When it comes to growing or establishing a small business, one of the most significant hurdles entrepreneurs face is securing the funding to build or expand their commercial space. Whether you are constructing a new storefront, expanding an office, or renovating a facility, the right financing can turn your dream into a reality.

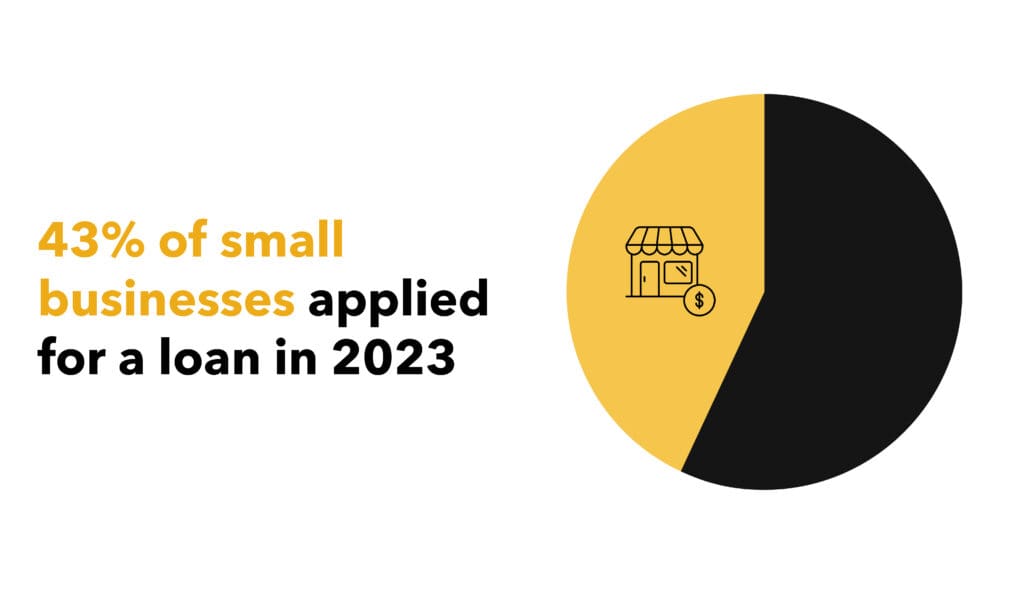

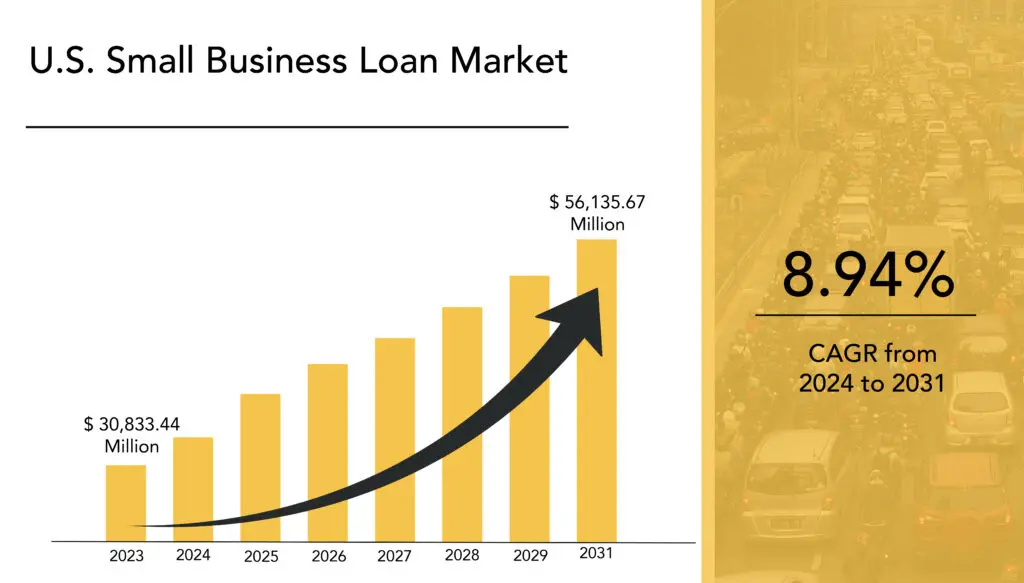

This is where small business construction loans come into play. These specialized loans provide entrepreneurs with the capital needed to fund construction projects, from purchasing land to completing the final touches on a building. According to the U.S. Small Business Administration (SBA), small businesses are vital to the American economy, contributing to nearly 44% of the U.S. GDP and employing about 47% of the private workforce. Despite this, obtaining construction financing remains a challenge for many business owners, especially when traditional lenders are hesitant to offer funding for new ventures or complex projects.

