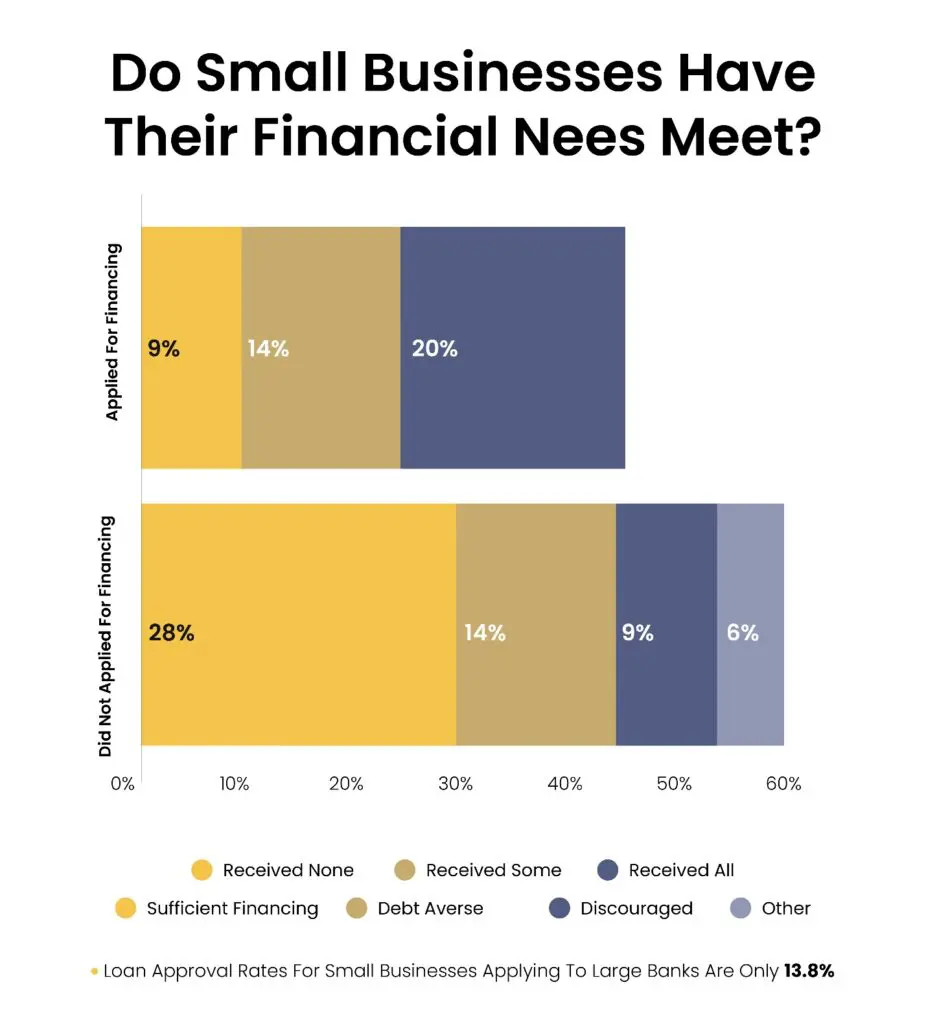

The lifeblood of any small business is access to capital. Securing funding allows you to invest in growth, maintain operations, and ultimately achieve success. Traditionally, small businesses have relied on bank loans to meet their financial needs. However, the process of obtaining a traditional bank loan can be fraught with hidden costs and frustrating roadblocks.

This blog post explores the hidden costs of traditional bank loans and highlights the advantages of online small business loans offered by companies like VIP Capital Funding.

The Allure of Traditional Bank Loans: A Double-Edged Sword

On the surface, traditional bank loans seem like a straightforward solution for businesses seeking funding. Banks have a long-standing reputation and an established track record, which can provide a sense of security and reliability.

However, the process of securing a traditional bank loan can be time-consuming and complex, revealing several hidden costs and challenges that may not be immediately apparent. Here are some of the key drawbacks associated with traditional bank loans:

Rigorous Application Process

Traditional banks have stringent lending criteria and require extensive documentation. This includes detailed business plans, comprehensive financial statements, and past tax returns. For busy small business owners, compiling and submitting all this information can be overwhelming and time-consuming. This rigorous application process diverts their attention from core business operations, potentially impacting productivity and growth.

Additionally, the need to gather such a large amount of documentation can be daunting for newer businesses that may not have all the required records readily available.

Slow Approval Times

Even after submitting a complete application package, traditional banks can take weeks or even months to make a decision. This extended waiting period can hinder your ability to seize time-sensitive opportunities or address urgent financial needs. For instance, if a business owner needs to purchase inventory quickly to meet unexpected demand or repair critical equipment, the slow approval process of traditional bank loans can result in lost revenue or operational disruptions.

High Credit Score Requirements

Traditional banks heavily rely on credit scores when evaluating loan applications. Small businesses with limited credit history or those that have experienced temporary dips in their credit score due to seasonal fluctuations might find themselves disqualified despite having a viable business model and strong growth potential. This reliance on credit scores can be particularly challenging for newer businesses or those in industries with inherent seasonal variability, making it difficult for them to access the necessary capital.

