Unsecured Business Loans: A Smart Financing Solution for Washington Entrepreneurs

Unsecured Business Loans

Unsecured Business Loans in Washington

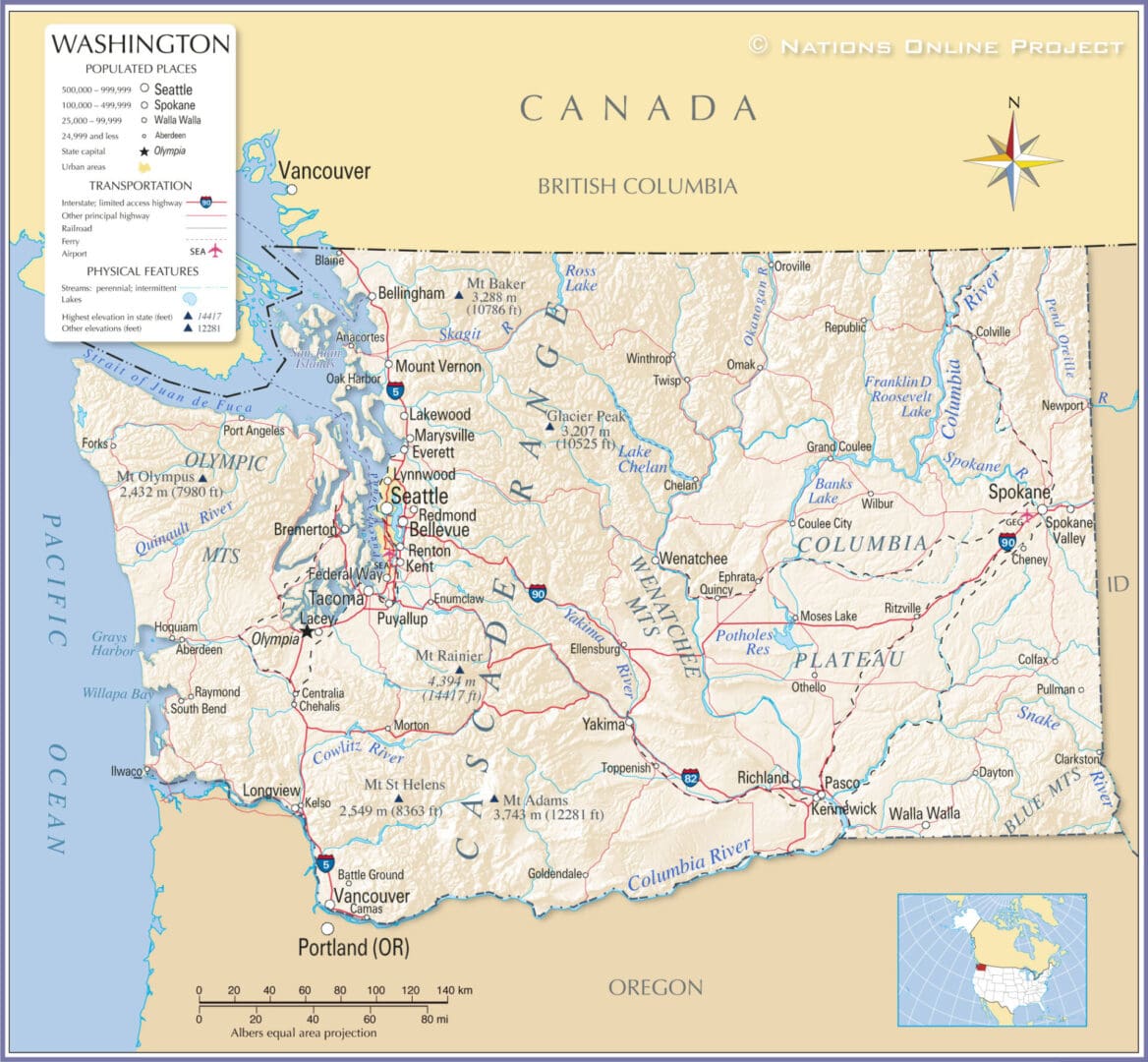

Washington State is home to a thriving business environment, with 647,639 small businesses employing 1.4 million workers—over half of the state’s private-sector workforce. These small businesses represent 99.5% of all Washington-based businesses, with a large portion employing fewer than 100 workers. Key sectors such as technology, aerospace, agriculture, and healthcare play vital roles in the state’s growth, with significant business hubs in cities like Seattle, Tacoma, and Spokane.

With a GDP of $668 billion as of 2022, Washington ranks as the 14th largest economy in the U.S., underscoring its dynamic landscape and the high potential for business growth. Despite this promising economic backdrop, small and medium-sized businesses (SMBs) in Washington often encounter financial challenges, especially when traditional lenders require high credit scores or collateral. Unsecured business loans offer a practical solution for companies looking to expand, manage cash flow, or invest in growth opportunities without risking their assets.

At VIP Capital Funding, we understand the unique needs of Washington’s diverse business sectors. Our unsecured business loans deliver essential capital without requiring collateral, offering the flexibility and support businesses need to thrive in today’s competitive market.

With loan amounts ranging from $5,000 to $55 million, we tailor our financing solutions to meet the specific requirements of Washington businesses.

Contact us today to learn more about how we can help your business grow.

Supporting Washington’s Key Industries with Flexible, No-Collateral Loans

Unsecured business loans provide a financing solution that doesn’t require businesses to pledge assets. For Washington-based companies, this offers a fast, accessible way to secure capital and support growth without risking valuable property or equipment.

