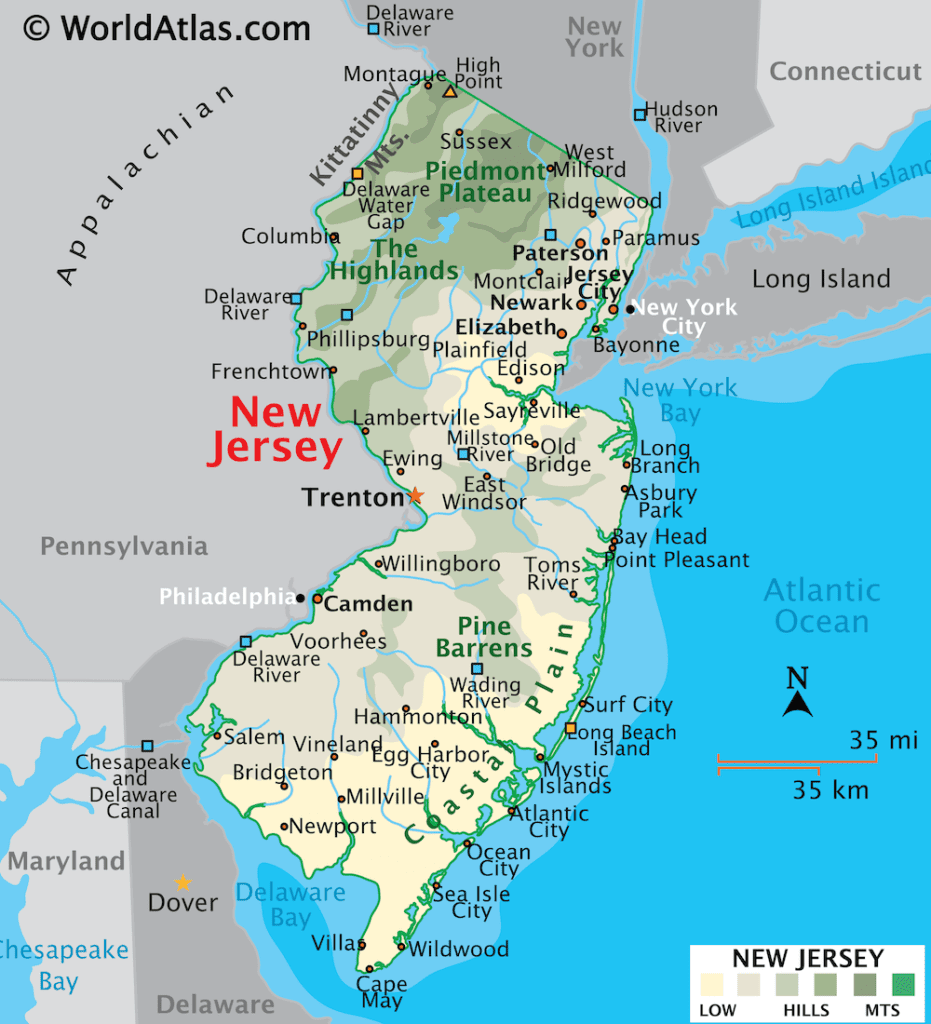

Working Capital Loans in New Jersey: Empowering Businesses with Financial Flexibility

Working Capital

Manage Cash Flow Effectively with Working Capital Loans

Working capital represents the difference between your current assets and liabilities. It ensures you can cover day-to-day expenses such as payroll, inventory purchases, rent, or unexpected costs. However, even the most successful businesses face cash flow gaps due to seasonal fluctuations, delayed customer payments, or sudden market shifts. This is where VIP Capital Funding steps in to offer quick, reliable, and flexible financing solutions tailored to your unique needs.

At VIP Capital Funding, we understand the hurdles small businesses face. That’s why we specialize in providing working capital loans designed to give you the financial flexibility to grow, adapt, and succeed. Whether you need funding for day-to-day operations, expansions, or unexpected expenses, we’ve got your back.

Why Working Capital Loans Matter

A working capital loan provides businesses with the liquidity they need to cover operational costs and navigate financial challenges. In New Jersey’s competitive business environment, having reliable access to cash can be the difference between thriving and just surviving.

Common Uses of Working Capital Loans:

- Smooth Out Cash Flow: Cover payroll, rent, and utilities during slow seasons or delayed receivables.

- Expand Operations: Open a new location, hire more staff, or purchase equipment to scale your business.

- Seize New Opportunities: Take advantage of limited-time deals or launch marketing campaigns to attract more customers.

Tackle Unexpected Costs: Handle emergency repairs, supply chain disruptions, or rising material costs without missing a beat.

How VIP Capital Funding Stands Out

In a state like New Jersey, where business opportunities move fast, waiting weeks for traditional financing is not an option. VIP Capital Funding offers a streamlined process that gets you the funds you need—quickly and with minimal paperwork.

What Makes Us Different?

- Fast Approvals: Get a decision within 24 hours and funding in as little as 1-3 business days.

