Short-term business funding is a financial solution designed to provide businesses with quick access to capital for a short period, typically ranging from a few months to a year. Unlike long-term financing, which is structured for extended repayment periods, short-term business funding addresses immediate financial needs, offering a swift injection of cash to help manage operational expenses, seize growth opportunities, or navigate unexpected financial hurdles.

This type of funding can be particularly valuable for small businesses facing seasonal fluctuations in revenue, those looking to capitalize on time-sensitive opportunities, or startups needing initial capital to purchase essential equipment or cover other startup expenses.

Short-Term Funding vs. Traditional Loans: Key Differences

When comparing short-term business funding to traditional loans, several key differences stand out.

- Repayment Duration:Traditional loans often come with lengthy repayment terms, sometimes extending over several years. In contrast, short-term business funding is designed for quicker repayment, usually within 3 to 18 months. This means businesses can address their immediate needs without committing to long-term financial obligations.

- Application and Approval Process:The application process for traditional loans can be time-consuming and complex, involving extensive documentation and credit evaluations. Short-term business funding typically features a streamlined application process with faster approval times. This efficiency is ideal for businesses that require urgent financial support.

- Funding Speed:One of the most significant differences is the speed at which funds are disbursed. Traditional loans may take weeks or even months to be processed and approved. Short-term business funding, however, can often provide funds within days or even hours, allowing businesses to act quickly on pressing needs or opportunities.

- Amounts and Flexibility:While traditional loans might offer larger amounts with more flexible terms, short-term funding is generally more focused on providing smaller, immediate amounts. This approach caters to businesses needing quick, short-term capital rather than long-term financial solutions.

