So, you’ve got this killer tech idea that’s going to change the world, but there’s one tiny hitch—you need cash to make it happen. Welcome to the wild ride of securing funding for your tech startup! Buckle up as we dive into the coolest ways to snag that much-needed capital, from traditional routes to some off-the-beaten-path options.

The Startup Funding Landscape: A Quick Overview

Before we get into the nitty-gritty, let’s set the stage. Funding your tech startup isn’t a one-size-fits-all deal. Depending on where you’re at—be it the seed stage with just an idea or the growth stage looking to scale—different funding avenues make sense. Here’s a snapshot:

- Seed Stage: You’re in the “I’ve got an idea” phase. Funding here is all about turning that idea into a prototype or MVP (Minimum Viable Product).

- Early Stage: You’ve got a prototype, maybe even some early users. Now, it’s time to refine your product and start thinking about scaling.

- Growth Stage: Things are clicking. Users are signing up, and revenue is flowing. Funding now focuses on scaling operations, entering new markets, or expanding your product line.

Understanding where you stand helps in zeroing in on the right funding sources. Now, let’s break down those options.

Bootstrapping: The DIY Approach

First up, the OG of startup funding—bootstrapping. This is all about using your resources to get your startup off the ground. It might mean dipping into your savings, tapping into personal credit, or reinvesting any early profits back into the business.

Why Bootstrapping Rocks:

- Control: You’re the boss. No external investors mean you call the shots.

- Equity Preservation: Since you’re not giving away pieces of your company, you keep all the future profits.

The Not-So-Great Part:

- Risk: You’re putting your own financial well-being on the line.

- Limited Resources: Without external funds, growth might be slower due to cash constraints.

Bootstrapping is a solid choice if you want to maintain control and are okay with a potentially slower growth trajectory.

Friends and Family: Your Inner Circle Investors

If bootstrapping isn’t enough, the next circle to consider is friends and family. These are the folks who believe in you and your vision (or at least love you enough to support your dreams).

Perks of Friends and Family Funding:

- Flexible Terms: They’re likely to offer more lenient repayment terms or equity stakes.

- Quick Access: No lengthy pitch meetings or due diligence processes.

Watch Outs:

- Relationship Strain: Mixing money and personal relationships can get tricky.

- Informal Agreements: Without formal contracts, misunderstandings can arise.

To keep things smooth, treat these investments professionally. Draft clear agreements outlining the terms to ensure everyone’s on the same page.

Angel Investors: The Early Believers

Angel investors are individuals with cash to spare who are looking to invest in promising startups. They often come in during the early stages, providing not just money but also mentorship and connections.

Why Angels Are Heavenly:

- Experience: Many are seasoned entrepreneurs who can offer valuable guidance.

- Flexibility: They might be more open to taking risks compared to traditional investors.

The Trade-Offs:

- Equity Share: They’ll want a piece of the pie, which means giving up some ownership.

- Potential for Control Issues: Depending on the stake they take, they might want a say in how things are run.

When courting angel investors, have a solid business plan and be clear about how their investment will be used to drive growth.

