Let’s dive into the world of manufacturing and uncover a secret weapon that’s helping businesses thrive: Supply Chain Financing (SCF). Imagine a tool that smooths out cash flow wrinkles, keeps production lines humming, and strengthens relationships with suppliers. Intrigued? Let’s break it down.

The Lowdown on Supply Chain Financing

So, what’s SCF all about? In simple terms, it’s a set of solutions that optimize cash flow by allowing businesses to extend payment terms to their suppliers while enabling those suppliers to get paid early. It’s a win-win that keeps everyone in the supply chain happy and operations running smoothly.

Cash Flow: The Lifeblood of Manufacturing

Picture this: You’re running a manufacturing business, and you’ve got orders flying in. Awesome, right? But wait—those raw materials and components you need? They require upfront payment, and your clients won’t pay you until the final product is delivered. This gap can put a serious strain on your cash flow.

Enter SCF. By leveraging this financing, you can bridge the gap between outgoing payments to suppliers and incoming payments from customers. This means you can pay your suppliers promptly without waiting for your clients to settle their invoices. Smooth cash flow = happy suppliers and uninterrupted production.

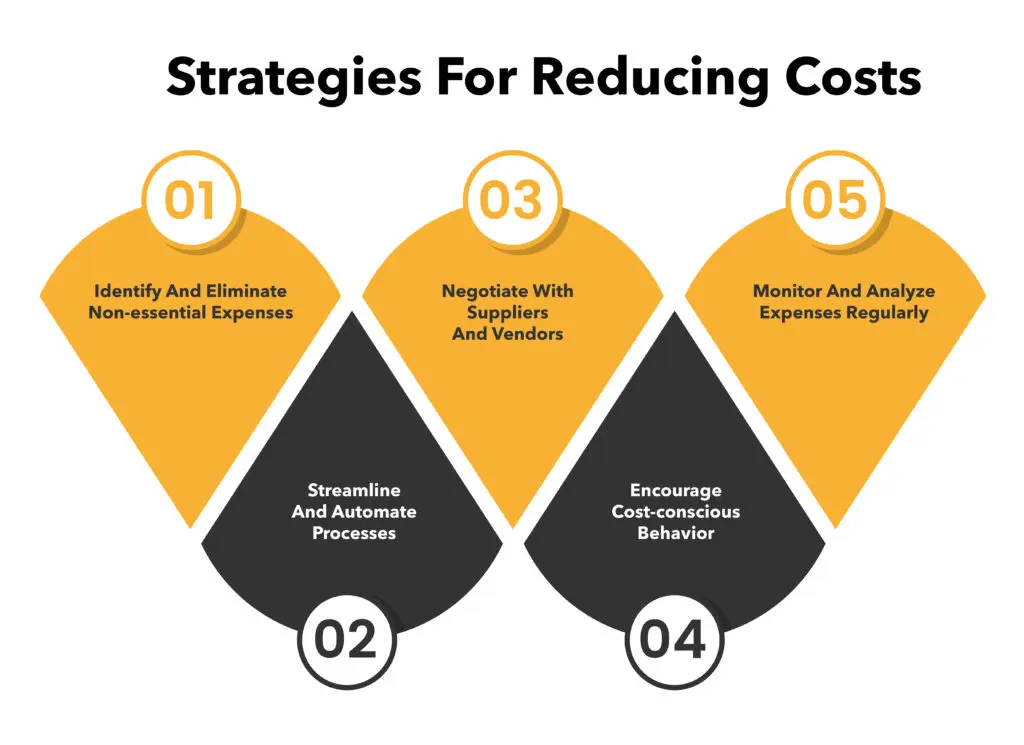

Taming Supplier Costs

Negotiating with suppliers can sometimes feel like a high-stakes poker game. They want prompt payment; you want favorable terms. SCF deals you a winning hand. Here’s how:

- Early Payments with Benefits: With SCF, suppliers can opt to receive early payments on their invoices, often at a slight discount. This provides them with the liquidity they need without resorting to expensive loans. In return, you might negotiate better pricing or terms. Cha-ching!

