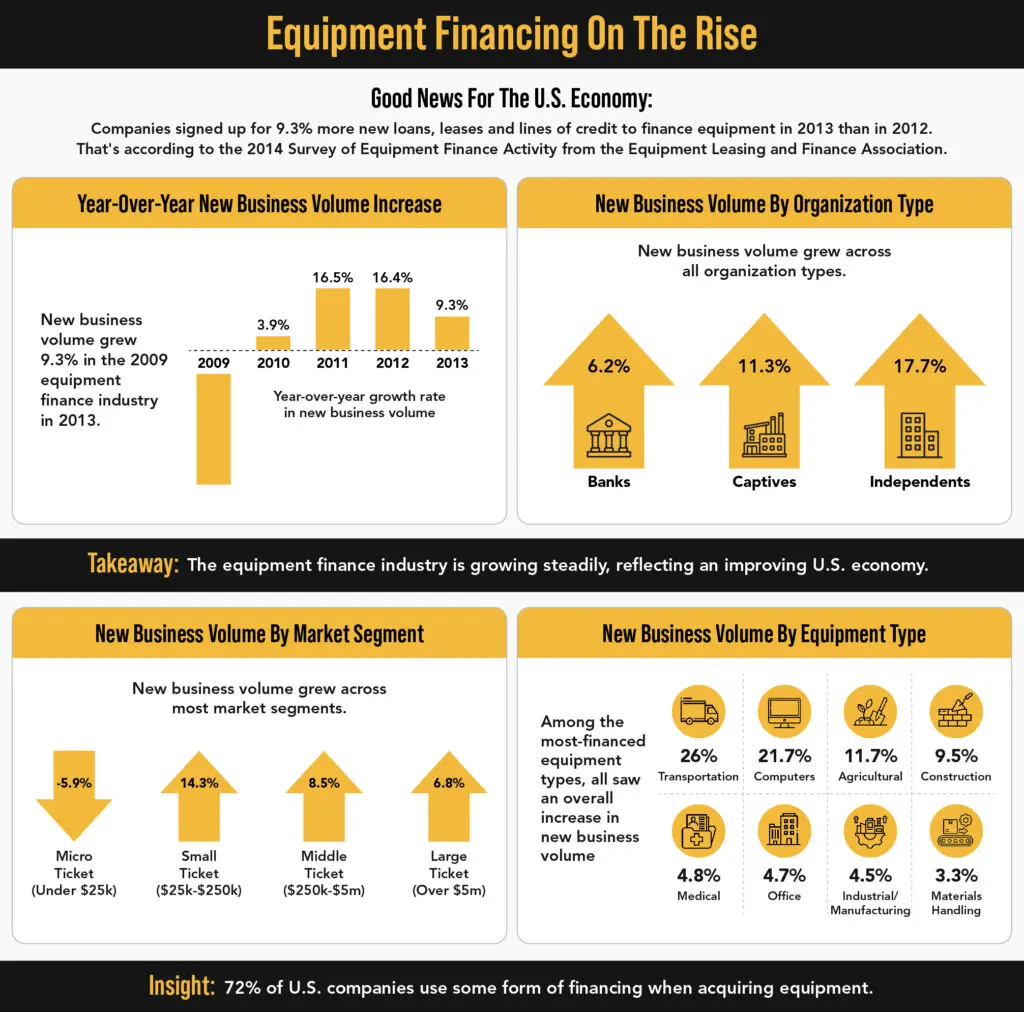

How Equipment Financing Impacts Small Businesses

1. Encourages Business Growth

Access to state-of-the-art equipment enables small businesses to scale operations, take on larger projects, and boost production. For instance, a construction firm that finances new machinery can complete projects faster and more efficiently, winning more contracts.

2. Improves Productivity

Updated equipment often translates into better efficiency and higher-quality output. For example, modern software can automate processes and reduce human errors, giving businesses a competitive edge.

