Starting or expanding a small business in Florida requires careful planning and adequate funding. For many entrepreneurs, securing a small business loan is an essential step in this journey. With the variety of loan options available, understanding the intricacies of small business loans in Florida can help you make informed decisions that align with your business goals.

This comprehensive guide will cover key aspects, including understanding small business loans, the benefits they offer, how to determine your loan needs, and the various loan programs available in Florida.

Understanding Small Business Loans

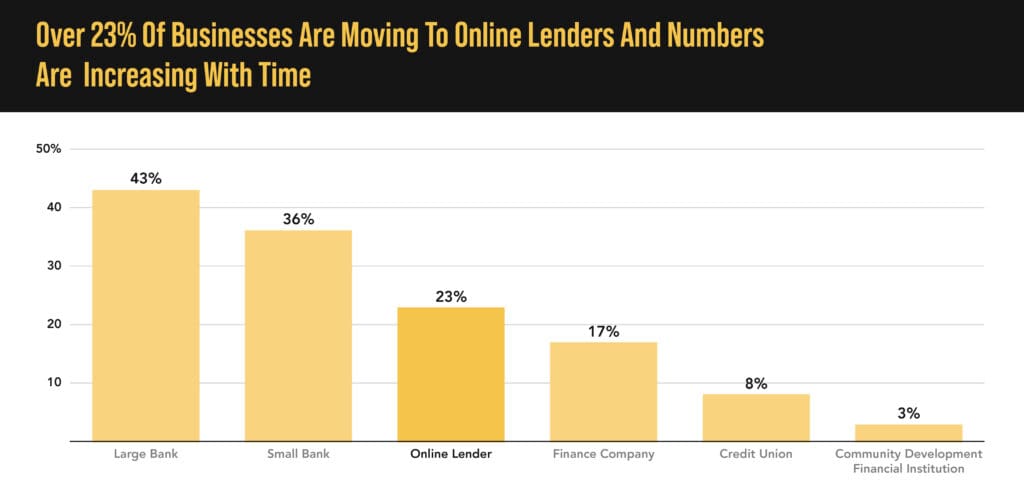

Small business loans are financial products designed to provide capital to businesses that need funding for various purposes, such as startup costs, expansion, purchasing equipment, or managing cash flow. These loans can come from various sources, including private lenders, credit unions, and online lenders. Unlike traditional bank loans, private money loans offer more flexibility and faster approval processes, making them an attractive option for many small business owners.

Determining Your Loan Needs in Florida

Define the Purpose of the Loan

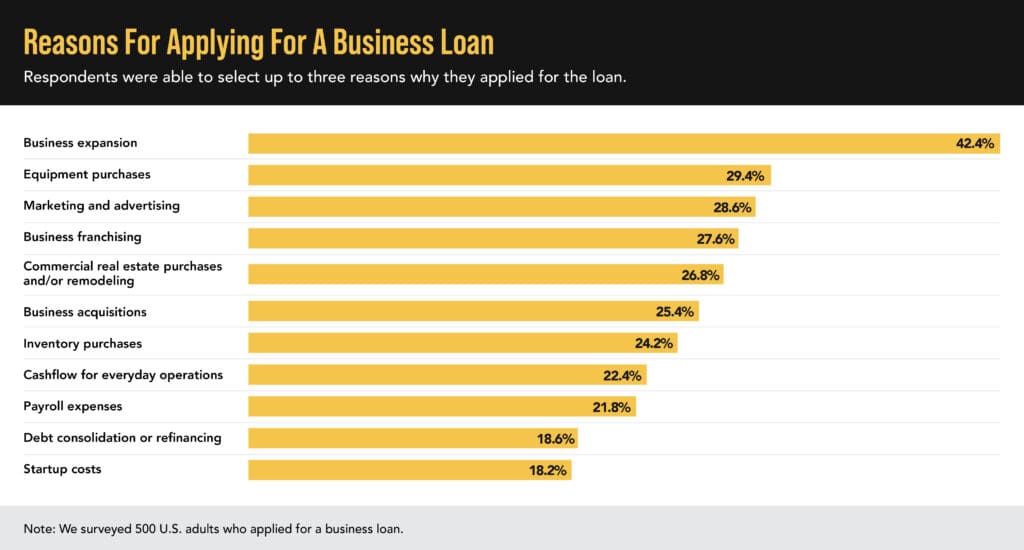

Identify the specific purpose for which you need the loan. This could be for purchasing new equipment, expanding your business, covering operating expenses, or managing cash flow. Clearly defining the purpose will help you determine the type of loan that best suits your needs.

