Revenue-Based Funding Solutions for Washington Businesses

Revenue Based Funding

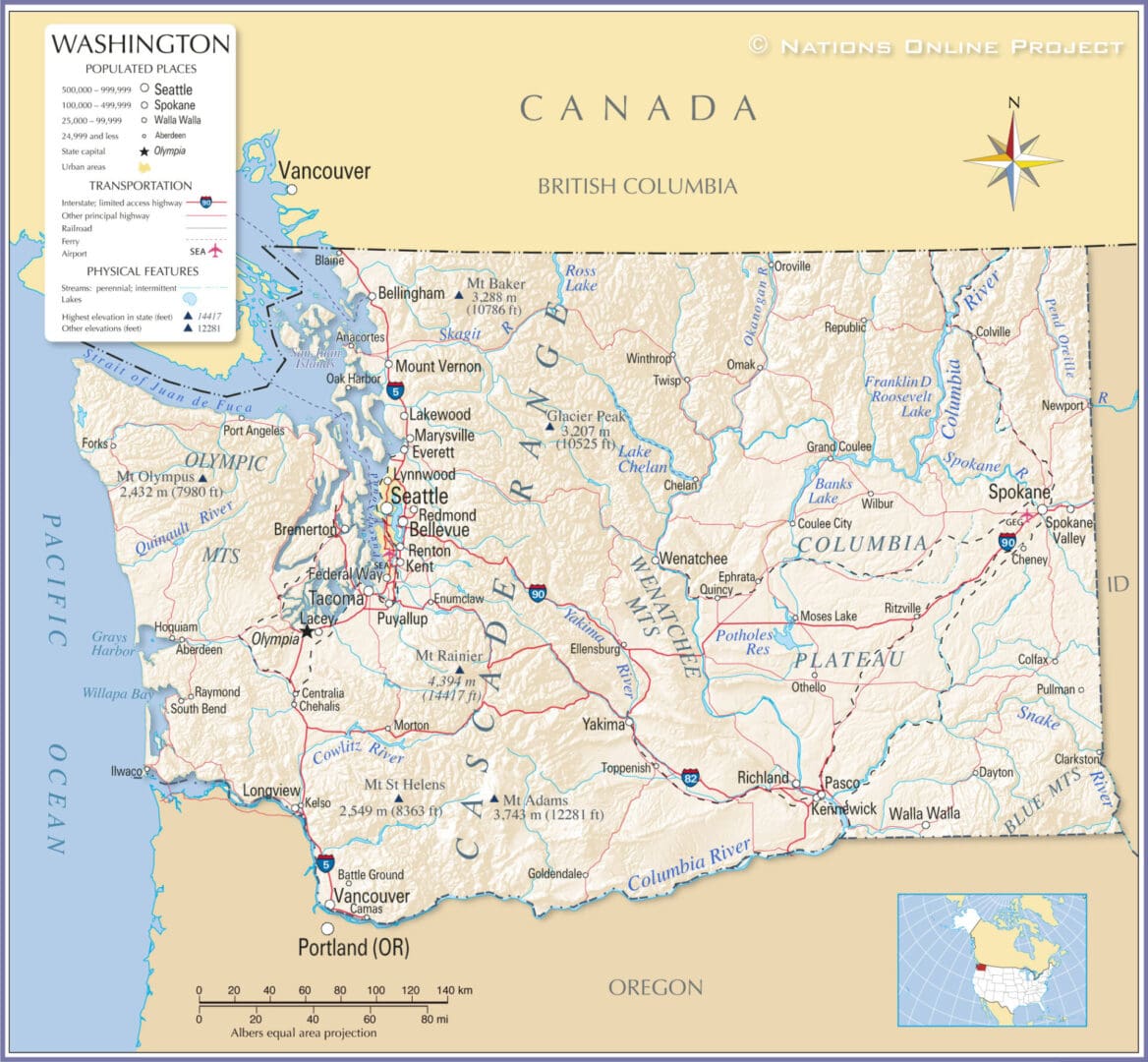

Overview of Revenue-Based Funding in Washington

Revenue-Based Funding (RBF) is an innovative financing option designed to meet the unique needs of businesses in Washington. With repayments linked to monthly revenue, RBF offers flexibility that allows businesses to manage cash flow more efficiently.

Washington is ranked #7 in Business Environment and #14 in Economy, with a GDP of $802 billion, making it an ideal location for small and mid-sized businesses to thrive. RBF provides these businesses with the capital needed for expansion, new projects, or managing operational costs without the burdens of traditional loans.

