Business Loans

Washington's Fastest Small Business Loans. Apply Now!

Don’t let access to capital hinder your business dreams. VIP Capital Funding is here to help.

Streamlined, flexible, and fast—our small business loans in Washington accelerate your growth. Apply now.

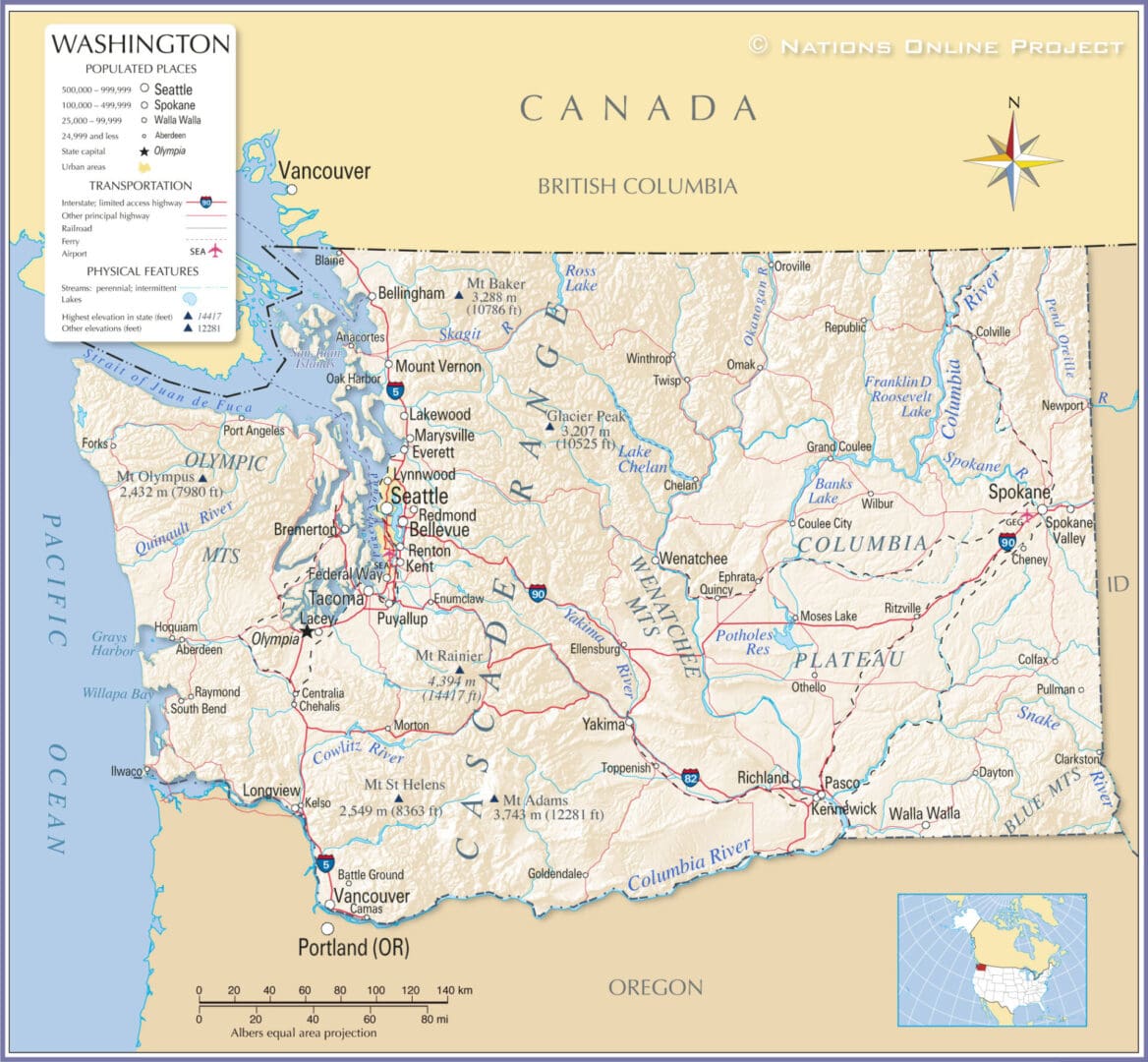

Small Business Loans in Washington

With its diversified economy, booming tech industry, and robust support system for entrepreneurs, Washington hosts over 600,000 small businesses in the state, employing over 1.4 million people. While tech giants like Microsoft and Amazon headline the state’s business scene, small businesses represent 99.5% of all Washington-based businesses.

Aspiring entrepreneurs are well-supported by Washington’s network of business incubators, accelerators, and development centers. These resources provide mentorship, funding opportunities, and co-working spaces, making it easier to turn ideas into thriving businesses.

Washington is known for its business-friendly environment with a focus on manageable regulations. The absence of personal and corporate income tax makes it attractive for both businesses and employees. Moreover, the state’s proximity to major transportation hubs and international trade partners like Canada facilitates the seamless movement of goods and services.

Despite the strong support system for small businesses in Washington, securing capital remains a hurdle for many. While incubators and favorable regulations provide a great starting point, turning innovative ideas into successful businesses often requires investment. This is where our fast small business loans in Washington come to the rescue!

Although traditional bank loans have played a historical role, the increased competition and cumbersome application processes can make them challenging for many small businesses. To bridge this gap, VIP Capital Funding offers small business loans that provide entrepreneurs with greater flexibility and faster access to capital.

As the state’s trusted small business loan provider, our goal is to eliminate any financial hurdles in your business journey. We provide a seamless online small business loan application process, eliminating paperwork and waiting lines, so you can get your funds within days, not weeks or months.

Apply for a small business loan now.

VIP Capital Funding – Your Partner for Success in Washington

Whether you’re running a construction business or a restaurant, our small business loan program can provide the essential funding you need. This working capital will help cover various costs, including inventory, equipment, marketing campaigns, and securing the perfect location. By leveraging our well-structured loan, you can overcome financial hurdles and position your venture for long-term success.