Estimate the Required Amount

Calculate the amount of funding required for your specific purpose. Be realistic in your estimation, considering both the immediate and potential future costs. It’s better to ask for a bit more than to find yourself short of funds, but ensure that the amount is justifiable and manageable within your business’s financial structure.

Evaluate Your Repayment Capacity

Assess your ability to repay the loan by examining your business’s revenue streams and existing financial obligations. Create a projected cash flow statement to see how loan repayments would fit into your budget. Ensuring that you can comfortably meet the repayment terms is crucial to maintaining your business’s financial health.

Research Lender Requirements

Different lenders have varying requirements and terms for their loan products. Research potential lenders to understand their loan criteria, interest rates, repayment terms, and any fees associated with the loan. This will help you choose a lender whose terms align with your business’s financial situation and goals.

Prepare Necessary Documentation

Gather the necessary documentation required by lenders. This may include financial statements, tax returns, business plans, and proof of collateral, if applicable. Having your documents organized and ready can expedite the loan application process.

Loan Programs in Florida

Florida offers various loan programs specifically designed to support small businesses. These programs can provide the funding needed to start or grow your business, purchase equipment, or manage cash flow. Here are some prominent loan programs in Florida:

1. Business Equipment Financing

Business equipment financing is designed to help businesses acquire the equipment they need without a significant upfront investment. This type of financing allows businesses to spread the cost of equipment over time, making it more affordable and manageable. The equipment itself often serves as collateral for the loan, which can make it easier to secure approval.

Benefits of Business Equipment Financing:

Preserve Cash Flow: By financing equipment, businesses can preserve their cash flow for other operational needs.

Tax Benefits: In some cases, equipment financing may offer tax benefits, such as the ability to deduct interest payments.

Improved Efficiency: Acquiring the latest equipment can enhance productivity and efficiency, leading to increased profitability.

Key Considerations:

Loan Terms: Understand the terms of the financing agreement, including the interest rate, repayment schedule, and any associated fees.

Equipment Value: Ensure that the equipment being financed is essential to your operations and will provide a return on investment.

2. Short-Term Business Funding

Short-term business funding provides quick access to capital for businesses that need immediate financial support. These loans typically have a shorter repayment period, often ranging from a few months to a year, and are ideal for addressing urgent financial needs or taking advantage of time-sensitive opportunities.

Benefits of Short-Term Business Funding:

Fast Access to Capital: These loans are often approved and disbursed quickly, providing timely financial support.

Flexibility: Short-term loans can be used for various purposes, including managing cash flow, covering unexpected expenses, or seizing growth opportunities.

Improved Cash Flow: By addressing immediate financial needs, short-term funding can help maintain a steady cash flow.

Key Considerations:

Higher Interest Rates: Short-term loans often come with higher interest rates compared to long-term loans.

Repayment Terms: Ensure that your business can meet the repayment terms within a short period to avoid financial strain.

3. Florida Small Business Emergency Bridge Loan Program

The Florida Small Business Emergency Bridge Loan Program provides short-term, interest-free loans to small businesses impacted by a disaster. This program is designed to help businesses bridge the gap between the time of the disaster and the time when long-term recovery funding is secured.

Benefits of the Emergency Bridge Loan Program:

Immediate Relief: Provides quick financial assistance to businesses affected by disasters, helping them recover and resume operations.

Interest-Free: These loans are interest-free, making them a cost-effective option for businesses in need.

Key Considerations:

Eligibility Requirements: Ensure your business meets the eligibility criteria for the program, such as location and impact of the disaster.

Repayment Terms: Understand the repayment terms and ensure your business can meet the repayment obligations.

