Securing an online small business loan for your medical practice can be a crucial step in ensuring the financial stability and growth of your business. Whether you need funds to purchase new equipment, hire staff, or expand your facilities, online small business loans offer a convenient and accessible option for medical professionals. In this comprehensive guide, we’ll walk you through the process of obtaining a loan, provide tips for a smooth application, and discuss various financing options tailored to medical practices.

Understanding the Basics of Online Small Business Loans

Before diving into the application process, it’s essential to understand the basics of online small business loans. These loans are offered by a variety of lenders, including banks, credit unions, and specialized online lenders. Unlike traditional bank loans, online small business loans can be applied for entirely online, often with a quicker approval process and fewer paperwork requirements.

Medical practices, like other small businesses, can benefit from these loans in several ways:

- Working capital for day-to-day expenses

- Equipment financing for purchasing medical tools and devices

- Expansion financing for adding new locations or renovating existing ones

- Emergency funds for unexpected costs

Step 1: Assess Your Financial Needs

The first and most critical step in securing an online small business loan for your medical practice is to thoroughly assess your financial needs. Understanding why you need a loan and how much financing you require is essential in determining the right type of loan to apply for and ensuring the long-term success of your medical practice.

Evaluate Your Current Financial Situation

Start by taking a close look at your medical practice’s current financial standing. Review your financial statements, including your income statement, balance sheet, and cash flow statement, to understand your revenues, expenses, assets, and liabilities. Consider your practice’s monthly cash flow and identify any shortfalls that may need to be addressed with a loan. If your cash flow is irregular, you may require a loan to help cover periods of low income or high expenses.

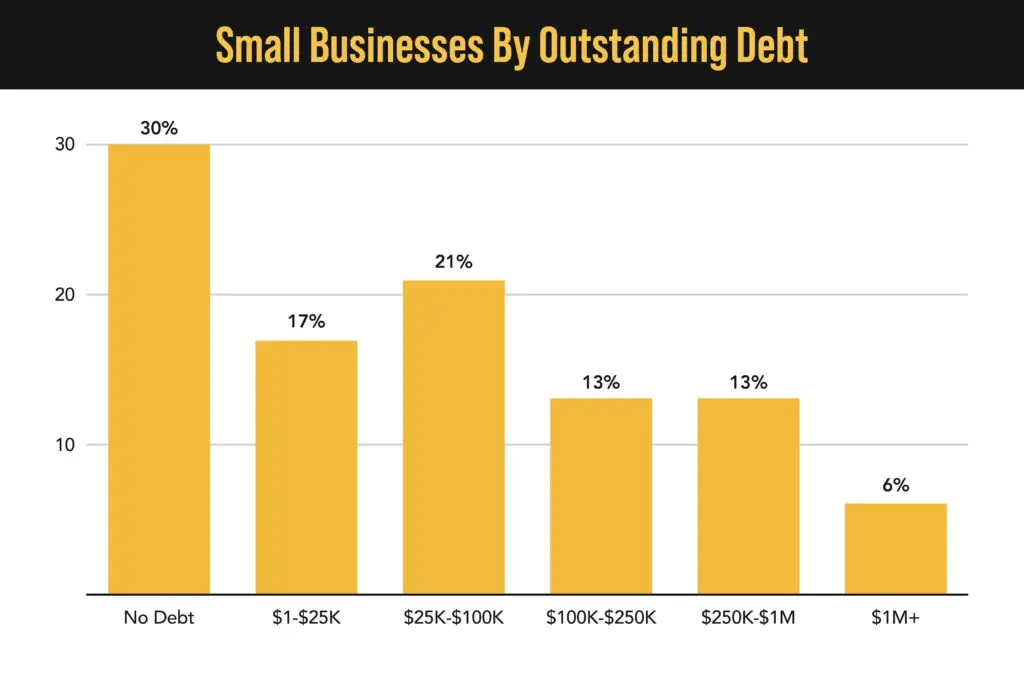

Additionally, assess your existing debts and financial obligations. Understanding your current debt load will help you determine how much more debt your practice can reasonably take on without compromising its financial stability. This step is crucial for identifying the types of loans that best suit your needs—whether they are short-term loans for small businesses to address immediate cash flow issues or longer-term financing options for significant investments.

Identify Your Financial Goals

Once you have a clear understanding of your current financial situation, consider your short-term and long-term financial goals. Are you aiming to stabilize your practice’s cash flow, purchase new equipment, expand your facilities, or cover unexpected expenses? Clearly defining your objectives will help you determine the type and amount of financing you need.

For instance, if you aim to address immediate operational needs, such as paying salaries or covering overhead costs, a working capital loan or short-term loan might be the most suitable option. These types of loans provide quick access to funds to maintain daily operations, especially during times when your practice experiences a temporary dip in revenue. If your practice is looking to invest in new technologies or equipment, equipment financing loans can help you purchase or lease necessary medical tools without a significant upfront cost, allowing you to spread the payments over time.