Venture Capitalists (VCs): The Big Leagues

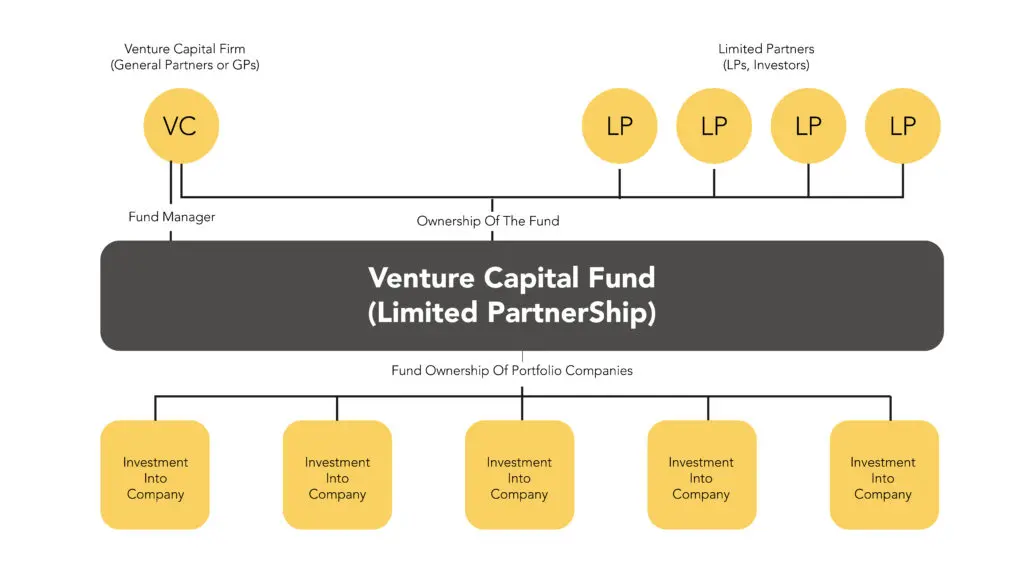

Venture capitalists are firms that invest pooled funds from various sources into startups with high growth potential. They come into play when you’re looking for significant capital to scale rapidly.

VCs Bring to the Table:

- Large Investments: They have deep pockets, perfect for scaling operations.

- Expertise and Networks: VCs often have a wealth of resources and connections to help your startup grow.

But Keep in Mind:

- Equity and Control: VCs will take a substantial equity stake and often want a say in major decisions.

- Pressure for Returns: They’re looking for significant returns, which can translate into pressure for rapid growth and profitability.

Securing VC funding is competitive. You’ll need a strong track record, a scalable business model, and a clear plan for how you’ll use the funds to achieve explosive growth.

Crowdfunding: Power to the People

Crowdfunding has become a popular way to raise funds by tapping into the collective power of the internet. Platforms like Kickstarter, Indiegogo, and GoFundMe allow you to pitch your idea to the masses.

The Upside:

- Market Validation: A successful campaign proves there’s demand for your product.

- Marketing Buzz: It creates early awareness and a community around your brand.

The Challenges:

- All-or-Nothing: Some platforms require you to hit your funding goal to receive any money.

- Campaign Costs: Creating a compelling campaign requires time, effort, and sometimes upfront costs.

Crowdfunding works well for consumer-facing products with broad appeal. It’s also a way to gauge interest before fully committing to production.

Grants and Competitions: Free Money (With Strings Attached)

Who doesn’t love free money? Grants and competitions offer funding without requiring you to give up equity. They’re often provided by governments, foundations, or corporations looking to foster innovation.

The Good Stuff:

- Non-Dilutive: You don’t have to give away any ownership.

- Credibility: Winning a grant or competition can boost your startup’s credibility.

The Not-So-Good Stuff:

- Stringent Criteria: Grants often come with specific requirements and reporting obligations.

- Time-Consuming: The application process can be lengthy and competitive.

Look for grants and competitions that align with your industry and business goals. Resources like America’s Seed Fund offer funding for early-stage R&D without taking equity.

Venture Debt: The Middle Ground

Venture debt is a type of loan designed for startups that have already raised some equity funding. It’s a way to secure additional capital without further diluting ownership.

Perks of Venture Debt:

- Non-Dilutive: You retain more of your company’s equity.

- Extend Runway: Provides additional funds to reach the next milestone or funding round.

Considerations:

- Repayment Obligations: Unlike equity, debt needs to be repaid, often with interest.

- Risk of Default: If things don’t go as planned, you could face financial strain.

Venture debt is best suited for startups with predictable revenue streams looking to finance specific initiatives like scaling sales or entering new markets.

Corporate Venture Capital: Strategic Partnerships

Corporate venture capital (CVC) involves established companies investing in startups. These investments are often strategic, aiming to align with the corporation’s business interests.

Why CVCs Are Cool:

- Resources and Expertise: Corporations can offer more than just money—they bring industry knowledge, mentorship, and access to their networks.