- Strengthening Partnerships: Consistently offering early payments fosters trust and collaboration. Suppliers are more likely to prioritize your orders and offer favorable terms, knowing they won’t be left hanging when it comes to payments.

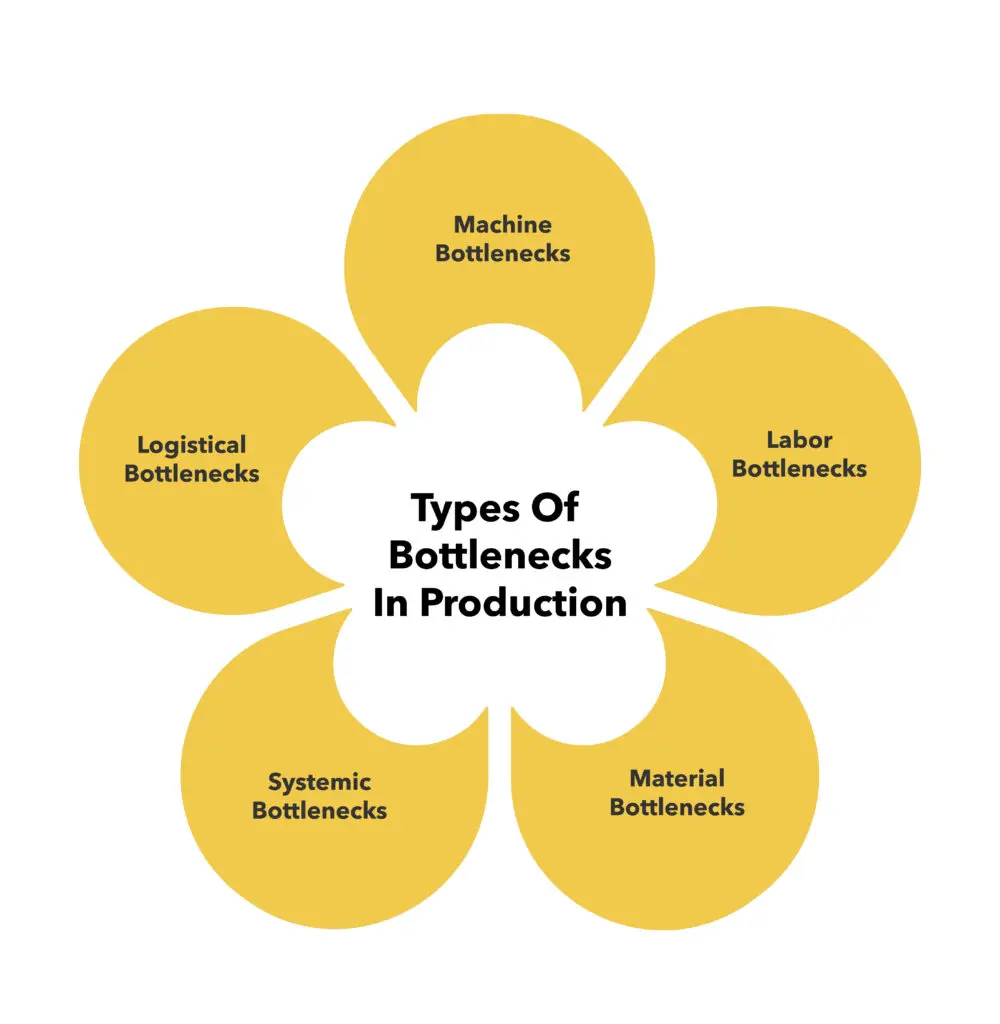

Busting Through Production Bottlenecks

Ah, the dreaded production bottleneck—that pesky point where everything grinds to a halt. These can be caused by delayed supplies, equipment failures, or unexpected demand spikes. SCF to the rescue!

