Hey there, trailblazing manufacturers! Let’s dive into the nitty-gritty of how working capital loans can be the game-changer your manufacturing business needs. Whether you’re crafting the next big thing or keeping the essentials rolling off the line, managing cash flow is your lifeline. So, how do these loans fit into the picture? Let’s break it down.

The Manufacturing Cash Flow Maze

Manufacturing isn’t just about turning raw materials into products; it’s about orchestrating a symphony of financial responsibilities:

- Raw Material Procurement: Securing the essential materials to keep your production lines buzzing.

- Operational Expenses: Covering wages, utilities, equipment maintenance, and more.

- Inventory Management: Balancing the costs of storing unsold products without tying up too much capital.

- Vendor Payments: Ensuring suppliers are paid on time to maintain good relationships and favorable terms.

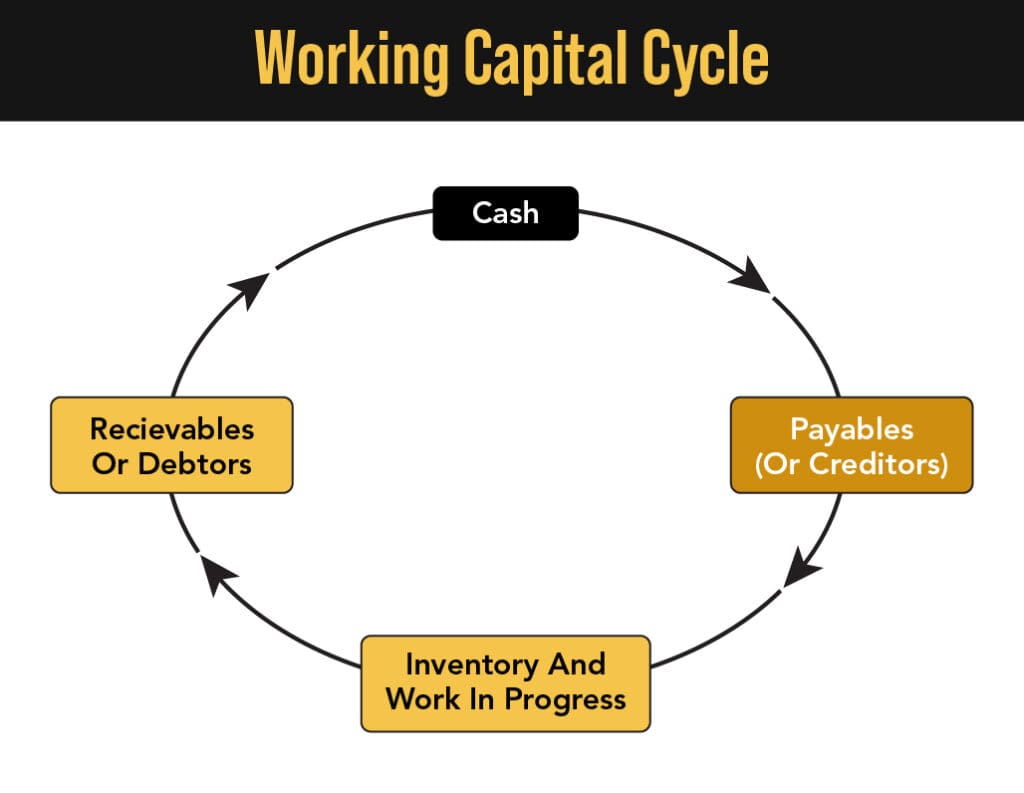

These components are crucial for smooth operations but can lead to significant cash being tied up, especially when sales are pending or customers delay payments. This is where cash flow challenges rear their heads.