Limited Loan Options

Traditional banks typically offer a limited range of loan products, which may not always align with the specific needs of a small business. For example, a business seeking a short-term loan for a quick project might find that their bank only offers long-term loan options with less favorable terms. This lack of flexibility can be a significant drawback for businesses that require specialized financing solutions tailored to their unique circumstances.

Hidden Fees

Beyond the advertised interest rate, traditional bank loans often come with a plethora of hidden fees, including application fees, origination fees, prepayment penalties, and maintenance fees. These additional costs can significantly increase the overall cost of borrowing, making the loan much more expensive than initially anticipated. For instance, a business owner might be attracted by a seemingly low-interest rate, only to find that various fees add up to a much higher effective cost, impacting their financial planning and cash flow management.

Practical Examples and Implications

Consider a small retail business looking to expand its inventory before the holiday season. The owner decides to apply for a traditional bank loan but faces several significant hurdles that could have been avoided with online small business loans:

Documentation Overload

The owner spends countless hours gathering and preparing the required documents, including financial statements, business plans, and tax returns. This extensive documentation process takes valuable time away from running the business during a critical sales period. During this time, the owner could have focused on strategic planning for the holiday season, marketing campaigns, or staff training. By opting for online small business loan applications, this time-consuming process could be simplified significantly, allowing the owner to apply for a small business loan quickly and easily.

Delayed Approval

Despite submitting a thorough application, the bank takes over a month to approve the loan. By the time the funds are available, the prime shopping season has passed, resulting in missed sales opportunities. This delay means that the store might not have enough inventory to meet customer demand during the busiest shopping period of the year. In contrast, fast small business loans from online lenders can provide approvals within 24-48 hours, ensuring that the business has the necessary funds when they are needed most.

Credit Challenges

The business experienced a minor credit score dip due to slow sales during the off-season. This temporary fluctuation leads to the loan application being denied, despite the business’s overall strong financial health. Traditional banks heavily weigh credit scores in their lending decisions. However, online small business loans take a more holistic approach, considering the business’s overall health and future potential. This means that seasonal businesses with temporary credit issues can still secure funding through working capital loans or short-term loans for small businesses.

Limited Loan Products

The bank only offers long-term loans with fixed monthly payments, whereas the business owner needed a short-term loan to cover seasonal inventory costs. This results in an ill-fitting financial solution that doesn’t meet the specific needs of the business. Online lenders, on the other hand, offer a variety of loan products, such as short-term business funding, business equipment financing, and lines of credit. These options can be tailored to the unique financial needs of the business, whether it’s a small business loan in California, Florida, or Texas.

Unexpected Fees

The traditional bank loan comes with high origination fees and prepayment penalties, making the total cost of the loan significantly higher than the owner had budgeted for. These hidden costs can strain the business’s finances and reduce profit margins. In contrast, online small business loans are known for their transparency. With clear and upfront terms, business owners are aware of all costs involved from the outset. This transparency helps in better financial planning and avoids unpleasant surprises.

Online Small Business Loans: A Streamlined Solution

Online small business loans offered by companies like VIP Capital Funding present a compelling alternative to traditional bank loans. They provide a faster, more flexible, and often more accessible way for businesses to secure the funding they need.

Here’s how online small business loans can benefit your business:

Fast and Easy Application Process

Our online application process is designed to be quick and user-friendly, allowing you to apply for a small business loan in a matter of minutes from the comfort of your own office or home. This eliminates the need for time-consuming visits to a bank and lengthy paperwork. For instance, a small retail store owner looking to expand their inventory can complete the application during a break in their busy day without disrupting their operations.

Additionally, for those in states like California, Florida, and Texas, our platform offers specific options such as small business loan California, small business loan Florida, and small business loan Texas, catering to regional needs.

Fast Approvals

We understand the urgency of your financial needs. That’s why we strive to provide fast small business loans with approvals often within 24-48 hours. This rapid turnaround time ensures that you can seize business opportunities as they arise or address urgent financial needs without delay. For example, a restaurant owner needing to replace a broken refrigerator can secure the necessary funds quickly, preventing any disruption to their service. Our fast small business loans are particularly beneficial for those seeking short-term loans for business, providing the flexibility to manage cash flow effectively.

Focus on Business Potential, Not Just Credit Score

While credit score is a factor, we take a more holistic approach by considering your overall business health, future growth prospects, and the viability of your business plan. This means that even if your credit score is less than perfect, you still have a good chance of securing a loan if your business demonstrates strong potential. For instance, a startup with an innovative product and a solid business plan but limited credit history can still qualify for funding based on its projected growth and market potential. This is especially useful for those applying for working capital loans or equipment financing for new business ventures.

