First Time Business Loans

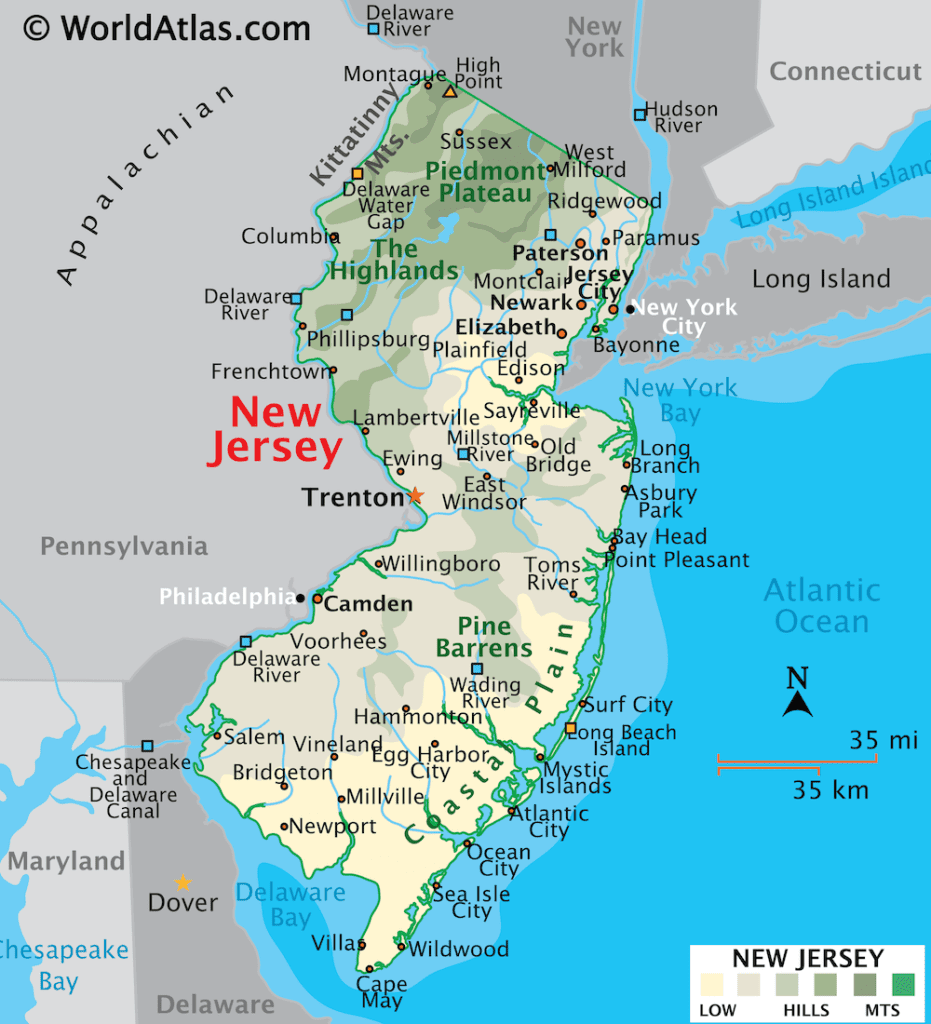

First-Time Business Loans in New Jersey

Launching a business is an exciting milestone, but it often comes with financial challenges. Whether you need funding for equipment, inventory, or marketing, securing your first business loan is critical to laying the foundation for long-term success. First-time business loans are designed to provide startups and new companies with the capital they need to turn their ideas into thriving enterprises.

What Are First-Time Business Loans?

First-time business loans are specifically tailored for entrepreneurs and startups entering the business world for the first time. These loans provide the necessary financial support to cover startup costs, operational expenses, and growth initiatives.

Starting a business requires significant upfront investment. From renting office space to purchasing inventory and equipment, early-stage businesses often encounter expenses that exceed their initial cash flow. First-time business loans bridge this financial gap, allowing startups to focus on building their operations rather than worrying about funding.

