Industries We Serve

Seamless Manufacturing Business Funding

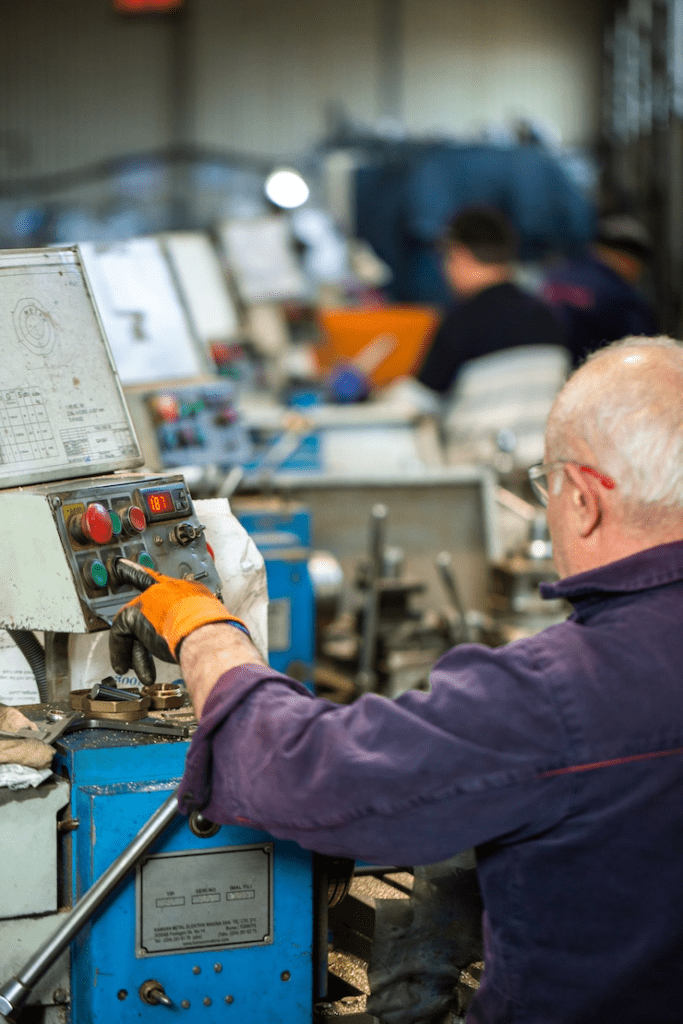

Manufacturing is a cornerstone of the global economy, contributing significantly to the Gross Domestic Product (GDP) and employment in many countries, including the United States. The industry drives innovation, exports, and economic stability, making it vital to support manufacturing businesses in maintaining and expanding their operations.

Manufacturing plays a pivotal role in the economic health of the United States. According to the National Association of Manufacturers (NAM), the manufacturing sector contributed $2.89 trillion to the US economy in 2020, accounting for 11.39% of the GDP.

Additionally, manufacturing supports 13 million jobs in the US. These figures underscore the importance of a robust manufacturing sector for economic growth and stability.

However, this essential industry faces unique challenges, and manufacturing business funding plays a crucial role in overcoming those hurdles and propelling growth.

Why Manufacturers Require Financing?

Manufacturing businesses require funding for several reasons, including capital investment, operational expenses, research and development, and maintaining cash flow.

Here’s a closer look at why these needs are crucial:

Capital Investment

Manufacturing is a capital-intensive industry. Companies need to make a significant upfront investment to purchase the machinery, equipment, and technology necessary for production. This requirement is especially pertinent for small and medium-sized enterprises (SMEs) that may not have substantial reserves to fund these purchases out of pocket.

According to a report by the Manufacturing Institute, manufacturers invest nearly $250 billion annually in capital equipment and structures in the United States. This investment is vital for maintaining competitiveness, improving productivity, and ensuring that manufacturing processes meet current technological standards.

Operational Expenses

Manufacturing is a capital-intensive industry. Companies need to make a significant upfront investment to purchase the machinery, equipment, and technology necessary for production. This requirement is especially pertinent for small and medium-sized enterprises (SMEs) that may not have substantial reserves to fund these purchases out of pocket.

According to a report by the Manufacturing Institute, manufacturers invest nearly $250 billion annually in capital equipment and structures in the United States. This investment is vital for maintaining competitiveness, improving productivity, and ensuring that manufacturing processes meet current technological standards.

Research and Development

Innovation is a key driver of growth in the manufacturing industry. Companies must continuously invest in research and development (R&D) to develop new products, improve existing ones, and implement advanced manufacturing processes. These investments not only help them stay competitive but also comply with regulatory standards and meet changing consumer demands.