In this comprehensive guide, we will break down everything you need to know about small business construction loans. We will cover the eligibility criteria, loan amounts, the application process, and how these loans help entrepreneurs build, renovate, and expand their business spaces. By the end of this blog, you will have a better understanding of how small business construction loans work and how you can leverage them for your next big project.

What Are Small business construction loans?

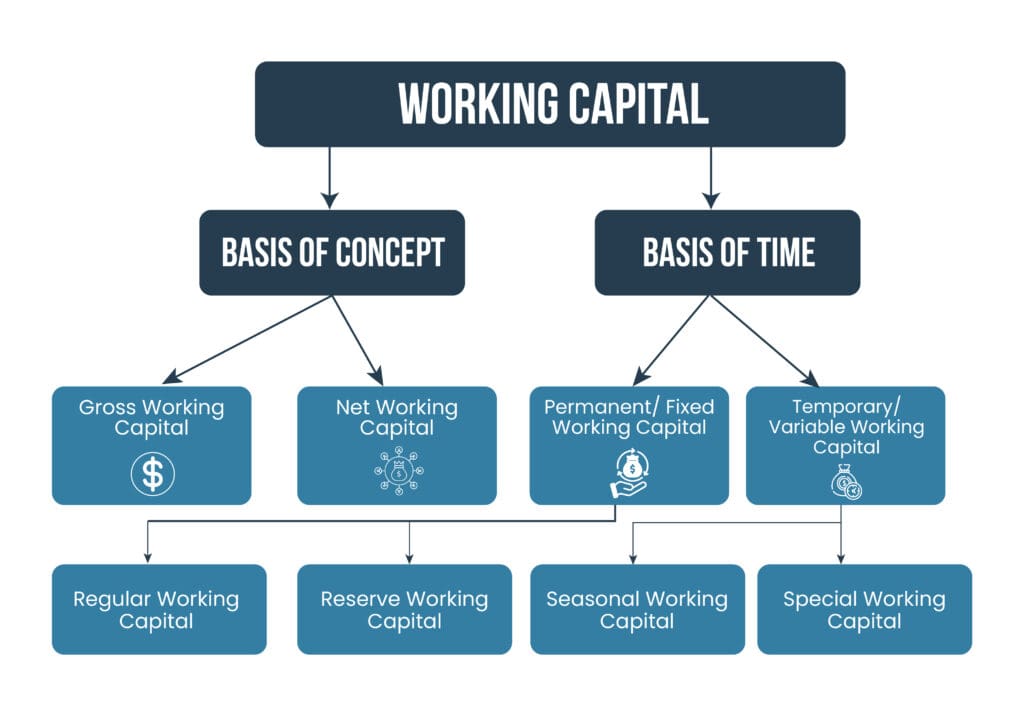

A small business construction loan is a financial product designed to help entrepreneurs fund the costs associated with building or renovating commercial properties. These loans can cover a wide range of expenses, including purchasing land, paying for labor and materials, and financing the construction of buildings or infrastructure.

