First-Time Business Loans in Washington

Your Path to Entrepreneurship

Starting a business can be an exhilarating experience, but it often requires significant financial investment. In Washington State, a vibrant economy featuring booming sectors such as technology, healthcare, and manufacturing offers many opportunities for first-time entrepreneurs. However, accessing the funds needed to launch or grow a business can be a challenge. This guide will explore essential insights about first-time business loans in Washington, designed to equip you with the information necessary for success.

Washington’s Economic Landscape

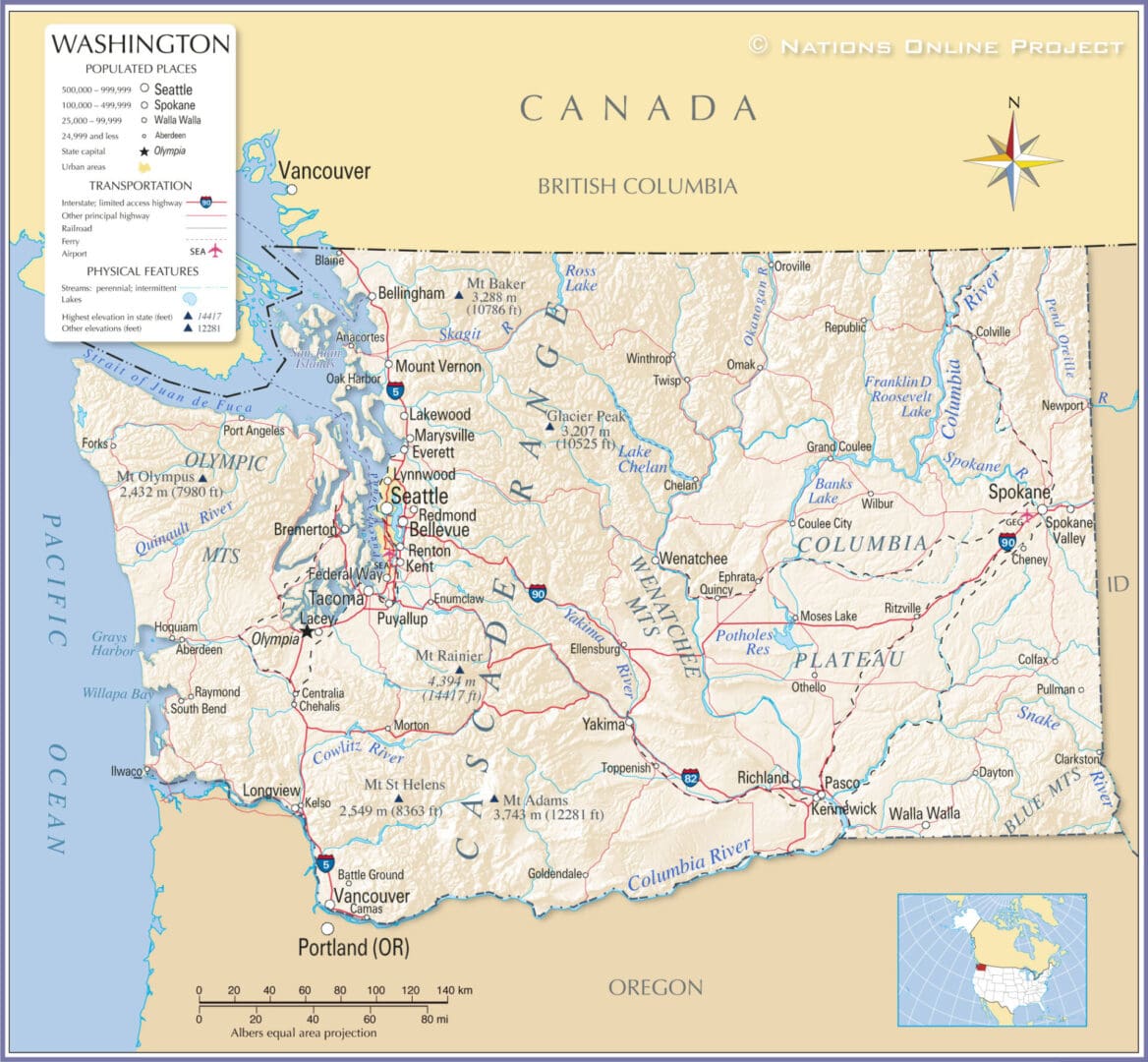

With over 700,000 small businesses, Washington is a fertile ground for entrepreneurs. Major urban centers like Seattle, Tacoma, and Spokane provide a diverse array of markets and resources, catering to various industries. The state’s economy is among the fastest-growing in the U.S., driven largely by innovation and a skilled workforce. For first-time business owners, understanding this landscape is crucial, as it helps identify potential opportunities and challenges in the marketplace.

