For small businesses, maintaining a healthy cash flow is crucial to ensure smooth operations. This is where working capital loans come into play, providing the necessary funds to cover short-term expenses and sustain day-to-day business activities.

This comprehensive guide will explore what working capital loans are, how they work, the reasons for acquiring them, the amount of working capital needed by small businesses, the strategic use of these loans for cash flow management, and some frequently asked questions. Read on!

What is a Working Capital Loan?

A working capital loan is a type of short-term loan designed to cover a company’s everyday operational expenses. These expenses might include payroll, rent, utilities, inventory purchases, and other short-term liabilities. Unlike other types of loans that are used for long-term investments or major purchases, working capital loans are specifically tailored to provide the liquidity needed to run daily business operations smoothly.

Working capital loans are particularly beneficial for small businesses that may experience seasonal fluctuations in revenue or have uneven cash flows. By securing a working capital loan, these businesses can bridge the gap between their income and expenses, ensuring they have the necessary funds to continue operating without interruption.

How Does a Working Capital Loan Work?

The process of obtaining a working capital loan involves several steps, from application to repayment. Here’s a detailed breakdown of how it works:

Application Process

Identify Needs: The first step is to determine the exact financial needs of the business. This involves assessing the short-term expenses that need to be covered.

Choose a Lender: Small businesses can choose from various private money lenders who offer working capital loans. It’s essential to compare the terms, interest rates, and repayment options of different lenders to find the best fit.

Prepare Documentation: Most lenders require specific documents to process a loan application. These may include financial statements, bank statements, tax returns, and proof of business ownership.

Submit Application: Once all necessary documentation is gathered, the application can be submitted either online or in person, depending on the lender’s process.

Approval and Disbursement

Credit Assessment: Lenders will evaluate the business’s creditworthiness, focusing on its ability to repay the loan. While credit scores are considered, they are not the sole determining factor for approval.

Loan Offer: If the application is approved, the lender will present a loan offer detailing the amount, interest rate, and repayment terms.

Acceptance and Disbursement: Upon accepting the loan offer, the funds are disbursed to the business’s bank account. This process can be swift, with some lenders providing funds within a few days.

Repayment

Repayment terms for working capital loans vary based on the lender and the specific loan agreement. Generally, these loans are short-term, with repayment periods ranging from a few months to a couple of years. Repayment can be structured in various ways, including:

FixedMonthly Payments: Equal payments made each month.

Weekly or Bi-weekly Payments: Smaller, more frequent payments.

Revenue-based Payments: Payments based on a percentage of the business’s monthly revenue.

Reasons to Get a Working Capital Loan

There are several reasons why a small business might seek a working capital loan, including:

1. Managing Cash Flow

One of the primary reasons to get a working capital loan is to manage cash flow effectively. Small businesses often face periods where expenses exceed income, such as during off-peak seasons or when waiting for customer payments. A working capital loan can bridge these gaps, ensuring that bills and payroll are covered without disrupting operations.

2. Seizing Business Opportunities

Opportunities often arise unexpectedly, and having the financial flexibility to seize them can make a significant difference for small businesses. Whether it’s purchasing discounted inventory, investing in marketing campaigns, or expanding product lines, a working capital loan provides the necessary funds to act swiftly and capitalize on these opportunities.

3. Covering Unexpected Expenses

Unexpected expenses can occur at any time, from equipment breakdowns to sudden increases in supply costs. A working capital loan can provide a safety net to cover these unforeseen costs without straining the business’s finances.

