The American dream of owning and operating a successful business is alive and well. However, the journey from conception to a thriving enterprise often requires capital – sometimes significant amounts. This is where small business loans come in, providing the fuel to bridge the gap between where a business is and where it wants to be.

Traditionally, securing a small business loan meant navigating the often-daunting world of traditional banks. But in recent years, a growing number of business owners are turning to private financial solutions for their funding needs. Let’s delve into the reasons behind this shift and explore the advantages private financial solutions can offer.

The Struggles with Traditional Banking

While traditional banks have long been a primary source of small business loans, the process can be cumbersome and frustrating for many entrepreneurs. Here’s a closer look at some of the common challenges:

Lengthy Application Process

Traditional banks often require extensive paperwork and a lengthy application process. This can be a significant time drain for busy business owners who need funding quickly. Entrepreneurs must gather and submit a myriad of documents, including detailed business plans, financial statements, tax returns, and personal financial information. The review and approval process can take weeks or even months, during which time opportunities may be lost, and business operations can be disrupted. The prolonged waiting period can be especially detrimental for businesses that need to seize market opportunities swiftly or address urgent financial needs. Online small business loan applications are becoming a more attractive option for those needing fast small business loans.

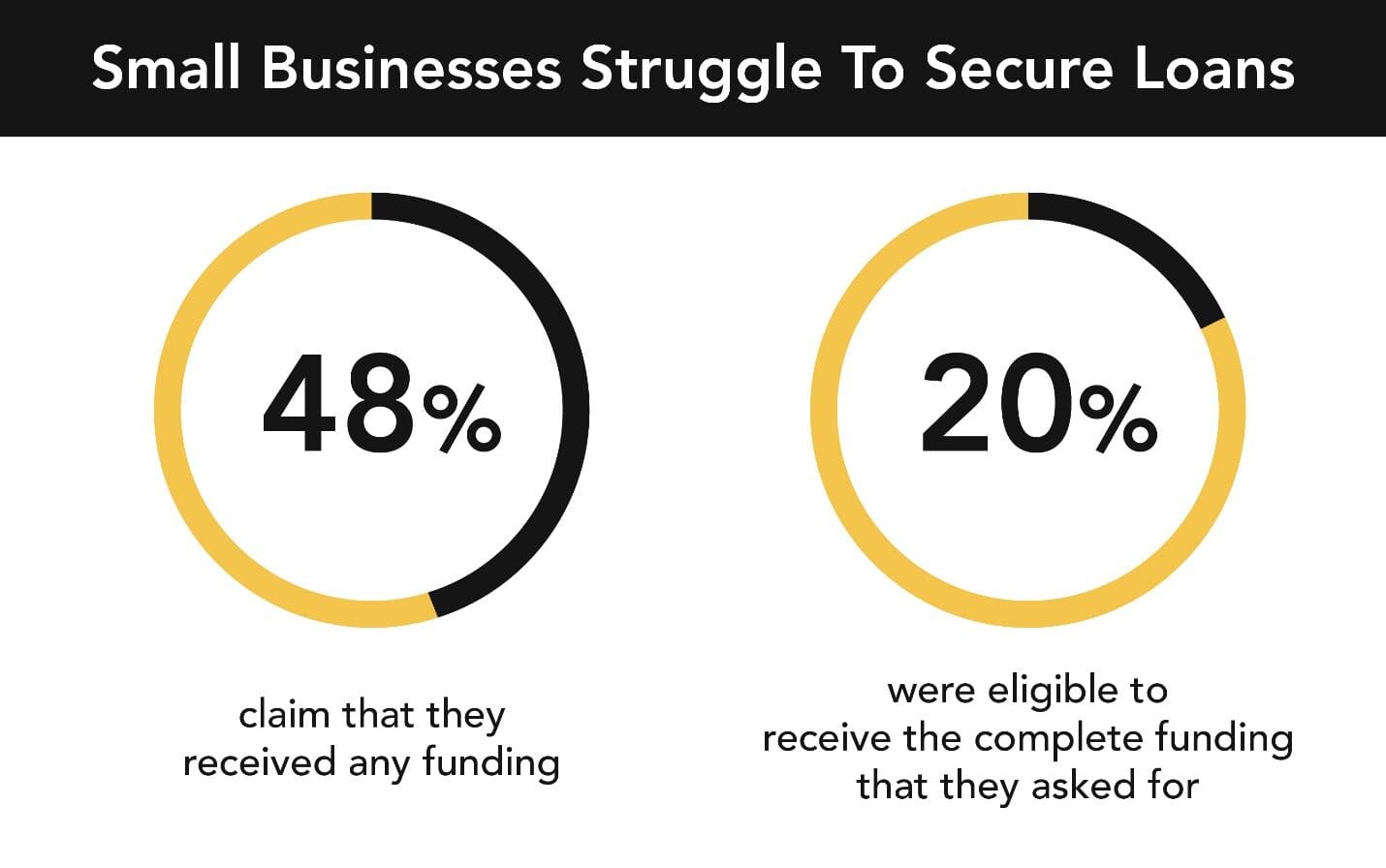

Strict Qualification Criteria

Banks typically have stringent credit score requirements and may look for a long track record of profitability before approving a loan. This can be a major hurdle for startups or businesses experiencing temporary financial setbacks. Many small business owners, particularly those with new ventures, find it challenging to meet these high standards. Banks often require collateral, such as real estate or equipment, to secure the loan, which many startups may not have. Additionally, traditional lenders may be hesitant to extend credit to businesses in industries they perceive as high-risk, further narrowing the pool of eligible applicants. Entrepreneurs with less-than-perfect credit histories or those who have faced recent financial difficulties may find themselves automatically disqualified from obtaining necessary funds. However, easy small business loans and working capital loans for small business from alternative lenders are providing more accessible options. These alternatives are especially useful for businesses in need of working capital for new business or working capital loan for new business.

Limited Loan Amounts