- Potential for Acquisition: If your startup fits well within their ecosystem, a corporate investor could eventually acquire your company.

The Catch:

- Strategic Limitations: Some CVCs may push startups in a direction that benefits their parent company more than the startup itself.

- Exit Pressures: Many corporate investors have specific expectations about potential exits, which can create long-term strategic conflicts.

If your startup aligns with a corporation’s long-term goals, this can be a great way to secure funding while benefiting from a powerhouse industry player.

Small Business Loans: Reliable but Overlooked

Most tech startups think about equity before debt, but small business loans can be a smart way to secure funding without giving up ownership. Traditional banks, alternative lenders, and government-backed programs like SBA loans offer loans for various business needs, including working capital, R&D, and equipment financing.

Types of Small Business Loans for Tech Startups:

- Working Capital Loans: Cover day-to-day expenses and bridge cash flow gaps.

- Equipment Financing: Helps purchase necessary tech and infrastructure without large upfront costs.

- Short-Term Loans: Provide quick funding for urgent expenses.

- SBA Loans: Government-backed loans with favorable terms, ideal for scaling businesses.

Pros of Business Loans:

- No Equity Loss: You retain full ownership and decision-making power.

- Predictable Repayment: Unlike investors who expect a percentage of profits, loans have fixed repayment terms.

Cons of Business Loans:

- Repayment Obligations: You have to pay back the loan regardless of business performance.

- Qualification Requirements: Strong credit scores and financial history are often needed.

For startups in states like California, Texas, Florida, Georgia, and Pennsylvania, there are specialized small business loan programs catering to local businesses.

The Best Funding Strategy? A Mix of Everything

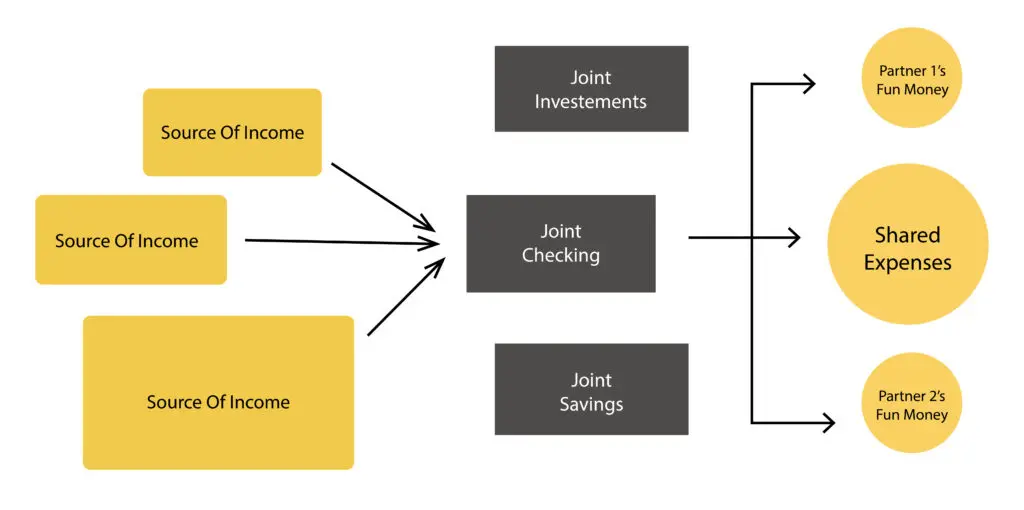

No single funding method is perfect. The best approach often combines multiple funding sources. For example:

- Start with bootstrappingto build an MVP.

- Raise angel or VC fundingfor early scaling.

- Use business loansto cover operating expenses without giving up more equity.

- Apply for grantsto fund R&D.

Having a hybrid funding strategy not only provides flexibility but also minimizes reliance on any single source.

Secure Capital for Your Startup Growth

At VIP Capital Funding, we provide working capital loans for small businesses, short-term loans, and business equipment financing to fuel your startup’s success. Whether you need fast, small business loans or alternative lending solutions, we’ve got you covered. Apply for a small business loan today and scale your innovation! Call now.