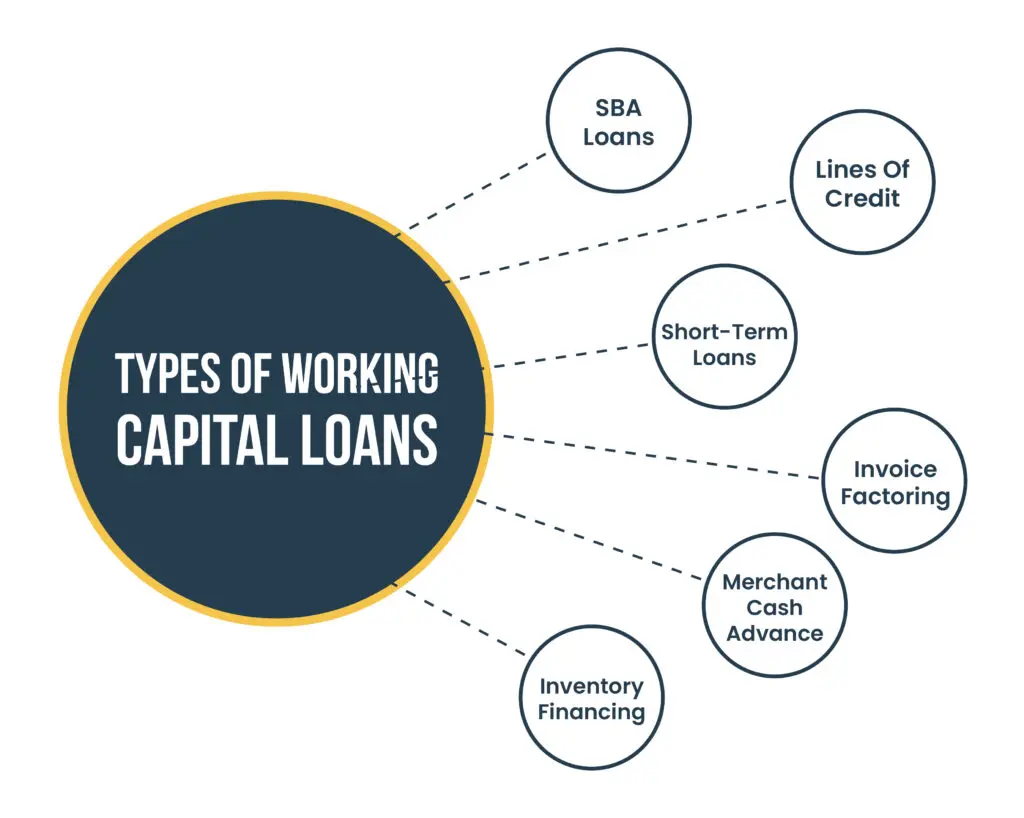

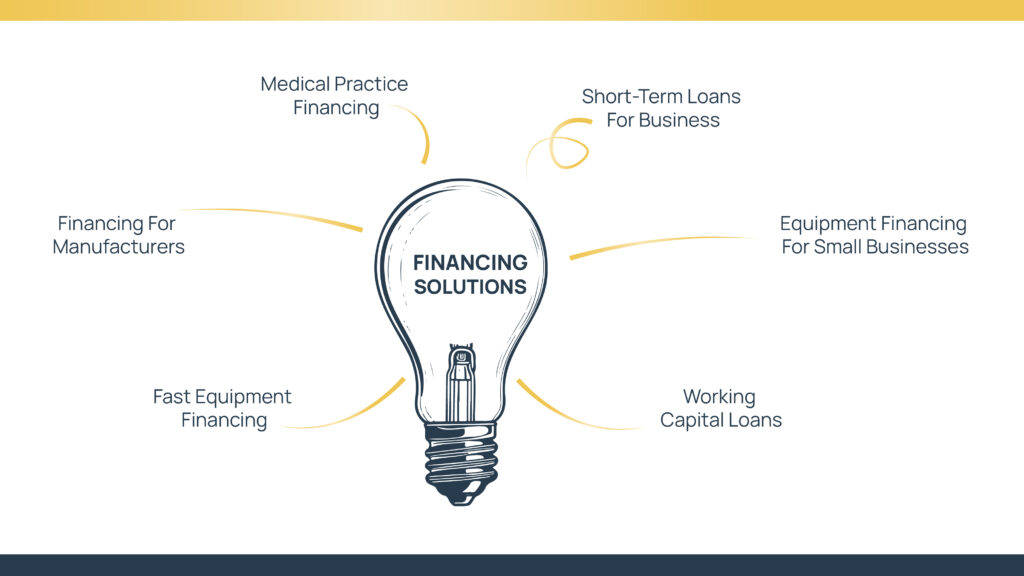

These loans are often provided by banks, credit unions, or online small business loan providers, and they typically come in two types:

1. Construction-to-Permanent Loans

These loans cover the construction costs and automatically convert into a traditional mortgage once the construction is completed. They often offer lower interest rates and long-term repayment options, making them a good choice for business owners planning to stay in the property long-term.

