Short-Term Business Loans in New Jersey: Fast, Flexible Funding for Your Next Big Move

Short Term Business Loans

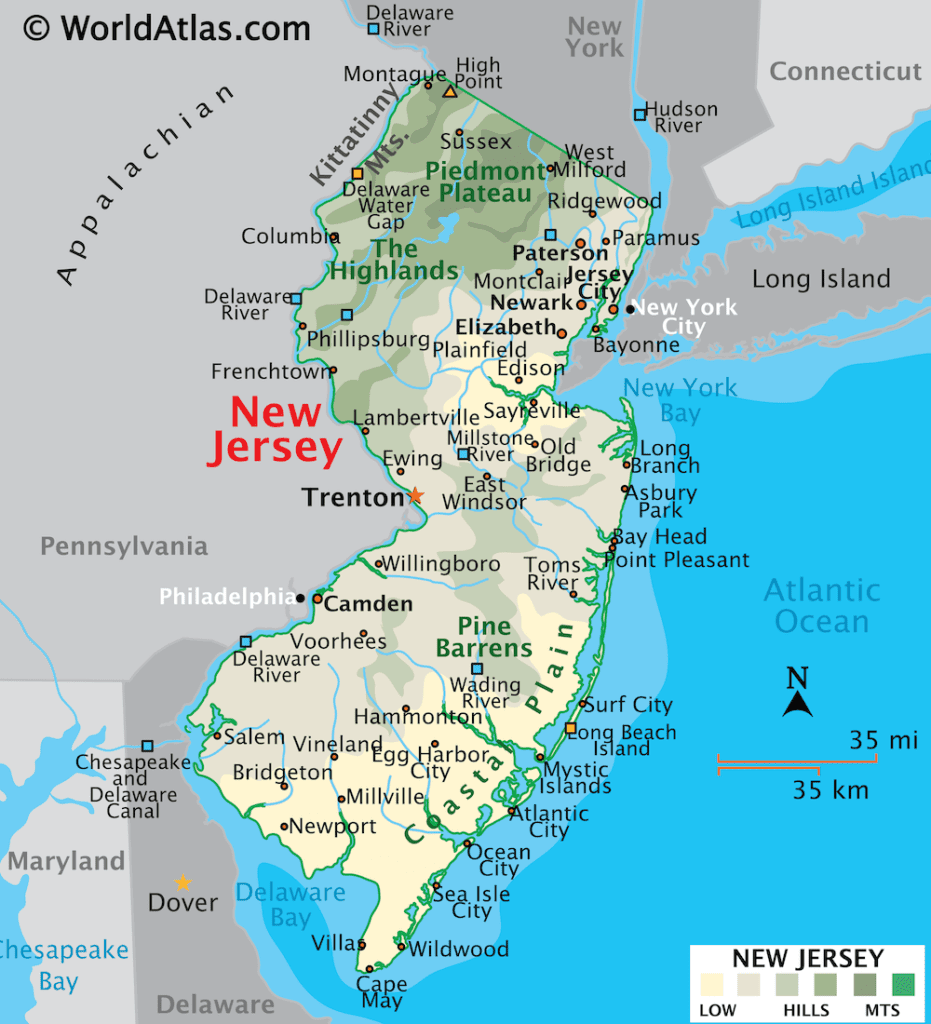

Overview of Short-Term Business Loans in New Jersey

New Jersey’s economy thrives because of its small businesses, which total 908,209 and make up 99.6% of all businesses in the state. In fact, New Jersey ranks 11th in the number of small businesses in the country. These businesses are vital to the state’s success, from the bustling cities of Newark and Jersey City to smaller towns along the shore.

A short-term business loan is designed to provide businesses with the working capital they need to cover immediate expenses, manage cash flow, or fund new ventures. Unlike long-term loans, which often require lengthy approval processes and large amounts of paperwork, short-term loans are typically approved quickly and have shorter repayment periods, usually ranging from three to 18 months.

Whether you’re dealing with seasonal fluctuations, a sudden expense, or an exciting growth opportunity, VIP Capital Funding’s short-term business loans offer fast, flexible funding to meet your needs. Our loans range from $50,000 to $15 million.

Why Choose Short-Term Business Loans in New Jersey?

There are several reasons why businesses in New Jersey should consider short-term loans:

Quick Access to Capital

With VIP Capital Funding, you can expect fast approval and funding—sometimes within 24 hours—so you can focus on running your business without interruption.

Flexibility to Use Funds as You Need

Unlike other financing options that may come with restrictions on how funds are used, short-term business loans offer you the flexibility to allocate resources where they are most needed.

No Collateral Requirements

One of the biggest barriers to traditional loans is the need to provide collateral, such as real estate or equipment, to secure funding. With VIP Capital Funding’s unsecured short-term business loans, you can access the capital you need without putting your assets at risk.

Tailored Repayment Terms

At VIP Capital Funding, we work with New Jersey businesses to tailor repayment plans that align with cash flow patterns, ensuring that you can repay the loan without putting a strain on your daily operations.

Increased Creditworthiness

Successfully repaying a short-term business loan can have a positive impact on your credit score, positioning your business for better loan terms and opportunities in the future.

Who Can Benefit from a Short-Term Business Loan?

Short-term business loans can benefit a wide variety of businesses across New Jersey, especially those in need of fast financial support.

Retail

New Jersey’s retail sector, with its mix of small boutiques and larger chains, often experiences fluctuating demand. Seasonal spikes in sales (such as holiday shopping) require stores to purchase inventory and hire staff in advance. A short-term loan can provide the capital needed to stock shelves and manage payroll during these peak seasons.

Hospitality

From hotels to restaurants, businesses in the hospitality industry need to maintain high standards to attract guests and diners. Short-term loans can help cover the cost of renovations, marketing efforts, and supply purchases during the slower off-season, ensuring that you are well-prepared when business picks up again.

Construction

Short-term loans are ideal for construction businesses needing quick access to capital for purchasing materials, hiring additional workers, or renting equipment to meet project deadlines. As payments from clients may be delayed, having extra cash on hand can help keep projects moving without unnecessary delays.

Healthcare Providers

Medical practices and healthcare facilities may need to invest in new equipment, hire staff, or improve facilities to remain competitive and offer the best patient care. A short-term loan allows them to access funds quickly without the burdensome application process of traditional loans.

How Does the Loan Process Work with VIP Capital Funding?

At VIP Capital Funding, we’ve streamlined the loan application process to ensure that New Jersey business owners can access the funds they need without any unnecessary delays. Here’s how it works:

Submit Your Application

Our application process is simple and can be completed online in just a few minutes. You’ll provide basic information about your business, such as its age, revenue, and funding needs. Don’t worry if your business is newer—our team works with a variety of companies, regardless of their length of operation.

Receive Approval

Once you submit your application, our team will review it quickly. We understand that time is of the essence, so approvals are often granted within 24 hours. You’ll be notified as soon as your loan is approved, and we’ll walk you through the next steps.

Get Funded

After approval, funds are typically deposited into your business account within a day or two so you can start using the money immediately.

Repayment

Repaying a short-term loan is straightforward. We’ll set up a tailored repayment plan that fits your business’s cash flow, making it easy to stay on top of payments without disrupting your day-to-day operations.

Get Started Today

If you’re a New Jersey business owner looking for a reliable, fast, and flexible funding solution, VIP Capital Funding’s short-term business loans, ranging from $50,000 to $15 million, may be the perfect fit.

Contact us today to learn more about our loan options or to start your application process. We’re here to help you achieve your business goals, no matter how big or small.