In the world of business finance, the concept of working capital is often discussed but not always well understood. Working capital is a critical factor that can determine the health and success of a business, whether it’s a startup or an established enterprise.

In this blog, we’ll explore what working capital is, how it’s calculated, why it’s essential for your business, and how to manage it effectively to drive growth.

What Is Working Capital?

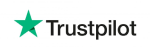

Working capital is the difference between a company’s current assets and current liabilities. It measures a business’s short-term financial health and its ability to cover day-to-day operational expenses. Essentially, working capital indicates whether a company has enough cash or liquid assets to meet its obligations within the next 12 months.

Why Is Working Capital Important?

Working capital is vital for any business as it affects day-to-day operations and overall financial stability. Here are a few reasons why maintaining adequate working capital is essential:

1. Ensures Smooth Operations

Working capital enables a business to cover daily expenses like rent, wages, utilities, and inventory. Without enough working capital, a company may struggle to maintain regular operations.

2. Supports Growth Opportunities

With sufficient working capital, a business can invest in growth initiatives such as expanding product lines, opening new locations, or launching marketing campaigns.

3. Protects Against Financial Stress

Businesses with limited working capital may find it challenging to weather financial hardships, such as slow sales periods, economic downturns, or unexpected expenses.

4. Enhances Creditworthiness

A company with adequate working capital is seen as financially stable, making it easier to secure financing from lenders or investors.

How to Calculate Working Capital

Calculating working capital is straightforward with the following formula:

Working Capital = Current Assets – Current Liabilities

Here’s a breakdown of the components involved:

Current Assets

This includes assets like cash, accounts receivable (money owed by customers), and inventory.

Current Liabilities

This includes obligations such as accounts payable (bills you owe to suppliers), wages, short-term debt, and any other expenses due within a year.

For example, if a business has $100,000 in current assets and $60,000 in current liabilities, the working capital would be:

100,000 – 60,000 = 40,000

A positive working capital indicates that the business can cover its short-term liabilities, while a negative working capital suggests potential liquidity issues.

