Starting or expanding a medical practice can be a challenging yet rewarding endeavor. One of the critical components of ensuring your practice’s success is securing adequate financing.

In this comprehensive guide, we will delve into small business loans for medical practices, explore the different types of loans available, and provide detailed insights on how to navigate the application process.

What Are Medical Practice Business Loans?

Medical practice business loans are financial products designed to help healthcare providers manage the operational, expansion, and equipment costs associated with running a medical practice. These loans are tailored to meet the unique needs of medical professionals, offering flexible terms and conditions to support everything from purchasing state-of-the-art medical equipment to expanding office space or covering working capital needs.

Medical practice financing is essential for various reasons, including:

- Upgrading Medical Equipment:Keeping up with the latest medical technology is crucial for providing high-quality care.

- Expanding Facilities:As your patient base grows, so does the need for more space and additional staff.

- Managing Cash Flow:Ensuring smooth operations, especially during periods of low revenue, is vital for sustained practice health.

- Acquiring or Merging with Other Practices:Strategic growth often requires significant capital investment.

How to Get a Business Loan for a Medical Practice

Securing a business loan for a medical practice involves several steps, each crucial to ensuring you get the financing you need on favorable terms. Here’s a detailed look at the process:

1. Assess Your Financing Needs

Before you begin your search for small business loans for your medical practice, it’s essential to have a clear understanding of your financing needs. Consider the following:

- Purpose of the Loan:Are you looking to purchase new equipment, expand your facility, or cover operational costs?

- Loan Amount:Estimate how much capital you need. Be realistic about your requirements to avoid over-borrowing or under-borrowing.

- Repayment Terms:Determine the repayment period you can handle comfortably without straining your practice’s finances.

2. Explore Different Financing Options

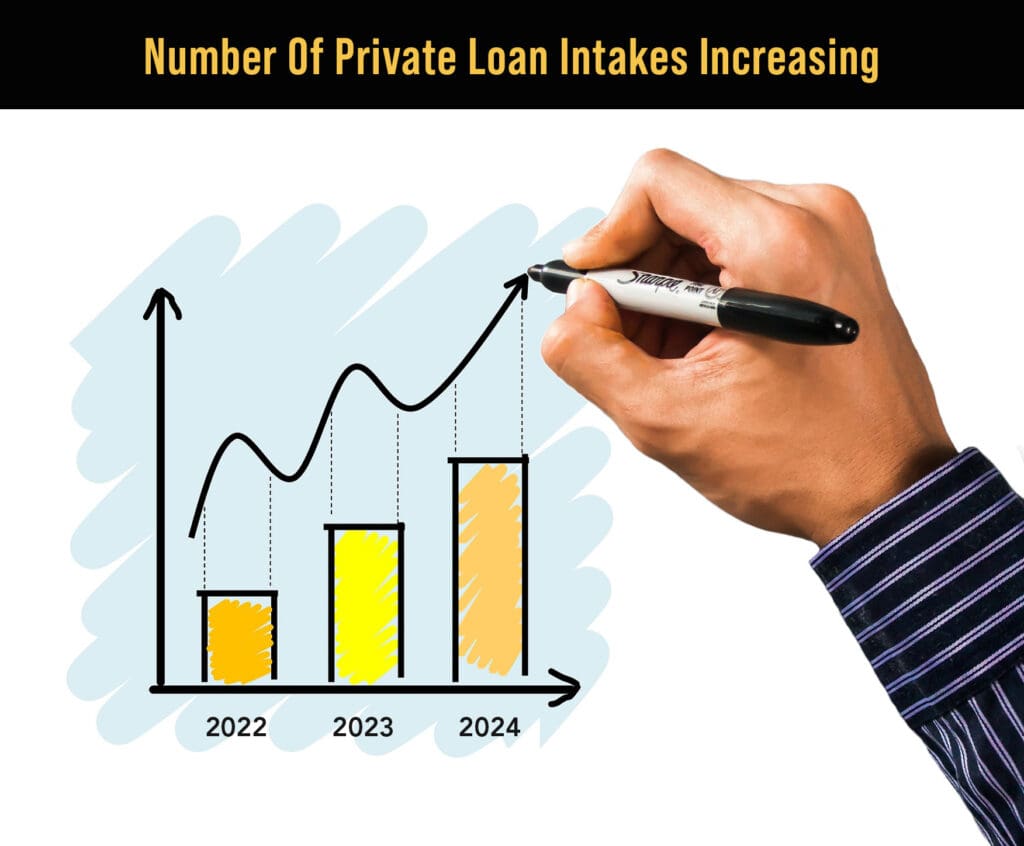

While traditional bank loans and SBA loans are commonly known, they may not always be the best fit for medical practices. Here’s why you might want to consider private money lenders instead:

- Flexibility in Terms:Private money lenders often offer more flexible loan terms compared to traditional banks. This can be crucial for medical practices that may not fit the typical bank loan criteria.