Key Industries in Washington:

- Technology and Innovation: As a leading tech hub, Washington hosts major players in software, cloud computing, and e-commerce. Unsecured business loans enable tech companies to scale quickly, drive research, and hire talent.

- Aerospace and Manufacturing: Washington is renowned for its aerospace sector, home to prominent industry leaders. Businesses in this field often require capital to invest in equipment, streamline operations, and manage cyclical cash flow.

- Agriculture: Washington’s agricultural sector is diverse, producing everything from apples to wine. Unsecured loans offer farmers and agricultural businesses a source of funding for seasonal expenses, land development, and new equipment.

- Healthcare: With a strong focus on medical innovation and service expansion, healthcare providers in Washington need reliable funding sources to invest in technology, expand facilities, and support patient care.

In 2022, Washington’s information industry alone contributed $128.33 billion in value to the state’s GDP, highlighting the significance of sectors like technology. Additionally, small businesses make up 89.4% of the firms exporting goods from Washington, contributing $15.4 billion to the state’s $49.1 billion export market in 2021. Unsecured business loans empower Washington’s varied industries to adapt, grow, and stay competitive, providing essential financial support to manage economic shifts and invest in the future.

Secured vs. Unsecured Loans: The Best Fit for Your Washington Business

When it comes to financing, understanding the difference between secured and unsecured loans is essential for choosing the right solution for your business.

Secured Loans

Secured loans require borrowers to provide collateral, such as property, equipment, or inventory. While they may offer lower interest rates and higher loan amounts, they come with the risk of losing pledged assets if repayment terms aren’t met.

Unsecured Loans

Unsecured loans, like those offered by VIP Capital Funding, don’t require collateral. Instead, approval depends on your business’s creditworthiness, revenue, and financial health. These loans offer faster access to funds and eliminate the need to risk assets, making them an ideal choice for businesses seeking quick, flexible funding.

For Washington businesses, unsecured loans provide a straightforward, lower-risk way to access necessary capital. VIP Capital Funding’s unsecured business loans allow you to secure the funding you need to grow, expand, and meet day-to-day financial needs—without pledging any collateral.

Frequently Asked Questions

VIP Capital Funding offers unsecured business loans ranging from $5,000 to $55 million based on your business’s financial profile and funding requirements.

Repayment terms vary depending on the loan amount and your business’s financial situation. VIP Capital Funding provides flexible repayment options tailored to suit your cash flow and financial goals.

One of the main advantages of unsecured business loans is fast access to capital. VIP Capital Funding’s streamlined process allows loan approval within 24 to 48 hours, with funds transferred shortly after.

While a strong credit score improves approval chances, it’s not the only factor. VIP Capital Funding assesses your overall business health, cash flow, and repayment capability, working with businesses of various credit backgrounds.

Yes, VIP Capital Funding’s unsecured business loans are versatile and can be used for a variety of business needs, including expansion, managing cash flow, hiring, marketing, purchasing equipment, and refinancing existing debt.

Fast, Flexible, and Risk-Free Funding: Propel Your Business Forward

Washington’s business landscape is dynamic and full of potential. The state’s economy grew by an impressive 6.7% in 2021, outpacing the national growth rate of 5.7%, reflecting the state’s vibrant business potential. VIP Capital Funding’s unsecured business loans offer a straightforward, risk-free way for small and medium-sized businesses to thrive. With no collateral required, rapid approvals, and adaptable loan terms, our financing solutions provide the freedom and flexibility your business needs to grow confidently.

Our experienced team is here to support you at every step, offering professional guidance and customized funding options that align with your business goals. VIP Capital Funding makes accessing the capital you need simple and efficient, whether you’re looking to expand operations, manage cash flow, or seize new opportunities.

Contact VIP Capital Funding today to explore how our unsecured business loans can help your business succeed in Washington’s competitive market.

Step-by-Step Loan Application Process

At VIP Capital Funding, we make it easy for Washington businesses to secure the funding they need with a simple, streamlined application process. Here’s how it works:

- Complete the Online Application

Start by filling out our online application form with basic business and personal information. This step helps us understand your needs and business background. - Submit Required Documents

Upload necessary documents, such as financial statements (e.g., balance sheet, profit and loss statement), bank statements, and identification. Specific requirements may vary depending on your desired loan amount. - Receive Approval in 24 to 48 Hours

Our team reviews your application quickly, often providing approval within 24 to 48 hours. We prioritize cash flow and business health, so you can expect a high approval rate even if credit scores aren’t perfect. - Review and Accept Loan Terms

Once approved, review the loan terms tailored to suit your business’s needs. VIP Capital Funding maintains transparency in all terms and fees, so there are no hidden surprises. - Access Your Funds

After you accept the terms, your funds are transferred directly to your business account. You can begin using your loan immediately to support your business goals.

Our process is designed for simplicity and speed, helping you access the capital you need without lengthy wait times or complex requirements.

Take Your Washington Business to New Heights with VIP Capital Funding

Unlock the potential of your Washington business with a trusted financing partner that understands your unique needs. VIP Capital Funding is dedicated to empowering small and medium-sized businesses by providing fast, collateral-free access to the capital necessary for growth and success.

With a simple application process, rapid approvals, and flexible loan options, securing the funds you need has never been easier. Whether you’re looking to expand, manage daily operations, or invest in new opportunities, VIP Capital Funding is here to help.

Ready to take the next step? Contact our team or apply online today to discover how our unsecured business loans can fuel your business’s growth in Washington.