Variety of Loan Options

We offer a diverse range of loan products tailored to meet the unique needs of different businesses. Our options include working capital loans, business equipment financing, lines of credit, and term loans. Each of these products is designed to address specific financial needs. For instance, a construction company can opt for small business construction loans to purchase new machinery, while a seasonal business might prefer a line of credit to manage cash flow fluctuations throughout the year.

Our variety also includes specialized loans like medical practice financing, construction company loans, and financing for manufacturers.

Transparent Loan Terms

We believe in transparency and ensure that our loan terms are clear and upfront, with no hidden fees or surprises. You’ll know exactly what you’re getting into before you sign on the dotted line. This transparency helps you make informed decisions about your financing options.

For example, a small business owner looking to expand their operations can review all the terms and conditions beforehand, ensuring there are no unexpected costs that could affect their financial planning. This approach is ideal for those seeking easy small business loans and online small business loan applications.

Real-World Advantages for Different Industries

Let’s delve into specific examples of how online small business loans can empower businesses in various industries:

Restaurants

A new restaurant owner might need a working capital loan to purchase kitchen equipment, hire staff, and build inventory before their grand opening. The fast and easy application process of online small business loans allows them to apply for a small business loan quickly without extensive paperwork. For instance, a restaurant in California could take advantage of a small business loan in California to set up their operations smoothly. Similarly, a restaurant in Florida or Texas could benefit from a small business loan in Florida or Texas to manage their startup expenses.

Retail Stores

A seasonal retail store might experience fluctuations in cash flow throughout the year. A line of credit from an online lender provides them with the flexibility to access additional funds as needed during peak seasons, ensuring they have the inventory to meet customer demand. This can be particularly beneficial for retail businesses looking to capitalize on holiday seasons or special promotions. For example, a boutique in Michigan might secure a small business loan in Michigan to stock up on seasonal merchandise, while a store in New Jersey might use a small business loan in New Jersey to prepare for a big sales event.

Manufacturing Companies

A growing manufacturing company might identify the need for specialized equipment to expand their production capacity. Equipment financing from an online lender allows them to acquire the necessary equipment without a large upfront investment, facilitating growth and increased profitability. Companies in states like Georgia and Illinois can leverage specific options such as small business loan Georgia and small business loan Illinois to enhance their production capabilities. Additionally, financing for manufacturers ensures that they can maintain and upgrade their machinery to stay competitive.

Medical Practices

A medical practice might need a term loan to finance upgrades to medical equipment or expand their office space to accommodate more patients. Online small business loans offer a flexible and streamlined solution to meet these capital needs. For instance, a clinic in Maryland could apply for a small business loan in Maryland to upgrade its diagnostic tools, while a practice in North Carolina might seek a small business loan in North Carolina to renovate and expand their facilities. Medical practice financing ensures that healthcare providers can continue offering high-quality services without financial strain.

Construction Companies

Construction projects are often subject to unforeseen expenses. A working capital loan from an online lender can provide construction companies with a financial safety net, ensuring they have the resources to cover unexpected costs and avoid project delays. For example, a construction firm in Ohio might use a small business loan Ohio to cover the costs of additional materials due to a sudden price increase. Similarly, companies in Pennsylvania and Virginia can benefit from small business loan in Pennsylvania and Virginia respectively to manage their project budgets effectively. Construction business financing ensures that projects stay on track and within budget.

Home Care Businesses

A home care business might need a short-term loan to cover payroll expenses during a period when they are waiting for payments from clients. The fast approval process offered by online lenders ensures they have the funds readily available to maintain operations and meet their financial obligations. For instance, a home care service in Washington could secure a small business loan Washington to manage their cash flow during billing cycles. This ensures that caregivers are paid on time and services continue uninterrupted. Small business loans for home care provide the financial stability needed to focus on patient care and business growth.

These are just a few examples of how online small business loans can benefit businesses across a wide range of industries. By providing fast, flexible, and transparent financing solutions, online lenders empower small businesses to overcome challenges, seize opportunities, and achieve long-term success.

VIP Capital Funding: Your Partner in Growth

At VIP Capital Funding, we are passionate about helping small businesses thrive. We understand the unique challenges faced by entrepreneurs and are committed to providing financing solutions tailored to your specific needs.

Here are some additional reasons to choose VIP Capital Funding for your small business loan needs:

Experienced Loan Specialists: Our team has extensive experience working with small businesses from various industries. They can guide you through the loan application process and recommend the best financing solution for your specific situation.

Exceptional Customer Service: We are dedicated to providing exceptional customer service throughout the entire loan process. Our team is always available to answer your questions, address your concerns, and support you every step of the way.

Dedicated Account Representative: You’ll be assigned a dedicated account representative who understands your business and its unique financial landscape. This personalized approach ensures you receive tailored guidance and support throughout the life of your loan.

Don’t Let Traditional Bank Loan Challenges Hinder Your Dreams

The path to success for small businesses is often paved with challenges. The hidden costs and bureaucracy associated with traditional bank loans can create unnecessary hurdles. Online small business loans from VIP Capital Funding offer a streamlined and transparent alternative, empowering you to focus on what matters most – running and growing your business. Get in touch with us today.