The lifeblood of any small or mid-sized business (SMB) is cash flow. It’s the fuel that keeps your operations running smoothly, allows you to meet payroll, invest in growth, and ultimately, achieve success. But what happens when your cash flow sputters? Unexpected expenses, seasonal fluctuations, or slow-paying customers can create a strain on your finances, leading to a stressful scramble to keep things afloat.

This is where working capital loans come in. They are a powerful financial tool specifically designed to bridge short-term cash flow gaps and provide the breathing room your business needs to thrive

Understanding Working Capital Loans

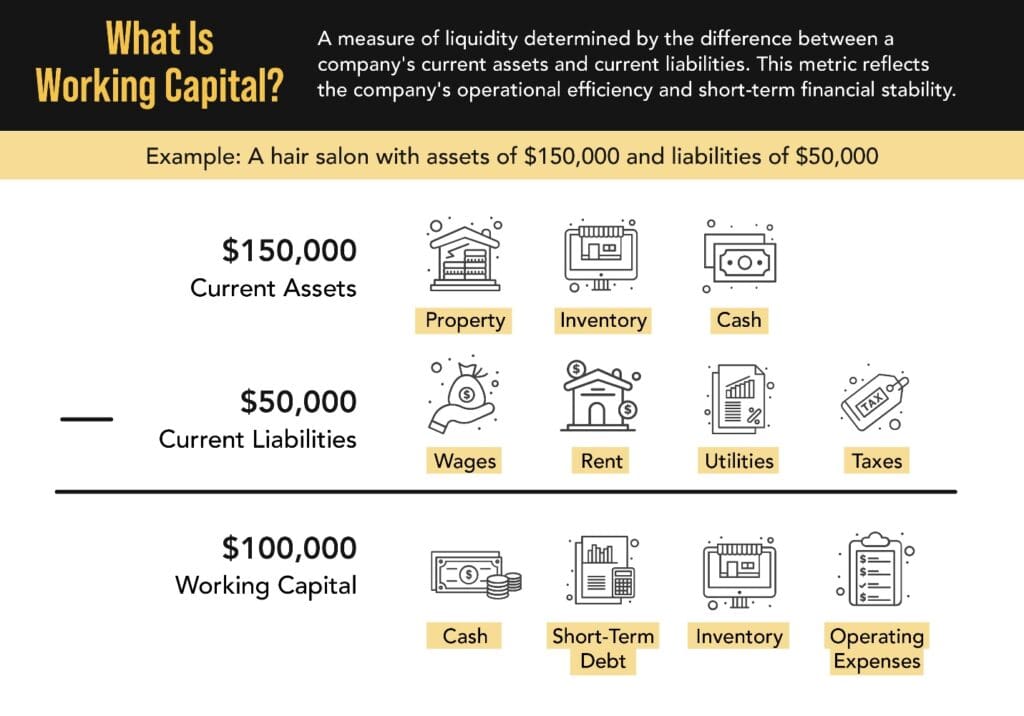

Working capital loans are short-term financing solutions that provide a quick and convenient way to access immediate funds. Unlike traditional loans that might be used for long-term investments like equipment or real estate, working capital loans are specifically designed to cover day-to-day operations. This can include a variety of critical business needs, such as:

Payroll expenses: Ensuring that employees are paid on time is crucial for maintaining morale and productivity. Working capital loans can help you manage payroll, even during periods of cash flow crunch.

Inventory purchases: Stocking up on inventory to meet customer demand, especially during peak seasons, requires significant upfront investment. Working capital loans can provide the necessary funds to purchase inventory in bulk, which can also lead to cost savings.

Marketing campaigns: Effective marketing can drive sales and business growth, but it often requires upfront spending. Working capital loans can finance your marketing initiatives, helping you attract new customers and increase revenue.

Unexpected bills: Businesses often face unforeseen expenses, such as equipment repairs or urgent supply orders. A working capital loan can provide the quick cash needed to cover these unexpected costs without disrupting operations.

Seasonal fluctuations in sales: Many businesses experience seasonal peaks and troughs. Working capital loans can help smooth out these fluctuations by providing funds during slower periods to cover ongoing expenses.

