In the ever-evolving landscape of entrepreneurship, securing adequate funding is often the cornerstone of success for small businesses. Whether you’re launching a startup or expanding an existing venture, navigating the process of applying for a small business loan can be daunting. However, armed with the right knowledge and strategy, you can increase your chances of obtaining the financing you need to fuel your business’s growth.

In this guide, we’ll walk you through a step-by-step approach to applying for small business loans, with a focus on private money lenders and alternative financing options.

Understanding Your Funding Needs

Before diving into the loan application process, it’s crucial to have a clear understanding of your business’s financial requirements. Take the time to assess your funding needs based on your short-term and long-term goals. Are you looking to purchase equipment, cover operational expenses, or finance expansion projects? Identifying your specific funding objectives will help you narrow down your options and tailor your loan application accordingly.

Determining Why You Need a Small Business Loan

Before applying for a small business loan, it’s essential to clearly define why you need the funding. Understanding your specific financial requirements will help you tailor your loan application and choose the most suitable financing option. Here are some common reasons why small businesses seek loans:

Equipment Purchase: If your business requires specialized equipment or machinery to operate efficiently, an equipment financing loan can provide the necessary capital to make the purchase without depleting your cash reserves.

Working Capital: Many businesses require additional funds to cover day-to-day operational expenses, such as payroll, inventory restocking, and utilities. A short-term loan can offer quick access to capital to bridge gaps in cash flow.

Expansion Projects: Whether you’re opening a new location, launching a marketing campaign, or diversifying your product line, expansion projects often require significant upfront investment. A small business loan can provide the financial resources needed to fuel growth and capitalize on new opportunities.

Emergency Situations: Unexpected events, such as natural disasters, equipment breakdowns, or economic downturns, can disrupt business operations and strain cash flow. Having access to emergency funding through a line of credit or short-term loan can help businesses weather these challenges and maintain stability.

Seasonal Trends: Businesses that experience fluctuations in demand throughout the year may need financing to manage seasonal peaks and valleys. A flexible financing solution, such as a revolving line of credit, can provide the necessary funds to adjust to changing market conditions.

Choosing the Right Type of Loan

Once you’ve determined why you need a small business loan, the next step is to choose the right type of loan for your specific needs. Here are some common types of loans to consider:

Equipment Financing Loans: If you need to purchase or lease equipment for your business, an equipment financing loan allows you to spread the cost over time while retaining ownership of the equipment. These loans are secured by the equipment itself, making them less risky for lenders and potentially offering lower interest rates.

Short-Term Loans: Short-term loans provide quick access to capital with relatively fast approval processes and flexible repayment terms. These loans are ideal for businesses in need of immediate funding to cover temporary cash flow shortages or unexpected expenses.

Lines of Credit: A business line of credit offers a revolving source of funding that can be drawn upon as needed, similar to a credit card. This flexibility makes lines of credit an excellent option for managing day-to-day expenses, covering seasonal fluctuations, or addressing emergencies.

Term Loans: Term loans provide a lump sum of capital that is repaid over a fixed period, typically ranging from one to five years. These loans are suitable for financing large purchases, funding expansion projects, or consolidating existing debt. Term loans may offer lower interest rates and longer repayment terms than other financing options.

Invoice Financing: Invoice financing, also known as accounts receivable financing, allows businesses to borrow against outstanding invoices to improve cash flow. This can be particularly beneficial for businesses with slow-paying customers or seasonal sales cycles.

Talk To a Financial Advisor

Navigating the small business loan landscape can be challenging, especially for entrepreneurs without a background in finance. Seeking advice from a qualified financial advisor can provide valuable insights and guidance throughout the loan application process. A financial advisor can help you assess your financing needs, evaluate different loan options, and develop a comprehensive financial strategy tailored to your business’s goals and circumstances.

Additionally, a financial advisor can assist with preparing loan applications, negotiating terms with lenders, and managing your finances effectively to maximize your chances of success.

Step-By-Step Approach

Exploring Financing Options

While traditional bank loans and Small Business Administration (SBA) loans are common sources of funding for small businesses, they may not always be the most accessible or suitable option. Private money lenders and alternative financing providers offer a viable alternative, providing flexible terms and faster approval processes. One such option is equipment financing loans, which allow businesses to purchase or lease equipment while conserving capital for other operational needs.

Additionally, short-term loans offer quick access to funds for businesses in need of immediate capital infusion. By exploring these alternative financing options, you can find the right solution to meet your business’s unique needs.