Why Businesses Need Short-Term Funding

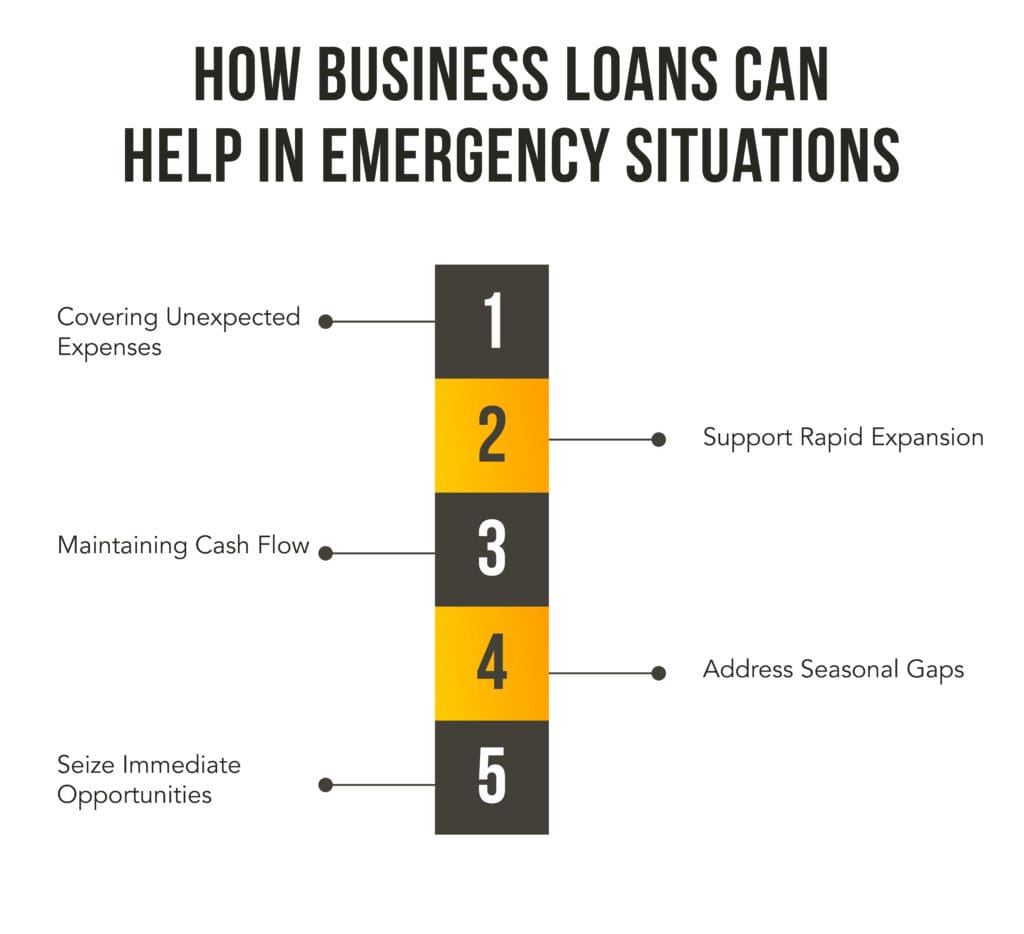

Short-term business funding can be a game-changer for various reasons:

- Managing Cash Flow:Businesses often encounter cash flow challenges due to delayed receivables, unexpected expenses, or seasonal variations in revenue. Short-term funding helps bridge these gaps, ensuring smooth operations and continuity.

- Seizing Growth Opportunities:Opportunities for growth, such as investing in new technology or expanding inventory, can be fleeting. Short-term funding provides the necessary capital to act swiftly and capitalize on these opportunities before they pass.

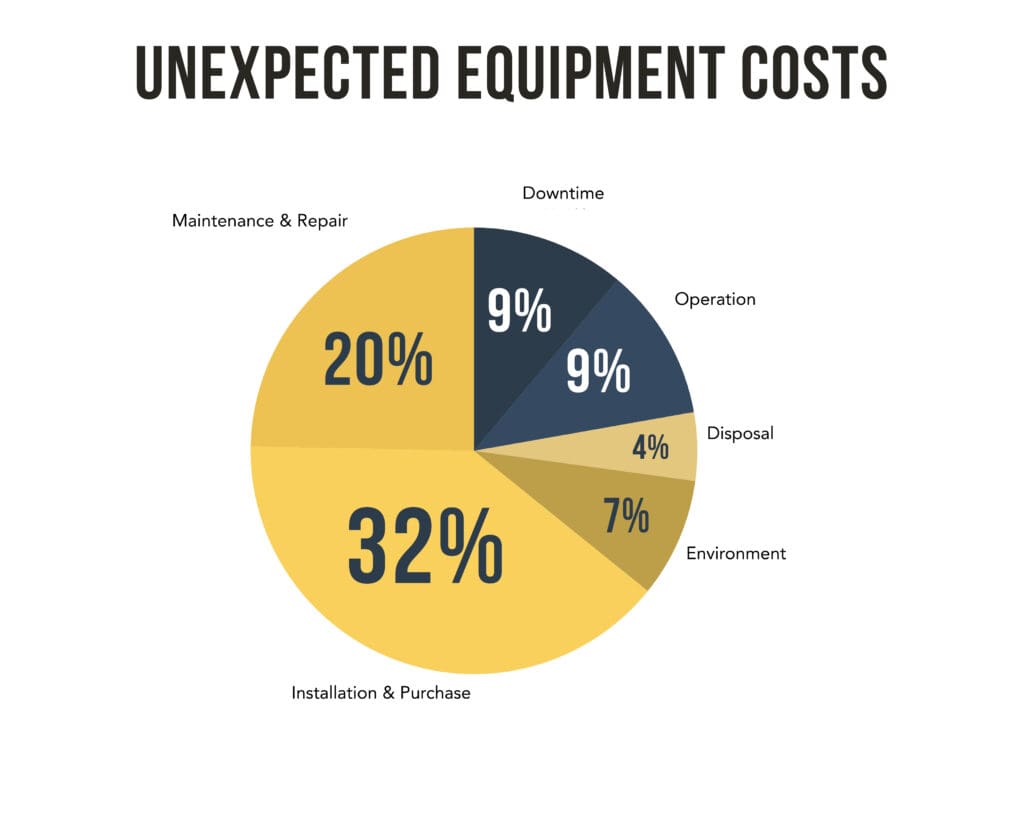

- Handling Emergency Expenses:Unforeseen emergencies, such as equipment breakdowns or sudden repairs, require immediate financial resources. Short-term funding offers a quick solution to cover these expenses and minimize operational disruptions.