4. Seasonal Fluctuations

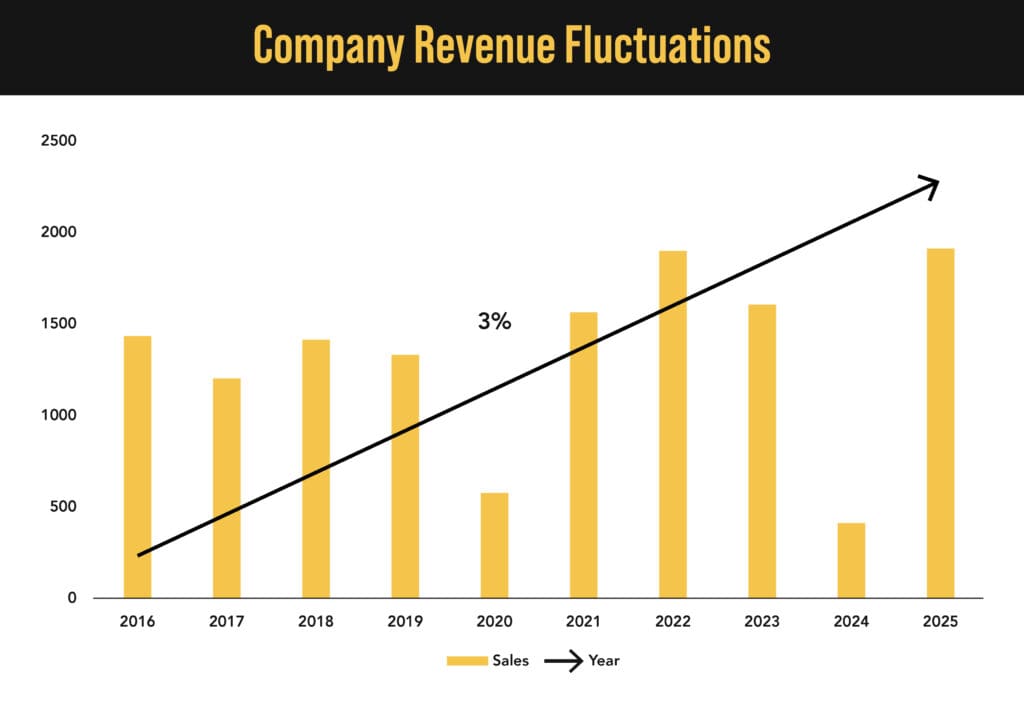

Many small businesses experience seasonal fluctuations in revenue, such as retail stores during holiday seasons or tourism-related businesses during peak travel periods. A working capital loan can help smooth out these fluctuations by providing the funds needed during slower periods to prepare for busy seasons.

5. Business Expansion

Expanding a business will often require significant upfront investments in areas such as new locations, additional staff, or enhanced marketing efforts. A working capital loan can provide the necessary capital to support growth initiatives without depleting the company’s reserves.

How Much Working Capital Does a Small Business Need?

Determining the right amount of working capital for a small business depends on several factors, including the nature of the business, industry standards, and specific operational needs. Here are some key considerations:

1. Assessing Current Assets and Liabilities

A fundamental step in determining working capital needs is to assess the business’s current assets and liabilities. Current assets include cash, accounts receivable, and inventory, while current liabilities include accounts payable and short-term debts. The difference between current assets and current liabilities is the working capital.

