Commercial Business Loans

Commercial Business Loans from VIP Capital Funding

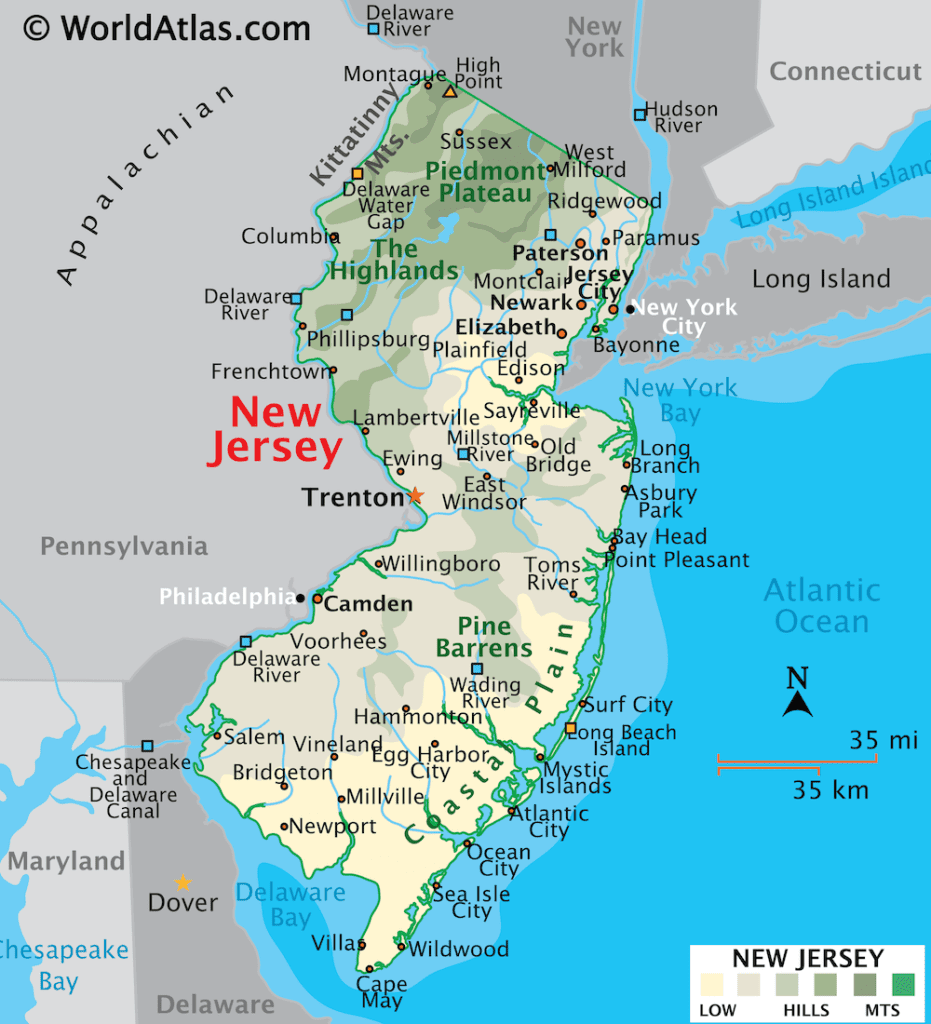

New Jersey: A Diverse and Growing Business Environment

New Jersey boasts one of the most vibrant and diverse economies in the United States, with a Gross Domestic Product (GDP) exceeding $800 billion in 2023. The state is home to nearly 950,000 small businesses, which account for over 99% of all businesses in New Jersey and employ around 1.9 million individuals. These small businesses are crucial drivers of innovation, job creation, and economic growth in the region. Prominent industries such as healthcare, logistics, technology, and manufacturing offer numerous opportunities for businesses to scale and thrive. As demand for capital grows, VIP Capital Funding is committed to providing New Jersey SMBs with the quick and flexible financing solutions they require for success.

Key Industries Driving Loan Demand in New Jersey

- Healthcare: The healthcare sector is a major employer in New Jersey, supporting over 600,000 jobs. Hospitals, clinics, and private practices constantly seek funding for infrastructure improvements, advanced medical equipment, and staffing needs. VIP Capital Funding offers loan solutions designed to help healthcare businesses develop and enhance their service capabilities in a competitive environment.

- Manufacturing: New Jersey is a leader in pharmaceuticals, chemicals, and food production, with its manufacturing sector contributing nearly $50 billion annually to the state’s economy. With over 240,000 people employed in this sector, manufacturers often require financing for equipment, modernization, and new facilities. Our commercial business loans provide the capital necessary for manufacturing firms to maintain competitiveness and efficiency.

- Technology and Startups: As an emerging tech hub, New Jersey is home to over 200,000 jobs in the technology sector, with cities like Newark and Jersey City fostering a growing number of startups. These companies often require substantial funding for research, development, infrastructure, and talent acquisition. VIP Capital Funding offers customized loans that empower tech companies with the financial support needed to innovate and expand.

Loan Solutions for New Jersey’s SMBs

At VIP Capital Funding, we understand that every business has unique financial requirements. To meet the needs of various industries and growth stages, we offer a range of tailored loan solutions:

- Working Capital Loans: Our working capital loans provide the essential cash flow needed for daily operations, allowing businesses to remain agile and responsive to emerging opportunities.

- Equipment Financing: Whether you require new machinery for manufacturing or advanced technology for your healthcare practice, our equipment financing options help facilitate investments in the tools and equipment necessary to keep your business running smoothly.

- Expansion Loans: If your business is looking to grow, our expansion loans can furnish you with the resources required to open new locations, expand your workforce, or enhance your marketing initiatives for growth.

Why Commercial Loans are Key to Business Expansion

Access to reliable financing is crucial for businesses positioned for growth. According to a 2023 report from the Federal Reserve, nearly 60% of small businesses nationwide face challenges in securing necessary financing. This issue is particularly prevalent in high-growth industries such as healthcare and technology, where consistent investment is vital for maintaining a competitive advantage.

At VIP Capital Funding, we are dedicated to delivering the flexible and rapid financing solutions that New Jersey businesses need to grow, innovate, and navigate financial obstacles.

Fast, Efficient, and Flexible Loan Options

We understand that businesses require swift access to capital to seize opportunities and face challenges effectively. Traditional lending methods often involve protracted application processes, leading to unnecessary delays. At VIP Capital Funding, we have streamlined our loan process to be fast, efficient, and tailored to the needs of business owners:

- Minimal Paperwork: Our application process only requires essential documentation, saving valuable time for business owners focused on growth.

- Fast Approvals: We typically process loan applications quickly, often within 1-2 days, ensuring businesses have timely access to needed funds.

- High Approval Rate: With a 95% approval rate, VIP Capital Funding provides businesses with a significantly higher chance of securing financing compared to traditional banks, delivering essential capital precisely when it’s most needed.

Get Started Today

Contact VIP Capital Funding today to explore how we can assist your New Jersey business in thriving within today’s competitive landscape. Together, we’ll build a solid financial foundation for your business’s future.