2. Short-Term Construction Loans

These loans are designed to cover only the construction phase. Once the project is completed, the borrower is expected to pay off the loan or refinance it into a longer-term loan. These loans generally have higher interest rates but are suitable for business owners who intend to sell or lease the property once construction is complete.

Both types of small business construction loans can be essential tools for entrepreneurs looking to expand or create commercial space but may require a more complex approval process than traditional loans.

Eligibility for Small business Construction Loans

The eligibility criteria for small business construction loans can vary depending on the lender and the specifics of the loan. However, most lenders will consider the following factors when reviewing an application:

1. Credit Score

Your credit score is one of the most significant factors lenders look at when evaluating a loan application. A higher credit score will increase your chances of being approved and may help you secure better terms. For small business loans in general, most lenders require a credit score of at least 650, but for construction loans, a score of 700 or higher may be preferred.

2. Business Revenue and Profitability

Lenders want to see that your business has a steady stream of revenue and is profitable enough to handle the loan payments. Typically, lenders will require a minimum of two years of financial statements, tax returns, and possibly a business plan to demonstrate your ability to repay the loan.

3. Debt-to-Income Ratio

This ratio measures the total amount of debt you have in relation to your income. A lower debt-to-income ratio indicates that you have enough income to manage the loan payments.

4. Personal and Business Assets

Lenders will also look at your personal and business assets to determine your ability to repay the loan. If the business has valuable assets, such as equipment, property, or intellectual property, this can improve your chances of securing funding.

5. Type of Business and Industry

Certain types of businesses, like medical practices, manufacturing companies, or construction firms, may be more likely to secure small business construction loans because they often require physical spaces to operate. Lenders may also consider the risk level of the industry when making their decision.

How Much Can You Borrow?

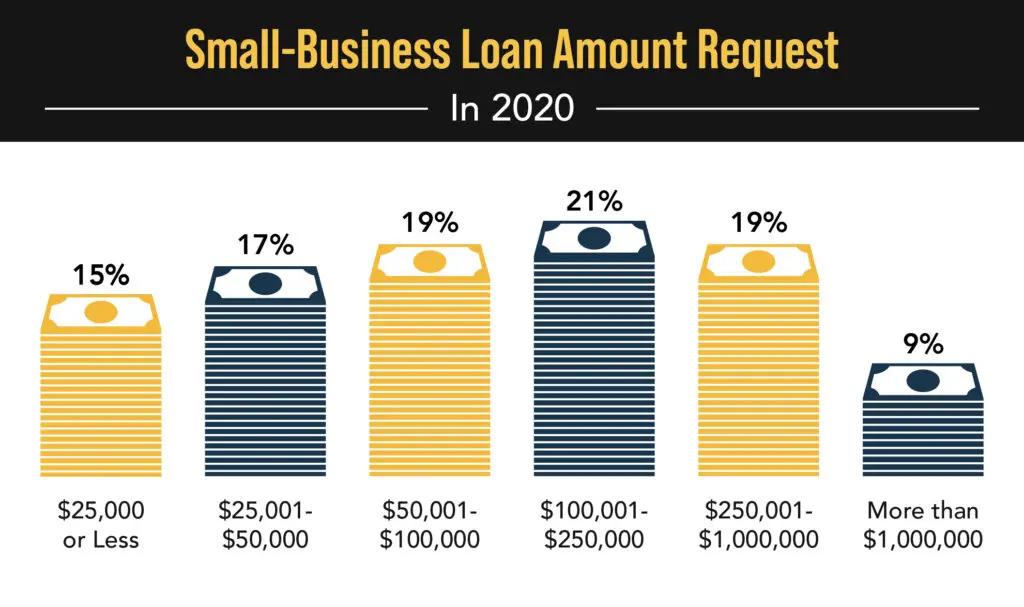

The amount of money you can borrow through a small business construction loan varies based on several factors, including the lender, the type of project, and the value of the property. Generally, construction loans range from $50,000 to $5 million or more.

