Unsecured Business Loans in New Jersey – No Collateral, No Worries

Unsecured Business Loans

Overview of Unsecured Business Loans in New Jersey

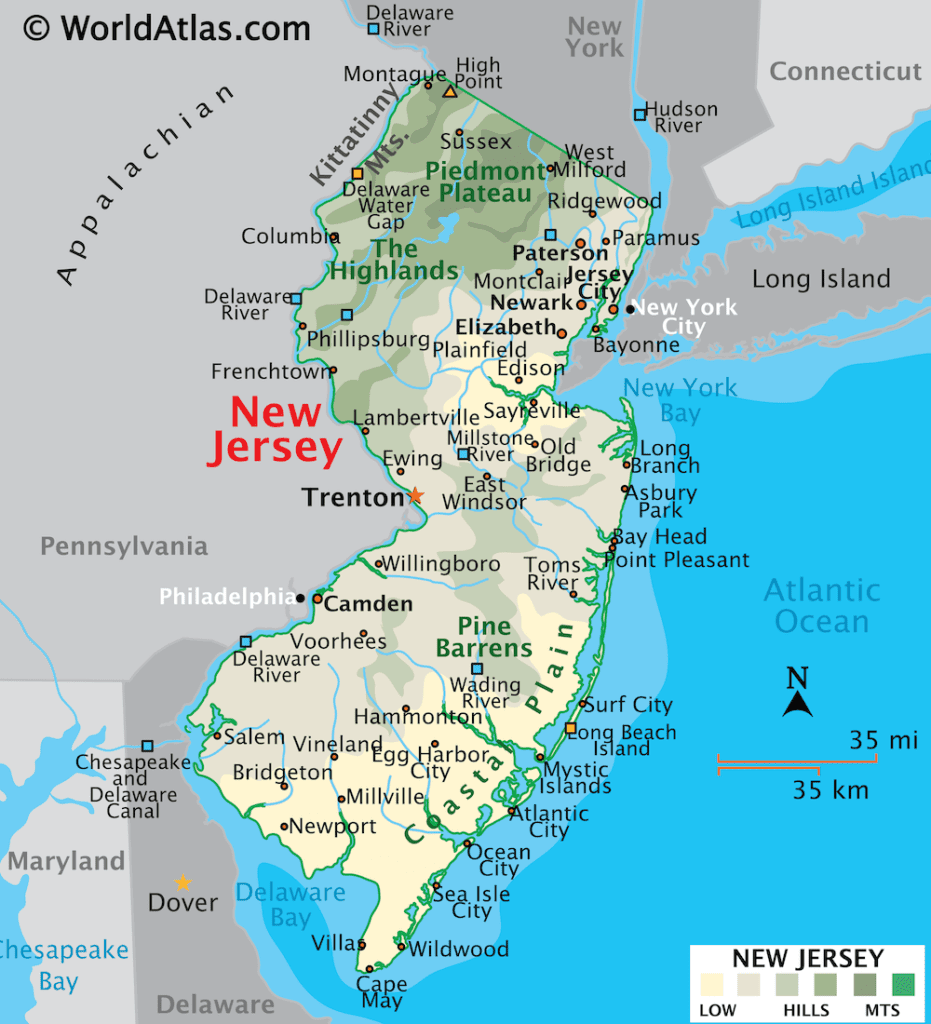

Business owners in New Jersey understand the value of flexibility and speed in securing funding to support their operations. Whether you’re running a small boutique in Hoboken, managing a tech startup in Jersey City, or operating a restaurant on the Jersey Shore, having access to fast and reliable financing can make all the difference.

Unsecured business loans offer a solution tailored to meet your unique needs. With no collateral requirements and a streamlined approval process, VIP Capital Funding empowers businesses across New Jersey to achieve growth, overcome challenges, and seize new opportunities.

Unsecured business loans are a type of financing that doesn’t require collateral such as property, equipment, or inventory to secure the loan. Instead, approval is based on factors such as your credit history, revenue, and business performance.

This makes unsecured loans an ideal choice for business owners who want access to funding without risking their assets. At VIP Capital Funding, we provide unsecured loans ranging from $50,000 to $15 million, helping businesses of all sizes achieve their financial goals.

Key Benefits of Unsecured Business Loans

1. No Risk to Your Assets

With unsecured loans, there’s no need to put your valuable assets on the line. This ensures your business can access the funds it needs without the stress of losing equipment, property, or inventory.

2. Quick Approval and Disbursement

Our streamlined process ensures you can get approved within 24 hours and receive funds in your account within 1–3 business days. This allows you to act quickly on opportunities or manage unexpected expenses.

3. Flexible Loan Amounts

We offer loans tailored to your needs, ranging from $50,000 to $15 million. Whether you need funds for day-to-day operations or a major expansion, we’ve got you covered.

4. Maintain Ownership

Unlike equity financing, unsecured loans don’t require you to give up any portion of your business. You retain full control while accessing the capital you need.

How Unsecured Business Loans Drive Success

1. Expand Operations

Unsecured loans can help you open new locations, expand your services, or enter new markets.

2. Manage Cash Flow

For businesses experiencing seasonal fluctuations or delayed payments, unsecured loans provide the working capital needed to maintain operations smoothly.

3. Upgrade Equipment and Technology

Invest in the latest tools, machinery, or software to stay competitive in your industry.

4. Fund Marketing Campaigns

Reach new customers and grow your brand with funding for targeted marketing and advertising campaigns.

VIP Capital Funding: Your Trusted Partner

With over 10 years of experience, VIP Capital Funding is a preferred financial institution for businesses nationwide. Our expertise in alternative lending allows us to provide tailored solutions that empower New Jersey businesses to succeed.

Why Choose VIP Capital Funding?

- Step-by-Step Guidance

We connect you with a dedicated specialist who will guide you through the application process and help you find the perfect loan for your needs. - Fast and Hassle-Free Application

Our streamlined application process ensures you can secure funding quickly and easily. - Tailored Loan Solutions

With loan amounts ranging from $50,000 to $15 million, we offer solutions that meet the unique needs of your business. - High ROI Potential

Clients report an average return on investment of 300% with our unsecured business loans, helping them achieve remarkable growth.

The Simple Loan Process

We’ve designed our process to make accessing funds as straightforward as possible:

- Create Your Profile

Begin by creating a business profile on our platform. - Submit Your Application

Provide information about your business and funding requirements. - Work with a Dedicated Consultant

Our specialists will help you identify the best loan options for your goals. - Receive Quick Approval

Get approved within 24 hours. - Access Your Funds

Funds are typically deposited into your account within 1–3 business days.

Apply for an unsecured business loan Today

Unsecured business loans are the perfect solution for New Jersey entrepreneurs looking for fast, flexible funding. At VIP Capital Funding, we’re here to support your growth with tailored solutions designed to meet your needs.

Take the next step toward success today.

Contact us to learn more or apply online to get started.