Traditional banks may not be able to provide the full amount of funding a growing business needs, especially for larger projects or equipment purchases. Small business equipment financing, including equipment financing loans and equipment financing for new business, can be critical for businesses looking to expand. Small business loans from banks often come with caps that may not align with the financial requirements of substantial expansions or major capital investments. For example, a business looking to purchase expensive machinery or expand its operations significantly might find that the maximum loan amount offered by a bank falls short of what is needed. This limitation forces business owners to seek alternative funding sources, potentially piecing together financing from multiple avenues, which can complicate financial planning and increase the overall cost of borrowing. Online small business loans, including short term loans for small business and short term business funding, can provide the necessary capital quickly and with less hassle.

Traditional banks play a crucial role in providing financing, their rigid and often slow processes, strict qualification criteria, and limited loan amounts pose significant challenges for small business owners. These hurdles can impede the growth and success of emerging businesses, prompting many entrepreneurs to explore alternative financing options that offer more flexibility and faster access to capital, such as easy equipment financing and fast equipment financing. Additionally, location-specific loans such as small business loan California, small business loan Florida, and small business loan Texas are becoming more popular, providing tailored financial solutions. Entrepreneurs in states like Georgia, Illinois, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, and Virginia can also find targeted options. These specific loan programs help local businesses meet their financial needs more effectively.

The Rise of Private Financial Solutions

Recognizing the limitations of traditional banking for small businesses, private financial solution providers have emerged to fill the gap. These companies offer a more streamlined and flexible approach to small business funding. Here are some key benefits of choosing private financial solutions:

Speed and Efficiency

Private lenders prioritize a faster turnaround time. The application process is often simpler, with less paperwork involved, allowing business owners to receive funding quickly. This is critical for businesses that need capital to seize time-sensitive opportunities. Unlike traditional banks, where the approval process for a small business loan can take weeks or even months, private lenders can often provide fast small business loans within days. This agility is particularly beneficial for companies that need to respond quickly to market changes or unexpected expenses.

Focus on Cash Flow over Credit Score

Unlike traditional banks that heavily rely on credit score, private lenders often place greater emphasis on a business’s current cash flow and future potential. This is a game-changer for businesses with lower credit scores or limited financial history but strong growth prospects. For example, a business with a solid and growing customer base but a short credit history can still qualify for funding based on its revenue projections and cash flow statements. This approach is particularly advantageous for startups and businesses in growth phases, as it provides access to working capital loans and short term business funding that might otherwise be out of reach.