Enter Working Capital Loans: Your Financial Sidekick

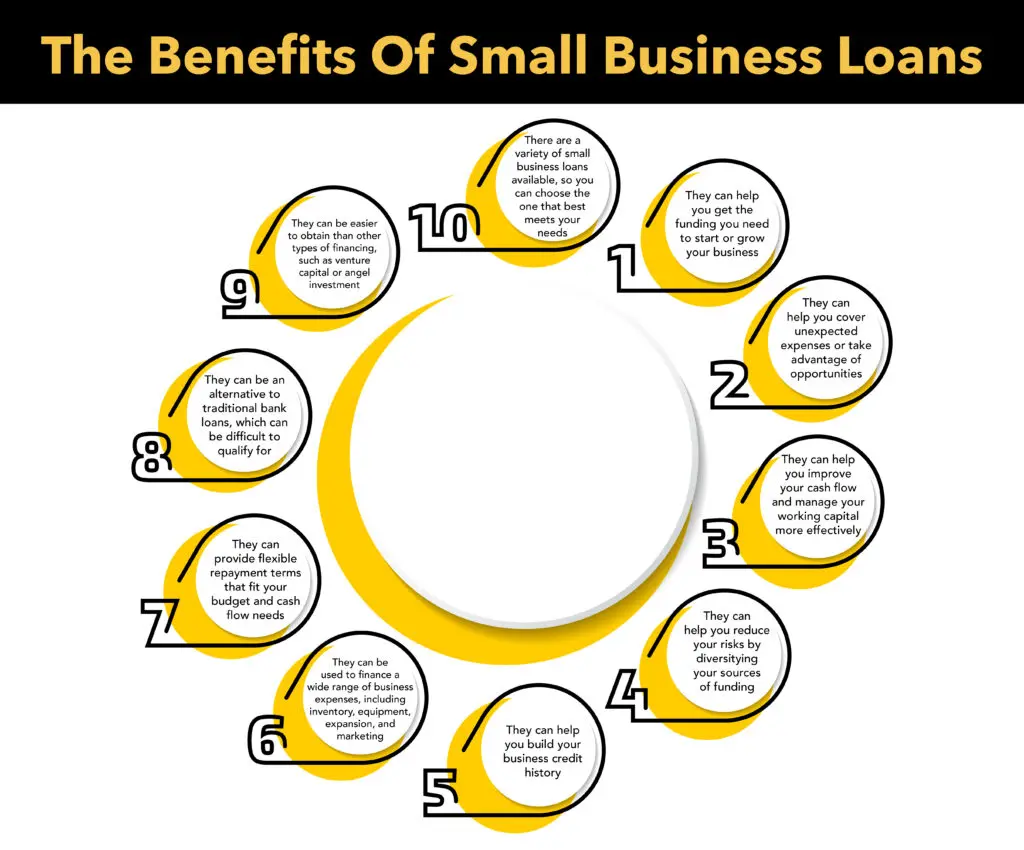

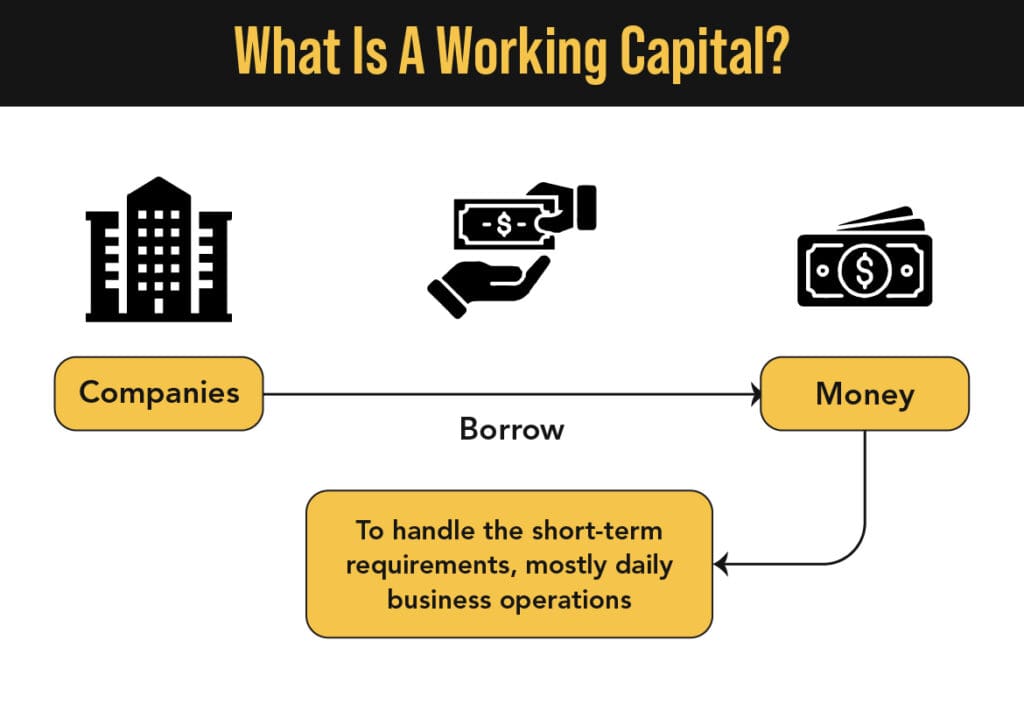

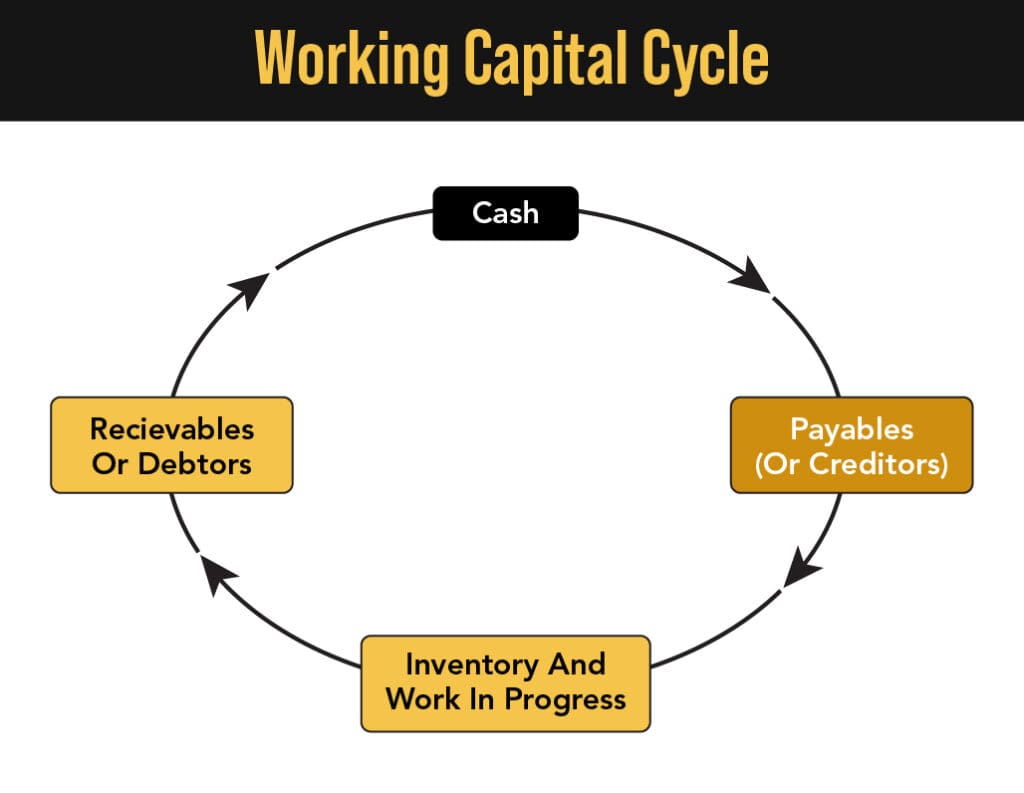

Working capital loans are short-term financial tools designed to help businesses manage their everyday operational expenses. Unlike loans meant for long-term investments or purchasing major assets, these loans provide the necessary funds to handle routine expenses such as payroll, rent, inventory purchases, and utilities. They ensure smooth business operations and prevent cash flow issues, allowing businesses to focus on growth and sustainability.

How Do They Work?

These loans offer immediate access to cash, which can be used flexibly to cover various operational needs. This flexibility is ideal for covering unexpected expenses or bridging gaps between accounts receivable and payable.

Tackling Cash Flow Challenges Head-On

One of the most significant hurdles for manufacturers is maintaining a steady cash flow, especially when large amounts of capital are tied up in inventory or when waiting for customer payments. Working capital loans provide the liquidity needed to bridge these gaps, ensuring that operations continue without a hitch.

Scenario: Bridging the Gap

Imagine you’re a manufacturer with a substantial order from a major retailer. You’ve produced the goods and shipped them, but the retailer’s payment terms are net 60 days. Meanwhile, you need to pay your suppliers and employees. A working capital loan can provide the necessary funds to cover these expenses until the retailer’s payment arrives.

Fueling Large Orders Without the Stress

Landing a large order is a cause for celebration, but it can also strain your resources. The need to ramp up production often requires purchasing more raw materials, hiring additional staff, or even upgrading equipment—all of which demand upfront capital.

Scenario: Scaling Up Production

Your company just received an order that’s twice the size of your typical demand. To fulfill it, you need to buy additional raw materials and perhaps run extra shifts. A working capital loan can provide the funds needed to scale up production without compromising your financial stability.