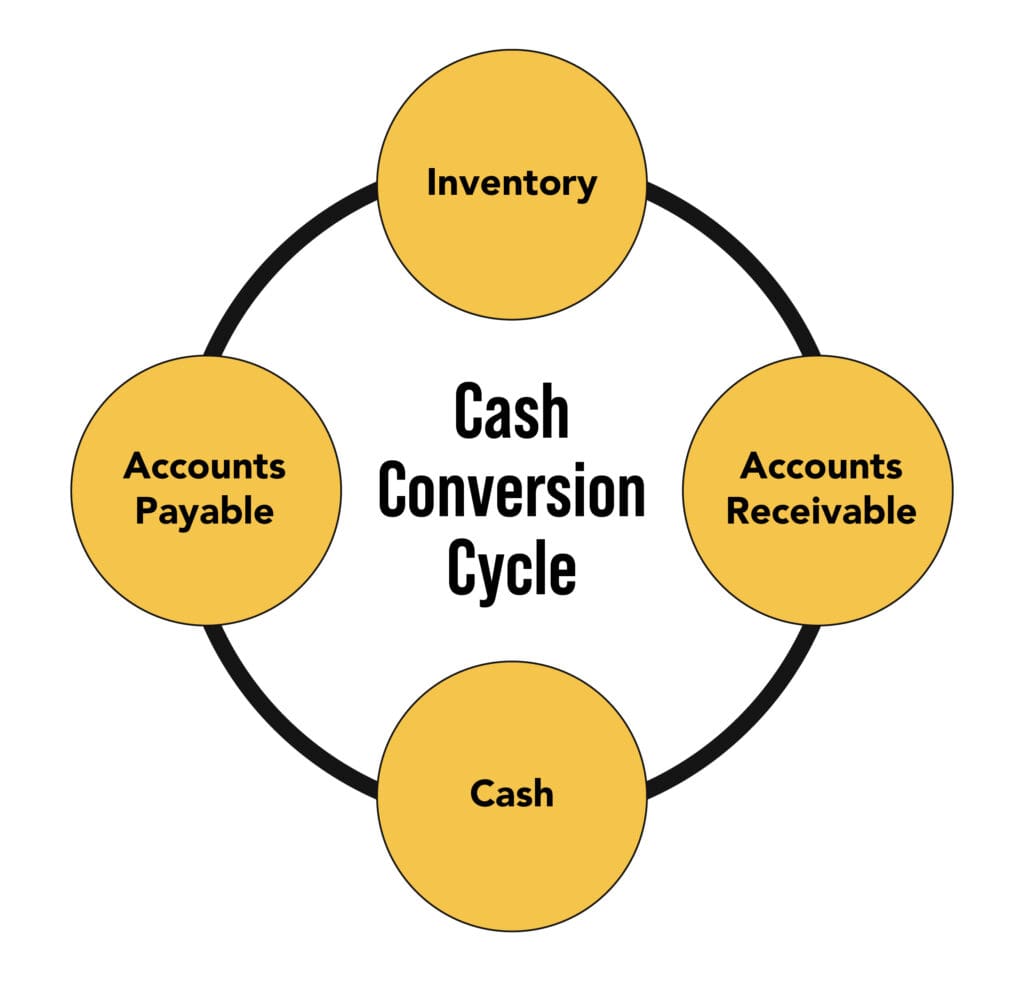

2. Cash Conversion Cycle

The cash conversion cycle (CCC)Â is a critical metric that measures the time it takes for a business to convert its inventory and other resources into cash flow from sales. The CCC helps determine how much working capital is needed to sustain operations during this period. A longer CCC typically indicates a higher need for working capital.

3. Industry Benchmarks

Different industries have varying working capital requirements based on their operational cycles and business models. Researching industry benchmarks can provide a useful reference point for small businesses to gauge their working capital needs.

4. Growth and Expansion Plans

Businesses planning for growth or expansion should factor in the additional working capital required to support increased operational demands. This might include higher inventory levels, increased marketing efforts, or additional staff.

5. Seasonal Needs

For businesses with seasonal fluctuations, it’s essential to plan for the periods when additional working capital will be needed to cover expenses during slower sales cycles. This planning ensures that the business can maintain operations and be ready for peak seasons.

Strategic Use of Working Capital Loans for Cash Flow

Effectively managing cash flow is critical for the success and sustainability of small businesses. Working capital loans can be a powerful tool in achieving this goal. Here are some strategic ways to use working capital loans to enhance cash flow management:

1. Inventory Management

Maintaining optimal inventory levels is crucial for meeting customer demand without tying up excessive funds in stock. A working capital loan can help small businesses purchase inventory in bulk at discounted rates or stock up on essential items before peak seasons, ensuring they have sufficient inventory to meet customer needs.

2. Payroll and Operational Expenses

Ensuring timely payment of salaries and operational expenses is vital for maintaining employee morale and smooth business operations. Working capital loans can provide the necessary funds to cover payroll and other recurring expenses during periods of low cash flow, preventing disruptions and maintaining employee satisfaction.

3. Marketing and Advertising Campaigns

Investing in marketing and advertising is essential for business growth and attracting new customers. However, these activities often require significant upfront costs. A working capital loan can provide the funds needed to launch marketing campaigns, enhance brand visibility, and drive sales, ultimately improving cash flow.

4. Renovations and Upgrades

Regular maintenance, renovations, and upgrades are necessary to keep a business competitive and appealing to customers. Whether it’s refurbishing a retail space, upgrading equipment, or enhancing the online presence, a working capital loan can fund these improvements without straining the business’s cash reserves.

5. Managing Accounts Receivable

Many small businesses face challenges with delayed payments from customers, leading to cash flow issues. A working capital loan can bridge the gap between invoicing and payment collection, ensuring that the business has the necessary funds to continue operations while waiting for customer payments.

6. Leveraging Early Payment Discounts

Suppliers often offer discounts for early payments, which can significantly reduce procurement costs. A working capital loan can provide the liquidity needed to take advantage of these discounts, ultimately improving profit margins and cash flow.

7. Expanding Product Lines

Introducing new products or services can attract more customers and increase revenue. However, developing and launching new offerings require investment in research, development, and marketing. A working capital loan can provide the necessary funds to support these initiatives and drive business growth.

8. Emergency Funds

Having access to emergency funds is crucial for small businesses to handle unexpected situations such as natural disasters, economic downturns, or sudden market changes. A working capital loan can serve as a financial cushion, allowing businesses to navigate through challenging times without compromising their operations.

How Working Capital Loans Can Grow Your Small Business

Working capital loans are designed to cover the short-term financial needs of a business. These needs can range from purchasing inventory, covering payroll, paying rent, or handling unexpected expenses. Here’s how these loans can contribute to the growth and stability of your small business:

1. Maintaining Cash Flow

Cash flow is the lifeblood of any business. Positive cash flow ensures that a business can meet its financial obligations, such as paying suppliers and employees, without disruption. Working capital loans provide a cushion that helps maintain cash flow during slow periods or when facing unexpected expenses. This stability allows business owners to focus on growth rather than constantly worrying about making ends meet.

2. Seizing Growth Opportunities

Opportunities for growth can arise unexpectedly. Whether it’s a chance to buy inventory at a discounted rate, expand to a new location, or invest in marketing to attract more customers, having access to working capital can make all the difference. A working capital loan can provide the funds needed to seize these opportunities without compromising the business’s financial health.