Greater Flexibility in Loan Options

Private lenders offer a wider variety of loan products tailored to specific business needs. This can include short-term loans for business, working capital loans, equipment financing loans, and more. Additionally, loan terms and repayment schedules can be more flexible than those offered by traditional banks. This flexibility allows businesses to choose products that best fit their financial situation and strategic goals. Whether it’s easy equipment financing for a manufacturing company or short term loans for small business to cover seasonal fluctuations, private lenders can provide customized solutions that traditional banks may not offer.

Personalized Customer Service

Private lenders often provide a more personalized experience, with dedicated representatives who understand the unique challenges faced by small businesses. This can be invaluable for navigating the loan process and obtaining guidance for financial growth. For instance, a dedicated loan officer can help a business owner evaluate the best type of working capital loan for new business or provide insights into how to manage repayments effectively. This level of service can make a significant difference in the overall borrowing experience, ensuring that businesses not only receive the funding they need but also the support to use it effectively.

Unleashing Growth: Real-World Examples of Private Financial Solutions in Action

Beyond the general advantages, private financial solutions shine in their ability to cater to specific business needs across diverse industries. Let’s explore a few examples:

Construction Company Growth

Imagine a thriving construction company ready to expand its operations by taking on larger projects. Traditional banks might hesitate due to the short-term nature of construction contracts. However, a private lender can provide a working capital loan based on the company’s proven track record and projected future earnings from upcoming projects. This crucial injection of capital allows the construction company to seize new opportunities and solidify its position in the market. Additionally, construction business financing options can include small business construction loans tailored to the specific needs of the industry, ensuring that the company has the resources to meet project demands and grow sustainably.

Medical Practice Innovation

A medical practice aiming to invest in cutting-edge technology to improve patient care might face challenges securing a loan from a traditional bank. The technology, while necessary for the practice’s long-term success, might not have a readily quantifiable ROI (Return on Investment) for traditional lenders. A private lender, however, can take a more holistic view, considering the potential for increased patient volume and improved service quality. This allows the medical practice to acquire the technology, enhance its services, and ultimately attract more patients. Medical practice financing options from private lenders can be specifically tailored to the unique needs of healthcare providers, including business loans for healthcare professionals and medical practice business loans.

Manufacturing Efficiency Boost

A manufacturing company struggling with outdated equipment might find traditional bank loans for equipment financing loans cumbersome and time-consuming. Here, a private lender can offer a streamlined equipment financing solution. This allows the manufacturer to quickly acquire the new equipment needed to boost production efficiency, reduce costs, and remain competitive in the market. Private lenders understand the importance of equipment financing for small business, and offer fast equipment financing options that enable manufacturers to stay ahead of technological advancements and market demands.

Main Street Flourishes

Even brick-and-mortar stores on Main Street can benefit from private financial solutions. A local bakery looking to expand its kitchen space or a bookstore needing to invest in online inventory management software can find the perfect fit with a private lender. These solutions provide the capital needed to modernize, expand their offerings, and compete effectively in the digital age. For instance, a small business loan in California might help a boutique expand its storefront, while small business loans in Florida could support a restaurant’s renovation. In states like Texas, Georgia, Illinois, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, and Virginia, private lenders offer small business loan programs.

Private financial solution providers offer a comprehensive and flexible alternative to traditional banking, enabling small businesses to access the funding they need to grow and thrive. Whether through online small business loans, working capital business loans, or short term small business loans, these lenders are helping to unleash the potential of businesses across all industries and regions.

Beyond the Numbers: The Human Touch in Business Funding

While speed, flexibility, and competitive rates are undeniably attractive features, the human touch offered by private financial solution providers shouldn’t be overlooked. Â Unlike traditional banks with a one-size-fits-all approach, private lenders take the time to understand your business, its unique challenges, and its long-term vision. This personalized approach allows for a collaborative relationship where the lender acts as a partner in your success story.

Imagine a dedicated loan officer working with you to tailor a financing plan that aligns perfectly with your business goals. They provide guidance and answer your questions throughout the process, ensuring a clear and comfortable experience. This personalized service fosters trust and empowers you to make informed decisions about your business finances.

Unlocking Your Business Potential with VIP Capital Funding

At VIP Capital Funding, we are passionate about helping small and mid-sized businesses like yours achieve their full potential. We offer a wide range of loan options, including:

Short-Term Loans for Business: Get the immediate cash flow you need to cover unexpected expenses, bridge seasonal gaps, or capitalize on time-sensitive opportunities.