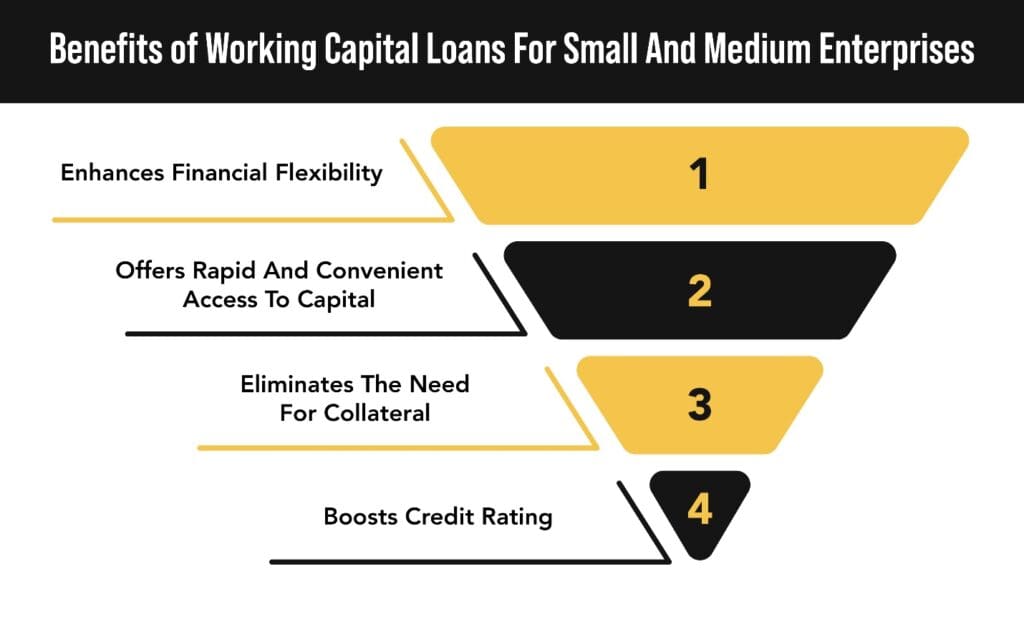

Benefits of Working Capital Loans

Beyond simply bridging cash flow gaps, working capital loans offer a multitude of benefits for your business:

Improved Cash Flow: The most immediate benefit is the obvious one: a healthy injection of cash to address your immediate needs. Working capital loans ensure you have the resources to cover essential expenses and maintain smooth operations. This liquidity can be critical in keeping your business running smoothly, especially during times when revenue might be lagging behind expenses. Whether you are looking at short-term business funding or working capital loans for small businesses, these options can significantly improve your cash flow situation.

Reduced Stress: Cash flow worries are a major source of stress for business owners. Working capital loans can alleviate that stress by providing a safety net and allowing you to focus on growing your business with peace of mind. Knowing that you have the necessary funds to cover short-term obligations can free up mental space and reduce the pressure of financial management. By opting for easy small business loans or online small business loan applications, you can streamline the process and reduce the stress associated with traditional loan applications.

Seize Opportunities: Unexpected opportunities for growth often arise quickly. With a working capital loan in place, you have the flexibility to take advantage of these opportunities without hesitation, whether it’s a lucrative new customer contract, a chance to purchase inventory at a bulk discount, or an opportunity to invest in a short-term marketing campaign. This agility can give you a competitive edge and help you scale your business more effectively. For example, short-term loans for businesses and small business short-term loans are designed to provide the quick funding needed to capitalize on these opportunities.

Maintain Positive Vendor Relationships: On-time payments to vendors are crucial for building strong business relationships. Working capital loans help ensure you can meet your financial obligations and maintain a positive reputation with suppliers. Consistent, timely payments can lead to better credit terms, discounts, and more favorable business deals in the future. This is particularly important when considering working capital business loans or working capital for small businesses.

Improved Profitability: By avoiding late payment penalties and ensuring a smooth flow of operations, working capital loans can indirectly contribute to improved profitability for your business. With the ability to manage your cash flow more effectively, you can focus on generating revenue and increasing your profit margins. This is true for businesses across various states, whether you are looking at a small business loan in California, a small business loan in Florida, or a small business loan in Texas.