The National Science Foundation (NSF) reported that US manufacturers spent $270 billion on R&D in 2020, highlighting the sector’s commitment to innovation. Funding for R&D enables manufacturers to advance technologically and maintain a competitive edge in the global market.

Maintaining Cash Flow

Cash flow management is critical in manufacturing due to the cyclical nature of the industry. Manufacturers often face fluctuations in demand, seasonal variations, and lengthy payment cycles from customers. These factors can create cash flow challenges that impact a company’s ability to pay suppliers, employees, and other essential expenses.

A report by the Federal Reserve Bank of New York found that 70% of small businesses in the manufacturing sector experienced cash flow issues, with 60% citing difficulties in accessing credit as a major obstacle. Reliable funding solutions can help manufacturers bridge these gaps and ensure operational continuity.

In conclusion, Manufacturing Business Loans are a vital tool for manufacturers looking to expand, innovate, and thrive in today’s competitive landscape. With flexible financing solutions, competitive rates, and expert support, [Your Company Name] is here to empower your manufacturing business’s success. Contact us today to learn more about how we can help fuel your growth journey.

Benefits of Manufacturing Business Capital

Manufacturing is the beating heart of a thriving economy. It fuels innovation, creates high-paying jobs, and underpins national security. In the United States, the manufacturing sector plays a vital role, contributing significantly to the nation’s economic health. However, this essential industry faces unique challenges, and manufacturing business funding plays a critical role in overcoming those hurdles and propelling growth.

One of the most crucial benefits of manufacturing business funding is its ability to ignite innovation. Loans can provide the capital needed to acquire cutting-edge equipment and technologies, propelling manufacturers to the forefront of their industries. This can involve:

Advanced machinery: Funding allows for the purchase of high-tech machinery like 3D printers, computer-controlled lathes, and automated assembly lines. These advancements significantly enhance production efficiency and product quality, allowing manufacturers to compete more effectively in the global marketplace.

- Research and Development (R&D): Funding can fuel vital R&D initiatives, fostering the development of new and innovative products. Whether it’s exploring novel materials or refining existing designs, R&D is the lifeblood of progress, and financing can make it possible.

- Emerging technologies: The landscape of manufacturing is constantly evolving, and embracing new technologies is vital to remaining competitive. Funding can be used to integrate robotics, artificial intelligence, and other advanced technologies into production processes, leading to increased automation, reduced costs, and improved product consistency.

Manufacturing business funding is not just about acquiring new technology; it’s also about modernizing existing infrastructure. Many manufacturers rely on outdated facilities and equipment, hindering productivity and efficiency. Funding can be used to:

- Modernize facilities: Investing in facility upgrades can involve improving lighting systems, optimizing factory layouts, and implementing energy-saving measures. These improvements create a more efficient and sustainable work environment, ultimately reducing operational costs.

- Replace outdated equipment: Aging equipment is prone to breakdowns and malfunctions, impacting production schedules and product quality. Funding allows manufacturers to upgrade to newer, more reliable machinery, minimizing downtime and ensuring consistent production output.

- Invest in automation: Automation is rapidly transforming the manufacturing landscape. Funding can be used to integrate robotic systems and automated processes, reducing reliance on manual labor, improving accuracy, and boosting.

Manufacturing businesses often experience fluctuations in cash flow. Raw materials need to be purchased; employees require timely payroll, and unexpected expenses can arise. Funding solutions like working capital loans bridge these temporary gaps, ensuring smooth day-to-day operations:

- Smooth cash flow:Working capital loans provide immediate access to funds, allowing manufacturers to meet ongoing expenses without disrupting production schedules. This financial buffer ensures timely payments to suppliers and avoids delays in critical operations.

- Flexibility:Unlike equipment financing or term loans earmarked for specific projects, working capital loans offer a flexible source of funds. Manufacturers can use them for a variety of operational needs, providing them with the financial agility to adapt to changing market conditions.

- Maintaining stability:Working capital loans contribute to overall business stability by ensuring consistent cash flow. Manufacturers can focus on core operations, innovation, and growth strategies without the worry of cash flow disruptions jeopardizing their progress.

By investing in innovation, upgrading infrastructure, and maintaining working capital, manufacturing business funding empowers manufacturers to overcome challenges, embrace new technologies, and propel their businesses toward a brighter future. This not only benefits individual companies but also contributes to the overall strength and competitiveness of the US manufacturing sector on the global stage.

That said, it can be quite challenging to find a reliable lender who can help manufacturing businesses access quick, easy, and affordable manufacturing business loans.