3. Improving Inventory Management

For businesses that rely heavily on inventory, having the right stock at the right time is crucial. Working capital loans can help small businesses purchase inventory in bulk, take advantage of supplier discounts, and ensure they have enough stock to meet customer demand. This not only helps in maintaining customer satisfaction but also improves profitability by reducing per-unit costs.

4. Handling Seasonal Fluctuations

Many small businesses experience seasonal fluctuations in sales. For instance, a retail business might see higher sales during the holiday season but slower periods during other times of the year. Working capital loans can provide the necessary funds to manage these fluctuations, ensuring that the business can operate smoothly throughout the year. This can include covering expenses during slow periods or ramping up inventory and staffing during peak seasons.

5. Enhancing Creditworthiness

Consistently managing cash flow and meeting financial obligations on time can enhance a business’s creditworthiness. While credit scores aren’t the primary focus here, having a history of successfully repaying loans can make it easier for a business to secure additional financing in the future. This can be beneficial for long-term growth and expansion plans.

Other Benefits of Working Capital Loans

Beyond the direct impact on business operations and growth, working capital loans offer several other benefits that make them an attractive financing option for small businesses.

1. Flexibility

One of the significant advantages of working capital loans is their flexibility. Unlike traditional loans that might be earmarked for specific purposes like purchasing equipment or real estate, working capital loans can be used for a variety of needs. This flexibility allows business owners to allocate funds where they are needed most, whether it’s for daily operations, covering unexpected costs, or investing in growth initiatives.

2. Quick Access to Funds

In the fast-paced world of small business, timing is everything. Working capital loans are often designed to provide quick access to funds, sometimes within days of approval. This rapid turnaround can be crucial when dealing with urgent financial needs or time-sensitive opportunities. Private money lenders, in particular, are known for their ability to expedite the loan process, making them a viable option for businesses that need funds quickly.

3. No Collateral Required

Many working capital loans do not require collateral, which can be a significant advantage for small businesses that may not have substantial assets to pledge. Unsecured working capital loans rely on the business’s overall health and cash flow rather than specific assets, making them more accessible to a broader range of businesses.

4. Preserve Ownership

Unlike equity financing, where business owners have to give up a portion of their ownership in exchange for capital, working capital loans allow owners to retain full control of their business. This means that the business can grow and benefit from the additional capital without diluting ownership or decision-making power.

5. Customizable Terms

Working capital loans often come with customizable terms that can be tailored to fit the specific needs of the business. This can include the loan amount, repayment schedule, and interest rates. By working with private money lenders, small business owners can negotiate terms that align with their financial situation and cash flow patterns, making repayment more manageable.

FAQs Related to Working Capital Loans

Navigating the world of small business financing can be complex. Here are some frequently asked questions about working capital loans to help clarify any uncertainties.

Q1: What are the eligibility criteria for a working capital loan?

At VIP Capital Funding, we offer revenue-based funding where credit score is primarily not an issue. We can fund businesses that have relatively lower credit scores, provided they are generating at least $50K annually. For businesses with higher revenues, such as $600K annually or $100K monthly, we can offer more substantial funding options.

Q2: What are the interest rates for working capital loans?

Interest rates for working capital loans can vary depending on the lender, the loan amount, and the repayment term. Private money lenders may have higher interest rates compared to traditional banks due to the increased risk they take. However, they often offer more flexible terms and quicker access to funds.

Q3: Can I get a working capital loan if I have an existing loan?

Yes, it is possible to obtain a working capital loan even if you have an existing loan. However, lenders will assess your overall financial health and ability to repay both loans. It’s essential to provide a clear picture of your business’s cash flow and how the new loan will be used to support your operations and growth.

Q4: How much can I borrow with a working capital loan?

The loan amount you can borrow depends on several factors, including your business’s revenue, cash flow, and the lender’s policies. Private money lenders may offer a wide range of loan amounts, from a few thousand dollars to several hundred thousand dollars, depending on your business needs and qualifications.

Q5: Can I use a working capital loan for any purpose?

While working capital loans are designed to cover short-term operational expenses, they offer significant flexibility in how the funds can be used. You can use the loan for various purposes, including purchasing inventory, covering payroll, paying rent, or investing in marketing and growth initiatives. However, it’s essential to use the funds in a way that supports your business’s financial health and growth.

Unlock your small business’s potential with VIP Capital Funding! Offering fast and flexible financing options like small business loans, equipment financing, and short-term business funding, we cater to businesses in California, Florida, Texas, and beyond. Apply online for easy and quick access to the capital you need to grow and thrive.

From medical practices to construction companies, we have the perfect funding solutions.

Contact us now to get started.