In today’s dynamic business landscape, securing the right type of financing is critical for small businesses looking to grow, stabilize cash flow, or invest in new opportunities. Among the many options available, two popular choices stand out: small business loans and working capital loans. Both can be beneficial, but understanding their unique advantages and limitations is essential for making the right decision. This guide will delve into the differences between small business loans and working capital loans, helping you determine which option is best suited to your business needs.

1. Understanding Small Business Loans

Small business loans are financing options designed specifically to help small businesses start, grow, or improve their operations. Typically offered by banks, credit unions, and online lenders, these loans can provide a substantial amount of capital over a longer term, making them ideal for large investments.

Types of Small Business Loans

There are several types of small business loans, each catering to different business needs:

Term Loans

Lump sum loans that are repaid over a fixed term, often used for significant investments like equipment or facility upgrades.

SBA Loans

Loans backed by the Small Business Administration, offering favorable terms for qualified small businesses.

Equipment Loans

Loans specifically for purchasing business-related equipment, often secured by the equipment itself.

Business Line of Credit

Provides ongoing access to funds up to a certain limit, useful for managing cash flow.

Pros of Small Business Loans

Longer Repayment Terms

Small business loans often come with extended repayment schedules, allowing businesses to spread costs over time.

Lower Interest Rates

For qualified applicants, small business loans can offer competitive interest rates, especially with SBA-backed loans.

Larger Loan Amounts

These loans can provide substantial funding, ideal for significant investments.

Cons of Small Business Loans

Stricter Eligibility Requirements

Traditional lenders often have rigorous requirements, including high credit scores and a proven track record.

Longer Approval Process

Due to the application process and requirements, securing a small business loan can take weeks or even months.

Collateral Requirements

Many small business loans require collateral, which could be risky if your business encounters financial trouble.

2. Understanding Working Capital Loans

Working capital loans are designed to cover day-to-day business expenses rather than long-term investments. They offer a quick way to access funds to keep your business running smoothly, especially during seasonal fluctuations or temporary cash flow gaps.