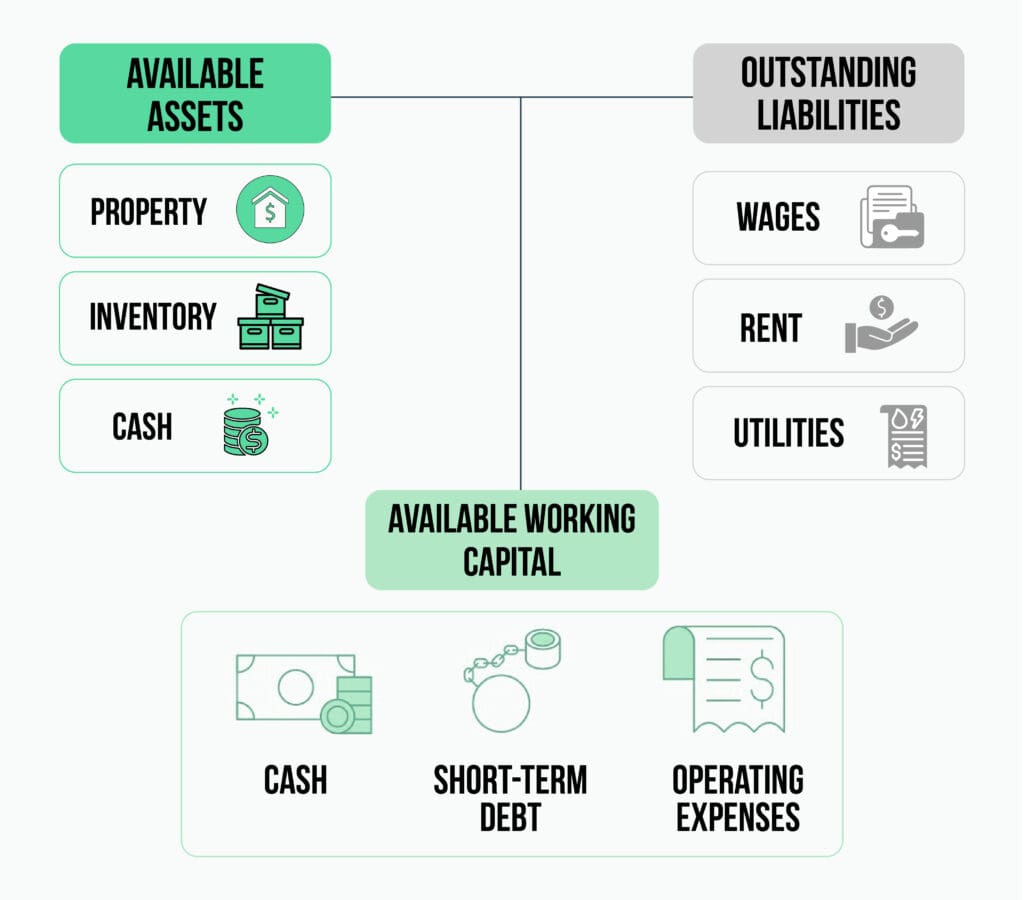

Types of Working Capital

Working capital can be categorized into different types depending on its purpose and usage. Here are the main types:

1. Gross Working Capital

The total of all current assets a business holds, regardless of current liabilities.

2. Net Working Capital

The difference between current assets and current liabilities, representing the liquid assets available to fund daily operations.

3. Temporary Working Capital

The additional working capital required to meet seasonal or unexpected demands, like stocking up for holiday sales.

4. Permanent Working Capital

The minimum amount of working capital required to run the business consistently, even during low sales periods.

Why Having Adequate Working Capital Matters for Your Business

While working capital provides the financial means to meet short-term obligations, it has a much more profound impact on business health and growth. Here’s why having adequate working capital is critical:

1. Avoiding Liquidity Issues

Running out of cash is a primary reason many small businesses fail. With enough working capital, you can ensure that cash flow remains positive, allowing you to manage your business without constantly worrying about liquidity.

2. Maintaining Supplier Relationships

Suppliers are more likely to work with businesses that pay on time. With adequate working capital, you can ensure timely payments to suppliers, which can lead to better credit terms and potential discounts.

3. Seizing Growth Opportunities

Businesses with sufficient working capital can respond to opportunities as they arise. Whether it’s investing in new equipment, taking advantage of bulk purchasing discounts, or expanding into new markets, working capital provides the flexibility to act when needed.

4. Managing Seasonal Sales Cycles

For businesses with seasonal sales patterns, working capital helps bridge the gap between high and low sales periods, ensuring smooth operations even during off-peak seasons.

5. Enhancing Financial Stability

A healthy level of working capital signals financial stability, which can improve your business’s reputation and make it easier to attract investors or secure loans.

Factors Affecting Working Capital Needs

The amount of working capital a business needs can vary based on several factors, including industry, business model, and growth stage. Here are some key factors that impact working capital needs:

1. Business Type and Industry

Retail businesses, for instance, usually need more working capital to maintain inventory, while service-based businesses might need less.

2. Sales Volume and Growth

Rapidly growing businesses often need more working capital to finance inventory, labor, and other costs associated with expansion.

3. Seasonal Demand

Businesses with seasonal demand fluctuations require additional working capital during peak seasons to ensure they have sufficient resources.

4. Operational Efficiency

Efficient inventory management, quick accounts receivable collection, and controlled expenses help reduce working capital needs.

5. Supplier and Customer Terms

The terms you negotiate with suppliers and customers (like payment periods) significantly impact your cash flow and, consequently, your working capital.

How to Improve Your Working Capital

Improving working capital involves managing both current assets and current liabilities effectively. Here are several strategies for enhancing working capital:

1. Optimize Inventory Management

Maintain an optimal level of inventory. Overstocking ties up cash, while understocking can lead to lost sales. Use inventory management software to streamline this process.

2. Speed Up Accounts Receivable

Encourage faster payments by offering early payment discounts, implementing strict credit policies, or utilizing invoice factoring.

3. Negotiate with Suppliers

Aim to negotiate longer payment terms with suppliers, which can free up cash to cover immediate expenses.

4. Control Operational Expenses

Review your operational expenses regularly and look for areas where you can cut costs without affecting quality or productivity.

5. Consider Short-Term Financing Options

If you need a quick boost to your working capital, consider a short-term business loan or a line of credit to bridge the gap.

Signs Your Business May Have a Working Capital Problem

Understanding when your business might be facing a working capital challenge is essential to preventing long-term issues. Here are a few signs that your working capital might be insufficient:

1. Inability to Pay Bills on Time

If your business frequently struggles to pay bills, wages, or other expenses on time, it may be a sign of insufficient working capital.

