Hey there, future construction mogul! Ready to lay the financial foundation for your dream project? Let’s dive into the world of small business construction loans and discover how they can turn your blueprints into reality.

What Exactly Are Construction Loans?

Think of construction loans as the financial scaffolding that supports your building ambitions. Unlike traditional loans that hand over a lump sum, construction loans are typically disbursed in stages, aligning with your project’s progress. This means you get the funds when you need them, keeping your budget on track and interest payments in check.

The Blueprint: How Do They Work?

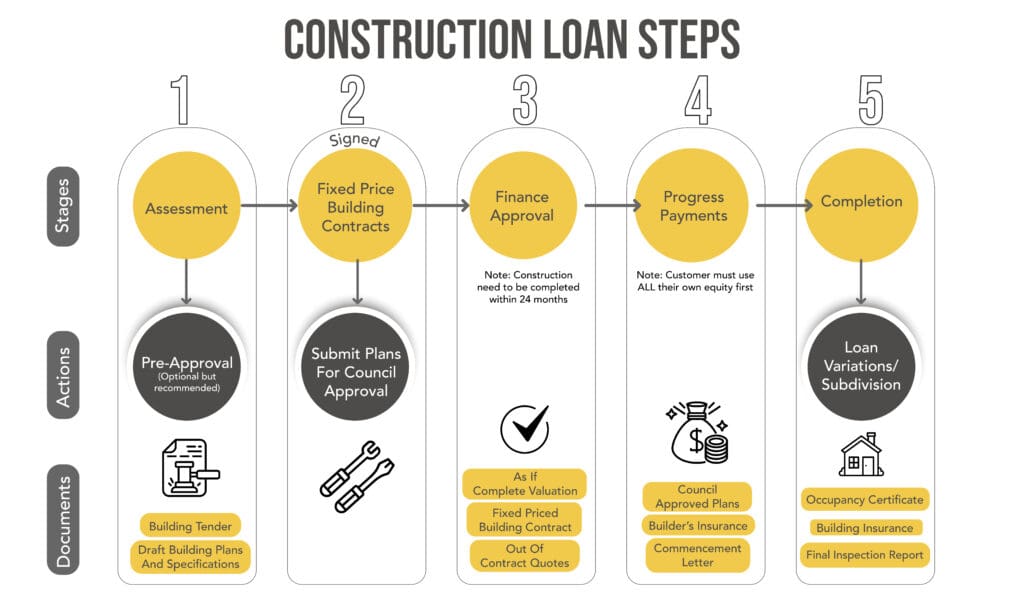

Here’s the drill: You apply for a construction loan with a detailed plan in hand—think project timelines, budgets, and building specs. Once approved, the lender doesn’t just cut you a big check. Instead, they release funds in “draws” as you hit specific milestones, like laying the foundation or completing the framing. This pay-as-you-go approach ensures you’re only borrowing (and paying interest on) what you need at each stage.

Types of Construction Loans: Choose Your Tool

Just like you wouldn’t use a hammer for a screw’s job, picking the right loan is crucial. Let’s break down the main types:

1. Commercial Construction Loans

Ideal for building new commercial properties—be it offices, retail spaces, or warehouses. These loans cover the entire construction process and often require a solid business plan and a hefty down payment. Once the project is complete, you’ll typically refinance into a permanent mortgage.

2. SBA 7(a) Loans

Backed by the Small Business Administration, these loans are versatile and can be used for various purposes, including construction, equipment purchases, and working capital. They offer competitive interest rates and longer repayment terms, making them a favorite among small business owners.

3. SBA 504 Loans

Tailored for major fixed asset purchases, SBA 504 loans are perfect for acquiring land, buildings, or heavy machinery. They involve a partnership between a lender and a Certified Development Company (CDC), offering long-term, fixed-rate financing.

4. Equipment Financing

Need that shiny new excavator? Equipment financing lets you spread the cost of expensive machinery over several years. The equipment itself often serves as collateral, making this a less risky option for lenders and a budget-friendly choice for you.

5. Business Line of Credit

Think of this as your financial safety net. A business line of credit provides flexible funds that you can draw upon as needed, perfect for covering unexpected expenses or bridging cash flow gaps during the construction process.

Unique Features of Construction Loans: What Sets Them Apart?

Construction loans come with their own set of quirks:

- Interest-Only Payments: During the construction phase, you’re often required to make interest-only payments, which can help keep your expenses lower until the project is complete.

- Draw Disbursements: Funds are released in stages based on the progress of the construction project, ensuring that money is available as needed and reducing the risk for lenders.

- Short-Term Financing: These loans are typically short-term, covering only the construction phase, which can last from 6 months to 2 years.

- Conversion to Permanent Loan: Some construction loans may convert into a permanent mortgage once the construction is complete, streamlining the financing process.

Financing Equipment Purchases: Power Up Your Project

In the construction biz, the right equipment can make or break your project. But let’s face it, heavy machinery comes with a hefty price tag. Here’s how you can manage:

- Equipment Loans: Borrow funds specifically to purchase equipment. The machinery itself serves as collateral, often leading to favorable interest rates. Once the loan is paid off, the equipment is all yours.

- Leasing: Not ready to commit? Leasing allows you to use the equipment for a set period with the option to purchase at the end. This can be a smart move for rapidly depreciating assets or short-term projects.