Greater Control: Unlike some financing options that come with restrictions on how funds can be used, working capital loans give you significant control over how you use the money. This flexibility allows you to tailor the loan to your specific needs and ensure the funds are used strategically for maximum benefit. Whether you need to address a short-term cash flow issue or invest in a critical business initiative, you have the freedom to allocate the funds where they are most needed. This makes options like fast small business loans, online small business loans, and small business loans particularly attractive for business owners who value control and flexibility.

Examples of How Working Capital Loans Can Help

Working capital loans can be a game-changer for businesses across various industries by providing the necessary funds to handle immediate financial needs and opportunities. Here are a few real-world scenarios where working capital loans can make a significant difference:

A Thriving Bakery Experiencing a Seasonal Surge in Demand

During the holidays, a bakery might see a significant increase in orders for cakes, cookies, and other festive treats. However, to meet this surge in demand, they need to purchase additional ingredients, hire temporary staff, and possibly invest in extra equipment. A working capital loan can provide the necessary funds quickly. This loan enables the bakery to maximize its holiday profits by ensuring it can fulfill all orders and maintain a high level of customer satisfaction. The bakery might also consider short-term business funding to manage the increased workload efficiently.

A Growing Clothing Boutique Needing to Invest in New Inventory

A boutique owner might identify a new clothing line with high sales potential. To capitalize on this opportunity, they need to purchase the new inventory upfront. A working capital loan can provide the funds to acquire this new stock, allowing the boutique to offer the latest trends to its customers and attract new clientele. By investing in fresh inventory at the right time, the boutique can boost sales and improve its market position. Small business loans tailored for inventory purchases can be particularly useful in such scenarios.

A Local Construction Company Facing a Delay in Customer Payments

Construction projects often involve substantial upfront costs and delayed payments from clients. This can strain the company’s cash flow, making it difficult to cover payroll and other ongoing expenses. A working capital loan can bridge this gap, providing the necessary funds to keep operations running smoothly while waiting for outstanding customer invoices to be paid. This financial buffer ensures that the company can continue taking on new projects without interruption. In this case, short-term loans for businesses are an ideal solution to maintain liquidity. For those in specific states, a small business loan in California, a small business loan in Florida, or a small business loan in Texas can provide the regional support needed.

A Medical Practice Upgrading Technology to Improve Patient Care

A medical practice aiming to invest in cutting-edge technology, such as new diagnostic equipment or electronic health record systems, might face challenges securing a traditional loan due to the high cost and uncertain immediate ROI. A working capital loan can offer the flexibility needed to upgrade their technology, enhancing patient care and operational efficiency. This can lead to increased patient volume and improved service quality, ultimately boosting the practice’s reputation and profitability. Medical practice financing options can specifically cater to such needs, ensuring healthcare professionals have the necessary resources.

A Manufacturing Company Needing to Upgrade Equipment

A manufacturing company struggling with outdated equipment might find it challenging to maintain production efficiency. Investing in new machinery can be costly but essential for staying competitive. A working capital loan can provide the funds needed for these upgrades, ensuring that the company can improve production speed, reduce operational costs, and meet increasing market demands. By leveraging equipment financing loans, manufacturers can acquire the latest technology without depleting their working capital. Financing for manufacturers can be critical in such scenarios.

A Retail Store Preparing for a Major Sales Event

A retail store planning a major sales event, such as Black Friday or a year-end clearance sale, needs to stock up on inventory and invest in marketing to attract customers. A working capital loan can provide the funds required to prepare for the event, including purchasing additional stock, creating promotional materials, and possibly hiring extra staff. This preparation can lead to a significant increase in sales and customer acquisition during the event. Online small business loan applications can streamline the process, ensuring the store gets the funds quickly.

A Restaurant Expanding Its Delivery Services

With the growing demand for food delivery services, a restaurant might decide to expand its delivery operations. This requires additional delivery vehicles, marketing, and possibly new hires. A working capital loan can provide the necessary funds to support this expansion, allowing the restaurant to reach more customers and increase revenue. Fast, small business loans are particularly beneficial for such timely expansions.