- Supporting Startups:New businesses often need initial capital to purchase equipment, cover operating costs, or finance marketing efforts. Short-term loans for small business can provide the necessary funds to get started and establish a foothold in the market.

The Rise of Private Lenders in Business Financing

The landscape of business financing has evolved significantly, with private lenders playing an increasingly prominent role. Unlike traditional financial institutions, private lenders offer a more flexible and personalized approach to funding. This rise in private lending is driven by several factors:

- Flexibility and Customization:Private lenders can tailor funding solutions to meet the specific needs of businesses, offering customized loan terms and conditions that align with individual circumstances. This flexibility is often lacking in traditional financing options.

- Faster Approval and Funding:Private lenders typically have less stringent requirements and faster processing times compared to traditional lenders. This speed is crucial for businesses that need immediate capital.

- Accessibility:Private lenders are more willing to work with businesses that might not meet the criteria of traditional institutions, including startups and companies with less established credit histories. This inclusivity expands access to funding for a broader range of businesses.

- Innovative Solutions:Many private lenders offer innovative financing solutions that address unique business needs, such as startup business equipment financing or short-term loans tailored for specific purposes.

Benefits of Partnering with a Private Lender

Partnering with a private lender can offer several advantages for businesses seeking short-term funding:

- Quick Access to Capital:One of the most significant benefits is the speed at which funds are made available. Private lenders often provide faster approval and disbursement, allowing businesses to address urgent financial needs without delay.

- Flexible Terms:Private lenders can offer more flexible repayment terms and conditions compared to traditional financing options. This flexibility allows businesses to tailor their funding solutions to better fit their financial situation and goals.

- Personalized Service:Private lenders often provide a more personalized approach, working closely with businesses to understand their unique needs and offering customized solutions. This personal touch can lead to a more favorable and supportive funding experience.

- Increased Accessibility:For businesses that may not qualify for traditional loans, private lenders provide an alternative source of capital. This accessibility can be especially beneficial for startups or companies with less established credit histories.

Finding the Right Lender for Your Small Business Loans

Selecting the right private lender for your short-term business funding needs is crucial to ensuring a positive and productive borrowing experience. Here are some tips for finding the right lender:

- Research and Compare Lenders:Start by researching different private lenders and comparing their offerings. Look for lenders with a track record of working with businesses similar to yours and offering terms that align with your needs.

- Check Reviews and Testimonials:Look for reviews and testimonials from other businesses that have worked with the lender. Positive feedback and successful case studies can provide valuable insights into the lender’s reputation and reliability.

- Evaluate Terms and Conditions:Carefully review the terms and conditions of the funding offered by different lenders. Pay attention to interest rates, repayment schedules, fees, and any other relevant terms to ensure they align with your business needs and financial capacity.

- Seek Recommendations:If possible, seek recommendations from other business owners or financial advisors. Their experiences and insights can help guide you toward reputable and reliable lenders.

Types of Short-Term Funding

Short-term business funding comes in various forms, each suited to different business needs. Here are some common types:

- Merchant Cash Advances (MCAs):An MCA provides a lump sum of capital in exchange for a percentage of future sales or daily credit card transactions. This type of funding is quick and flexible, making it suitable for businesses with steady sales.

- Invoice Financing:This form of funding allows businesses to borrow against outstanding invoices. Lenders provide immediate cash based on the value of unpaid invoices, helping businesses manage cash flow and cover expenses while waiting for customer payments.

