Seasonal fluctuations are a challenge faced by many businesses, particularly those operating in industries with distinct peak and off-peak seasons. From retail to manufacturing, businesses can experience drastic swings in cash flow, making it difficult to cover ongoing expenses, invest in new opportunities, or even maintain day-to-day operations. This is where short-term loans for businesses come in as a lifeline.

In this blog, we will explore how short-term business funding and business equipment financing can help businesses tackle seasonal cash flow challenges without draining their cash reserves. Additionally, we’ll discuss how VIP Capital Funding’s flexible financing options make it easier for companies to grow through strategic investments in equipment and technology.

Understanding Seasonal Cash Flow Challenges

Most businesses face periods of high and low demand, and the ability to manage cash flow during slower seasons can make or break a business. These challenges often include:

- Difficulty covering fixed expenses like rent, payroll, and utilities.

- Inability to invest in new equipment, inventory, or marketing during the off-season.

- Risk of turning away new opportunities due to insufficient cash reserves.

Seasonal cash flow challenges can be even more intense for industries like retail, manufacturing, and construction. For instance, a retailer may see a surge in sales during the holiday season but experience slow sales in the following months, while a construction company might face a slowdown during the winter months. To navigate these fluctuations, short-term loans for small businesses can provide the working capital necessary to cover expenses during downtime.

How Short-Term Business Loans Help

Short-term small business loans provide a quick, flexible solution to cash flow issues. These loans allow businesses to borrow a set amount of capital for a shorter repayment period, typically between 3 months to 18 months. Here’s how they can help:

- Bridge Cash Flow Gaps: Whether you’re waiting on late invoices or dealing with a seasonal lull, a short-term loan can provide the working capital for small businessesto maintain operations.

- Fast Access to Funds: Small business loanscan be disbursed quickly, often within days, allowing businesses to address immediate cash flow needs without delay.

- Flexible Terms: These loans come with more flexible repayment options, which can align with your business’s revenue cycles. VIP Capital Funding offers customized repayment plans that can be tailored to your seasonal revenue streams.

Equipment Financing: A Key to Growth

While short-term loans for small businesses help cover immediate expenses, equipment financing allows businesses to invest in new machinery, technology, and tools essential for growth without depleting cash reserves. Business equipment financing involves securing a loan specifically for the purchase of new equipment, allowing companies to spread out payments over time while immediately benefiting from the new assets.

For example, a manufacturing business might need to invest in new machinery to increase production efficiency, or a medical practice may require the latest diagnostic tools. With equipment financing loans, businesses can make these crucial upgrades without dipping into their operational cash flow.

Benefits of Equipment Financing

- Preserve Cash Reserves: By spreading out payments, businesses can acquire new equipment while keeping their cash on hand for other needs.

- Tax Benefits: Many equipment loans offer tax deductions, making this an attractive option for business owners.

- Upgrade to New Technology: Investing in the latest tools can give your business a competitive edge, allowing you to provide better service and increase efficiency.

VIP Capital Funding specializes in easy equipment financing options, ensuring that businesses of all sizes can get the equipment they need to thrive. For startups, startup business equipment financing allows new businesses to get off the ground with the tools they need without the financial strain.

VIP Capital Funding: Flexible Financing Solutions

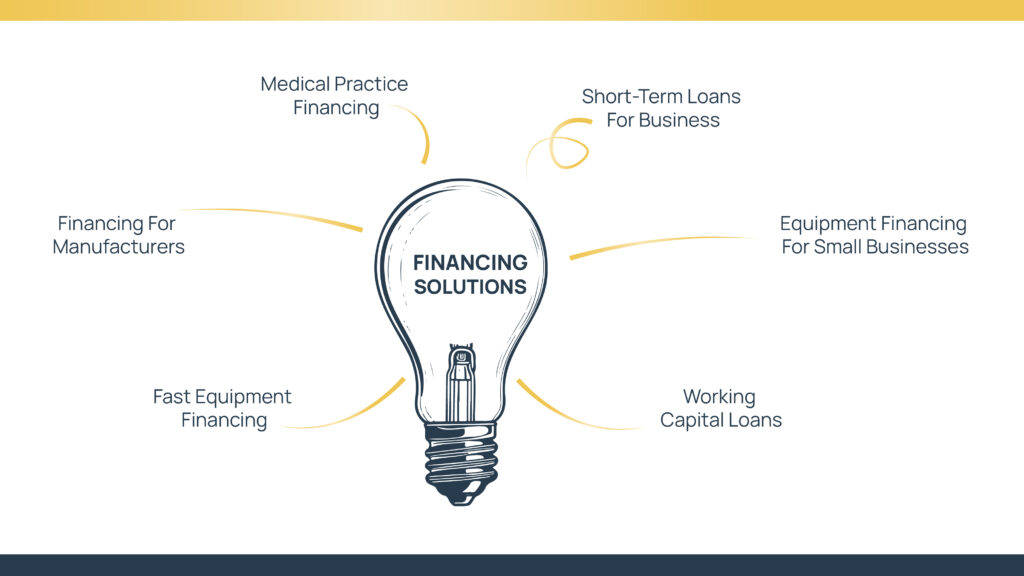

VIP Capital Funding understands that no two businesses are alike. This is why the company offers a variety of financing options designed to meet the specific needs of small businesses facing seasonal cash flow challenges.