Supporting Operational Growth and Expansion

Growth is the goal, but it often comes with increased expenses. Whether it’s launching a new product line, entering a new market, or upgrading technology, these initiatives require capital.

Scenario: Investing in New Technology

To stay competitive, you’re considering investing in automation technology that will increase efficiency and reduce long-term costs. A working capital loan can provide the upfront investment needed for this technology, allowing you to reap the benefits without depleting your cash reserves.

Addressing Seasonal Demand Fluctuations

Manufacturing businesses often experience seasonal peaks and troughs in demand. Industries like consumer electronics, holiday decorations, and even automobile parts have periods where orders skyrocket, requiring businesses to ramp up production quickly.

How a Working Capital Loan Helps:

- Allows manufacturers to stockpile raw materialsbefore peak seasons.

- Covers overtime wageswhen extra shifts are needed.

- Ensures cash flow stabilityduring slow periods when fewer orders come in.

- Provides the flexibility to adjust operations without straining financial reserves.

Strengthening Supplier Relationships with Bulk Purchases

Suppliers often provide better pricing and discounts on bulk purchases. However, manufacturers may struggle with large upfront payments to secure these deals.

How a Working Capital Loan Helps:

- Enables bulk purchases at lower rates, increasing profit margins.

- Prevents reliance on expensive supplier credit terms.

- Strengthens relationships with reliable suppliers, ensuring uninterrupted raw material supply.

By utilizing working capital business loans, manufacturers can negotiate better rates, maintain strong supplier partnerships, and reduce overall production costs.

Managing Unexpected Equipment Repairs and Maintenance

Machinery breakdowns can bring production to a screeching halt, leading to missed deadlines, lost revenue, and customer dissatisfaction. Regular maintenance and emergency repairs require immediate funding.

How a Working Capital Loan Helps:

- Covers the cost of urgent repairswithout depleting company reserves.

- Allows investment in preventative maintenanceto reduce future breakdowns.

- Helps manufacturers upgrade to more efficient equipmentthat cuts production time and costs.

A working capital loan for small businesses ensures that even unexpected expenses don’t disrupt daily operations.

Hiring and Training Skilled Workers

The manufacturing industry heavily relies on skilled labor, from machine operators to quality control specialists. With advancements in automation and new technologies, continuous employee training is essential.

How a Working Capital Loan Helps:

- Provides funds for new employee hiring and training.

- Supports upskilling existing workersto operate advanced machinery.

- Helps businesses retain top talentby offering competitive salaries.

With working capital for new businesses, manufacturers can invest in a skilled workforce to stay ahead of competitors.

Expanding Into New Markets

Manufacturers looking to expand their customer base or export products internationally need capital for:

- Market researchand feasibility studies.

- New distribution channels(warehouses, shipping infrastructure, logistics).

- Product adaptationsfor different markets (compliance with local regulations).

How a Working Capital Loan Helps:

- Covers expansion costswithout putting a strain on daily operations.

- Helps businesses explore international trade opportunities.

- Funds marketing effortsto reach new customers.

With the right manufacturing business loans, companies can enter new markets while maintaining financial stability.

Reducing Reliance on High-Interest Credit

Some manufacturers rely on high-interest credit cards or expensive short-term financing to manage cash flow gaps. This can lead to higher financial strain over time.

How a Working Capital Loan Helps:

- Provides a structured repayment planwith lower interest rates than credit cards.

- Offers better termsthan predatory short-term lenders.

- Improves a business’s financial health and creditworthiness.

By choosing easy small business loans, manufacturers can avoid the financial pitfalls of high-interest debt.

Enhancing Inventory Management Strategies

Manufacturers must balance inventory levels to avoid overstocking or understocking, which can lead to:

- Deadstock(unsold inventory taking up space).

- Lost salesdue to insufficient stock.

- Storage costsfor excessive inventory.

How a Working Capital Loan Helps:

- Funds data-driven inventory management systemsfor better forecasting.

- Allows businesses to restock essential items quickly.

- Prevents capital from being locked up in unsold goods.

Access to working capital loans for small business ensures optimal inventory management, boosting profitability.

Meeting Compliance and Regulatory Requirements

Manufacturing businesses must comply with environmental, safety, and labor regulations, which often require:

- Factory upgradesto meet emissions standards.

- Employee safety training programs.

- New certifications and licenses.

How a Working Capital Loan Helps:

- Covers the costs of regulatory compliancewithout affecting operational cash flow.

- Helps avoid penalties and finesfor non-compliance.

- Supports investments in eco-friendly manufacturingto meet sustainability goals.