- Business Line of Credit:A business line of credit offers access to a predetermined amount of capital that businesses can draw upon as needed. This type of funding provides flexibility, allowing businesses to use funds for various purposes and only pay interest on the amount borrowed.

- Equipment Financing:For businesses needing to purchase or lease equipment, equipment financing provides the necessary capital. This type of funding is specifically tailored for acquiring machinery, technology, or other essential equipment.

- Short-Term Loans:These loans provide a lump sum of capital with a fixed repayment period, typically ranging from a few months to a year. Short-term loans for small businesses are ideal for addressing immediate financial needs or funding specific projects.

Managing Your Short-Term Funding

Effectively managing short-term funding is crucial to prevent it from becoming a burden. The first step is to clearly define the purpose of the loan. Is it to cover operational costs, invest in inventory, or seize a time-sensitive opportunity? Once the purpose is clear, it’s essential to calculate the exact amount needed. Overborrowing can lead to unnecessary interest costs, while underborrowing may not fully address the issue.

Creating a Repayment Plan

A well-structured repayment plan is the backbone of successful short-term funding. This plan should be realistic and aligned with your business’s cash flow cycle. Break down the loan amount into manageable installments and determine the payment frequency. Consider using tools like cash flow forecasting to predict income and expenses, ensuring that repayments are sustainable. Regular monitoring of your cash flow will help you stay on top of your repayment schedule.

Strategies for Effective Cash Flow Management

Strong cash flow management is essential for repaying short-term loans and maintaining business health. Implementing strategies such as:

Invoice discounting:Â Accelerate cash inflow by selling outstanding invoices to a third party at a discount.

Inventory management:Â Optimize stock levels to avoid tying up capital in unsold goods.

Expense control:Â Identify areas where costs can be reduced without compromising business operations.

Pricing strategy:Â Review and adjust pricing to improve profit margins.

Debt collection:Â Implement efficient systems to recover outstanding payments promptly.

Can significantly improve your cash flow position.

Avoiding the Short-Term Funding Trap

While short-term funding can be a valuable tool, it’s essential to avoid becoming reliant on it. Overusing short-term loans can lead to a debt cycle that’s difficult to break. Focus on building a solid financial foundation through improved revenue generation, cost reduction, and efficient cash management. This will reduce your reliance on external financing.

Additional Considerations

Loan terms and conditions: Carefully review the terms and conditions of the loan agreement, including interest rates, fees, and repayment schedules.

Alternative financing options:Â Explore other financing options such as lines of credit, invoice factoring, or merchant cash advances to find the best fit for your business.

Financial planning:Â Develop a comprehensive financial plan that outlines your business goals, revenue projections, and expense budgets.

The Cost of Short-Term Funding: Fees and Interest Rates

Short-term business loans typically come with higher interest rates and fees compared to traditional loans. Understanding these costs is crucial for making informed decisions. Factors such as loan amount, repayment terms, and the lender’s risk assessment influence the overall cost.

Rewards of Short-Term Funding

Short-term business funding, often accessed through small business loans or other financial products, can be a catalyst for growth and stability when used strategically. Here are some key rewards:

1. Accelerated Growth and Expansion

Short-term funding can provide the necessary capital to seize market opportunities, introduce new products or services, or expand into new territories. By injecting funds into key areas, businesses can accelerate their growth trajectory and gain a competitive edge.

2. Overcoming Cash Flow Challenges

One of the most common reasons for seeking short-term business funding is to bridge cash flow gaps. Seasonal fluctuations, unexpected expenses, or slow-paying customers can strain a business’s finances. A small business loan can provide the liquidity needed to meet short-term obligations and maintain operations.

3. Preserving Working Capital

By utilizing short-term funding, businesses can preserve their working capital. This means avoiding the need to liquidate assets or delay critical payments, allowing the business to maintain its operational efficiency and focus on core competencies.