Key Financing Solutions Include:

- Short-Term Loans for Business: As discussed, these loans provide fast, flexible funding for immediate needs.

- Equipment Financing for Small Businesses: VIP Capital Funding offers easy and affordable equipment loans to help businesses invest in essential tools for growth.

- Working Capital Loans: These loans provide businesses with the liquidity needed to cover everyday expenses, helping to stabilize operations during slower periods.

- Fast Equipment Financing: The application process is streamlined, allowing businesses to get quick access to the capital needed to invest in new equipment or technology.

- Financing for Manufacturers: Manufacturers can benefit from manufacturing business loanstailored to their specific needs, including purchasing machinery and expanding production capacity.

- Medical Practice Financing: Medical practices often need to invest in expensive diagnostic equipment or expand their facilities. VIP Capital Funding offers medical practice business loansto support these vital businesses.

Benefits of Using Equipment Financing for New Business

Starting a new business is both exciting and challenging, especially when it comes to managing finances. Many startups and new ventures face significant hurdles in acquiring the equipment and technology they need to operate efficiently without draining their limited cash reserves. This is where equipment financing for new business comes in as a powerful solution. Equipment financing offers several key advantages for startups looking to grow without overwhelming their finances. Let’s explore these benefits in more detail:

Reduced Upfront Costs

One of the biggest challenges for new businesses is managing initial expenses. Startups often require significant capital investments in equipment and technology, whether they are in manufacturing, healthcare, construction, or another industry. Purchasing this equipment outright can be prohibitively expensive, especially for companies still building up their revenue streams.

Equipment financing loans solve this problem by allowing startups to spread the cost of expensive tools and machinery over a period of time. Instead of a large, upfront payment, businesses can break down the cost into manageable monthly payments. This reduces financial strain and allows startups to invest in essential tools without depleting their working capital.

Improved Cash Flow Management

Cash flow is the lifeblood of any startup, and managing it wisely is crucial for survival, especially in the early stages. When startups invest in equipment through financing, they can retain more of their cash reserves for other important operational needs such as marketing, hiring staff, or inventory management. This financial breathing room is essential for maintaining day-to-day operations and ensuring the business stays on track during its formative years.

By opting for equipment financing, businesses can avoid tying up their limited cash in long-term investments. Instead, they can allocate these funds toward growth initiatives that can further boost their revenue, allowing for smoother financial operations. Having the flexibility to manage cash flow is one of the most significant advantages of business equipment financing, especially for startups trying to establish themselves in competitive markets.

Access to Modern Equipment

In today’s fast-paced industries, staying competitive means keeping up with technological advancements. Whether it’s cutting-edge manufacturing equipment, state-of-the-art medical devices, or advanced construction tools, having access to modern equipment is critical for new businesses aiming to compete and grow.

For startups, outdated equipment can limit their ability to provide high-quality products or services, potentially driving customers toward competitors who have invested in newer technology.

Short-Term Financing for Manufacturers and Medical Practices

Certain industries have unique cash flow challenges that can be addressed by short-term loans and equipment financing loans. For example:

- Manufacturing: Manufacturers often face seasonal production cycles, which can create periods of downtime and cash shortages. Manufacturing business fundingallows them to invest in machinery and raw materials during slower periods, ensuring they are prepared when demand increases.

- Medical Practices: Doctors, dentists, and healthcare professionals need to continuously update their equipment and technology to offer the best care to patients. With medical practice financing, these professionals can upgrade their facilities and tools without disrupting their financial stability.

How to Apply for Small Business Loans

Applying for a loan with VIP Capital Funding is simple and straightforward. Whether you’re interested in small business loans or business equipment financing, the process is designed to be efficient, providing businesses with fast access to the capital they need.

Steps to Apply:

- Online Small Business Loan Applications: Fill out an easy, secure application on VIP Capital Funding’s website to start the process.

- Choose Your Loan Type: VIP Capital Funding offers a range of loan products, from online small businessloans to short-term loans for small business and construction company loans.

- Receive Funding: Once approved, funds are quickly disbursed, helping you address your cash flow challenges or equipment needs.

This regional focus allows businesses to get customized solutions, such as small business loan providers who understand the specific economic environment of their state.

Make Cash Flow Problems a Thing of the Past!

Seasonal cash flow fluctuations don’t have to hold your business back. With short-term business financing from VIP Capital Funding, you can access the working capital, equipment, and resources needed to thrive year-round. Whether you’re looking for short-term loans for business, business equipment financing, or specialized loans for manufacturers and healthcare providers, VIP Capital Funding has the solutions you need.

By utilizing easy small business loans and tailored financing options, your business can continue to grow, even in challenging times. Visit VIP Capital Funding today to explore loan options and apply for financing that fits your unique needs. Make seasonal cash flow challenges a thing of the past by investing in your business’s future.

Ready to overcome seasonal cash flow challenges and invest in your business’s growth? Apply for short-term business loans or equipment financing with VIP Capital Funding today. Whether you need quick access to working capital, new equipment, or specialized funding for your industry, our flexible financing solutions are designed to meet your unique business needs. Don’t let cash flow issues hold you back—take the next step toward securing your business’s future.

Apply now and let VIP Capital Funding help you achieve long-term success!