Here are some ways it can help:

Bridge Cash Flow Gaps

Even the most established business can experience temporary cash flow fluctuations. For small businesses, coping with reduced revenue can be even more challenging. A loan acts as a safety net, helping you cover operational costs during these periods. This way, you can maintain smooth business operations, meet payroll obligations, and avoid late payment penalties on bills.

Investing in Growth Initiatives

Running a business in a fast-paced environment like Washington means growth opportunities can arise at any minute. However, lack of access to adequate funds can hinder your ability to take advantage of these moments, which may slow down your growth. Obtaining a small business loan fast will provide the necessary capital to invest in growth opportunities, participate in trade shows, or implement new technologies. This agility allows you to stay ahead of the competition and take your business to the next level.

Building Business Credit

Responsible repayment of a Washington small business loan helps establish a positive credit history for your company. This improved credit score can unlock better loan terms and interest rates in the future, making it easier to secure financing for further growth endeavors.

Make sure to carefully consider your business goals and financial situation when selecting a loan option. Our loan specialists can help you navigate the different offerings and choose the loan that best suits your requirements. Get in touch with us now.

Fast and Hassle-Free Approval Process

Our soft credit pull minimizes the impact on your credit score while providing a quick assessment of your eligibility. Experience the speed and convenience of pre-approval within 24 hours, allowing you to make informed financial decisions without delay. There’s no waiting in line or getting caught in complex bureaucratic processes.

Access to Capital in Days

Get the funding you need quickly. Once approved, you can receive your business loan within 1-3 business days. This eliminates the wait times often associated with traditional bank loans, allowing you to capitalize on momentum and keep your business moving forward.

Tax Advantages

The interest paid on your small business loan from VIP Capital Funding is typically tax-deductible. This translates to potential tax savings that can significantly improve your bottom line and free up resources for further investment.