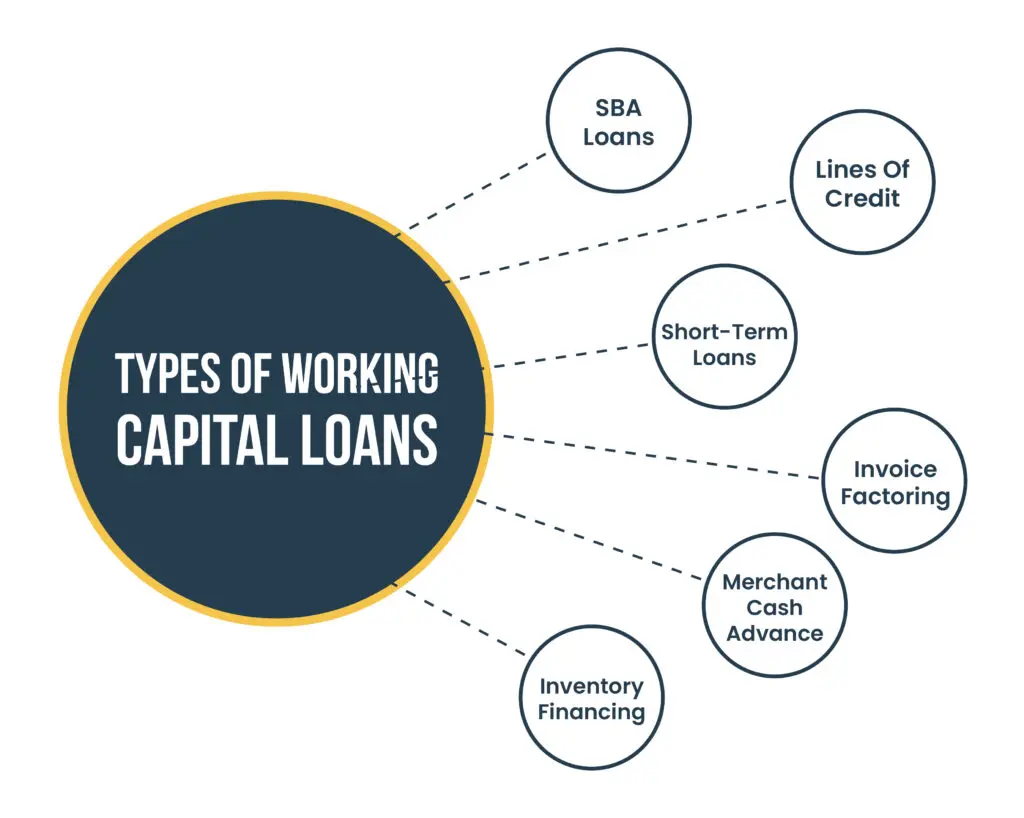

Types of Working Capital Loans

Working capital loans come in various forms to meet specific cash flow needs:

Short-Term Loans

These loans are typically repaid within a year and are used to cover immediate financial needs.

Invoice Financing

Allows businesses to borrow against outstanding invoices, providing quick cash flow for operations.

Merchant Cash Advances

A lump sum loan that is repaid through a percentage of future credit card sales, ideal for businesses with high daily sales.

Lines of Credit

A flexible option that allows you to borrow up to a certain amount and only pay interest on what you use.

Pros of Working Capital Loans

Quick Access to Funds

Working capital loans are typically approved quickly, providing fast access to cash.

Flexible Use of Funds

These loans can be used for various operational expenses, from payroll to rent, without specific restrictions.

No Collateral Required

Many working capital loans are unsecured, making them accessible for businesses without significant assets.

Cons of Working Capital Loans

Higher Interest Rates

Because they are short-term and unsecured, working capital loans often come with higher interest rates.

Smaller Loan Amounts

These loans are generally for smaller amounts, which may not be sufficient for major projects or investments.

Frequent Repayments

Working capital loans may require daily or weekly repayments, which could strain cash flow if not managed carefully.

3. Key Differences Between Small Business Loans and Working Capital Loans

Choosing between a small business loan and a working capital loan depends on several factors, including the purpose of the loan, the amount needed, and how quickly you need access to funds. Here’s a comparison of key differences:

| Factor | Small Business Loans | Working Capital Loans |

| Purpose | Long-term investments, expansion, large projects | Short-term expenses, cash flow |

| Loan Amount | Larger amounts | Smaller amounts |

| Repayment Term | Long-term | Short-term |

| Interest Rate | Lower rates | Higher rates |

| Approval Time | Slower | Faster |

| Collateral | Often required | Often not required |

Understanding these differences can help you select the financing option that aligns with your current business needs and financial strategy.

4. When to Choose a Small Business Loan

A small business loan might be the right choice if:

You Need a Large Sum of Money

For significant investments like opening a new location, purchasing equipment, or funding a large marketing campaign, a small business loan can provide the capital required.

You’re Planning for Long-Term Growth

Small business loans are designed for long-term projects that will yield returns over an extended period, such as five or ten years.

Your Business is Established and Profitable

Lenders offering small business loans generally prefer businesses with strong credit and a solid financial history.

Example Scenario

Imagine a small manufacturing company planning to upgrade its machinery to increase production capacity. The company estimates that it needs $100,000, and the machinery has a lifespan of over ten years. A small business loan with a long-term repayment schedule and a lower interest rate would be ideal in this case.

5. When to Choose a Working Capital Loan

A working capital loan might be the better choice if:

You Need Quick Access to Funds

If you need to cover payroll, rent, or other operational costs immediately, a working capital loan provides fast cash.

Your Business Experiences Seasonal Fluctuations

Many businesses, especially in retail and tourism, have seasonal cash flow needs. Working capital loans can help bridge the gap during off-seasons.

You Have a Short-Term Cash Flow Gap

If you’re waiting for client payments but need cash for immediate expenses, working capital loans or invoice financing can help cover the interim.

Example Scenario

Consider a retail business that needs additional cash flow for stocking inventory ahead of the holiday season. A working capital loan would provide the necessary funds quickly and could be repaid once holiday sales generate revenue.