With the right business equipment financing, manufacturers can meet industry regulations while staying profitable.

The Upsides and Downsides: Keeping It Real

Like any financial tool, working capital loans come with their pros and cons.

Benefits

- Immediate Access to Cash: Fast access to cash can be essential when you are struggling with cash flow. If you’re not sure how you’re going to pay suppliers or cover payroll, your business could be in serious trouble. A working capital loan can give you the liquidity you need to succeed.

- Flexibility: Unlike commercial real estate loans or equipment financing, working capital loans can be used for multiple purposes, including purchasing inventory, paying for marketing, or funding emergency repairs. This flexibility can be crucial when cash is tight.

- No Collateral Required: Many working capital loans are unsecured, meaning business owners don’t need to provide collateral, reducing the risk to personal and business assets.

Drawbacks

- Higher Interest Rates: To compensate for the higher risk, working capital loans often come with higher interest rates compared to traditional term loans.

- Short Repayment Terms: These loans typically need to be repaid within a year, which can strain cash flow if not managed carefully.

- Potential Impact on Credit: Missed payments can negatively affect your credit score, making it harder to secure future financing.

Making the Smart Move: Is a Working Capital Loan Right for You?

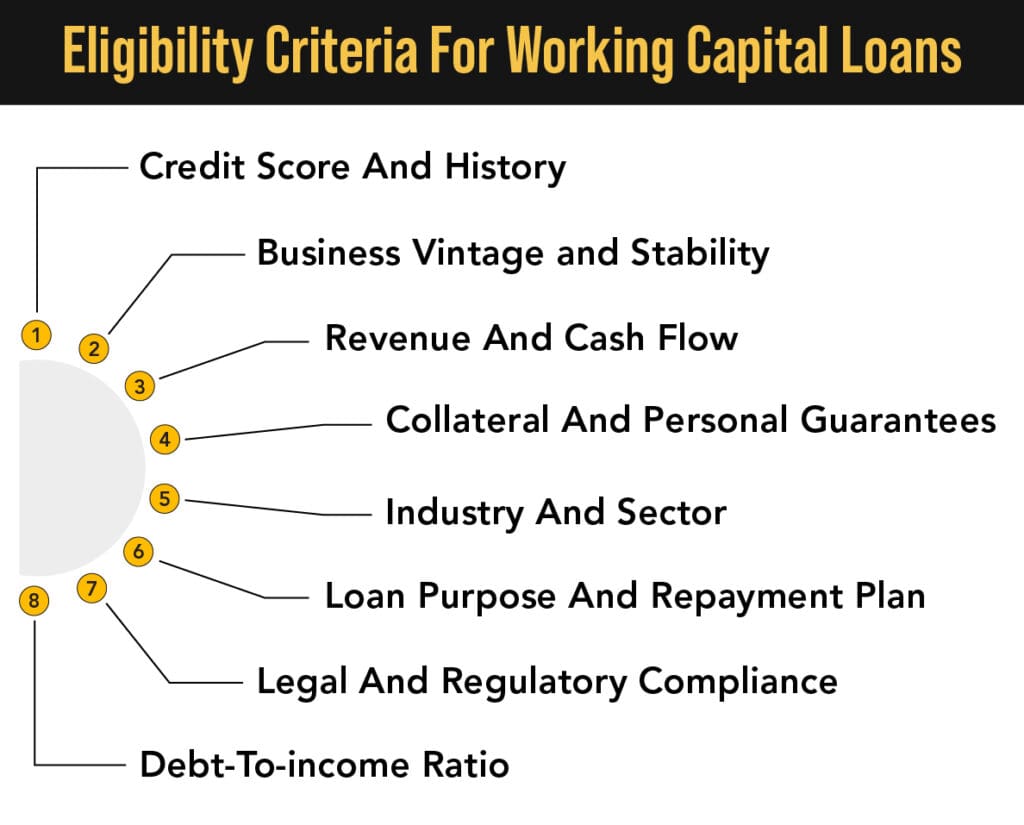

Before jumping on the loan bandwagon, consider the following:

- Assess Your Financial Health: Evaluate your cash flow, revenue projections, and existing debt. Ensure that taking on additional debt won’t overextend your finances.

- Define the Purpose: Clearly outline what the loan will be used for and how it will benefit your operations or growth.