- Ensuring Timely Supplies: By paying suppliers promptly through SCF, you reduce the risk of delays in receiving essential materials. Suppliers with assured cash flow are more reliable, ensuring your production line keeps moving.

- Investing in Equipment: Improved cash flow means you have the funds to invest in maintaining and upgrading equipment. No more unexpected breakdowns causing costly delays.

- Flexibility to Meet Demand: With a steady cash flow, you’re better positioned to ramp up production when demand surges, seizing opportunities without the stress of financial constraints.

Keeping Operations Smooth and Steady

In the fast-paced world of manufacturing, stability is key. SCF plays a pivotal role in maintaining this equilibrium.

- Predictable Cash Management: With SCF, you have a clearer picture of your cash flow. Predictability allows for better planning, budgeting, and the confidence to take on new projects or clients.

- Reducing Financial Stress: Knowing that your suppliers are paid and your operations are funded reduces the day-to-day financial stress. This peace of mind lets you focus on what you do best: innovating and growing your business.

- Competitive Edge: Efficient operations and strong supplier relationships position you ahead of competitors. You’re not just surviving; you’re thriving.

Expanding Supplier Networks

A strong supplier network is critical for manufacturers, and SCF plays a key role in building and maintaining it.

- Attracting High-Quality Suppliers: When suppliers know they’ll receive timely payments, they’re more willing to work with your business. SCF helps attract reliable, high-quality suppliers, ensuring consistent material quality.

- Diversifying Supplier Base: Instead of relying on a handful of suppliers, SCF enables businesses to engage with multiple suppliers by offering favorable payment terms. This diversification reduces dependency on a single source and minimizes risks of supply chain disruptions.

- Negotiating Favorable Bulk Pricing: Having immediate access to funds allows manufacturers to negotiate better pricing on bulk purchases, reducing costs and increasing profit margins.

Strengthening Relationships with Financial Institutions

Access to SCF also improves a manufacturing business’s relationship with lenders and financial institutions.

- Building Creditworthiness: Regularly using and successfully managing SCF demonstrates financial responsibility. This can help businesses secure larger credit lines and better financing terms in the future.

- Easier Loan Approvals: A strong SCF track record signals to lenders that the business has healthy financial management, improving the chances of securing other forms of financing, such as equipment financing loansor working capital business loans.

- Lowering Interest Costs: Many manufacturers rely on traditional loans to manage working capital, but SCF can reduce the need for high-interest debt, leading to long-term savings.

Managing Seasonal Demand Fluctuations

Manufacturers often experience seasonal spikes and dips in demand, making cash flow management tricky. SCF helps smooth out these fluctuations.

- Handling Peak Seasons Efficiently: During high-demand periods, SCF ensures manufacturers can purchase extra raw materials and increase production without waiting for revenue from previous sales.

- Avoiding Off-Season Cash Crunches: In slower periods, businesses can use SCF to maintain supplier relationships and keep operations steady without excessive financial strain.

- Scaling Production with Confidence: The ability to secure materials and pay suppliers without financial bottlenecks enables businesses to scale up quickly when demand surges.

Improving Inventory Management

Having too much or too little inventory can harm a manufacturing business. SCF helps strike the right balance.

- Preventing Stockouts: Manufacturers can use SCF to ensure they always have the necessary materials on hand, preventing production delays caused by inventory shortages.

- Avoiding Excess Inventory Costs: Businesses can better control their inventory levels, avoiding excess storage costs and reducing waste.

- Enabling Just-in-Time Production: SCF supports just-in-time (JIT) manufacturing, where materials are only acquired when needed, improving efficiency and reducing holding costs.

Enhancing Resilience Against Global Supply Chain Disruptions

With economic instability, trade restrictions, and logistical issues becoming more common, manufacturers need financial agility. SCF provides resilience against such disruptions.