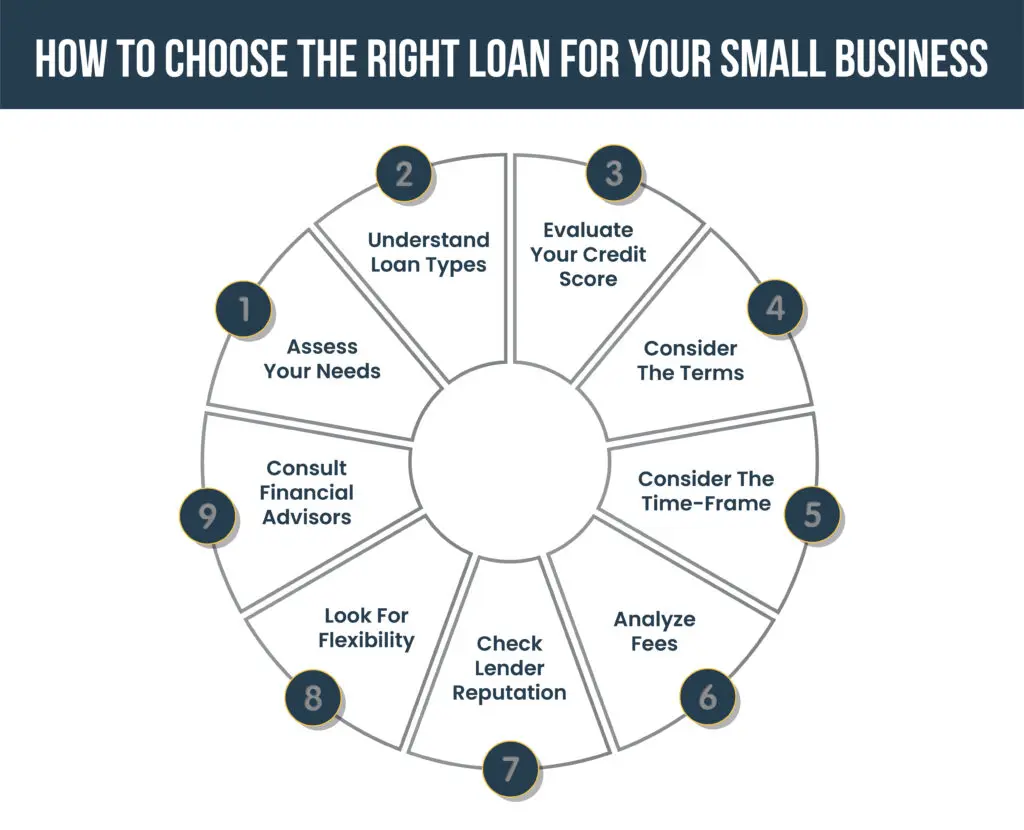

6. Choosing the Right Loan for Your Business

The choice between a small business loan and a working capital loan depends on various factors, including your business goals, timeline, and financial health. Here are a few questions to consider:

What Is the Purpose of the Loan?

If you’re funding a long-term project or expansion, a small business loan may be more suitable. If you’re covering short-term operating expenses, a working capital loan is likely the better choice.

How Soon Do You Need the Funds?

Small business loans generally have a longer approval process, while working capital loans can provide faster access to funds.

Can You Meet the Repayment Terms?

Small business loans come with longer terms, while working capital loans may have more frequent payments. Choose the option that aligns with your cash flow capabilities.

Do You Qualify for Traditional Loans?

If you meet the strict requirements of traditional small business loans, you may benefit from lower interest rates. Otherwise, consider the flexible terms of a working capital loan.

Final Thoughts

Both small business loans and working capital loans play an important role in helping businesses manage their finances and grow. However, the best choice depends on your business’s unique circumstances and goals.

Small business loans provide large sums for significant investments and long-term growth, making them ideal for established businesses with solid credit. Working capital loans, on the other hand, are well-suited for short-term needs, helping businesses manage cash flow fluctuations or bridge seasonal revenue gaps.

Taking the time to understand each option’s benefits and limitations will enable you to make an informed decision that supports your business’s financial health and growth potential.

Get Suitable Loans for Your Business Operation from VIP Capital Funding

Enjoy seamless business operations with loans from VIP Capital Funding! Whether you need working capital, equipment financing, or a line of credit, we offer tailored solutions to meet your unique needs. Secure the funding you deserve today. Visit our website or call us to learn more!