Working Capital Loans: Fuel your daily operations with flexible working capital loans to manage inventory, payroll, and other ongoing business expenses.

Equipment Financing: Invest in the equipment you need to operate efficiently and stay competitive in your industry. We offer various equipment financing options with affordable terms.

Business Line of Credit: Enjoy the flexibility of a business line of credit that allows you to access funds as needed, perfect for ongoing operational needs or unexpected expenses.

In addition to these loan options, we provide:

Fast and Streamlined Application Process: Our online application process is quick and easy, allowing you to focus on running your business.

Transparent Communication: We believe in clear communication throughout the entire process. You’ll always know the status of your loan application and have a dedicated representative to answer your questions.

Competitive Rates and Flexible Terms: We offer competitive rates and flexible terms to ensure your loan is affordable and aligns with your business goals.

Don’t let the limitations of traditional banking hinder your business growth. Partner with VIP Capital Funding today and unlock the full potential of your business!

VIP Capital Funding: Your Partner in Business Growth

VIP Capital Funding understands the struggles faced by small and mid-sized businesses in securing the capital they need to thrive. Â We offer a fast, efficient, and hassle-free way to access substantial amounts of working capital with minimal paperwork.

Our focus is on helping businesses aggressively improve their cash flow by providing the financial solutions they need, when they need them most. Whether you require funding for equipment financing, short-term business loans, working capital, or other needs, VIP Capital Funding can tailor a program specifically designed to meet your unique goals.

Here are just a few of the benefits you can expect when partnering with VIP Capital Funding:

Fast Approvals

One of the standout features of our financial services is the speed with which we process funding requests. Unlike traditional banks that may take weeks to review and approve loan applications, we aim to provide decisions within 24-48 hours. This rapid turnaround time is crucial for businesses that need immediate access to capital to address urgent needs or take advantage of time-sensitive opportunities. Whether you’re facing unexpected expenses, needing to quickly restock inventory, or looking to capitalize on a new business opportunity, our fast approval process ensures that you won’t be left waiting. We streamline the application process to minimize the hassle and expedite funding, so you can focus on running and growing your business without unnecessary delays.

Flexible Loan Options

We understand that every business is unique, with its own set of financial needs and goals. That’s why we offer a diverse range of loan products designed to meet various requirements. Our options include short-term financing, ideal for covering immediate cash flow gaps or unexpected expenses, and long-term equipment loans, perfect for investing in new machinery or technology that can drive your business forward. We also provide specialized loans such as working capital loans, short term loans for business, and equipment financing for new business. Whether you need funds to expand your operations, invest in new technology, or manage seasonal fluctuations, our flexible loan options allow you to choose the best solution tailored to your specific circumstances.

Competitive Rates and Terms

We are committed to helping your business succeed by offering competitive rates and terms that align with your financial objectives. Our goal is to provide you with the best possible financing solutions that are both affordable and sustainable. By working closely with you to understand your business needs, we tailor our loan terms to ensure they are manageable and beneficial. This includes offering easy small business loans with favorable interest rates, flexible repayment schedules, and transparent terms. We strive to make our loan products accessible to businesses of all sizes and stages, ensuring that you can obtain the necessary funding without putting undue strain on your financial resources.

Exceptional Customer Service

Our commitment to exceptional customer service sets us apart from other lenders. From the moment you inquire about a loan to the final repayment, our dedicated team is here to support you every step of the way. We pride ourselves on providing personalized service, ensuring that all your questions are answered and any concerns are addressed promptly. Our loan officers are knowledgeable and experienced, offering insights and advice tailored to your specific business needs. Whether you need assistance with the application process, understanding loan terms, or managing your repayments, we are here to help. Our goal is to build a long-term relationship with you, supporting your business’s growth and success through attentive and responsive service.

Ready to Take Your Business to the Next Level?

If you’re a small or mid-sized business owner looking for a faster, more flexible funding solution than traditional banking offers, VIP Capital Funding can be your ideal partner. Â We believe in the power of small businesses and are dedicated to helping them achieve their full potential.

Contact VIP Capital Funding today to discuss your business needs and explore how our private financial solutions can help you secure the capital you need to grow your business and achieve your goals.Don’t let traditional banking roadblocks hinder your entrepreneurial dreams. Choose VIP Capital Funding and unlock the full potential of your business!