1. Small-Scale Projects

For small projects, such as building a small office or retail space, small business construction loans typically range from $50,000 to $500,000. These loans are ideal for entrepreneurs looking to build or renovate smaller commercial spaces.

2. Large-Scale Projects

For larger projects, such as constructing multi-unit buildings, manufacturing facilities, or large retail centers, you may need to apply for larger loans, typically ranging from $500,000 to $5 million. Lenders may require more detailed documentation, including architectural plans, environmental assessments, and a breakdown of the costs involved.

How Can Small business construction loans Help You Build and Expand?

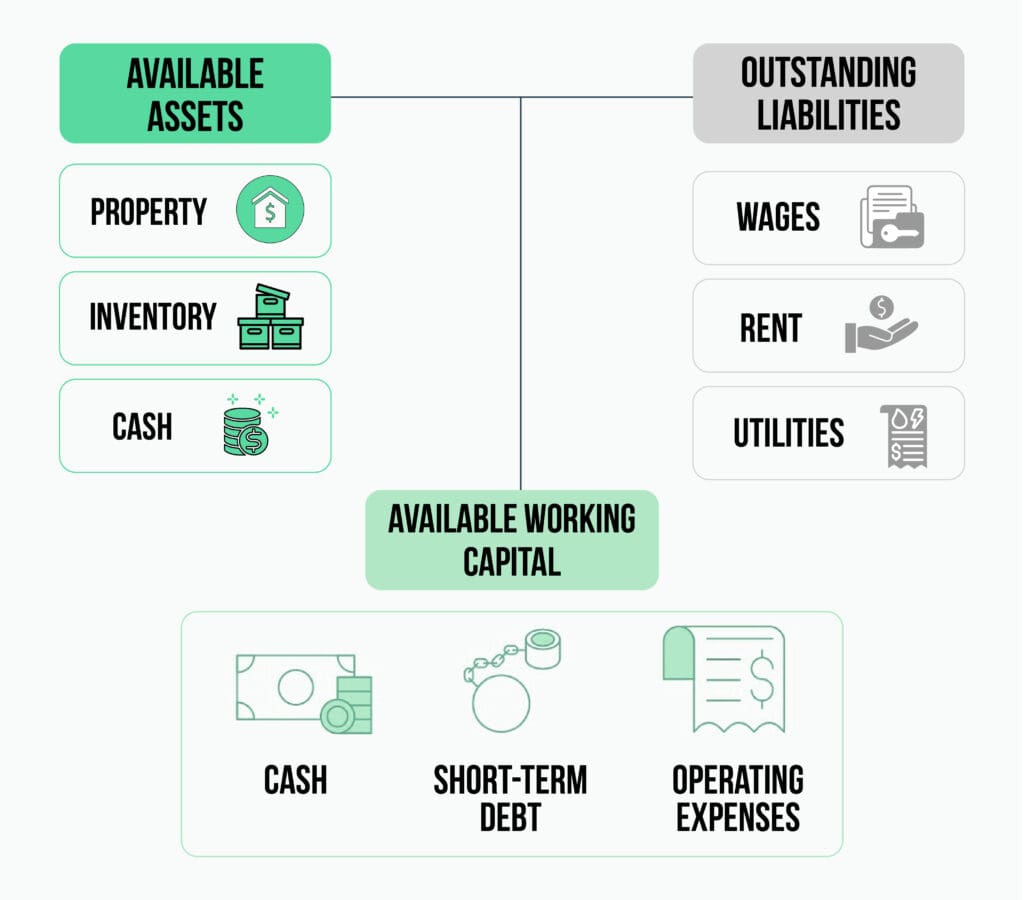

1. Access to Working Capital for Expansion

One of the main advantages of small business construction loans is that they provide business owners with access to the necessary working capital to expand or build their commercial spaces. Whether you’re looking to open a new location, expand an existing one, or improve your business operations, having the right space can make a significant difference.