3. Supports Startups

For startups with limited capital, equipment financing provides an opportunity to acquire the tools needed to get off the ground without depleting initial investments.

4. Stimulates Economic Activity

When businesses use financing to expand, they indirectly contribute to economic growth by creating jobs, increasing demand for raw materials, and boosting overall productivity.

Leasing vs. Buying: How to Choose?

Here are a few questions to help you decide between leasing and buying:

- How Long Will You Need the Equipment?

- Leasing is better for short-term or rapidly changing technology.

- Buying makes sense if the equipment will be used for many years.

- What’s Your Budget?

- Leasing usually requires lower monthly payments.

- Buying involves a significant upfront cost but no ongoing payments.

- Will You Need Upgrades?

- Leasing allows for easier upgrades at the end of the lease term.

- Buying may leave you stuck with outdated equipment.

By evaluating these factors, you can choose an option that aligns with your business goals.

Equipment Financing for New Businesses

New businesses often struggle to qualify for traditional loans due to a lack of credit history. However, many lenders offer equipment-specific loans for startups, focusing on the value and utility of the equipment rather than the business’s financial history. This type of financing enables startups to hit the ground running with the tools they need to compete.

Tips to Maximise the Benefits of Equipment Financing

- Compare Lenders:Don’t settle for the first lender you find. Compare terms, interest rates, and repayment flexibility.

- Negotiate Terms:Some lenders are willing to customise repayment schedules to better suit your business’s cash flow.

- Understand Fees:Be aware of any hidden fees, such as early repayment penalties or equipment insurance costs.

- Prioritise ROI:Ensure the equipment you’re financing will generate enough revenue or cost savings to justify the investment.

- Consider Bundled Financing:Some lenders offer bundled financing options, which include maintenance and repairs, saving you additional costs over time.

The Role of Alternative Lenders in Equipment Financing

Traditional banks may not always be the best choice for small businesses, especially those with limited credit history or unconventional needs. Alternative lenders, like VIP Capital Funding, offer:

- Faster Approvals:Get access to funds within days rather than weeks.

- Flexible Credit Requirements:These lenders often work with businesses that may not qualify for bank loans.

- Customised Solutions:Tailored financing options that align with your industry and goals.

Alternative lenders provide a much-needed lifeline to small businesses, ensuring they can compete with larger corporations that have greater access to traditional financing.

Industry-Specific Equipment Financing Examples

1. Healthcare

Doctors and dentists often use equipment financing to purchase diagnostic tools, x-ray machines, and specialised software, enabling better patient outcomes.

2. Construction

Builders use financing to acquire cranes, excavators, and concrete mixers, allowing them to complete projects more efficiently and bid on larger contracts.

3. Technology Startups

Tech companies can finance high-performance servers and cutting-edge software to stay competitive in a rapidly evolving industry.

Real-World Success Stories

Still on the fence? Check out these cool examples of businesses that leveled up with equipment financing:

- Northern Lights Cakery:This bakery secured an equipment loan to purchase state-of-the-art ovens, boosting production and sales.

- Construction Company:A construction firm financed heavy machinery, allowing them to take on larger projects without depleting their cash reserves.

These businesses seized the opportunity to grow without the financial strain of upfront equipment purchases.

Final Thoughts

Equipment financing loans are like the backstage pass to your business’s success. They provide the means to acquire essential tools—be it machinery, technology, or vehicles—without draining your cash reserves. By leveraging financing options, you can keep your operations running smoothly, stay ahead of the competition, and rock your business goals.

So, next time you’re eyeing that must-have piece of equipment, remember: financing could be your VIP ticket to success.

Ready to Amplify Your Business Growth?

At VIP Capital Funding, we specialize in providing equipment financing loans tailored to your unique needs. With over a decade of experience, we offer private/alternative lending, SBA loans, and business credit lines to small and mid-sized businesses across the United States. Let us help you gain a competitive edge and drive your business forward. Apply for equipment financing today and watch your business soar!