Preparing Your Loan Application

With your funding needs identified and alternative financing options explored, it’s time to prepare your loan application. Start by gathering the necessary documentation, which may include financial statements, tax returns, business plans, and proof of collateral. Be sure to review your credit report for any errors or discrepancies, as private money lenders may still consider your credit history as part of the evaluation process, albeit alot less heavily than traditional lenders.

Crafting a Compelling Business Plan

A well-crafted business plan is essential for demonstrating the viability of your business to potential lenders. Your business plan should outline your company’s mission, market analysis, competitive landscape, revenue projections, and growth strategies. Highlighting your industry expertise, unique value proposition, and potential for profitability will help instill confidence in lenders and increase your chances of securing financing.

Choosing the Right Lender

When selecting a lender, it’s essential to consider factors such as interest rates, repayment terms, and loan amounts. Private money lenders and alternative financing providers often offer more flexibility and personalized service than traditional banks, making them an attractive option for small businesses. Take the time to research and compare different lenders to find the best fit for your needs. Look for lenders with a track record of working with businesses in your industry and favorable reviews from past clients.

Submitting Your Loan Application

Once you’ve selected a lender, it’s time to submit your loan application. Be sure to review the application carefully and provide accurate information to avoid delays or complications. Include all required documentation and any additional supporting materials that may strengthen your case. If possible, consider meeting with the lender in person to discuss your business’s needs and answer any questions they may have.

Navigating the Approval Process

After submitting your loan application, be prepared to navigate the approval process, which may involve additional documentation requests, interviews, or due diligence procedures. Stay proactive and responsive throughout the process, addressing any concerns or inquiries from the lender promptly. If your application is approved, carefully review the terms of the loan agreement before signing to ensure they align with your business’s financial goals and capabilities.

Managing Your Loan

Once you’ve secured financing for your small business, it’s crucial to manage your loan responsibly to avoid financial pitfalls. Develop a repayment plan that fits within your budget and prioritize making timely payments to maintain a positive credit history. Stay in regular communication with your lender and notify them immediately of any changes to your business’s financial situation. By effectively managing your loan, you can build trust with your lender and position your business for future growth and success.

Benefits of Small Business Loans

Small business loans offer a plethora of benefits that can empower entrepreneurs to achieve their business goals and drive growth. Here’s a closer look at some of the key advantages of small business loans:

Access to Capital: One of the most significant benefits of small business loans is the access to capital they provide. Whether you’re just starting or looking to expand your operations, securing funding through a loan can provide the financial resources needed to invest in equipment, inventory, marketing, hiring, and other essential aspects of your business.

Fueling Growth: Small business loans can serve as a catalyst for growth by providing the necessary capital to expand your business’s reach, enter new markets, launch new products or services, and scale operations. With access to funding, you can take advantage of growth opportunities and maximize your business’s potential.

Flexibility: Small business loans come in various forms, from term loans and lines of credit to equipment financing and invoice financing. This flexibility allows entrepreneurs to choose the financing option that best aligns with their business needs, cash flow requirements, and repayment preferences.

Improving Cash Flow: Managing cash flow is crucial for small businesses, especially during periods of growth or economic uncertainty. A small business loan can provide a cash infusion to cover day-to-day expenses, bridge gaps in cash flow, and ensure smooth operations without depleting your working capital reserves.

Building Credit History: Responsible use of a small business loan can help establish and strengthen your business’s credit history. Making timely payments on your loan demonstrates financial responsibility and reliability to lenders, which can improve your eligibility for future financing opportunities and favorable terms.

Tax Benefits: In many cases, the interest paid on small business loans is tax-deductible, providing potential tax benefits for your business. Consult with a tax advisor to understand how your loan payments may impact your business’s tax liability and take advantage of available deductions.

Retaining Ownership: Unlike seeking equity financing through investors, small business loans allow you to retain full ownership and control of your business. You’re not required to give up equity or share profits with investors, allowing you to maintain autonomy and make decisions that align with your vision and objectives.

Faster Approval Process: Compared to traditional bank loans, which may involve lengthy approval processes and extensive documentation requirements, many alternative lenders offer quicker and more streamlined loan approval processes. This allows entrepreneurs to access funding more quickly and seize time-sensitive opportunities for growth.

Customized Solutions: Small business loans can be tailored to meet your specific financing needs, whether you’re looking to purchase equipment, cover short-term expenses, finance expansion projects, or consolidate existing debt. Lenders may offer personalized solutions and flexible repayment terms to accommodate your unique circumstances and goals.

Supporting Innovation and Creativity: By providing access to capital, small business loans enable entrepreneurs to innovate, experiment, and bring their creative ideas to life. Whether you’re developing groundbreaking products, implementing new technologies, or exploring unconventional business models, funding through a small business loan can fuel your innovation journey and drive competitive advantage.