2. Reliance on Short-Term Loans

Frequently using short-term loans to cover basic expenses can indicate a working capital shortage.

3. Growing Accounts Payable

If your accounts payable balance continues to increase, it could mean that you’re struggling to meet short-term obligations.

4. Low Cash Reserves

A lack of available cash for emergencies or unexpected expenses can suggest that your working capital is too low.

5. Difficulty in Securing Credit

Lenders are often reluctant to extend credit to businesses with poor cash flow, which can limit your access to working capital.

How to Manage Working Capital During Economic Uncertainty

Economic downturns or unexpected crises, like the COVID-19 pandemic, can drastically impact working capital. Managing working capital effectively during uncertain times requires careful planning and a proactive approach. Here are some strategies:

1. Strengthen Cash Reserves

Focus on building a cash buffer to cushion against potential revenue shortfalls or unexpected expenses.

2. Improve Cash Flow Forecasting

Regularly forecast your cash flow and working capital needs to anticipate potential shortfalls.

3. Review Payment Terms

Renegotiate terms with suppliers and customers, if possible, to create a more favorable cash flow arrangement.

4. Monitor Expenses Closely

During uncertain times, scrutinize all expenses and look for areas to reduce costs without sacrificing quality.

5. Use Short-Term Financing as a Last Resort

Rely on short-term financing only when necessary and ensure you have a repayment plan to avoid further financial stress.

Final Thoughts

Working capital is much more than a simple metric; it’s a key indicator of a business’s financial health and operational efficiency. By maintaining a positive working capital balance, you can ensure your business has the resources to meet its short-term obligations, seize growth opportunities, and navigate challenges effectively. Regularly monitor your working capital, use tools like cash flow forecasting, and implement strategies to optimize your current assets and liabilities.

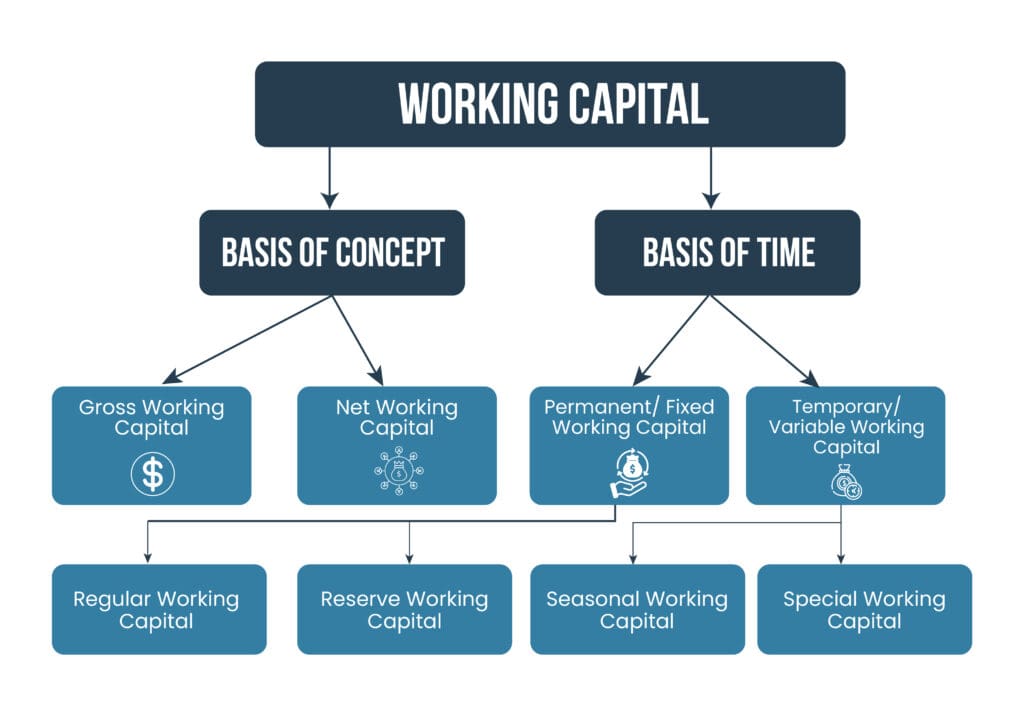

Protect Your Business from Financial Risks with Working Capital Loans from VIP Capital Funding

Secure the short term business financing you need to keep operations steady and cover unexpected expenses. VIP Capital Funding’s working capital loans offer flexible financing solutions to help protect and grow your business. Apply today for peace of mind!