A Tech Startup Launching a New Product

A tech startup ready to launch a new product needs capital for production, marketing, and distribution. A working capital loan can provide the necessary funding to ensure a successful product launch. This financial support allows the startup to focus on product development and market entry strategies without worrying about immediate cash flow constraints. Small business loans online offer a quick and convenient way for startups to secure the funds they need.

A Landscaping Business Preparing for Peak Season

A landscaping business gearing up for the busy spring and summer seasons needs to purchase equipment, hire additional staff, and invest in marketing. A working capital loan can provide the necessary funds to prepare for the peak season, ensuring that the business can take on more clients and increase its revenue. Easy equipment financing options can help the business acquire the tools needed for seasonal work.

A Small Business Facing Unforeseen Expenses

Unforeseen expenses, such as a sudden increase in rent or an unexpected repair, can disrupt a small business’s operations. A working capital loan can provide the immediate funds needed to cover these unexpected costs, ensuring that the business remains operational and can continue serving its customers without interruption. Short-term small business loans are designed to address such urgent financial needs efficiently.

Working capital loans are a versatile financial tool that can help businesses across various industries manage their short-term financial needs. They provide quick access to funds for essential operational expenses, enable businesses to seize growth opportunities, and ensure smooth operations during periods of cash flow constraints. By leveraging working capital loans, businesses can maintain stability, drive growth, and achieve long-term success. Whether you need to apply for a small business loan, seek small business loan providers, or explore short-term financing for business, these loans can play a critical role in your financial strategy.

Why Choose VIP Capital Funding for Your Working Capital Needs?

At VIP Capital Funding, we understand the unique challenges faced by small and mid-sized businesses. We offer a streamlined and hassle-free approach to working capital loans, allowing you to access substantial amounts of capital with minimal paperwork. Our focus is on helping businesses aggressively improve their cash flow and achieve their financial goals.

Streamlined Application Process

One of the most significant benefits of choosing VIP Capital Funding is our streamlined application process. Unlike traditional banks that require extensive paperwork and lengthy approval times, we prioritize speed and efficiency. Our online application process is simple, allowing you to apply for a working capital loan quickly and easily. This is especially beneficial for businesses that need to apply for small business loans or short-term business funding urgently.

Fast Approvals and Disbursement

Time is of the essence for small businesses facing cash flow challenges. At VIP Capital Funding, we understand this urgency. Our approval process is designed to be fast, often providing decisions within 24 to 48 hours. Once approved, the funds can be disbursed quickly, ensuring that you have immediate access to the capital you need to maintain operations, cover unexpected expenses, or seize new business opportunities. This quick turnaround makes us an ideal choice for businesses seeking fast,small-business loans.

Flexible Loan Options

We offer a wide range of loan products tailored to meet the specific needs of different businesses. Whether you need short-term loans for business, business equipment financing, or working capital loans for small businesses, VIP Capital Funding has you covered. Our loan options include easy small business loans and equipment financing for new businesses, ensuring that you can find a financing solution that fits your requirements.

Competitive Rates and Terms

At VIP Capital Funding, we are committed to providing competitive rates and favorable terms to ensure your financial success. Our loans are designed to be affordable and manageable, helping you maintain positive cash flow and achieve your business goals. Whether you need small business loans in California, small business loans in Florida, or small business loans in Texas, we offer terms that cater to your specific financial situation.

Personalized Customer Service

Our dedicated team of financial experts is here to guide you through the entire loan process. We provide personalized customer service to address any questions or concerns you may have, ensuring a smooth and stress-free experience. Our representatives understand the unique challenges faced by small businesses and are committed to helping you find the best financing solution. Whether you are looking for small business loans online or need assistance with online small business loan applications, we are here to help.

Tailored Solutions for Various Industries

VIP Capital Funding caters to businesses across various industries, offering specialized financing options such as medical practice financing, construction business financing, and manufacturing business loans. For example, a medical practice might need funds to invest in new diagnostic equipment or expand its services, while a construction company might require capital to manage upfront project costs. Our tailored loan products ensure that businesses in diverse sectors can access the necessary funds to grow and thrive.Reach out to us today.