- Faster Approval Process:Banks can be slow, with lengthy application and approval processes. Private lenders usually have a quicker turnaround, helping you access funds faster.

- Less Stringent Requirements:Private lenders typically have fewer stringent requirements, making it easier for medical professionals to qualify for the loan without overly focusing on credit scores.

3. Gather Required Documentation

The documentation required for a medical practice loan can vary depending on the lender and the type of loan. Common documents include:

- Business Plan:A detailed business plan outlining your practice’s vision, goals, financial projections, and how you plan to use the loan.

- Financial Statements:Recent financial statements, including balance sheets, income statements, and cash flow statements.

- Tax Returns:Personal and business tax returns for the past two to three years.

- Professional Licenses and Credentials:Proof of your medical license and any other relevant credentials.

4. Research and Compare Lenders

When searching for the right lender, focus on those specializing in medical practice financing. Here are some tips for comparing lenders:

- Reputation and Reviews:Look for lenders with positive reviews and a solid reputation in the healthcare financing space.

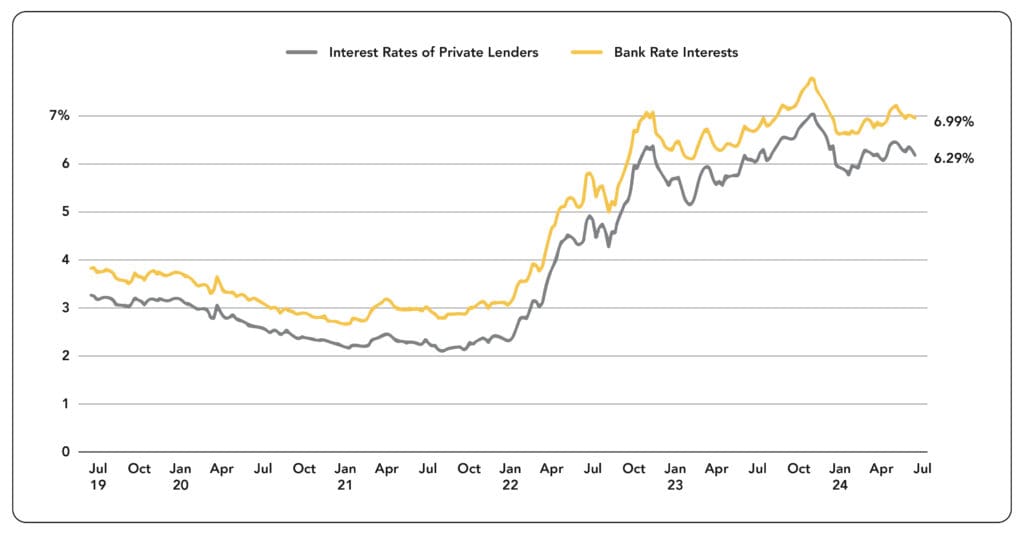

- Loan Terms and Rates:Compare interest rates, repayment terms, and any additional fees. Private money lenders often provide more competitive terms.

- Customer Support:Good customer service is crucial. Choose a lender that offers support and guidance throughout the loan process.

5. Submit Your Application

Once you’ve chosen a lender, it’s time to submit your application. Ensure you provide all the required documentation and information accurately. Be prepared to answer questions about your practice’s operations, financial health, and how you plan to use the loan proceeds.

Types of Medical Practice Loans

Medical practice financing can be categorized into several types of loans, each serving different needs. Let’s explore two primary types: traditional bank loans and private money lending loans.

Traditional Bank Loans

Traditional bank loans are often the first option considered by many business owners. However, they may not always be the best fit for medical practices. Here’s why:

- Stringent Requirements:Banks often have strict requirements, including high credit scores, substantial collateral, and extensive documentation. This can be challenging for many medical practitioners.

- Lengthy Approval Process:The approval process for bank loans can be lengthy, sometimes taking several weeks or even months. This delay can be problematic if you need funds quickly to seize an opportunity or cover urgent expenses.