4. Microfinance Loan Program

The Microfinance Loan Program in Florida is designed to provide small loans to businesses that may not qualify for traditional financing. These loans are typically for smaller amounts and can be used for various business purposes, including working capital, inventory purchase, and equipment acquisition.

Benefits of the Microfinance Loan Program:

Accessibility: Provides funding to small businesses that may have difficulty securing traditional loans.

Flexibility: Funds can be used for a variety of business needs, providing flexibility in how the loan is utilized.

Key Considerations:

Loan Amount Limits: Microfinance loans are generally for smaller amounts, so ensure the funding is sufficient for your needs.

Lender Terms: Different lenders may have varying terms, so research and compare options to find the best fit for your business.

5. Private Money Loans

Private money loans, also known as hard money loans, are provided by private lenders or investors. These loans are typically secured by collateral, such as real estate or business assets, and can be an excellent option for businesses needing quick access to capital or those that may not qualify for traditional financing.

Benefits of Private Money Loans:

Fast Approval and Funding: Private money loans often have a quicker approval and funding process compared to traditional loans.

Flexible Terms: Private lenders may offer more flexible terms, including interest-only payments or customized repayment schedules.

Less Stringent Requirements: These loans may have less stringent credit requirements, making them accessible to a broader range of businesses.

Key Considerations:

Higher Interest Rates: Private money loans typically come with higher interest rates due to the increased risk for lenders.

Collateral Requirements: These loans are usually secured by collateral, so ensure you have valuable assets to pledge.

Navigating the Loan Application Process

Applying for a small business loan in Florida involves several steps. Here’s a guide to navigating the loan application process:

1. Research and Select a Lender

Start by researching potential lenders and loan programs. Consider factors such as loan terms, interest rates, repayment schedules, and eligibility requirements. Choose a lender and loan product that best aligns with your business’s needs and financial situation.

2. Prepare Your Business Plan

A well-prepared business plan is essential for demonstrating to lenders that your business is viable and has a clear path to profitability. Include detailed information about your business, market analysis, financial projections, and how the loan will be used.

3. Gather Required Documentation

Collect all the necessary documentation required by the lender. This may include:

- Business financial statements

- Personal and business tax returns

- Legal documents (e.g., business licenses, articles of incorporation)

- A detailed explanation of how the loan will be used

- Collateral documentation (if applicable)

4. Submit the Application

Complete the loan application form provided by the lender and submit it along with the required documentation. Ensure that all information is accurate and complete to avoid delays in the approval process.

5. Follow Up

After submitting your application, follow up with the lender to check the status of your application. Be prepared to provide additional information or clarification if requested.

6. Review and Accept the Offer

If your loan application is approved, review the loan offer carefully. Pay attention to the terms and conditions, including the interest rate, repayment schedule, and any fees. If you agree with the terms, accept the offer and proceed with the loan closing process.

Eligibility and Requirements in Florida

Understanding Private Money Loans

Private money lenders in Florida provide a valuable resource for small business owners. These lenders typically offer more flexible terms and faster funding than traditional banks. They often base their lending decisions on the revenue and potential of the business rather than traditional credit scores. This can be particularly advantageous for businesses that have strong cash flows but may not have a long credit history or high credit scores.

Revenue-Based Funding

Private money lenders often use revenue-based funding models, which focus on the business’s cash flow rather than the owner’s credit history. Here’s how it works:

Revenue Assessment: Lenders look at the business’s monthly or annual revenue to determine loan eligibility and the amount that can be borrowed.

Repayment Terms: Repayment is typically a fixed percentage of the business’s revenue, ensuring that payments are manageable and proportional to the business’s income.

Flexible Requirements: Since the loan is secured against future revenues, lenders are more flexible regarding traditional collateral requirements.

General Eligibility Criteria

While private money lenders are more flexible, there are still some common eligibility criteria:

Business Age and Revenue: Lenders usually prefer businesses that have been operational for a certain period (e.g., six months to a year) and have a stable revenue stream.

Business Plan: A solid business plan outlining the use of funds, projected growth, and repayment strategy can significantly enhance your chances of securing a loan.

Financial Statements: Providing accurate and up-to-date financial statements, including profit and loss statements, balance sheets, and cash flow statements, is crucial.