Ready to explore your options?

The Flexibility of Revenue-Based Funding in Virginia

Revenue-Based Funding (RBF) is designed to align repayments with your business’s monthly revenue, ensuring that payments adjust based on how your business performs. This flexibility is particularly valuable for businesses in Washington, which may experience seasonal variations or fluctuating income.

By basing repayments on revenue, RBF allows businesses to preserve cash flow during slower periods while still accessing the capital they need for growth or operational expenses. With funding options ranging from $50K to $15MM, businesses can secure the resources required without the burden of fixed monthly payments.

RBF offers a quick and efficient approval process, typically allowing businesses to receive funding within days, which is much faster than traditional loan methods. Whether you are looking to invest in new projects, expand your team, or purchase necessary equipment, Revenue-Based Funding provides the financial flexibility to support your business goals while accommodating your revenue patterns.

Key Benefits of Revenue-Based Funding for Washington Businesses

Revenue-Based Funding (RBF) offers multiple advantages that are especially beneficial for Washington businesses. Here’s why businesses are choosing RBF:

- No Collateral Needed

- Quick Approvals

- Flexible Repayment Terms

- Maintain Cash Flow Stability

- Funding Ranges from $50K to $15MM

With 644,868 small businesses, making up 99.5% of Washington’s businesses, RBF is perfectly suited for companies that need flexible, fast funding. In 2021, banks issued $2.2 billion in loans to Washington businesses with revenues of $1 million or less. RBF provides a quicker and more accessible alternative.

Industry-Specific Uses of RBF in Washington

Revenue-Based Funding (RBF) serves a variety of industries across Washington, offering the flexibility to support specific growth and operational needs.

- Technology: Access fast capital for software development, tech infrastructure, or hiring skilled professionals to drive innovation.

- Healthcare: Fund essential equipment upgrades or expand facilities to meet increasing patient demands.

- E-commerce and Retail: Manage seasonal inventory, boost marketing efforts, or scale operations to meet customer demand.

- Manufacturing: Secure funding to enhance production capabilities, purchase machinery, or streamline processes for greater efficiency.

RBF provides businesses in these sectors with the agility to meet their industry-specific financial needs.

RBF vs. Traditional Financing Options for Washington Businesses

When comparing Revenue-Based Funding (RBF) to traditional financing options, several key differences stand out:

- Repayment Flexibility: RBF adjusts repayments based on monthly revenue, while traditional loans often have fixed payments.

- No Collateral Required: Unlike traditional loans, RBF doesn’t require you to put up assets as collateral.

- Faster Approval: RBF provides quicker approvals, often within 48 hours, compared to weeks or months for bank loans.

- Credit Score Emphasis: RBF focuses more on revenue rather than heavily relying on credit scores, making it accessible for a broader range of businesses.

For businesses in Washington, RBF is a flexible, faster, and less restrictive alternative to traditional financing methods.

Real Success Stories from Washington Businesses

Revenue-Based Funding (RBF) has proven to be a valuable resource for many businesses across Washington, helping them grow and adapt to changing financial needs. Washington businesses exported $49.1 billion worth of goods in 2021, with 89.4% of these exporters being small businesses. RBF has played a crucial role in supporting these exporters.

“VIP Capital Funding helped us secure the funds needed for expansion. The process was quick, and repayments adjusted perfectly with our revenue.”

— Emily R., Seattle, WA

“Thanks to VIP Capital Funding, we were able to purchase new equipment and manage our cash flow more effectively during a busy season.”

— Mark T., Spokane, WA

Frequently Asked Questions about Revenue-Based Funding in Washington

RBF is a financing model where repayments are based on a percentage of your monthly revenue, offering flexibility during periods of variable income.

Businesses with a steady revenue stream and at least $50K in monthly revenue typically qualify for RBF. The credit score is less important compared to revenue.

Approval generally takes 48 hours, with funds disbursed within 72 hours after approval.

We serve various industries, including healthcare, retail, technology, and manufacturing.

Apply for Revenue-Based Funding Today

Ready to secure fast, flexible funding for your Washington business? VIP Capital Funding offers a quick and seamless application process, allowing you to access the capital needed to grow, expand, or manage operations. With approvals typically within 48 hours and no collateral required, this is the perfect opportunity to get the financial support your business needs.

Apply Now to take your business to the next level!