These loans also help establish your business’s credit profile, which is essential for securing additional financing in the future.

Challenges with Conventional Lending for Startups

Traditional banks and SBA loans are often the first options entrepreneurs consider when seeking funding. However, these institutions can pose significant barriers for new businesses:

- Strict Eligibility Requirements

Conventional lenders often require years of financial history, high credit scores, and substantial collateral—criteria that many startups and first-time entrepreneurs cannot meet.

- Lengthy Approval Processes

Banks typically take weeks or even months to process loan applications, delaying access to critical funds when businesses need them most.

- Limited Flexibility

Traditional lenders may offer rigid loan structures and repayment terms, making it difficult for startups to manage cash flow effectively.

These obstacles leave many promising entrepreneurs unable to access the funds they need to get started. That’s where VIP Capital Funding comes in.

How VIP Capital Funding Supports New Jersey Startups

At VIP Capital Funding, we specialize in providing first-time business loans that prioritize the needs of entrepreneurs. Our innovative approach eliminates the barriers of conventional lending, ensuring you get the funding you need—when you need it.

- Fast and Simple Application Process

Our streamlined online application process takes just minutes to complete. Unlike banks, we require minimal paperwork, so you can focus on growing your business rather than navigating bureaucratic hurdles.

- Quick Approvals and Funding

We understand the urgency of launching a business. That’s why we process applications within 1-2 days, allowing you to access funds promptly and avoid unnecessary delays.

- High Approval Rates

With a 95% approval ratio, we’re committed to supporting entrepreneurs who may not qualify for traditional loans.

- Customized Loan Solutions

We offer loan amounts ranging from $50,000 to $15 million, tailored to meet the unique needs of your business. Whether you’re opening a boutique in Hoboken or a tech startup in Jersey City, we have the resources to help you succeed.

Types of Businesses That Benefit from First-Time Loans

New Jersey’s economy is rich with opportunities across various industries. First-time business loans are invaluable for startups in sectors such as:

- Retail: From local shops in Princeton to large-scale ventures in Newark, retail businesses often need funds for inventory, marketing, and storefront development.

- Technology: Startups in New Jersey’s growing tech sector use loans for research, hiring, and product launches.

- Food and Beverage: Restaurants, food trucks, and catering services benefit from loans to cover equipment, ingredients, and leasehold improvements.

- Healthcare Services: Private practices and wellness clinics use loans to invest in equipment and technology.

- Manufacturing: Small-scale manufacturers leverage loans to purchase machinery and raw materials.

Regardless of your industry, our loans are designed to provide the financial support you need to establish and grow your business.

How First-Time Business Loans Are Used

First-time business loans are highly versatile and can be used for a variety of purposes. Entrepreneurs often utilize these loans to:

- Cover Startup Costs

From legal fees and licenses to branding and website development, launching a business involves numerous expenses. First-time business loans ensure you can handle these costs with ease.

- Purchase Equipment

Businesses in construction, manufacturing, and healthcare often require specialized equipment to operate. Loans provide the upfront capital needed for these essential purchases.

- Fund Marketing Campaigns

Effective marketing is critical for attracting customers and building your brand. Use your loan to invest in digital advertising, social media, and promotional materials.

- Manage Cash Flow

Startups frequently encounter cash flow gaps, especially in their early stages. Loans provide a financial cushion to cover payroll, rent, and other operational costs.

- Expand Operations

If your business grows quickly, a loan can help you scale up by hiring staff, expanding facilities, or increasing inventory.

Take the First Step Toward Business Success

Starting a business takes courage, determination, and the right financial support. With VIP Capital Funding, first-time entrepreneurs in New Jersey can access the capital they need to turn their dreams into reality.

Apply today and experience the VIP Capital Funding difference. Let’s build the future of your business together.