- Inflexible Terms:Bank loans may come with rigid terms that don’t align with the cash flow patterns of medical practices. This lack of flexibility can strain your finances, especially if you experience fluctuations in patient volume or insurance reimbursements.

Private Money Lending Loans

Private money lending loans present a compelling alternative to traditional bank loans. Here’s why they are often the preferred choice for medical practices:

- Flexibility in Terms:Private lenders are more flexible, offering customized loan terms that cater specifically to the needs of medical practices. This flexibility can include adjustable repayment schedules, lower collateral requirements, and more favorable interest rates.

- Faster Approval and Funding:Private money lenders typically have a streamlined application process, allowing for quicker approval and funding. This speed is crucial for practices needing immediate capital for equipment purchases, expansions, or operational expenses.

- Less Emphasis on Credit Scores:While credit history is still considered, private lenders often focus more on the practice’s cash flow, assets, and overall financial health rather than stringent credit score requirements. This makes it easier for many medical professionals to qualify for the financing they need.

Benefits of Choosing Private Money Lenders

- Tailored Loan Products:Private lenders often offer loan products specifically designed for the unique needs of medical practices, such as equipment financing loans or working capital loans.

- Personalized Service:Working with private lenders usually means more personalized service and support. They understand the nuances of medical practice financing and are more likely to work closely with you to find the best solution.

- Potential for Better Rates:While rates vary, private lenders can sometimes offer competitive interest rates, especially for well-prepared borrowers. Additionally, their willingness to negotiate terms can lead to better overall loan conditions.

Application Process for Medical Practice Loans

Navigating the application process for a medical practice loan involves several critical steps. Here’s a detailed look at what you need to do:

1. Pre-Qualification

Pre-qualification is an initial step that helps you understand your borrowing capacity without affecting your credit score. During this stage, you’ll typically provide basic information about your practice and your financing needs. The lender will review this information to give you an estimate of the loan amount you may qualify for.

2. Preparing Your Documentation

Assemble all necessary documentation before you apply. This includes:

- Business Plan:A detailed plan that outlines your practice’s goals, market analysis, financial projections, and how the loan will be used.

- Financial Statements:Up-to-date financial statements, including balance sheets, income statements, and cash flow statements.

- Tax Returns:Personal and business tax returns for the past two to three years.

- Proof of Licenses and Credentials:Copies of your medical licenses and any other relevant professional credentials.

3. Submitting the Application

With your documents ready, submit your loan application to the chosen lender. Ensure all information is accurate and complete to avoid delays. Some lenders may offer online application portals, making the process more convenient.

4. Loan Review and Approval

Once submitted, the lender will review your application and supporting documents. They may request additional information or clarification. During this stage, be prepared for:

- Interviews or Discussions:You may have to discuss your business plan and loan needs with the lender’s representative.

- Asset Evaluation:The lender may assess your practice’s assets, including equipment and property, to determine collateral value.

5. Loan Agreement and Funding

If approved, you’ll receive a loan agreement outlining the terms and conditions of the loan. Review the agreement carefully, paying attention to the interest rate, repayment schedule, fees, and any other terms. Once you sign the agreement, the funds will be disbursed to your account, ready for use.

How You Can Use Medical Business Loans

Medical business loans offer flexibility and can be utilized for various purposes to support and grow your practice. Here are several key areas where these loans can be instrumental:

1. Equipment Financing

Medical equipment is often expensive but essential for providing high-quality care. Equipment financing loans can be used to purchase new diagnostic machines, surgical tools, electronic health record systems, and other necessary medical devices. By spreading the cost over several years, you can manage your cash flow more effectively while ensuring your practice is equipped with the latest technology.

2. Office Space

Whether you are looking to lease a new office space, purchase an existing building, or even construct a new facility, a small business loan can cover the real estate costs. A well-located, comfortable, and state-of-the-art facility can significantly enhance patient experience and increase your practice’s visibility and reputation.

3. Working Capital

Day-to-day operations require a steady flow of working capital. This includes salaries, utility bills, supplies, marketing, and other operational expenses. Small business loans for working capital ensure that your practice runs smoothly without financial hiccups, even during slow periods.

4. Expansion and Renovation

If your practice is growing, you may need to expand your current space or renovate it to improve functionality and aesthetics. Loans can fund construction projects, interior design upgrades, and the addition of new rooms or wings to accommodate more patients or new services.