Freedom from Prepayment Penalties:

We are not like your ordinary lender; we believe in empowering your financial decisions. There’s no penalty for early repayment. We encourage you to pay down your loan at your own pace while still benefiting from the prepayment discounts offered.

Renewal Opportunities

Demonstrate your financial responsibility by diligently paying down at least 50% of your initial loan. This commitment unlocks the opportunity to renew your loan and access additional capital for continued growth. VIP Capital Funding is here to support you throughout your entrepreneurial journey.

Small Business Loans Made Simple and Fast

With so many funding options available, it can be difficult to determine which one is the best fit for your business. However, at VIP Capital Funding, we offer a hassle-free and streamlined loan process, along with flexible terms that are tailored to meet your unique needs. Our goal is to help you achieve your growth objectives and take your business to the next level. Here’s what sets us apart:

Financing Tailored to Your Needs

We understand that every business has unique funding needs. Our small business loan programs range from $50,000 to $15,000,000. This allows you to secure enough capital to address your specific business needs. Whether you require capital for a new venture, expansion plans, or overcoming cash flow gaps, VIP Capital Funding has the resources to empower your growth.

Applying for Your Small Business Loan in Washington

Here’s a step-by-step guide to securing our quick and easy small business loans:

Step 1: Gather Your Documents

To expedite the process, have the following documents readily available:

- Basic business information: Name, address, formation documents, etc.

- Financial statements: Recent bank statements and business tax returns (if applicable).

- Ownership details: Identification and ownership percentages of all business owners.

Step 2: Apply Online in Minutes

Head over to our secure online application portal. The user-friendly interface guides you through a series of questions about your business, funding needs, and financial situation. The entire process can be completed in a matter of minutes.

Step 3: Soft Credit Pull and Pre-Approval (within 24 hours)

We understand the importance of protecting your credit score. Our soft credit pull provides a quick assessment of your eligibility without impacting your score. Within 24 hours, you’ll receive a pre-approval notification, allowing you to move forward with confidence.

Step 4: Submit Supporting Documents

Once pre-approved, securely upload the requested documents through our online portal. Our dedicated team will review your application thoroughly.

Step 5: Funding Approval and Disbursement (within 1-3 business days):

Following a comprehensive review, you’ll receive a final loan approval decision. Upon successful approval, your business loan will be disbursed within 1-3 business days, eliminating lengthy wait times.

Your Dedicated Partner Beyond Funding

Our commitment to your success doesn’t stop at funding. The VIP Capital Funding team is here to support you throughout your loan repayment journey. We offer:

- Transparent Repayment Schedule: A clear and easy-to-understand breakdown of your loan repayment plan, ensuring you stay on top of your obligations.

- Flexible Payment Options: We understand that business cash flow can fluctuate. Our team is available to discuss any questions or concerns you may have regarding your repayment plan and explore potential solutions if needed.

- Dedicated Customer Service: Our friendly and knowledgeable customer service representatives are just a phone call or email away. They can answer any questions you have about your loan or repayment process or even offer guidance on financial management strategies.

With VIP Capital Funding, you gain a dedicated partner invested in your long-term growth. Our streamlined application process, combined with our unwavering support throughout your repayment journey, makes us the ideal choice to grow your small business.

Invest in Growth. Reap the Rewards.

VIP Capital Funding is one of the leading small business finance companies in Washington, providing a competitive advantage to small businesses with our funding solutions. Founded in 2017, our mission is to help you improve your cash flow with minimal hassle or paperwork.

Our clients have seen remarkable results. By leveraging our small business loans, they’ve achieved an impressive 300%-500% increase in ROI, directly contributing to significant job creation and business expansion. These results solidify our commitment to empowering Washington’s businesses to thrive.

Partner with us today and benefit from our fast funding decisions, transparent repayment plans, and dedicated customer service.

Apply for a small business loan today!