Flex Your Business with Fast Commercial Loans in Washington

Commercial Business Loans

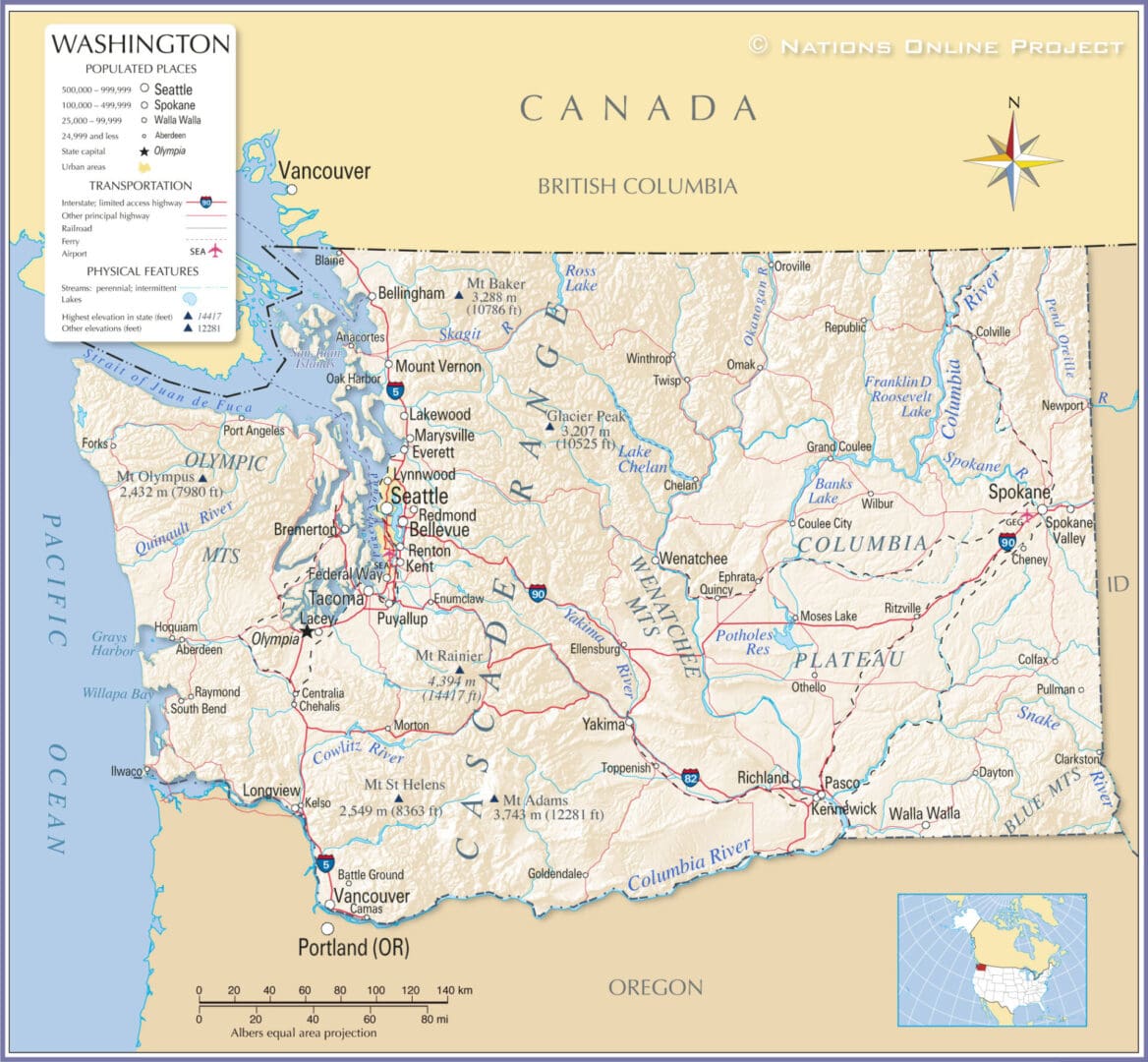

Understanding Commercial Business Loans in Washington

Are you a business owner in Washington looking for quick, reliable funding to grow your operations? Whether you’re expanding your workforce, purchasing new equipment, or managing cash flow, securing a commercial business loan can be a game-changer.

Businesses actively utilize commercial loans to stay competitive in dynamic markets. From a tech startup in Seattle to a manufacturing firm in Spokane, Washington companies across all industries rely on these loans to maintain momentum, secure new contracts, or fund innovation. When strategic opportunities arise, having quick access to funding can make all the difference.

Why Alternative Lending Is the Smart Choice

Traditional bank loans are often associated with hurdles: lengthy application processes, extensive documentation, and rigid approval requirements. For small and mid-sized businesses, these challenges can make securing funding feel unattainable. Alternative lending has emerged as the solution, offering a streamlined process designed for today’s fast-paced business environment.

With alternative lending, you can skip the weeks—or even months—of waiting that come with conventional banks. VIP Capital Funding provides businesses with quick, flexible solutions, ensuring that you can capitalize on opportunities without delay. Whether you need working capital for day-to-day operations or funds for a larger project, alternative lending offers speed, simplicity, and accessibility.

How VIP Capital Funding Stands Out

- Fast Approvals: Time is critical in business. Our streamlined process ensures applications are processed in just 1-2 days, getting funds into your hands faster.

- Minimal Paperwork: Say goodbye to stacks of forms. Our simple application process focuses on efficiency, allowing you to secure funding without being buried in red tape.

- High Approval Rates: With a 95% approval ratio, we offer accessible solutions even for businesses that face challenges with conventional lenders.

- Customized Loan Options: Whether you’re looking for $50,000 or $15 million, we provide loans that align with your business’s unique needs and revenue structure.

The Benefits of Choosing VIP Capital Funding for Your Washington Business

Fast Turnaround: Our 1-2 day approval process means you can act quickly on new opportunities or address pressing needs.

Flexible Use: Use the funds as you see fit—whether it’s for inventory, payroll, equipment upgrades, or marketing campaigns.

Transparent Terms: With no hidden fees or surprise costs, you can plan your finances with confidence.

Dedicated Support: Our team works closely with you to create a loan plan that fits your business goals.

How to Apply for a Commercial Business Loan

Getting started with VIP Capital Funding is simple and straightforward.

- Submit Your Application Online:Start with a short form that captures the basics of your business.

- Provide Key Documents:No excessive paperwork—just the essentials to evaluate your eligibility.

- Receive a Quick Decision:Our 95% approval rate means you’ll likely hear back within 1-2 days.

- Access Your Funds:Once approved, funds are disbursed promptly, allowing you to focus on your business.

Why VIP Capital Funding Is the Right Choice for Washington Businesses

Unlike traditional banks or SBA loans, VIP Capital Funding is designed with the needs of SMBs in mind. We’re here to help you navigate the challenges of running a business in Washington, whether you’re managing seasonal cash flow, expanding operations, or responding to market demands.

With tailored solutions, fast approvals, and a commitment to your success, we’re more than just a lender—we’re your partner in growth.

Ready to Grow Your Washington Business?

If you’re ready to take your business to the next level, VIP Capital Funding is here to help. Our fast, flexible commercial loans are designed to provide the resources you need without the delays and frustrations of traditional financing.

Contact us today or start your application online. Together, we’ll build a financing solution that drives your success.