By securing the right financing, you can ensure that your construction project is completed on time and within budget, allowing you to focus on other aspects of your business growth.

2. Increased Efficiency and Productivity

A well-designed commercial space can improve the efficiency of your business operations. Whether it’s optimizing the layout of your office, creating a better flow for manufacturing, or designing a space that’s more conducive to customer interaction, the right environment can help boost productivity and reduce operational costs.

3. Long-Term Investment

Investing in real estate through small business construction loans allows you to own your business property rather than renting. This can result in long-term savings on rent and potentially increase the value of your property over time.

4. Tailored Space for Your Business Needs

One of the most significant advantages of financing construction is the ability to design a space that’s tailored to your business’s specific needs. Whether you need a larger warehouse, a customized office layout, or specialized equipment installations, building your space allows you to create a perfect environment for your operations.

How to Apply for a Small business Construction Loan

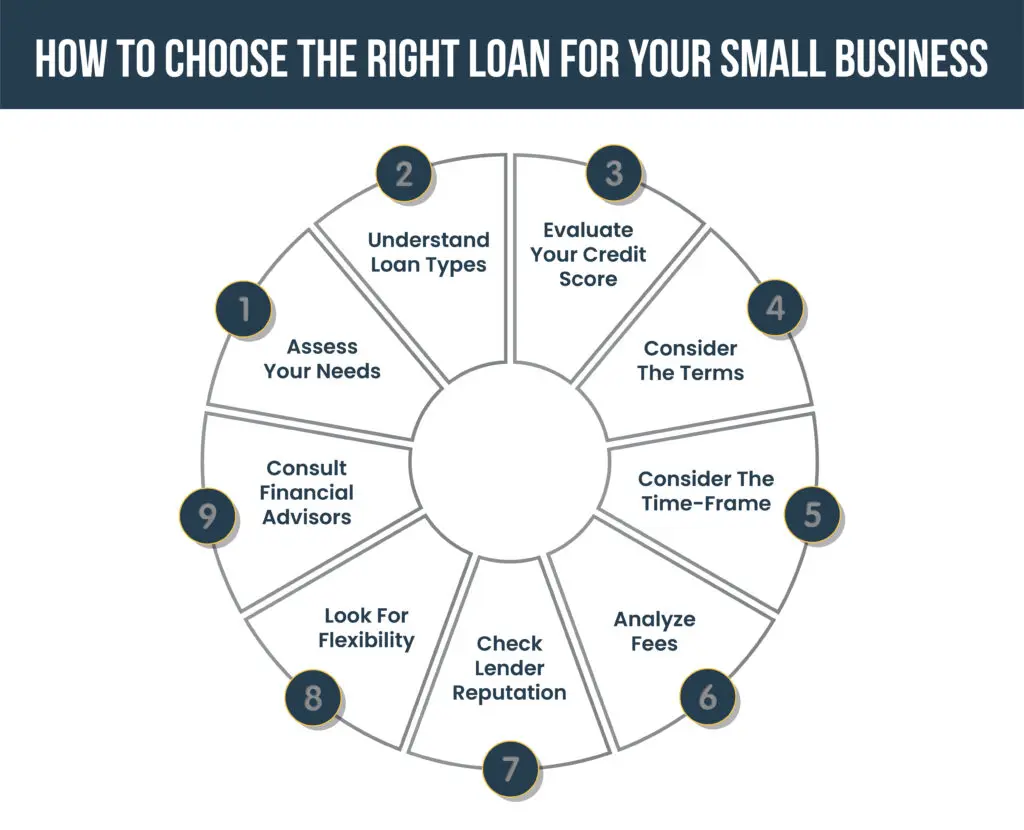

Applying for a small business construction loan can be a straightforward process if you follow the right steps. Here’s a general outline of how to apply:

Research Lenders

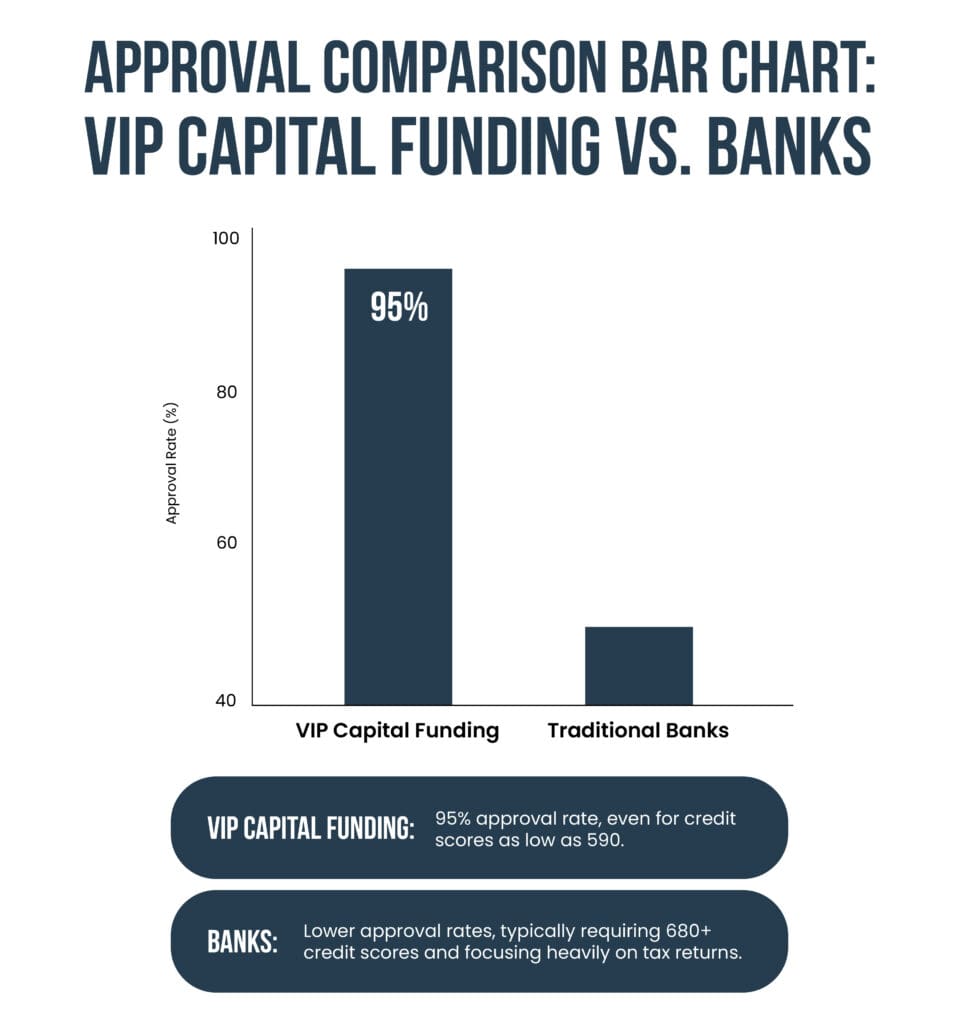

Look for lenders that offer small business construction loans. Compare interest rates, loan terms, and requirements. Consider both traditional banks and online lenders like VIP Capital Funding, who offer flexible financing options.

Prepare Your Documents

Gather the necessary documents, such as business financials, tax returns, business plan, and construction plans.

Submit Your Application

Complete the application process, which may include providing a detailed construction budget and timeline.

Review Loan Offers

Once approved, review the loan terms carefully before signing.

Take the Next Step Toward Your Business’s Future

Securing the right small business construction loan can be the key to unlocking your business’s full potential. Whether you are building from scratch or expanding an existing space, construction loans provide the funding you need to bring your vision to life.

At VIP Capital Funding, we understand the importance of finding the right financing solution for your business. With our fast, flexible loan options, we can help you secure the small business construction loan you need to move forward.

Are you ready to start building your business’s future? Contact VIP Capital Funding today to learn more about how our small business construction loans can help you grow and thrive.