Purpose of the Loan: Clearly articulating why you need the loan—whether for business equipment financing, short-term business funding, or another purpose—can help lenders understand and approve your application.

Loan Application Process in Florida

Step 1: Research and Identify Potential Lenders

Start by researching private money lenders in Florida. Look for those who offer the type of loan you need, whether it’s for business equipment financing, fast small business loans, or short-term business funding. Pay attention to their terms, interest rates, and customer reviews.

Step 2: Prepare Your Documentation

Having your documentation ready can streamline the application process. Here’s a checklist of commonly required documents:

Business Financial Statements: Profit and loss statements, balance sheets, and cash flow statements for the past six months to a year.

Tax Returns: Business and personal tax returns for the past one to two years.

Bank Statements: Recent business bank statements (typically the last three to six months).

Business Plan: A detailed business plan outlining the purpose of the loan, how the funds will be used, and how you plan to repay the loan.

Legal Documents: Business licenses, incorporation documents, and other relevant legal documents.

Step 3: Submit the Application

Most private money lenders offer online applications, making the process quick and convenient. Fill out the application form accurately, attach the necessary documents, and provide any additional information requested.

Step 4: Review and Follow Up

After submitting your application, follow up with the lender to ensure they have received all required documents and to check on the status of your application. Be prepared to answer any additional questions or provide further documentation if needed.

Step 5: Receive Approval and Funding

Once your application is approved, the lender will provide the loan terms and conditions. Review these carefully to ensure they meet your needs and that you understand all aspects of the agreement. Upon acceptance, funds are typically disbursed quickly, often within a few days.

Finalizing the Loan Terms in Florida

Reviewing the Loan Agreement

Carefully review the loan agreement provided by the lender. Key elements to consider include:

Interest Rates: Understand whether the rate is fixed or variable and how it compares to other loan options.

Repayment Schedule: Ensure that the repayment schedule aligns with your business’s cash flow. For revenue-based loans, this will be a percentage of your revenue.

Fees and Penalties: Be aware of any origination fees, processing fees, or penalties for late payments or early repayment.

Collateral Requirements: If the loan requires collateral, ensure you understand what assets are being used and the implications of default.

Negotiating Terms

Don’t hesitate to negotiate the terms of the loan. Private money lenders are often more flexible and willing to adjust terms to secure your business. Discussing options like interest rates, repayment schedules, and fees can result in more favorable terms.

Legal Review

It’s wise to have a legal professional review the loan agreement before signing. They can help you understand the fine print and ensure there are no unfavorable terms or hidden clauses.

Signing the Agreement

Once you’re satisfied with the terms, sign the loan agreement. Keep a copy for your records and ensure you understand the next steps for receiving the funds.

Post-Loan Acceptance Considerations

Utilizing the Funds

After receiving the loan, it’s crucial to use the funds as outlined in your business plan. Proper allocation ensures that the loan helps achieve its intended purpose, whether it’s purchasing equipment, expanding operations, or managing cash flow.

Managing Repayments

Stay on top of your repayment schedule to maintain a good relationship with your lender and avoid penalties. For revenue-based loans, this means ensuring that the agreed-upon percentage of your revenue is consistently paid.

Financial Monitoring

Regularly monitor your business’s financial health to ensure you’re on track with your goals and can meet your repayment obligations. Use financial software or consult with an accountant to keep accurate records and make informed decisions.

Communication with Lender

Maintain open communication with your lender. If you encounter any issues or foresee difficulties in making payments, contact your lender immediately. Many lenders are willing to work with you to adjust terms or provide solutions.

Planning for Future Financing

Successfully managing and repaying a small business loan can enhance your business’s financial profile, making it easier to secure future financing. Keep detailed records of your loan and repayment history, and consider how additional funding could support your business’s long-term goals.

Looking for fast small business loans? Apply for a small business loan with VIP Capital Funding today! We offer business equipment financing, short-term business funding, and working capital loans tailored to your needs.

Whether you need a small business loan in California, Florida, or Texas, we’ve got you covered. Our easy small business loans and equipment financing loans are perfect for new businesses and manufacturers. Apply for short-term loans for small businesses online and get the funds you need quickly.