Small businesses are the backbone of the U.S. economy, accounting for 99.9% of all firms and employing nearly half of the private workforce. However, many small business owners face a significant challenge: securing capital. According to the Federal Reserve’s Small Business Credit Survey (2023), small businesses cite access to credit as a barrier to growth.

Traditional lending institutions like banks often require extensive documentation, high credit scores, and collateral—factors that can exclude many entrepreneurs from accessing the funding they need. But online small business loans are changing the game, providing accessible, fast, and hassle-free solutions that empower small businesses to thrive.

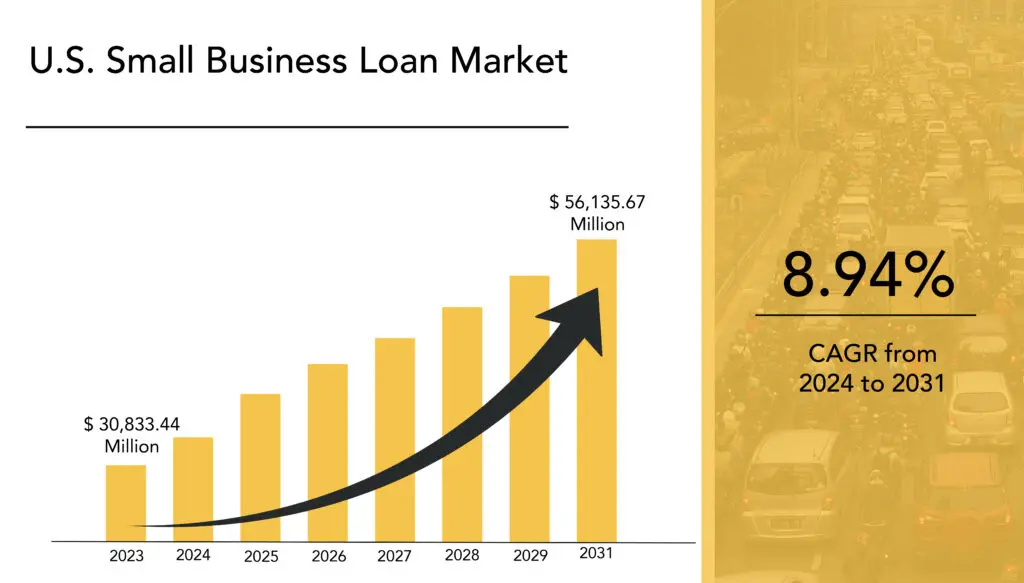

The growth of online lending platforms is staggering. The Federal Reserve reports that online lenders provide billions in funding to U.S. businesses year after year. This surge reflects a growing shift toward digital solutions that prioritize convenience, speed, and inclusivity. Entrepreneurs seeking short term loans for small business, working capital for small businesses, or specialized loans like medical practice financing can now bypass the red tape of traditional banks and access funding in record time.

These innovations are particularly impactful for businesses in states like Georgia, Illinois, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Texas, Florida, and California, where industries such as healthcare, construction, and retail drive economic growth. Entrepreneurs in these regions can tap into resources like small business loans to fuel expansion, cover operational costs, and seize new opportunities.

Advantages of Online Small Business Loans

1. Fast Approvals and Funding

Traditional loan approvals can take weeks—or even months. For businesses with urgent needs, this timeline is untenable. Online lenders, however, offer unparalleled speed. Most online small business loan applications are reviewed within 24–48 hours, with funds often disbursed in less than a week.

This rapid turnaround is a lifeline for businesses facing immediate expenses, such as repairing equipment, purchasing inventory, or covering payroll. Entrepreneurs in industries like construction and retail, which often encounter unexpected costs, can use short term loans for business to address these challenges quickly.

For example, a restaurant owner needing new kitchen equipment can apply for equipment financing loans and receive approval almost immediately. This ability to act quickly ensures small businesses can maintain operations without disruption.

2. Diverse Loan Options

Online lenders understand that no two businesses are alike. They offer a variety of loan products to meet different needs, including:

- Working capital loans for small business: Ideal for covering day-to-day expenses like rent, utilities, and salaries.

- Small business equipment financing: Helps businesses acquire the tools and technology needed for growth.

- Small business construction loans: Tailored for contractors and builders, these loans cover materials, labor, and other project costs.

- Medical practice business loans: Designed for healthcare providers to upgrade equipment, expand facilities, or hire staff.

- Manufacturing business funding: Enables manufacturers to scale production, invest in new technology, or purchase raw materials.

Whether you’re running a healthcare clinic in Maryland, a manufacturing plant in Michigan, or a retail store in Pennsylvania, there’s a loan option designed specifically for your industry and needs.