- Mitigating Currency Fluctuation Risks: When dealing with international suppliers, SCF can help hedge against currency fluctuations by securing payments at stable rates.

- Managing Import Tariffs and Duties: Some SCF solutions help manufacturers absorb additional costs from tariffs and duties without negatively impacting cash flow.

- Navigating Supply Chain Shocks: Whether it’s a pandemic, trade war, or logistics crisis, SCF ensures businesses can maintain operations and quickly adapt to unexpected changes.

Reducing Dependence on Costly Emergency Funding

Without SCF, many manufacturers turn to high-interest credit lines or emergency loans when facing cash flow shortages. SCF helps avoid such costly options.

- Avoiding Expensive Short-Term Loans: Emergency loans often come with high interest rates and unfavorable terms. SCF provides an alternative with lower financial risk.

- Minimizing Late Payment Penalties: With SCF, suppliers get paid on time, preventing late fees or penalties that eat into profit margins.

- Improving Debt Management: By using SCF instead of accumulating debt, manufacturers can maintain a healthier financial profile and reduce overall liabilities.

Supporting Innovation and Research & Development (R&D)

Innovation is the lifeline of manufacturing, but R&D requires significant investment. SCF helps businesses fund new product development.

- Funding New Product Lines: With freed-up cash flow, manufacturers can invest in testing, prototyping, and launching new products without disrupting day-to-day operations.

- Upgrading Technology: Businesses can afford to implement automation, AI, and IoT technologies, improving efficiency and staying competitive.

- Encouraging Sustainable Practices: Manufacturers can invest in eco-friendly materials and energy-efficient processes, aligning with sustainability goals without financial strain.

Ensuring Compliance and Regulatory Preparedness

Manufacturers face strict industry regulations and compliance requirements. SCF helps cover the costs associated with meeting these standards.

- Funding Safety and Quality Upgrades: SCF ensures businesses have the capital to invest in equipment upgrades and employee training, reducing compliance risks.

- Managing Environmental Regulations: Meeting sustainability standards often requires additional investment. SCF can fund initiatives such as waste reduction and energy-efficient machinery.

- Avoiding Regulatory Fines: Having sufficient cash flow means businesses can promptly address compliance issues, avoiding costly legal penalties.

Real-World Success Stories

Let’s take a look at how SCF has made a tangible difference:

- AGCO’s Strategic Move: AGCO, a global agricultural equipment manufacturer, implemented SCF to extend payment terms while ensuring suppliers received early payments. This strategy improved AGCO’s cash flow and strengthened supplier relationships, creating a more resilient supply chain.

- Spirit AeroSystems’ Lifeline: Facing financial challenges, aerospace manufacturer Spirit AeroSystems received advance payments from Boeing. This infusion of funds helped Spirit maintain operations and manage high inventory levels, showcasing how SCF can provide critical support during tough times.

The Bigger Picture: Economic Resilience

Beyond individual businesses, SCF contributes to broader economic stability. By ensuring that manufacturers and their suppliers maintain healthy cash flows, SCF supports job retention, encourages investment, and fosters innovation. It’s a ripple effect that strengthens the entire economic fabric.

Wrapping It Up

Supply Chain Financing isn’t just a financial tool; it’s a game-changer for manufacturing businesses. By enhancing cash flow, reducing supplier costs, eliminating production bottlenecks, and ensuring smooth operations, SCF empowers manufacturers to navigate challenges and seize opportunities with confidence.

Ready to take your manufacturing business to the next level? Explore how SCF can be the catalyst for your growth and success.

Unlock Your Business’s Potential with VIP Capital Funding

At VIP Capital Funding, we specialize in providing financing for manufacturers, including equipment financing loans and working capital business loans. With over a decade of experience, we offer tailored solutions like SBA loans and business credit lines to help small and mid-sized businesses thrive. Contact us today to apply for small business loan options that give your company a unique competitive advantage.