4. Building a Strong Financial Foundation

Successful management of short-term funding can contribute to building a strong financial foundation. By demonstrating responsible borrowing and repayment, businesses can improve their creditworthiness and access more favorable financing options in the future. This lays the groundwork for long-term growth and stability.

5. Enhanced Ability to Compete

Short-term business funding can equip businesses with the resources to invest in technology, marketing, or employee training. These investments can enhance competitiveness, improve efficiency, and ultimately drive sales and profitability.

By understanding and leveraging these rewards, businesses can make informed decisions about whether short-term funding is the right choice and how to maximize its benefits.

Building a Strong Financial Foundation for Future Growth

Using short-term funding as a stepping stone to long-term financial stability is ideal. By effectively managing the loan and implementing sound financial practices, businesses can strengthen their creditworthiness and access more favorable financing options in the future. A strong financial foundation is essential for sustainable growth and resilience.

Remember, short-term business funding is a tool, not a solution. By understanding its benefits, risks, and proper management, you can harness its power to drive your business forward while minimizing potential pitfalls.

When to Use Short-Term Business Funding

Short-term business financing can be a lifeline for companies facing temporary cash flow challenges or seeking to capitalize on fleeting opportunities. This type of funding, often in the form of small business loans or lines of credit, can be instrumental in various business scenarios.

Bridging Cash Flow Gaps

Seasonal Fluctuations:Â Businesses with seasonal sales patterns may experience cash shortages during slower periods. Short-term financing can tide them over until revenue picks up.

Unexpected Expenses:Â Unforeseen costs like equipment repairs or legal fees can disrupt cash flow. Short-term funding can provide the necessary liquidity to address these issues.

Delayed Payments:Â Outstanding invoices can strain a business’s cash flow. Short-term financing can help maintain operations while awaiting payments.

Capitalizing on Opportunities

New Product or Service Launch:Â Introducing new offerings often requires upfront investments. Short-term financing can fund these initial costs.

Business Expansion:Â Expanding into new markets or locations can be costly. Short-term financing can cover initial expenses.

Inventory Purchases:Â Opportunities to buy inventory at discounts or in bulk can be seized with short-term financing.

Managing Growth

Hiring:Â Expanding the workforce to meet increased demand may require upfront costs. Short-term financing can cover these expenses.

Equipment Purchases:Â Investing in new equipment can improve efficiency. Short-term financing can fund these purchases.

Maximizing Short-Term Funding

To fully leverage short-term financing:

Plan Carefully:Â Develop a detailed budget and cash flow forecast to determine the exact funding needed.

Prioritize Repayment:Â Create a realistic repayment plan to avoid accumulating unnecessary interest.

Explore Alternatives:Â Consider other financing options like invoice factoring or merchant cash advances.

Build Credit: Maintain a good credit score to improve loan terms.

Focus on Long-TermHealth:Â Use short-term financing as a stepping stone to a strong financial foundation.

Short-term business funding is a valuable tool for managing immediate financial needs, supporting growth, and navigating cash flow challenges. By effectively managing your funding, creating a solid repayment plan, and avoiding common pitfalls, you can maximize the benefits of short-term loans for small business and set the stage for long-term success.

Understanding the costs, rewards, and considerations associated with short-term funding helps in making informed decisions and leveraging this financial resource effectively. With careful planning and strategic execution, short-term business funding can be a powerful asset in achieving your business goals and driving future growth.

Looking for reliable funding solutions for your small business? VIP Capital Funding offers tailored small business loans, including short-term loans, construction loans, and working capital options. Whether you’re in New Jersey, North Carolina, Ohio, Pennsylvania, Virginia, Georgia, Illinois, Maryland, Michigan, or Texas, our flexible loan programs are designed to meet your specific needs.

We also provide medical practice financing, equipment financing, and fast funding solutions. Apply online today and discover how VIP Capital Funding can help your business thrive with easy and efficient loan options. Contact us now to get started and unlock your business’s potential!