Small Business Funding

How Small Business Funding Supports New Jersey Businesses

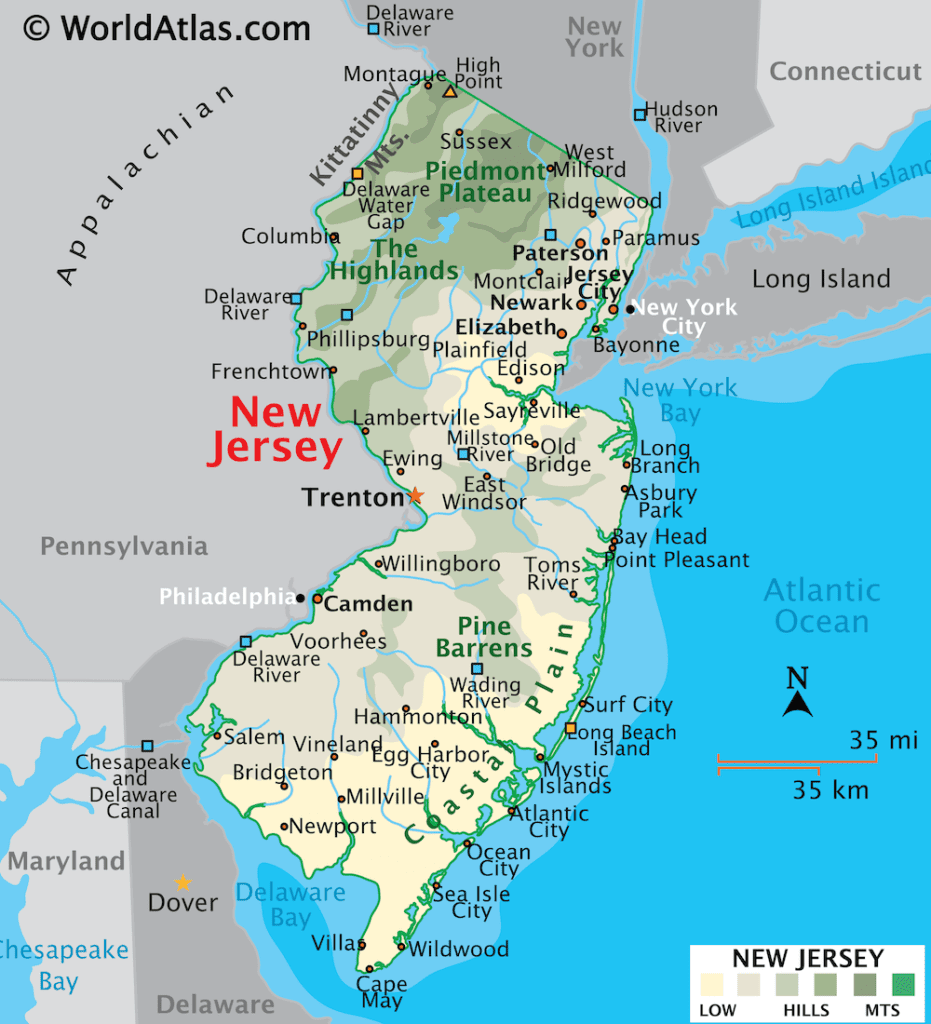

Small businesses in New Jersey, numbering 953,416 and representing 99.6 percent of all businesses in the state, face various financial demands, from managing cash flow and inventory to covering expansion costs. These funding needs are critical to maintaining daily operations and preparing for growth opportunities. Whether it’s handling seasonal fluctuations or investing in new technologies, small business funding provides the financial flexibility New Jersey companies need to remain competitive and continue their upward trajectory.

The recent designation of New Jersey as the Most Improved State for Business highlights the evolving opportunities for growth and innovation across the state.

For personalized assistance, contact us today to explore how we can support your business goals.

Challenges Faced by New Jersey Businesses

Running a business in New Jersey comes with several challenges that demand flexibility and access to funding. Here are a few key areas where financial flexibility is crucial:

- Managing High Operational Costs:With rising rent, taxes, and wages, businesses need capital to cover these costs while remaining competitive.

- Handling Seasonal Fluctuations:Many industries in New Jersey, such as retail and tourism, face seasonal downturns. Accessible funding helps maintain cash flow during slower periods.

- Expanding into New Markets:As businesses grow, they need funds to invest in technology, hire new staff, or expand their locations. Flexible financial solutions allow businesses to seize growth opportunities when they arise.

This backdrop of economic growth, marked by first-rate job creation since June 2020 and a personal income increase of over 5%, underscores the necessity for robust financial solutions that VIP Capital provides, enabling businesses to thrive in an ever-changing environment.

Why Choose VIP Capital Funding?

When partnering with VIP Capital Funding, businesses gain several advantages that enhance their financial flexibility:

- Fast Approvals:Receive approvals typically within 24-48 hours, allowing your business to quickly access needed capital.

- No Collateral:Obtain funding without risking your business or personal assets.

- Flexible Repayment Options:Enjoy payment plans tailored to your business’s cash flow and operational needs.

- Personalized Service:Our financial experts provide custom solutions, ensuring you get the best funding fit for your business goals.

VIP Capital Funding prioritizes efficient, client-focused solutions designed to empower businesses.

A Simple and Fast Application Process

Applying for small business funding with VIP Capital Funding is straightforward and fast. Here’s how it works:

- Create Your Profile: Share your basic business information to help us understand your needs.

- Submit Your Application: Provide financial documentation for a thorough assessment.

- Consult with a Specialist: Our experts will guide you in selecting the best funding option.

- Receive Approval: Approvals are typically issued within 24-48 hours, and funds are disbursed shortly thereafter.

Our process ensures clarity and quick access to capital, helping your business thrive.

Key Benefits of Small Business Funding in New Jersey

- No Collateral Requirements: You can secure funds without putting up your assets as collateral, reducing risk.

- Competitive Interest Rates: Our loan terms are designed to help you grow without financial strain.

- Fast Access to Funds: Approved businesses receive funds quickly, often within 24-48 hours, crucial in a state leading the Northeast in private sector job creation.

- Tailored Funding Solutions: Customizable loans based on your business’s unique needs.

- Flexible Repayment Terms: Choose a repayment plan that aligns with your cash flow, making it easier to manage payments without disrupting your operations.

Frequently Asked Questions (FAQs)

- What types of businesses are eligible for funding? Businesses from various sectors, including retail, services, and manufacturing, are eligible, provided they meet the basic requirements.

- How long does the approval process take? Once all documentation is submitted, approvals can take as little as 24-48 hours.

- Is collateral required for funding? No, most funding options through VIP Capital Funding do not require collateral.

- What loan amounts are available? Funding amounts range from $50K to $15MM, depending on your business needs.

Secure Your Business’s Future with VIP Capital Funding

Take the next step toward strengthening your business’s financial future. With VIP Capital Funding, you can access the capital you need quickly and without hassle. Our flexible funding options are designed to fit your business’s unique needs, and our streamlined process ensures fast approvals and disbursement. Don’t wait to secure the financial backing your business deserves. Apply now and set your business up for continued growth and success.

Get Started Today

At VIP Capital Funding, we’re dedicated to helping local entrepreneurs realize their dreams and build thriving businesses that contribute to the economic vitality of our community. Contact us today to learn more about our Small Business Funding solutions and take the next step towards a brighter future for your business.