On the other hand, if you are planning for long-term growth, such as expanding your practice or renovating your facilities, a small business construction loan might be the right choice. These loans are specifically designed to finance construction projects and often come with terms that match the timeline of the project, allowing for more flexibility in repayment.

Determine the Type of Loan That Best Fits Your Needs

Based on your financial assessment and goals, you can determine the type of loan that best suits your needs. Here are some common types of loans available to medical practices:

- Working Capital Loans: These loans are used to cover everyday expenses such as payroll, utilities, rent, and other operating costs. They are particularly useful for maintaining smooth operations during periods of low cash flow. If your practice experiences seasonality in patient visits or billing cycles, a working capital loan can help you manage these fluctuations without disrupting your services.

- Equipment Financing Loans:Medical practices often require specialized equipment that can be expensive. Equipment financing loans are designed specifically for purchasing or leasing equipment. These loans often use the equipment itself as collateral, which can make them easier to obtain than unsecured loans. This type of loan is ideal for practices looking to upgrade their technology, purchase new diagnostic tools, or replace outdated equipment without depleting their cash reserves.

- Short-Term Loans: Short-term loans are typically repaid within a year or less and are ideal for covering temporary cash flow gaps or unexpected emergencies. For example, if your practice needs to cover an unexpected expense, such as a sudden increase in supply costs or a repair bill, a short-term loan can provide the necessary funds quickly. Short-term business funding options are also helpful for taking advantage of a sudden opportunity, like a discounted bulk purchase of supplies.

- Construction Loans: If you are looking to expand your practice, add a new location, or undertake major renovations, a construction loan is a suitable option. These loans provide funds specifically for building or improving facilities. They typically offer longer repayment terms and are disbursed in stages as the construction progresses, reducing the interest burden during the construction phase. Construction business financing can be more complex than other types of loans, so it’s important to work with a lender experienced in construction lending to navigate the process smoothly.

Step 2: Research and Compare Lenders

After you’ve identified your financial needs, the next critical step in securing an online small business loan for your medical practice is to thoroughly research and compare different small business loan providers. With a variety of lenders available, each offering different types of loans with unique terms, interest rates, and conditions, choosing the right one can make a significant impact on the financial health of your practice. Taking the time to evaluate your options carefully will help you secure the best possible loan for your specific situation.

Start with a Broad Search

Begin your research by creating a list of potential lenders. You can find loan providers online through financial institutions like banks, credit unions, online lenders, and specialty finance companies. Consider both traditional and non-traditional lenders, such as small business loan providers that operate exclusively online. Online lenders often offer a more streamlined application process, faster approvals, and more flexibility in terms of credit requirements, which can be advantageous for medical practices that need quick access to funds.

When conducting your search, be sure to include lenders that specialize in providing loans to healthcare professionals or that offer medical practice financing. These lenders are often more familiar with the unique financial challenges that medical practices face, such as fluctuating cash flows, insurance reimbursements, and high equipment costs. They may offer more favorable terms or tailored loan products designed specifically for the healthcare industry.

Key Factors to Consider When Comparing Lenders

As you compile your list of potential lenders, there are several key factors to consider to ensure you choose the best loan provider for your needs:

- Interest Rates: The interest rate is one of the most critical factors to consider when comparing small business loans.Lower interest rates will save your practice money over the life of the loan, reducing the total amount you will need to repay. Rates can vary significantly between lenders and will depend on various factors, including your credit score, the type of loan, and the loan amount. Some lenders may offer variable rates, which can fluctuate over time, while others offer fixed rates that remain constant throughout the loan term. Evaluate both options to determine which is most suitable for your practice’s financial stability and risk tolerance.

- Loan Terms: Loan terms, or the length of time you have to repay the loan, can vary widely. They can range from a few months (typically seen with short-term loans or short-term business financing) to several years or even decades (as with small business construction loans). Choose a loan term that aligns with your ability to repay and your financial strategy. Shorter terms often come with higher monthly payments but lower overall interest costs, while longer terms reduce monthly payments but increase total interest paid over time. Consider the cash flow of your medical practice and choose a term that provides a balance between manageable monthly payments and total loan cost.

- Fees and Additional Costs: Many loans come with additional fees that can increase the overall cost of borrowing. These may include origination fees, which are charged by lenders to process the loan; prepayment penalties, which are fees for paying off the loan early; and late payment fees, which are charged if you miss a payment. Some lenders may also charge fees for application processing, loan servicing, or disbursement. It’s essential to carefully review the fee structure for each lender to fully understand the total cost of the loan. Include these fees in your cost analysis when comparing different loan options to avoid any surprises.