3. Simplified Application Process

Gone are the days of submitting stacks of paperwork and waiting weeks for a decision. With online small business loans, the application process is simple and efficient. Entrepreneurs can apply from anywhere using a smartphone or computer, uploading basic financial documents like bank statements and tax returns.

This streamlined process not only saves time but also reduces stress. Businesses in North Carolina, Virginia, and Ohio, for example, can complete their applications without the need for multiple in-person visits or tedious paperwork.

Many lenders also provide user-friendly platforms with tools to calculate loan terms, helping business owners make informed decisions. This transparency builds trust and ensures borrowers fully understand their commitments before proceeding.

4. Access for Businesses with Less-Than-Perfect Credit

Traditional banks often require high credit scores, which can be a barrier for startups or businesses with limited financial histories. Online lenders take a more inclusive approach, evaluating metrics like cash flow and revenue trends.

This flexibility opens the door for businesses in underserved communities or those recovering from financial setbacks. Entrepreneurs in Nevada, Washington, and Florida, for instance, can benefit from small business loans, even if their credit scores fall below the threshold for traditional loans.

5. Specialized Loan Programs for Diverse Needs

One of the standout benefits of online small business loans is the availability of specialized loan programs tailored to meet specific business challenges and opportunities. These programs focus on addressing the diverse needs of small business owners by considering factors like industry, growth stage, and operational priorities.

For instance:

- Seasonal Business Loans: Perfect for businesses like tourism operators or retail stores, these loans provide the working capital needed to prepare for peak seasons.

- Equipment Financing Loans: Ideal for startups and established companies looking to upgrade or purchase essential tools and machinery without depleting their cash flow.

- Startup Business Equipment Financing: Designed to help new businesses acquire the equipment they need to get off the ground.

- Construction Business Financing: Supports contractors and builders with funding for tools, heavy machinery, or covering project-related expenses.

- Medical Practice Financing: Assists healthcare professionals in expanding their practices, acquiring state-of-the-art equipment, or even managing day-to-day cash flow.

By offering these specialized programs, online lenders make it possible for entrepreneurs to access funding that aligns perfectly with their unique business objectives. Whether it’s preparing for the holiday rush or expanding into new markets, these loans open doors for growth and efficiency.

Industries Benefiting the Most

Construction

Construction companies often require large upfront investments for materials and labor before receiving payments from clients. Construction business financing bridges these gaps, ensuring projects stay on schedule. Entrepreneurs can use small business loans for construction company to cover costs, take on larger projects, and maintain positive cash flow.

Healthcare

Doctors, dentists, and other healthcare providers rely on modern equipment and facilities to deliver quality care. However, upgrading these essentials can be costly. Medical practice financing and equipment financing loans enable healthcare professionals to invest in cutting-edge technology, hire skilled staff, and expand their practices.

Manufacturing

Manufacturers operate in a capital-intensive industry, where upgrading machinery or purchasing raw materials is crucial for staying competitive. Manufacturing business loans provide the funding needed to scale production and meet growing demand.

Retail and E-Commerce

Retailers and e-commerce businesses face fluctuating demand and seasonal trends. Working capital loans and short term business funding help these businesses manage inventory, fund marketing campaigns, and respond to market changes quickly.

Home Care Services

The demand for home care services is growing, particularly in states like Pennsylvania, North Carolina, and Michigan. Entrepreneurs can use small business loans for home care to hire qualified caregivers, purchase equipment, and expand service offerings.

How to Apply for Online Small Business Loans

The application process for online small business loans is straightforward:

- Identify Your Needs

Determine how much funding you require and for what purpose. Whether it’s equipment financing for small businessor working capital for new business, having clear goals will guide your decision. - Research Lenders

Find reputable lenders like VIP Capital Funding that offer solutions tailored to your needs. Look for platforms that specialize in fast small business loansand startup business equipment financing. - Gather Documentation

Prepare essential documents like bank statements, tax returns, and business financials. - Submit an Application

Complete an online small business loan application, providing accurate and detailed information. - Review Loan Offers

Once approved, review the loan terms, including interest rates, repayment schedules, and fees. - Receive Funds

Upon accepting the terms, funds are typically disbursed within days, allowing you to focus on your business goals.

Why VIP Capital Funding is Your Trusted Partner

At VIP Capital Funding, we understand that every business is unique. That’s why we offer a wide range of solutions, including short term small business, equipment financing, and working capital loan options.

Our process is fast, transparent, and hassle-free. Whether you’re a contractor looking for construction company loans or a healthcare provider exploring medical practice business loans, we’re here to support you.

Our dedicated team is committed to helping you secure the funding you need to grow. With our streamlined application process, you can apply from anywhere and receive approval quickly. Visit our website today to get started. Take the first step toward transforming your business vision into reality!