- Flexible Loan Amounts: Borrow between $50,000 and $15 million, tailored to your business needs.

- Simple Application: Skip the mountains of paperwork and lengthy processes of traditional banks.

- No Collateral Needed: Many of our working capital loans are unsecured, letting you focus on growth without risking your assets.

Trusted Expertise: With over 10 years of experience and a 95% approval rate, we are a leading FinTech lender serving SMBs nationwide.

Benefits of Working Capital Loans

- Flexibility

Unlike traditional loans earmarked for specific uses, working capital loans give you the freedom to allocate funds wherever they’re needed most.

- Quick Access

With funds available in just a few days, you won’t miss out on critical opportunities or fall behind on essential expenses.

- No Long-Term Commitments

Most working capital loans are short-term, allowing you to repay quickly and focus on your next business goal.

- Empowered Decision-Making

Having access to extra cash lets you take control of your business’s growth trajectory, whether it’s upgrading equipment or expanding services.

Benefits of Working Capital Loans

- Flexibility: Unlike traditional loans earmarked for specific uses, working capital loans give you the freedom to allocate funds wherever they’re needed most.

- Quick Access: With funds available in just a few days, you won’t miss out on critical opportunities or fall behind on essential expenses.

- No Long-Term Commitments: Most working capital loans are short-term, allowing you to repay quickly and focus on your next business goal.

- Empowered Decision-Making: Having access to extra cash lets you take control of your business’s growth trajectory, whether it’s upgrading equipment or expanding services.

Common Questions about Working Capital

Our streamlined process allows you to get approved within 24 hours. Once approved, you can receive funds in as little as 1-3 business days.

No! We provide funding for over 700 industries, including retail, healthcare, manufacturing, hospitality, and more. If your business generates revenue, we’re here to help.

No, our working capital loans are unsecured, meaning you don’t need to put up any collateral to qualify for funding.

Eligibility is based on factors such as your business’s revenue, credit history, and overall financial health. Our flexible requirements cater to small and mid-sized businesses.

We offer working capital loans ranging from $50,000 to $15 million, tailored to your specific business needs and goals.

Yes! Working capital can be used for various purposes, including payroll, inventory, marketing, equipment upgrades, or even expanding your business.

Repayment terms are flexible and customized to align with your cash flow, ensuring you can meet obligations without straining your finances.

Yes, you can repay your loan early, and there are no prepayment penalties.

While credit history is considered, it’s not the sole determining factor. We focus more on your business’s revenue and potential for growth.

For seasonal businesses, working capital provides the cash flow needed to stock inventory, hire staff, or prepare for peak periods without financial strain.

Yes, startups can apply, though eligibility may depend on initial revenue and business plans. Our consultants can guide you through the process to determine the best options.

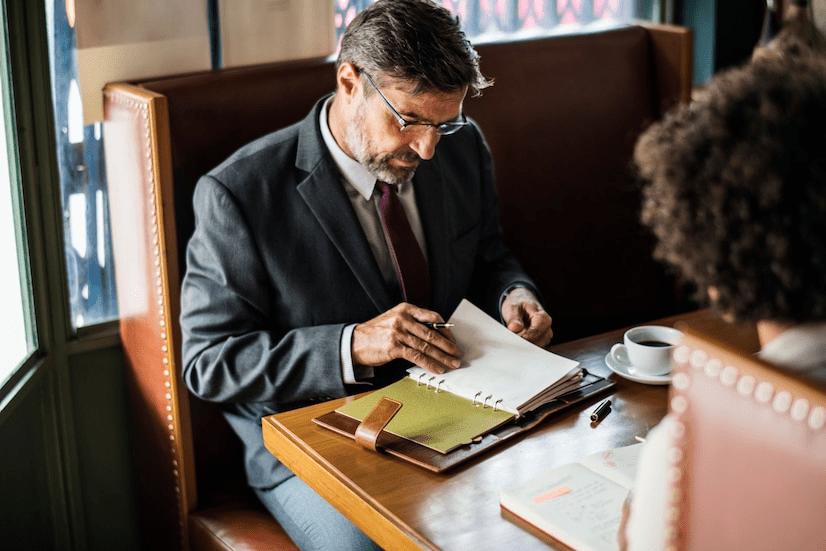

Simply create a profile, submit your application, and connect with a dedicated funding consultant.

Unlike traditional banks, we offer a fast application process, minimal paperwork, and flexible terms, all with a 95% approval rate.

Yes, you can still apply for working capital funding even if you have an existing loan.

Absolutely. If your business faces unexpected expenses like equipment repairs or urgent operational needs, working capital loans can provide fast relief.

While the funding is based on your business’s operations in New Jersey, you can use the funds as needed to support your business’s growth, even if it expands beyond state lines.

Ready to Take Your Business to the Next Level?

With VIP Capital Funding, securing working capital in New Jersey has never been easier. Whether you’re looking to stabilize cash flow, invest in growth, or manage unexpected challenges, our loans offer the flexibility and reliability you need.

Contact us today to discuss your financial goals and discover how our solutions can transform your business.