Fueling Expansion Plans: Laying the Groundwork for Growth

Thinking big? Here’s how construction loans can help you scale:

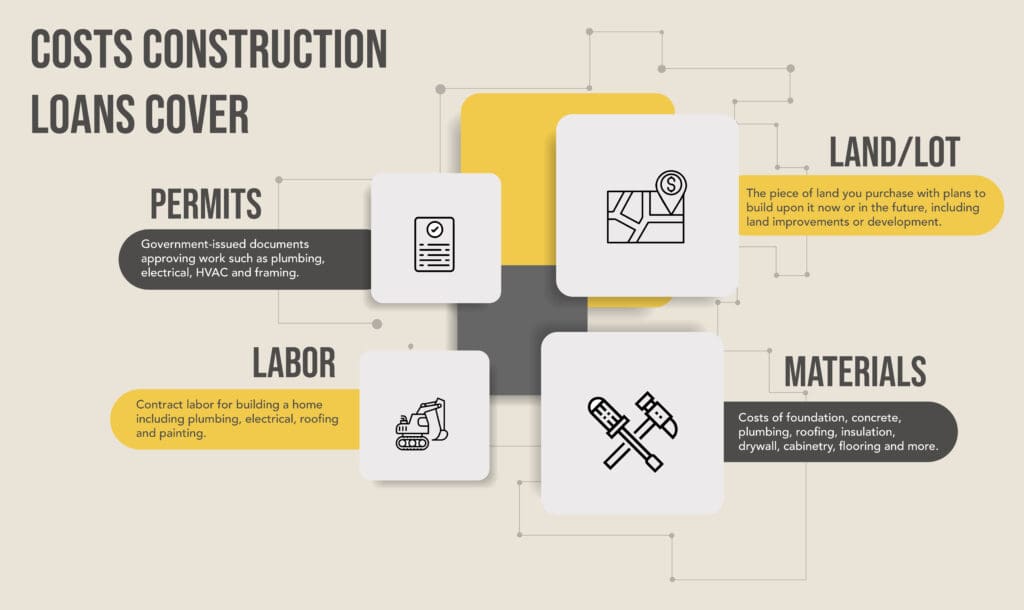

- Land Acquisition and Development: Secure funds to purchase and develop land for new projects, setting the stage for future builds.

- Renovation and Remodeling: Update existing structures to meet new business needs or market demands, enhancing your property’s value and functionality.

- New Construction: From laying the first brick to the final coat of paint, finance the creation of new facilities to expand your operations.

The Nitty-Gritty: Application Process and Requirements

Ready to break ground? Here’s what you’ll need:

- Detailed Business Plan: Outline your project’s scope, timelines, and financial projections.

- Creditworthiness: A solid credit score can open doors to better terms and interest rates.

- Down Payment: Be prepared to invest a percentage of the project cost upfront, often ranging from 10-30%.

- Collateral: Lenders may require assets to secure the loan, which could include the property under construction or other business assets.

- Financial Documentation: Lenders will want to see proof of your financial health. This includes profit and loss statements, balance sheets, tax returns, and cash flow projections.

- Construction Plans and Permits: Detailed blueprints and a clear timeline are essential to show lenders you’re serious. Permits ensure everything aligns with local laws and regulations.

- Experienced Contractors: Some lenders require you to work with licensed and experienced contractors. This provides reassurance that the project is in capable hands and will stay on schedule.

- Insurance Coverage: Before funds are released, lenders often require proof of construction insurance to mitigate risks, including liability, builder’s risk, and workers’ compensation coverage.

Key Benefits of Small Business Construction Loans

- Tailored for Growth: These loans are specifically designed to fund construction projects, helping your business expand or establish a solid presence.

- Flexibility in Usage: Whether it’s building from scratch, renovating existing structures, or purchasing equipment, construction loans adapt to your needs.

- Incremental Funding: The staged disbursement process ensures funds are available when required, preventing misuse or over-borrowing.

- Preservation of Cash Flow: By financing your construction or equipment needs, you can keep your working capital intact to manage day-to-day operations.

- Potential Tax Benefits: Depending on your jurisdiction, you may be able to deduct interest payments or claim depreciation on newly acquired assets.

Challenges and How to Overcome Them

1. High Upfront Costs

- Challenge: Down payments and associated fees can be hefty.

- Solution: Look for lenders offering competitive rates or explore SBA-backed loans, which typically require lower down payments.

2. Complex Approval Process

- Challenge: Detailed plans and extensive documentation make it time-consuming to secure a loan.

- Solution: Partner with a trusted lender familiar with construction financing, like VIP Capital Funding, to streamline the process.

3. Short Repayment Terms

- Challenge: Most construction loans have short terms (6–24 months), adding pressure to complete projects quickly.

- Solution: Consider refinancing to a longer-term loan or converting to a permanent mortgage after project completion.

How to Find the Right Lender

Not all lenders are created equal. Here’s how to pick the best one:

- Specialisation: Seek lenders with experience in construction financing who understand the unique challenges of the industry.

- Competitive Rates: Compare interest rates, fees, and repayment terms. A small difference in rates can save you thousands.

- Flexibility: Look for loan providers offering tailored solutions, such as VIP Capital Funding, which specialises in small and mid-sized businesses.

- Customer Support: The construction process can be stressful. A responsive lender with stellar customer service can make all the difference.

Tips for Maximising Your Construction Loan

- Plan for Contingencies: Always factor in unexpected costs—add 10–20% to your budget as a safety net.

- Maintain Good Communication: Keep your lender updated on project progress. This ensures smooth fund disbursement.

- Stay Organised: Keep all your documents—permits, contracts, and receipts—neatly filed to avoid delays or complications.

Ready to Build? Let’s Get Started

At VIP Capital Funding, we’ve been empowering businesses for over a decade. Whether you’re in Georgia, Illinois, or North Carolina, our small business construction loans and private lending options give you a competitive edge. Take the first step toward growth with fast, flexible financing.

Call now to apply for your loan!