5. Technology Upgrades

Keeping up with technological advancements is crucial in the medical field. Loans can be used to upgrade your practice management software, electronic health records (EHR) systems, and telemedicine capabilities, ensuring your practice remains competitive and efficient.

6. Training and Development

Investing in the professional development of your staff can lead to better patient care and increased job satisfaction. Loans can be used to fund continuing education, training programs, and certifications for your medical and administrative staff.

7. Inventory and Supplies

Maintaining a sufficient inventory of medical supplies, pharmaceuticals, and other consumables is critical. Loans can help you purchase these items in bulk, often at a lower cost, ensuring you have the necessary supplies on hand without straining your finances.

Other Factors to Consider Before Getting Small Business Loans for Medical Practice

Before you apply for a small business loan for your medical practice, there are several important factors to consider:

1. Loan Types and Terms

Understanding the different types of loans available and their terms is essential. Some common loan types include:

- Term Loans:These are lump-sum loans repaid over a fixed period with regular payments. They are suitable for significant, one-time expenses like equipment purchases or renovations.

- Equipment Financing Loans:Specifically designed to purchase medical equipment, these loans use the equipment itself as collateral.

- Lines of Credit:A flexible option that allows you to borrow up to a certain limit as needed and pay interest only on the amount used. Ideal for managing cash flow and covering short-term expenses.

2. Interest Rates and Fees

Interest rates and fees can significantly impact the overall cost of your loan. Shop around and compare offers from different private money lenders to find the most favorable terms. Be sure to understand any additional fees, such as origination fees, prepayment penalties, and late payment charges.

3. Repayment Terms

Consider the repayment terms carefully. A longer repayment period may result in lower monthly payments but higher overall interest costs, while a shorter term can save you money on interest but require higher monthly payments. Choose a repayment plan that aligns with your cash flow and financial projections.

4. Lender Reputation and Experience

Working with a reputable lender who has experience in providing loans to medical practices can make the process smoother and more reliable. Research potential lenders, read reviews, and seek recommendations from other medical professionals.

5. Financial Health of Your Practice

Evaluate the financial health of your practice before applying for a loan. Lenders will want to see that your practice is financially stable and capable of repaying the loan. Prepare detailed financial statements, including profit and loss statements, balance sheets, and cash flow statements.

6. Purpose of the Loan

Clearly define the purpose of the loan and how it will benefit your practice. Whether it’s for expansion, equipment purchase, or working capital, having a clear plan will not only help you in the application process but also ensure that the loan is used effectively.

7. Collateral Requirements

Some loans may require collateral, such as property, equipment, or other assets. Understand the collateral requirements and be prepared to provide the necessary documentation. Ensure that you are comfortable with the risk involved in using your assets as collateral.

8. Application Process and Documentation

The application process for small business loans can be detailed and time-consuming. Be prepared with all necessary documentation, including financial statements, tax returns, business plans, and legal documents. A well-prepared application can expedite the approval process.

9. Impact on Credit and Financial Statements

Understand how taking on new debt will impact your practice’s credit and financial statements. While we are not focusing on credit scores, it’s essential to be aware that new loans will affect your overall financial profile and future borrowing capacity.

Common FAQs

What types of small business loans are available for medical practices?

There are several types of small business loans available for medical practices, including term loans, equipment financing loans, lines of credit, and working capital loans. Each type of loan has its specific use cases and benefits, depending on your practice’s needs.

How can I use an equipment financing loan for my medical practice?

An equipment financing loan can be used to purchase medical equipment, such as diagnostic machines, surgical tools, and electronic health record systems. The equipment itself typically serves as collateral for the loan, making it a cost-effective way to upgrade your practice’s technology.

How will a small business loan affect my practice’s financial health?

Taking on a small business loan will impact your practice’s financial statements and borrowing capacity. It’s essential to ensure that your practice can manage the loan repayments and that the loan will ultimately contribute to the growth and stability of your practice.

What are the interest rates and fees associated with small business loans for medical practices?

Interest rates and fees vary by lender and loan type. It’s crucial to compare offers from different lenders to find the most favorable terms. Be sure to understand any additional fees, such as origination fees, prepayment penalties, and late payment charges.

Unlock the potential of your business with VIP Capital Funding! Apply for small business loans, business equipment financing, and short-term business funding. We offer easy small business loans in California, Florida, and Texas, including working capital loans and equipment financing loans. Enjoy fast small business loans and online applications tailored for medical practice financing, construction, and manufacturers.

Apply for short-term loans and experience hassle-free financing for your new or existing business today!