- Approval Process and Requirements: Different lenders have varying approval processes and requirements. Some lenders may offer quicker approval times than others, which can be crucial if you need funds fast for urgent needs, such as purchasing new equipment or covering unexpected expenses. Online lenders, in particular, often provide expedited application and approval processes, sometimes approving loans within 24 hours. In contrast, traditional banks may take longer due to more stringent underwriting standards. Additionally, consider the documentation requirements for each lender. Some may require detailed financial statements, tax returns, and business plans, while others may have more lenient requirements. Ensure that you have all the necessary documentation ready to streamline the application process.

- Reputation and Customer Service: The reputation of a lender and the quality of their customer service can significantly impact your borrowing experience. Look for lenders with a strong track record in providing loans to small businesses, particularly in the healthcare sector. Read reviews and testimonials from other medical practices to gauge their experiences with the lender. Customer service is also critical, especially if you have questions or encounter issues during the loan term. Choose a lender that offers robust customer support, clear communication, and a commitment to helping you navigate the loan process smoothly.

Step 3: Prepare Your Application

Once you’ve chosen a lender, the next step is to prepare your application. Most lenders will require a variety of documents to assess your creditworthiness and the financial health of your medical practice. Commonly required documents include:

- Personal and business tax returns

- Financial statements (profit and loss, balance sheet)

- Bank statements

- A detailed business plan

- Licenses and certifications relevant to your medical practice

Be thorough and accurate when preparing your application. Missing or incomplete information can delay the approval process or result in a denial.

Step 4: Improve Your Creditworthiness

Before applying for a loan, it’s wise to review and improve your creditworthiness. Lenders will look at both your personal credit score and your business credit score when evaluating your application for an online small business loan. Here are some steps to improve your creditworthiness:

- Check your credit report: Look for any errors or inaccuracies that could be negatively affecting your score and dispute them if necessary.

- Pay down existing debt: Lowering your debt-to-income ratio can improve your credit score.

- Make timely payments: Ensure all your bills, including credit card payments, are paid on time.

- Avoid opening new credit accounts: This can negatively impact your credit score in the short term.

A higher credit score can improve your chances of securing a loan with favorable terms.

Step 5: Submit Your Application

Once you’ve prepared your documents and improved your creditworthiness, it’s time to submit your application. Most online small business loan applications are straightforward and can be completed within minutes. Make sure to double-check all information for accuracy before submitting.

After submission, you may be asked for additional information or clarification. Respond promptly to any requests from the lender to avoid delays.

Step 6: Review Loan Offers

After submitting your application, you will likely receive multiple loan offers. Carefully review each offer, considering the interest rates, repayment terms, fees, and any other conditions. Don’t hesitate to ask questions or negotiate terms if you feel that adjustments are needed.

Step 7: Accept the Best Loan Offer

Once you’ve reviewed all the offers, choose the one that best fits your medical practice’s needs and financial situation. Make sure you fully understand the terms of the loan agreement before signing.

Step 8: Use the Funds Wisely

After securing your online small business loan, it’s crucial to use the funds wisely. Allocate the loan amount according to your planned expenses, whether it’s for equipment financing for new business, working capital for small businesses, or another purpose. Proper financial management ensures that the loan benefits your practice without causing undue financial strain.

Tips for a Smooth Application and Approval Process

To increase your chances of a successful loan application, keep the following tips in mind:

- Maintain Accurate Financial Records: Lenders will scrutinize your financial records, so make sure they are accurate and up-to-date.

- Showcase a Strong Business Plan: A well-drafted business plan that outlines your practice’s goals, strategies, and financial projections can make a strong case to lenders.

- Build Relationships with Lenders: Even if you’re applying online, developing a relationship with potential lenders can improve your chances of approval and lead to better terms.

- Consider Multiple Lenders: Don’t limit yourself to one lender. Apply to multiple lenders to increase your chances of getting a loan with favorable terms.

- Be Transparent: Be honest about your financial situation and business needs. Transparency can build trust with lenders and lead to a smoother application process.

Each state may have specific programs, such as small business loans in Georgia, Illinois or Maryland, that are tailored to support local businesses. It’s essential to explore these options and understand any state-specific requirements.

Securing an online small business loan for your medical practice is a strategic move that can help you manage cash flow, invest in new equipment, and grow your business. By understanding your financial needs, researching lenders, preparing a strong application, and being mindful of state-specific loan opportunities, you can navigate the loan process with confidence. Remember, the key to a successful loan application is preparation and understanding your practice’s unique financial landscape. With the right loan and careful financial planning, your medical practice can thrive and continue to provide exceptional care to your patients.

Secure the Funding You Need With VIP Capital Funding

Unlock the Financial Potential of Your Medical Practice with VIP Capital Funding! Whether you need fast working capital, equipment financing, or a loan to expand your practice, VIP Capital Funding is here to help. With tailored solutions and flexible terms, we make it easy for healthcare professionals to secure the funding they need to thrive. Apply now to get started on your path to financial success!