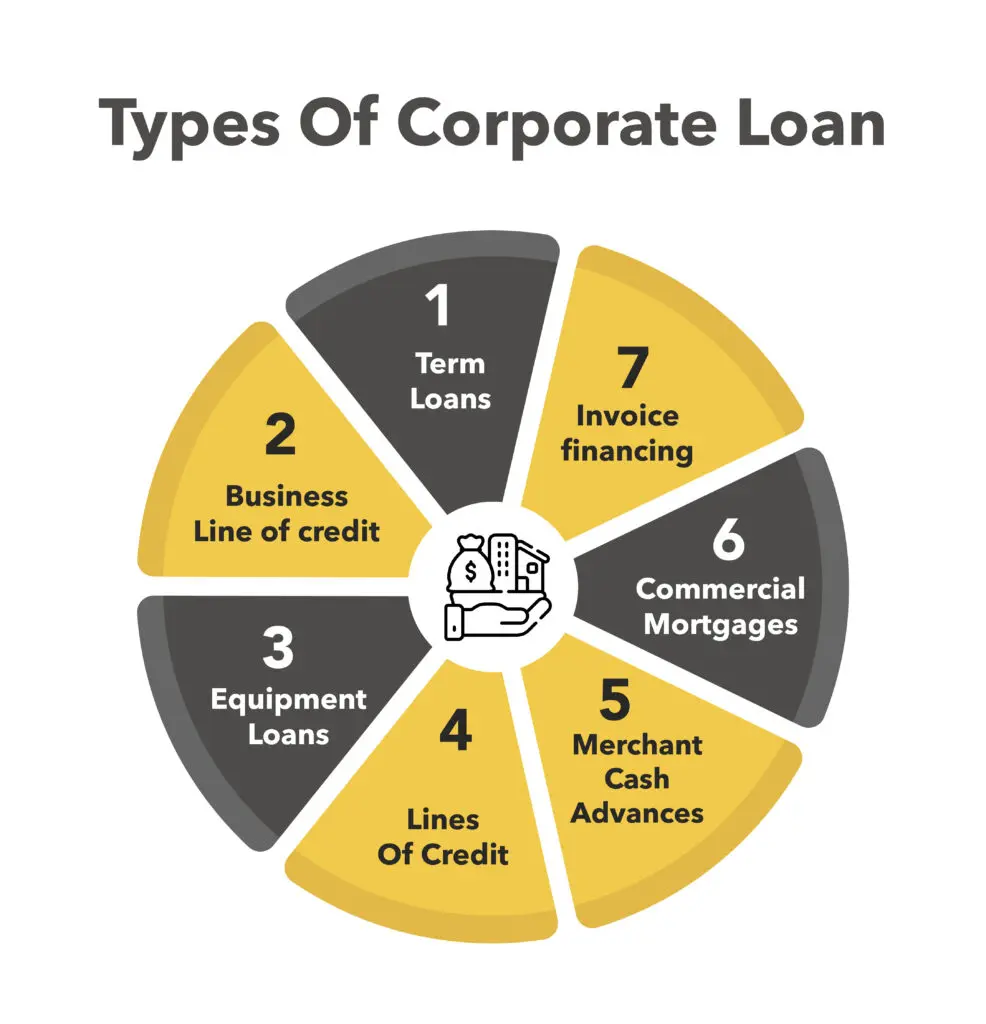

- Explore Alternatives: Consider other financing options, such as lines of credit, trade credit, or even equity financing, to determine the best fit for your needs.

Wrapping It Up

In the fast-paced world of manufacturing, staying ahead requires agility and smart financial management. Working capital loans can be a valuable tool in your financial toolkit, helping you navigate cash flow challenges, seize growth opportunities, and keep your operations running smoothly. As with any financial decision, careful planning and a solid understanding of your needs are key to making the most of these loans.

If you’re considering working capital business loans, be sure to evaluate your financial situation, compare different small business loan providers, and choose a lending option that aligns with your business goals. Whether you need to fund large orders, cover daily operational costs, or invest in growth, these loans can provide the financial boost you need to thrive in the competitive manufacturing sector.

Get Fast and Flexible Working Capital for Your Manufacturing Business!

At VIP Capital Funding, we specialize in providing working capital loans for small businesses to keep your operations running smoothly. With over 10 years of experience, we offer fast small business loans, short-term loans for business, and equipment financing loans tailored to your needs. Whether you’re in Georgia, Illinois, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Virginia, Texas, Florida, California, Washington, or Nevada, we can help you secure manufacturing business funding with minimal hassle.

Apply for a small business loan today and take your manufacturing business to new heights. Call now!