FAQs about Applying for Small Business Loans

What is the difference between a traditional bank loan and a private money lender?

Traditional bank loans are typically offered by commercial banks and require extensive documentation, stringent credit checks, and collateral to secure the loan. Private money lenders, on the other hand, are alternative financing providers that offer more flexible terms, faster approval processes, and personalized service. While traditional bank loans may offer lower interest rates, private money lenders may be more willing to work with businesses with less-than-perfect credit or unique financing needs.

How can I improve my chances of getting approved for a small business loan?

To increase your chances of getting approved for a small business loan, it’s essential to have a solid business plan, maintain accurate financial records, and demonstrate the ability to repay the loan. Additionally, improving your credit score, reducing outstanding debt, and providing collateral can strengthen your loan application and instill confidence in lenders.

What documents do I need to prepare when applying for a small business loan?

When applying for a small business loan, you’ll typically need to provide financial statements, tax returns, business plans, proof of collateral, and any other documentation requested by the lender. Be sure to review the loan application carefully and include all required materials to avoid delays or complications.

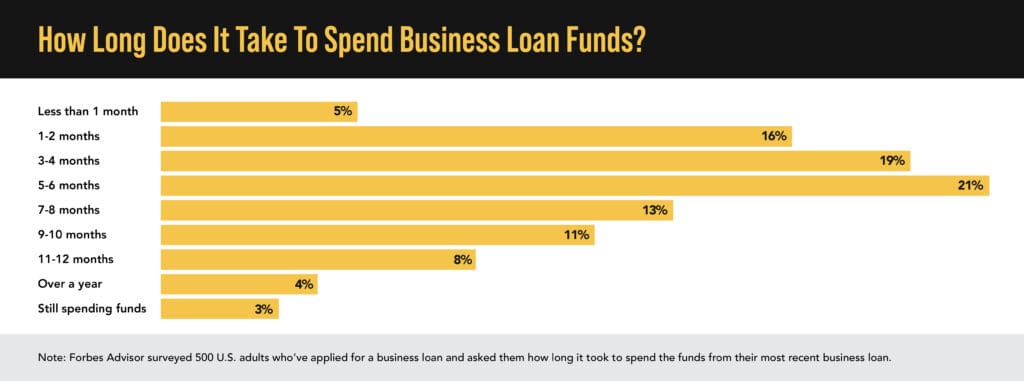

How long does it take to get approved for a small business loan?

The time it takes to get approved for a small business loan can vary depending on the lender, the complexity of your application, and the type of loan you’re applying for. While some lenders may offer quick approval processes for short-term loans or lines of credit, others may require more extensive due diligence for larger loan amounts or riskier borrowers. It’s essential to be patient and proactive throughout the application process and to provide any additional information or documentation requested by the lender promptly.

Can I use a small business loan to consolidate existing debt?

Yes, you can use a small business loan to consolidate existing debt from multiple sources, such as credit cards, lines of credit, or other loans. Consolidating debt can help streamline your finances, reduce interest costs, and simplify repayment by combining multiple debts into a single monthly payment. Be sure to compare interest rates, fees, and repayment terms carefully to ensure that debt consolidation is the right solution for your business’s financial situation.

Can I apply for a small business loan if I have a limited operating history?

Absolutely! At VIP Capital Funding, we understand that many small businesses may have a limited operating history, especially startups and newly established ventures. While some lenders may require a certain number of years in operation, we take a more holistic approach to evaluating loan applications.

We recognize the potential of businesses at every stage of their journey, from startups with innovative ideas to established enterprises seeking growth opportunities. Our goal is to support your vision and help you achieve your business goals, regardless of your operating history.

Can I Get Private Small Business Funding with Low Credit?

Absolutely! Our financial product, revenue-based funding, emphasizes your business’s performance over your credit score. While traditional banks heavily consider credit scores, we focus on your business’s revenue potential. Even if your credit score is as low as 590, we’re open to considering your application if your business generates sufficient revenue.

Contrary to traditional banks, which heavily rely on credit scores and tax returns, we emphasize revenue (80%) over credit scores. This approach allows us to support businesses with varying credit profiles, ranging from below 590 to 650-750 and beyond.

Ready to take your business to the next level? At VIP Capital Funding, we specialize in providing tailored financing solutions to meet your unique needs. Whether you need working capital, equipment financing, or short-term funding, we’ve got you covered.

Apply for a small business loan today and experience our easy online application process. From California to Florida, Texas to Washington, we serve businesses across the nation. Don’t let financial barriers hold you back – let us help you access the capital you need to succeed. Explore our flexible loan options and get started with VIP Capital Funding today!