Types of Financing for First-Time Entrepreneurs

First-time business loans come in various forms, each tailored to meet specific needs. Understanding the different options available can help you make an informed decision:

- Startup Loans:These loans are designed specifically for new businesses to cover initial expenses, such as equipment purchases, inventory, or marketing efforts. Startup loans can be pivotal in setting up operations.

- Business Lines of Credit:This flexible financing option allows you to withdraw funds as needed, making it suitable for managing fluctuating cash flow and unexpected expenses.

- Equipment Financing:Ideal for businesses that require specialized equipment, this type of loan uses the equipment itself as collateral, allowing you to acquire essential tools without a large upfront payment.

Essential Requirements for Loan Approval

When seeking a first-time business loan in Washington, being prepared is essential. Most lenders will look for specific criteria, including:

- Credit Score:A solid credit score (generally 650 or higher) can significantly impact your ability to secure a loan. For new businesses, personal credit scores may be considered, especially if you haven’t established business credit yet.

- Comprehensive Business Plan:A detailed business plan outlines your vision, target market, and financial projections. Lenders want to see a clear roadmap that demonstrates how you intend to use the funds effectively.

- Collateral Options:Some lenders may require collateral to secure the loan, which can include business assets, real estate, or personal assets.

- Financial Documentation:Providing financial statements and bank records will help lenders assess your financial health and ability to repay the loan.

Current Trends in First-Time Business Loans

The lending landscape in Washington has evolved in recent years, with many first-time entrepreneurs increasingly seeking financing. The Washington State Department of Financial Institutions reported a noticeable increase in loan applications among small businesses. This trend indicates a growing awareness of available funding sources and the importance of securing capital to drive growth.

In 2022, nearly 30% of small business owners in Washington applied for financing, with various industries seeing positive loan approval rates, particularly in technology and health services.

How The First-Time Business Loan Process Works

1. Initial Consultation: The process begins with an initial consultation. This is where you can discuss your business needs and goals with a representative from VIP Capital Funding. During this stage, you’ll provide details about your business, including your industry, funding requirements, and how you plan to use the loan.

2. Pre-Qualification: After the consultation, VIP Capital Funding will conduct a pre-qualification assessment. This step involves evaluating your financial profile, including credit history, revenue projections, and business plan. Pre-qualification helps determine the types of loans you may be eligible for and gives you an idea of the potential loan amounts.

3. Documentation Preparation: Once pre-qualified, you will need to gather and submit the necessary documentation. Common documents required include:

- Business Plan:A comprehensive plan outlining your business model, market analysis, and financial projections.

- Financial Statements:Recent income statements, balance sheets, and cash flow statements.

- Credit Information:Personal and business credit scores, if applicable.

- Legal Documentation:Business licenses, permits, and incorporation papers.

4. Loan Application Submission: With the documentation in order, you’ll complete the formal loan application. VIP Capital Funding offers a user-friendly application process, allowing you to submit your information online or through a representative. This application includes details about your business, the loan amount requested, and the intended use of the funds.

5. Loan Review and Approval: Once your application is submitted, VIP Capital Funding’s underwriting team will review all provided information. This includes assessing your creditworthiness, financial health, and business viability. The review process is typically quick, with many applicants receiving feedback within 1-2 business days.

6. Loan Offer and Terms Negotiation: If your loan is approved, you will receive a loan offer detailing the terms and conditions, including the interest rate, repayment period, and any fees involved. At this stage, you can discuss the terms with a VIP representative and negotiate any aspects as needed.

7. Finalizing the Loan: Once you agree to the terms, you’ll sign the loan agreement. After this, VIP Capital Funding will finalize the loan details, including the disbursement schedule. The funds are typically released quickly, often within 1-2 business days after finalization.

Why Choose VIP Capital Funding?

At VIP Capital Funding, we understand the unique challenges first-time entrepreneurs face in Washington. Our commitment is to empower you with customized financing solutions that cater to your specific needs. With a high approval rate and a straightforward application process, we strive to make securing funding easier for you.

Our loans feature minimal paperwork and rapid processing times, ensuring you receive timely support to take advantage of new opportunities.

Contact VIP Capital Funding today to discover how our first-time business loan offerings can propel your entrepreneurial journey in Washington State. Together, we can turn your business aspirations into reality!